Hi

*************************************************************************************************

I am just looking for how the book comes up with this solution????

Where does 19,909.20 and 9,331.30 come from to do the highlighted calculation?????

****************************************************************************************************

EXERCISE 91 Forecasting Income and Income Components Quaker Oats Company Refer to the financial statements of Quaker Oats Company in Problem 96. Prepare a forecasted income statement for Year 12 using the following assumptions ($ millions):

1. Revenues are forecast to equal $6,000.

2. Cost of sales forecast uses the average percent relation between cost of sales and sales for the three-year period ending June 30, Year 11.

3. Selling, general, and administrative expenses are expected to increase by the same percent increase occurring from Year 10 to Year 11.

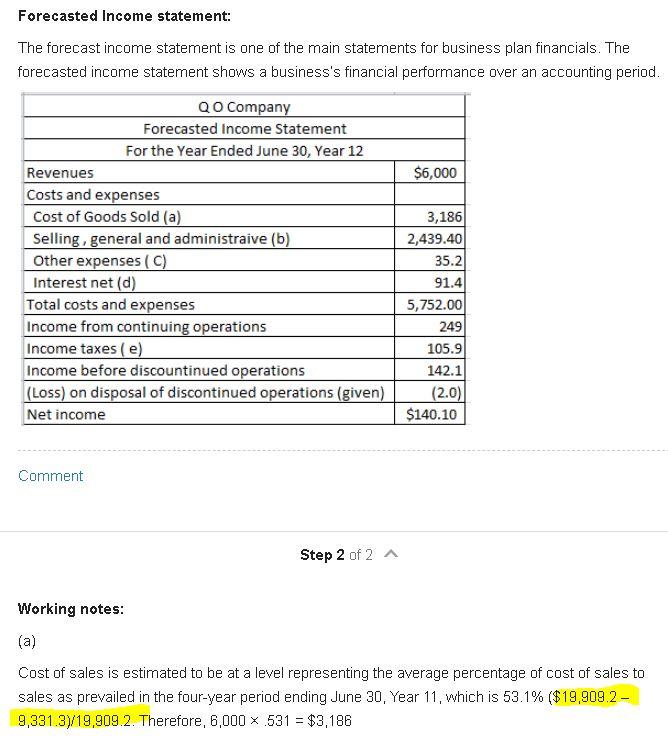

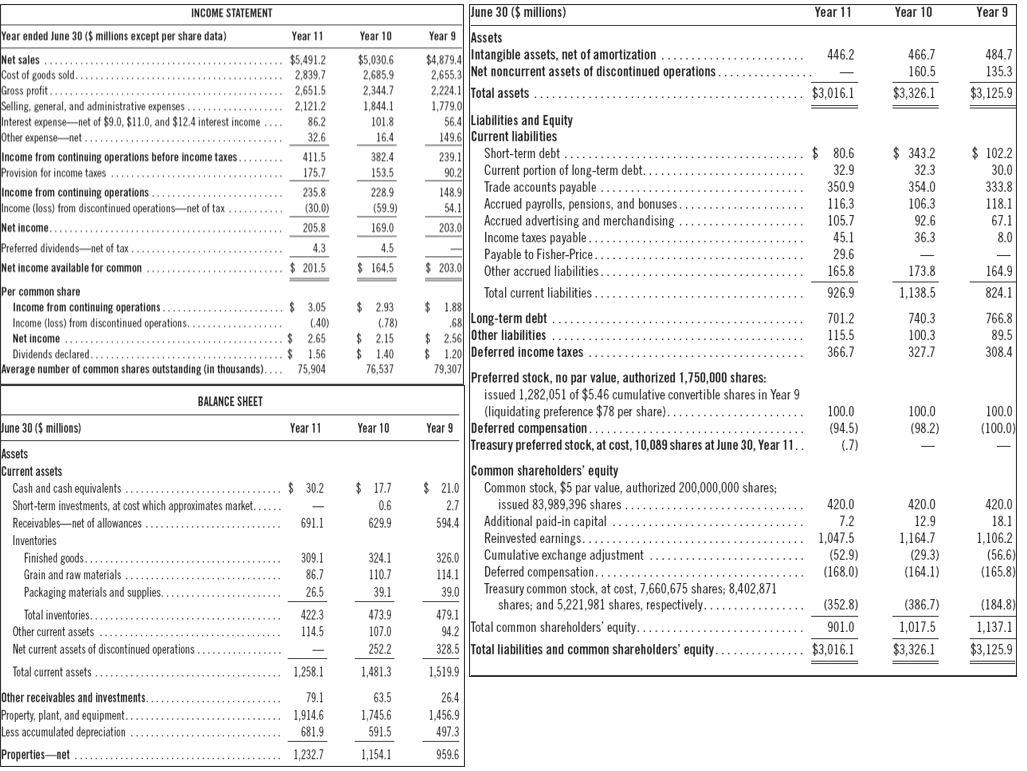

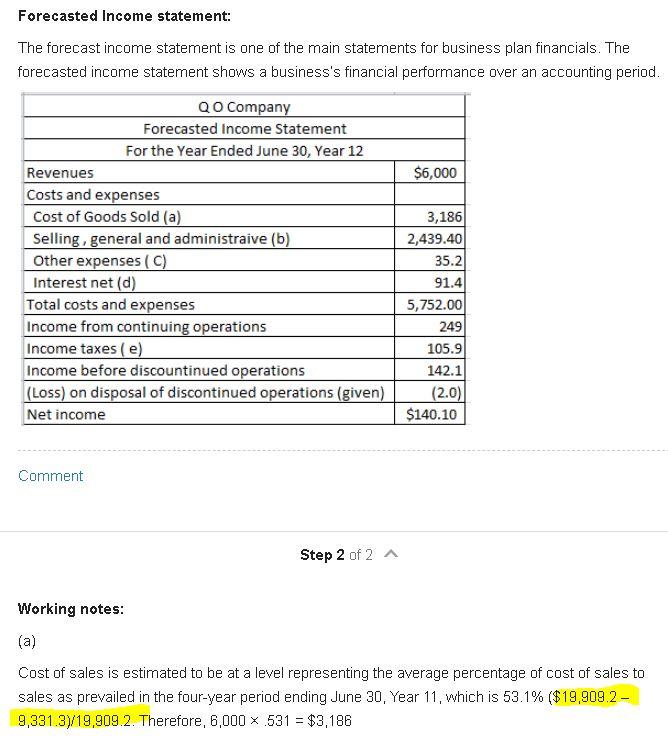

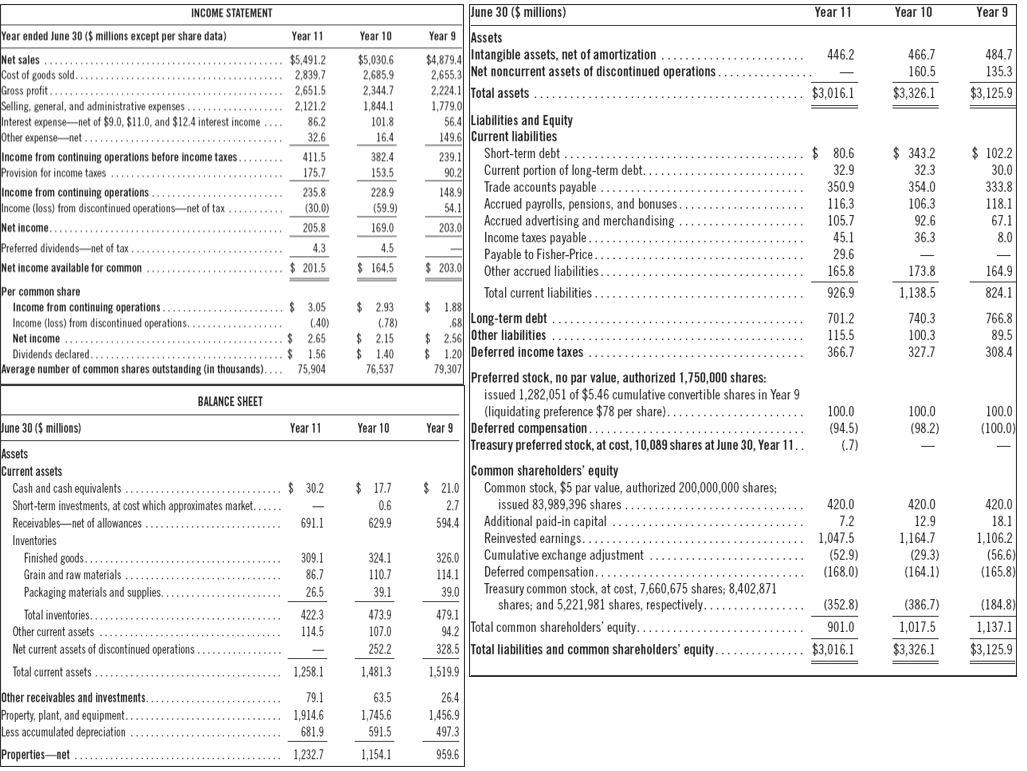

Forecasted Income statement: The forecast income statement is one of the main statements for business plan financials. The forecasted income statement shows a business's financial performance over an accounting period. $6,000 QO Company Forecasted Income Statement For the Year Ended June 30, Year 12 Revenues Costs and expenses Cost of Goods Sold (a) Selling, general and administraive (b) Other expenses (C) Interest net (d) Total costs and expenses Income from continuing operations Income taxes (e) Income before discountinued operations (Loss) on disposal of discontinued operations (given) Net income 3,186 2,439.40 35.2 91.4 5,752.00 249 105.9 142.1 (2.0) $140.10 Comment Step 2 of 2 A Working notes: (a) Cost of sales is estimated to be at a level