Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi here is the solution below. how did they get the tax refund what is it ? they do not say? also, how did they

hi here is the solution below. how did they get the tax refund what is it ? they do not say? also, how did they get the journal entry of 1500 for deferred income tax based on solution (3) part c so the 0.6. The (75000 - 9000) - (75000 - 12000) times .20 where did they get the 9000 and 12000 from.

please can someone help me right away

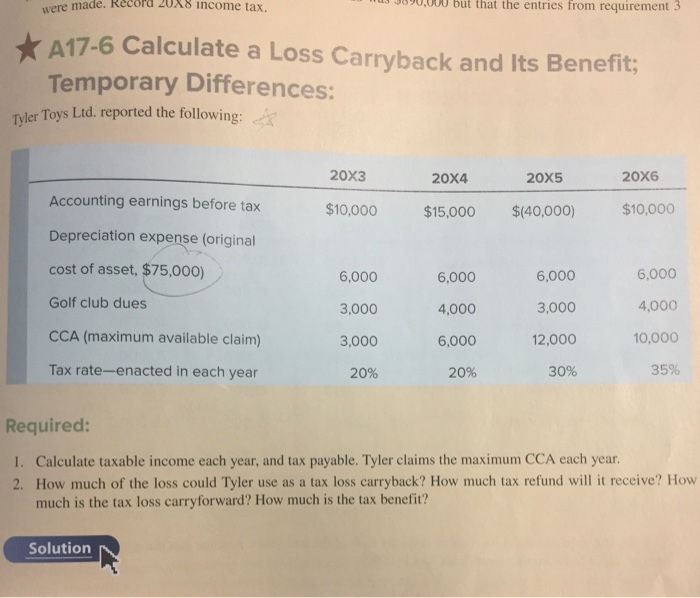

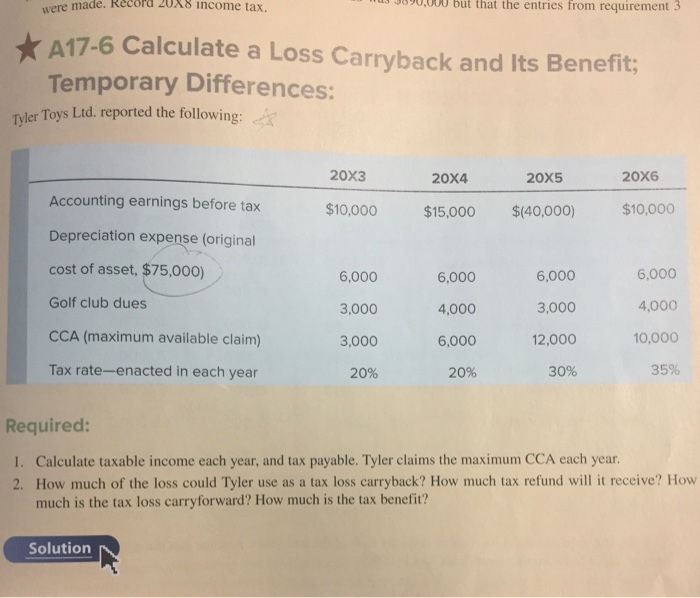

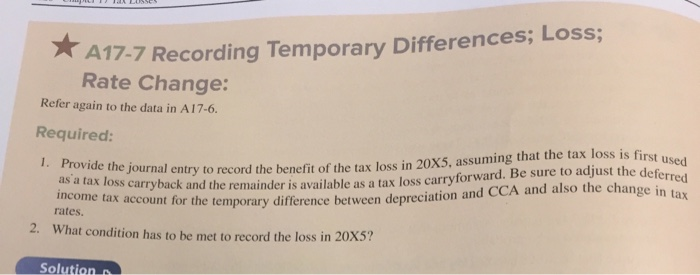

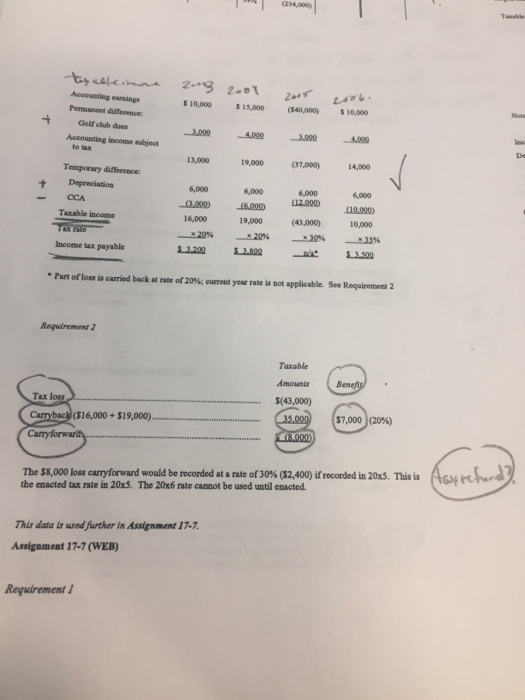

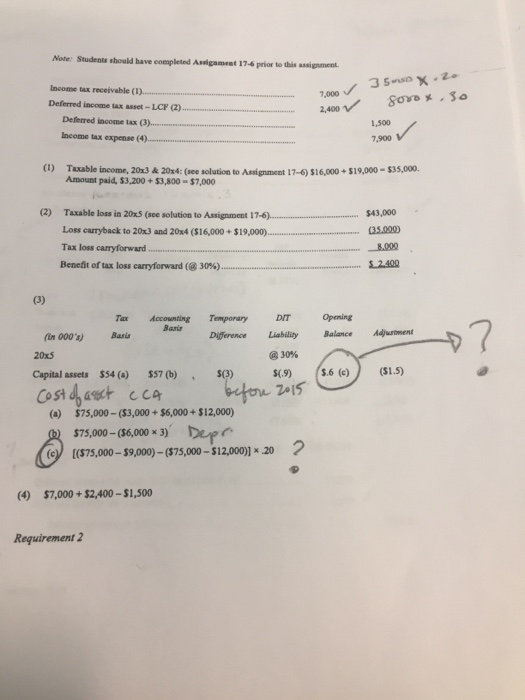

were made. Record 20X8 income tax. 090,000 but that the entries from requirement 3 A17-6 Calculate a Loss Carryback and Its Benefit; Temporary Differences: Tyler Toys Ltd. reported the following: 20x3 20X4 20X5 20x6 Accounting earnings before tax $10,000 $15,000 $(40,000) $10,000 Depreciation expense (original cost of asset, $75,000) 6,000 6,000 6,000 6,000 4,000 Golf club dues 3,000 4,000 3,000 CCA (maximum available claim) 3,000 6,000 12,000 10,000 Tax rate-enacted in each year 20% 20% 30% 35% Required: 1. Calculate taxable income each year, and tax payable. Tyler claims the maximum CCA each year. 2. How much of the loss could Tyler use as a tax loss carryback? How much tax refund will it receive? How much is the tax loss carryforward? How much is the tax benefit? Solution A17-7 Recording Temporary Differences; Loss; Rate Change: Refer again to the data in A17-6. Required: tax loss is first used 1. Provide the journal entry to reco urnal entry to record the benefit of the tax loss in 20X5, assuming that the tax loss is first as a tax loss carryback and the remainder is available as a tax loss carryo loss carryforward. Be sure to adjust the deferr tax account for the temporary difference between depreciation and CCA and also the change in to just the deferred ange in tax rates. 