Answered step by step

Verified Expert Solution

Question

1 Approved Answer

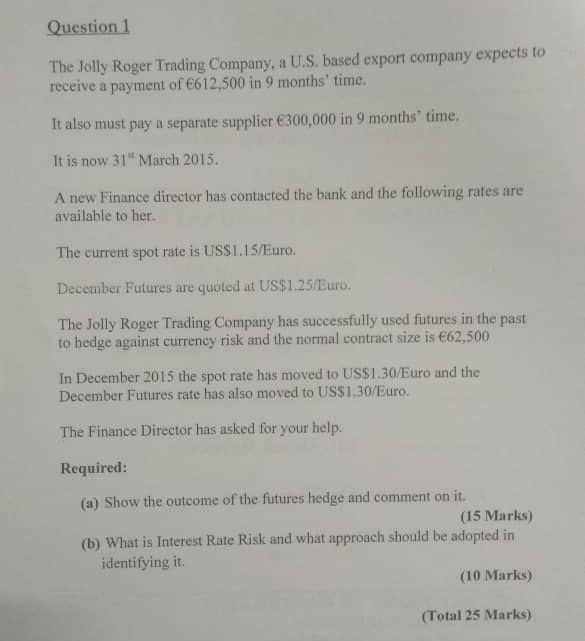

Hi, how to do this question? Question 1 The Jolly Roger Trading Company, a U.S. based export company expects to receive a payment of 612,500

Hi, how to do this question?

Question 1 The Jolly Roger Trading Company, a U.S. based export company expects to receive a payment of 612,500 in 9 months' time. It also must pay a separate supplier 300,000 in 9 months' time, It is now 31" March 2015. A new Finance director has contacted the bank and the following rates are available to her The current spot rate is US$1.15/Euro. December Futures are quoted at US$1.25/Euro. The Jolly Roger Trading Company has successfully used futures in the past to hedge against currency risk and the normal contract size is 62,500 In December 2015 the spot rate has moved to US$1.30/Euro and the December Futures rate has also moved to US$1,30/Euro. The Finance Director has asked for your help. Required: (a) Show the outcome of the futures hedge and comment on it. (15 Marks) (b) What is Interest Rate Risk and what approach should be adopted in identifying it (10 Marks) (Total 25 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started