representing the average percentage of cost of sales to sales as prevailed in the four-year period ending June 30, Year 11, which is 53.1% ($19,909.2- 9,331.3/19,909.2. Therefore, 6,000 X 531 = $3,186 INCOME STATEMENT Year 11 Year 10 Year 9 446.2 466.7 160.5 $3,326.1 484.7 135.3 $3,125.9 $3,016.1 Year ended June 30 (5 millions except per share data) Year 11 Net sales $5,491.2 Cost of goods sold 2,839.7 Gross profit 2,651.5 Selling, general, and administrative expenses... 2,121.2 Interest expense---ret of $9.0, $11.0 and $12.4 interest income.... 86.2 Other expense-net 32.6 Income from continuing operations before income taxes 4115 Provision for income taxes... 175.7 Income from continuing operations ........ 235.8 Income (loss) from discontinued operations net of tax Net income...... 205.8 Preferred dividendsnet of tax 4.3 Net income available for common $ 201,5 Per common share Income from continuing operations $ 3.05 Income (loss) from discontinued operations, (40) Net income... $ 2,65 Dividends declared........ $ 1.56 Average number of common shares outstanding (in thousands).... 75,904 Year 10 $5,030.6 2,685.9 2,344.7 1,844.1 101.8 16.4 382.4 153.5 228.9 (59.9) 169.0 4.5 $164.5 $ 80.6 32.9 350.9 116.3 105.7 45.1 29.6 165.8 926.9 $ 343.2 32.3 354.0 106.3 92.6 36.3 $ 102.2 30.0 333.8 118.1 67.1 8.0 (30,0) 164.9 824.1 $ 2.93 1.78) $ 2.15 $ 1.40 76,537 June 30 ($ millions) Year 9 Assets $4,8794 Intangible assets, net of amortization 2,655,3 Net noncurrent assets of discontinued operations 2.224.1 Total assets 1,779.00 56.4 Liabilities and Equity 149.6 Current liabilities 239.1 Short-term debt 90.2 Current portion of long-term debt. 148.9 Trade accounts payable ... 54.1 Accrued payrolls, pensions, and bonuses. 