2. What condition has to be met to record the loss in 20X5 Solution (234.000 2.01 $ 10,000 5 15.000 (340,000) $10.000 Accounting a ng Permanent difference Golf club dues Accounting income w to ex 4,000 est 13,000 19,000 (37,000) 14,000 Temporary difference Depreciation CCA Taxable income 6,000 6,000 (6.000) 19,000 6.000 (12.000) 6,000 110.000 10,000 16,000 nale (43,000) 20% - 30% Income tax payable 5.3.200 $ 3.809 $1.500 Part of loss is carried back at rate of 20%; current year rate is not applicable. See Request 2 Requirement 2 Taxable Amounts Tax loss Carryback (516,000+ $19,000).... Carryforward $(43,000) 35.000 13.000) 00 $7,000 (20%) The $8,000 low curryforward would be recorded at a note of 30% ($2,400) if recorded in 2035. This is Awa the enacted tax rate in 20x5. The 20x6 rate cannot be used until enacted. r d This data is used further in Assignment 17-7. Assignment 17-7 (WEB) Requirement / Note: Students should have completed Assigament 17-6 prior to this assigment 35- so X.2 se Income tax receivable (1). Deferred income tax asset-LCF (2) ........ Deferred income tax (3) Income tax expense (4) 7,000 2,400 V 1,500 7.900 (1) Taxable income, 20x3 & 20x4: (e solution to Assignment 17-6516,000+ $19,000 - $35,000 Amount paid, 53,200 + 53,800 - $7,000 (2) Taxable loss in 20x5 (see solution to Assignment 17-6).................. Loss carryback to 20x3 and 20x4 (S16,000+ $19,000)...................... Tax loss carryforward .................... Benefit of tax loss carryforward (@30%)............. $43,000 035.000 8.000 3.2.400 Opening Balance Adjustment $1.9) $.6 () ($1.5) Tax Accounting Temporary DIT in 000's) Basis Difference Liability 20x5 30% Capital assets $54) $57(b) $(3) Cost of asset CCA before 2015 (a) $75,000 - ($3,000 + $6,000+ $12,000) () $75,000 - ($6,000 * 3) Depr ( ) [(S75,000 - $9,000) (575,000 - $12,000)] .20 (4) $7,000 + $2,400 - $1,500 Requirement 2 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started