hi how to do question c,d, and e) please no excel :')

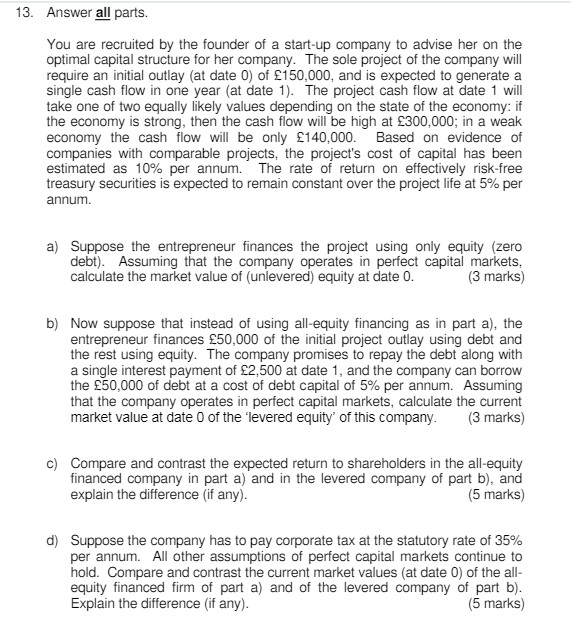

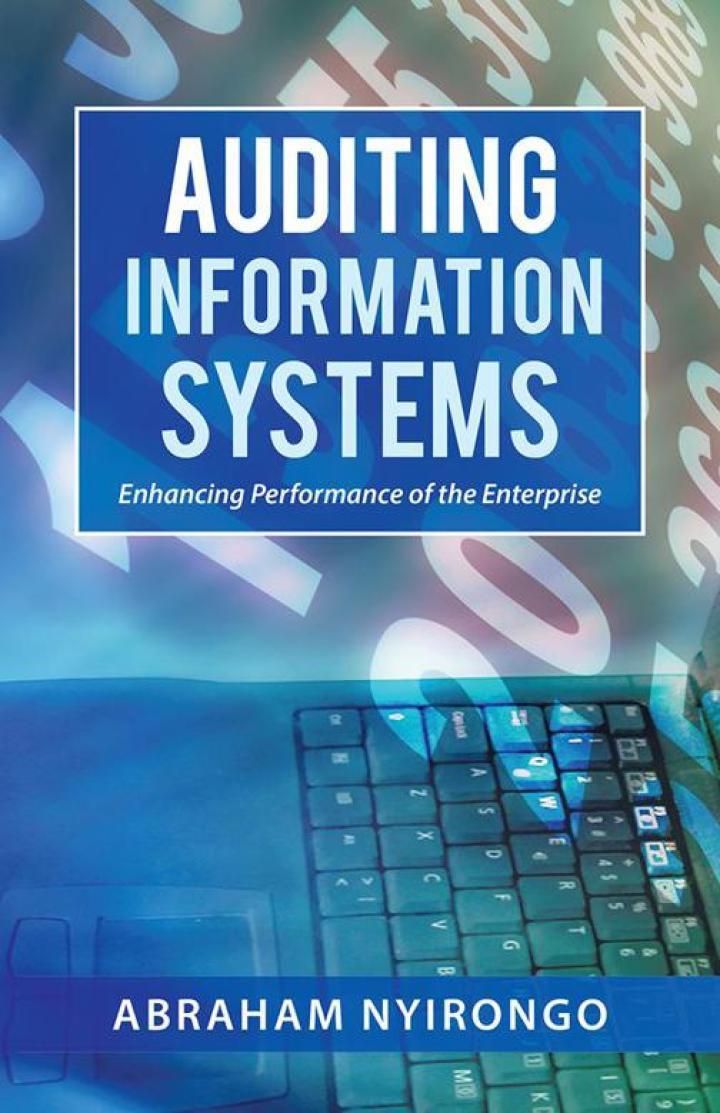

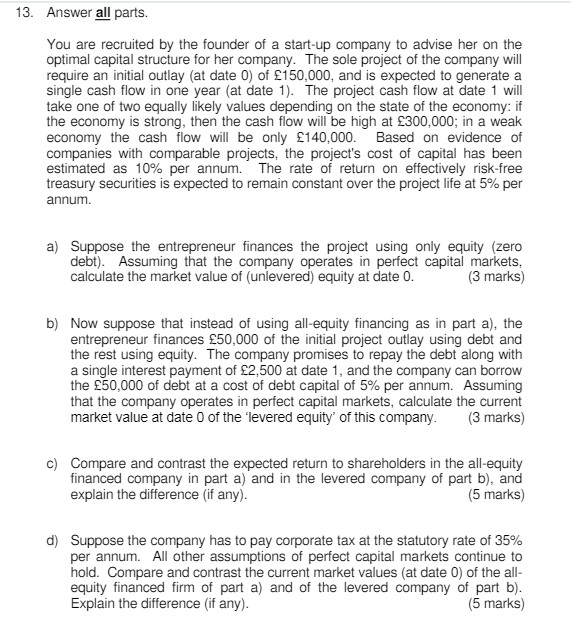

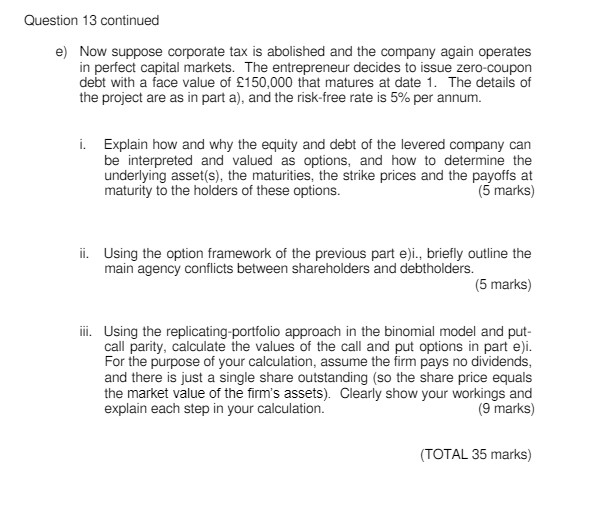

13. Answer all parts. You are recruited by the founder of a start-up company to advise her on the optimal capital structure for her company. The sole project of the company will require an initial outlay (at date 0) of 150.000. and is expected to generate a single cash flow in one year (at date 1). The project cash flow at date 1 will take one of two equally likely values depending on the state of the economy: if the economy is strong, then the cash flow will be high at 300,000; in a weak economy the cash flow will be only 140,000. Based on evidence of companies with comparable projects, the project's cost of capital has been estimated as 10% per annum. The rate of return on effectively risk-free treasury securities is expected to remain constant over the project life at 5% per annum. a) Suppose the entrepreneur finances the project using only equity (zero debt). Assuming that the company operates in perfect capital markets, calculate the market value of (unlevered) equity at date 0. (3 marks) b) Now suppose that instead of using all-equity financing as in part a), the entrepreneur finances 50,000 of the initial project outlay using debt and the rest using equity. The company promises to repay the debt along with a single interest payment of 2,500 at date 1, and the company can borrow the 50,000 of debt at a cost of debt capital of 5% per annum. Assuming that the company operates in perfect capital markets, calculate the current market value at date 0 of the 'levered equity' of this company. (3 marks) c) Compare and contrast the expected return to shareholders in the all-equity financed company in part a) and in the levered company of part b), and explain the difference (if any). (5 marks) d) Suppose the company has to pay corporate tax at the statutory rate of 35% per annum. All other assumptions of perfect capital markets continue to hold. Compare and contrast the current market values (at date 0) of the all- equity financed firm of part a) and of the levered company of part b). Explain the difference (if any). (5 marks) Question 13 continued e) Now suppose corporate tax is abolished and the company again operates in perfect canital markets. The entrepreneur decides to issue zero-coupon debt with a face value of 150,000 that matures at date 1. The details of the project are as in part a), and the risk-free rate is 5% per annum. i. Explain how and why the equity and debt of the levered company can be interpreted and valued as options, and how to determine the underlying asset(s), the maturities, the strike prices and the payoffs at maturity to the holders of these options. (5 marks) ii. Using the option framework of the previous part e)i., briefly outline the main agency conflicts between shareholders and debtholders. (5 marks) iii. Using the replicating-portfolio approach in the binomial model and put- call parity, calculate the values of the call and put options in part ei. For the purpose of your calculation, assume the firm pays no dividends, and there is just a single share outstanding (so the share price equals the market value of the