203.0 Accrued advertising and merchandising Income taxes payable Payable to Fisher-Price $ 203.0 Other accrued liabilities Total current liabilities $ 1.88 .68 Long-term debt $ 2.561 Other liabilities $ 1.20 Deferred income taxes 79,307 Preferred stock, no par value, authorized 1,750,000 shares: issued 1,282,051 of $5.46 cumulative convertible shares in Year 9 (liquidating preference $78 per share).. Year 9 Deferred compensation Treasury preferred stock, at cost, 10,089 shares at June 30, Year 11.. Common shareholders' equity $ 21.0 Common stock, $5 par value, authorized 200,000,000 shares; 2.7 issued 83,989,396 shares 594.4 Additional paid-in capital Reinvested earnings... 326.0 Cumulative exchange adjustment 114.1 Deferred compensation.... 39.0 Treasury common stock, at cost, 7,660,675 shares: 8,402,871 shares; and 5,221,981 shares, respectively, 479.1 94.2 Total common shareholders' equity. 328.5 | Total liabilities and common shareholders' equity 1,519.9 7012 115.5 366.7 173.8 1.138.5 740.3 100.3 327.7 766.8 89.5 308.4 BALANCE SHEET 100.0 (98.2) 100.0 (100.0) June 30 (5 millions) 100.0 (94.5) (.7) Year 11 Year 10 $ 30.2 $ 17.7 0.6 629.9 691.1 420.0 7.2 1,047.5 (52.9) (168.0) 420.0 12.9 1,164.7 (29.3) (164.1) 420.0 18.1 1,106.2 (56.6) (165.8) Assets Current assets Cash and cash equivalents Short-term investments, at cost which approximates market...... Receivables--net of allowances Inventories Finished goods...... Grain and raw materials Packaging materials and supplies. Total inventories. Other current assets .... Net current assets of discontinued operations Total current assets Other receivables and investments. Property , plant, and equipment. Less accumulated depreciation .... Properties-net 309.1 86.7 26.5 4223 114.5 324.1 110.7 39.1 473.9 107.0 252.2 1,481.3 (352.8) 901.0 $3,016.1 (386.7) 1,017,5 $3,326.1 (184.8) 1,137.1 $3,125.9 1,258.1 79.1 1,914.6 681.9 1,232.7 63.5 1.745.6 591.5 1.154.1 26.4 1.456.9 497.3 959.6