Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, help please! please type the answers completely and clearly! Thank you!!!!! Integrating Case 9-3 (Static) FIFO and lower of cost or net realizable value

Hi, help please!

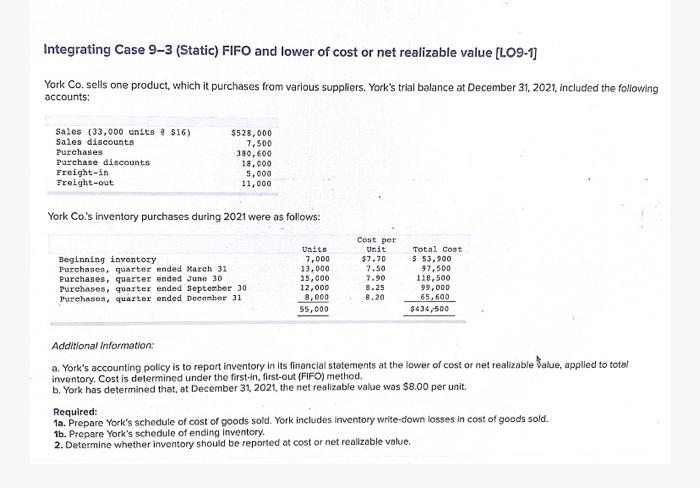

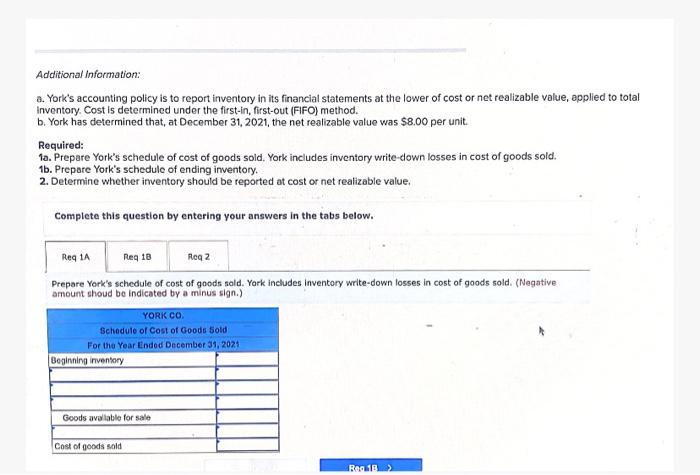

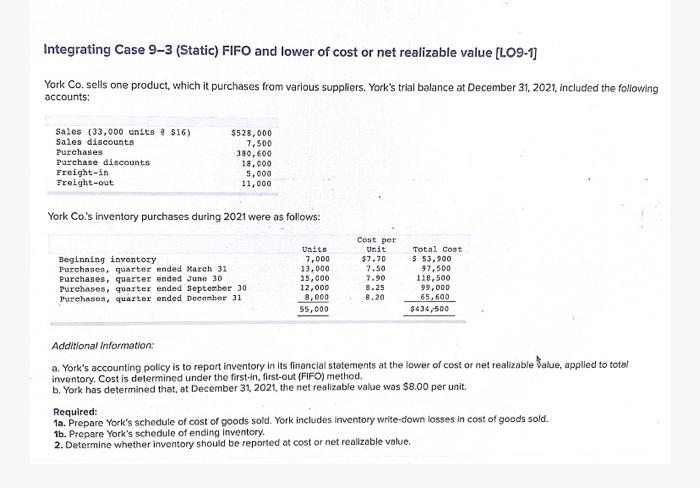

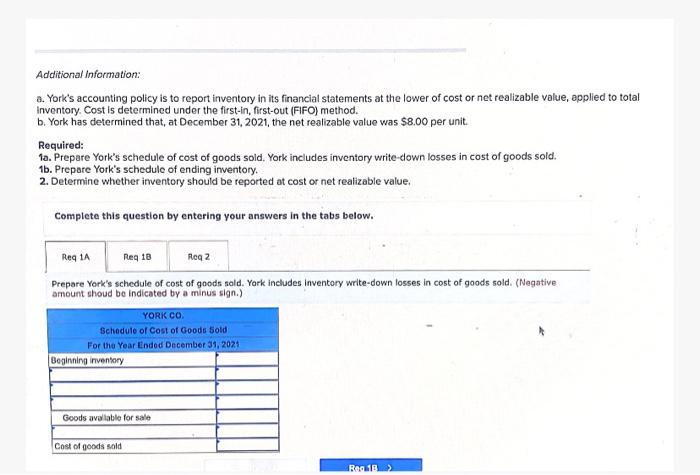

Integrating Case 9-3 (Static) FIFO and lower of cost or net realizable value (LO9-1] York Co.sells one product, which it purchases from various suppliers. York's trial balance at December 31, 2021, included the following accounts: Sales (33,000 units : $16) Sales discounts Purchases Purchase discounts Freight-in Freight-out $528,000 7,500 380, 600 18,000 5.000 11,000 York Co's inventory purchases during 2021 were as follows: Beginning inventory Purchases, quarter ended March 31 Purchases, quarter ended June 30 Purchases, quarter ended September 30 Purchases, quarter ended December 31 Units 7,000 13,000 35,000 12,000 9,000 55,000 Cost per Unit $7.70 7.50 7.90 8.25 8.20 Total cost $ 53,900 97,500 118,500 99,000 65,600 $434,500 Additional Information: a York's accounting policy is to report inventory in its financial statements at the lower of cost or net realizable Salue, applied to total inventory, Cost is determined under the first-in, first-out (FIFO) method. b. York has determined that, at December 31, 2021, the net realizable value was $8.00 per unit. Required: 1a. Prepare York's schedule of cost of goods sold. York includes inventory write-down losses in cost of goods sold. 1b. Prepare York's schedule of ending Inventory. 2. Determine whether inventory should be reported at cost or net realizable value. Additional Information: a. York's accounting policy is to report inventory in its financial statements at the lower of cost or net realizable value, applied to total Inventory. Cost is determined under the first-in, first-out (FIFO) method. b. York has determined that, at December 31, 2021, the net realizable value was $8.00 per unit. Required: 1a. Prepare York's schedule of cost of goods sold. York includes inventory write-down losses in cost of goods sold. 1b. Prepare York's schedule of ending inventory. 2. Determine whether inventory should be reported at cost or net realizable value, Complete this question by entering your answers in the tabs below. Reg 1A Reg 10 Rog2 Prepare York's schedule of cost of goods sold. York includes inventory write-down losses in cost of goods sold. (Negative amount shoud be indicated by a minus sign.) YORK CO. Schedule of Cost of Goods Sold For the Year Ended December 31, 2025 Beginning inventory Goods available for sale Cost of goods sold R01> please type the answers completely and clearly! Thank you!!!!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started