firm's assets). Clearly show your workings and explain each step in your calculation. (9 marks) (TOTAL 35 marks) 13. Answer all parts. You are recruited by the founder of a start-up company to advise her on the optimal capital structure for her company. The sole project of the company will require an initial outlay (at date 0) of 150.000. and is expected to generate a single cash flow in one year (at date 1). The project cash flow at date 1 will take one of two equally likely values depending on the state of the economy: if the economy is strong, then the cash flow will be high at 300,000; in a weak economy the cash flow will be only 140,000. Based on evidence of companies with comparable projects, the project's cost of capital has been estimated as 10% per annum. The rate of return on effectively risk-free treasury securities is expected to remain constant over the project life at 5% per annum. a) Suppose the entrepreneur finances the project using only equity (zero debt). Assuming that the company operates in perfect capital markets, calculate the market value of (unlevered) equity at date 0. (3 marks) b) Now suppose that instead of using all-equity financing as in part a), the entrepreneur finances 50,000 of the initial project outlay using debt and the rest using equity. The company promises to repay the debt along with a single interest payment of 2,500 at date 1, and the company can borrow the 50,000 of debt at a cost of debt capital of 5% per annum. Assuming that the company operates in perfect capital markets, calculate the current market value at date 0 of the 'levered equity' of this company. (3 marks) c) Compare and contrast the expected return to shareholders in the all-equity financed company in part a) and in the levered company of part b), and explain the difference (if any). (5 marks) d) Suppose the company has to pay corporate tax at the statutory rate of 35% per annum. All other assumptions of perfect capital markets continue to hold. Compare and contrast the current market values (at date 0) of the all- equity financed firm of part a) and of the levered company of part b). Explain the difference (if any). (5 marks) Question 13 continued e) Now suppose corporate tax is abolished and the company again operates in perfect canital markets. The entrepreneur decides to issue zero-coupon debt with a face value of 150,000 that matures at date 1. The details of the project are as in part a), and the risk-free rate is 5% per annum. i. Explain how and why the equity and debt of the levered company can be interpreted and valued as options, and how to determine the underlying asset(s), the maturities, the strike prices and the payoffs at maturity to the holders of these options. (5 marks) ii. Using the option framework of the previous part e)i., briefly outline the main agency conflicts between shareholders and debtholders. (5 marks) iii. Using the replicating-portfolio approach in the binomial model and put- call parity, calculate the values of the call and put options in part ei. For the purpose of your calculation, assume the firm pays no dividends, and there is just a single share outstanding (so the share price equals the market value of the firm's assets). Clearly show your workings and explain each step in your calculation. (9 marks) (TOTAL 35 marks)