Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, I am seeking help in answering these questions. Can someone please provide me with solutions for these questions? thank you so much 112 FINANCIAL

Hi, I am seeking help in answering these questions. Can someone please provide me with solutions for these questions? thank you so much

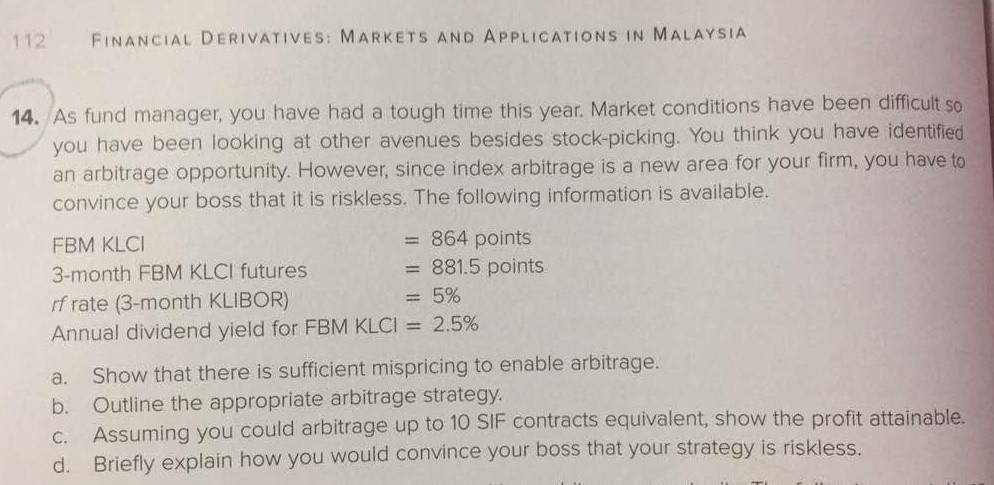

112 FINANCIAL DERIVATIVES: MARKETS AND APPLICATIONS IN MALAYSIA 14. As fund manager, you have had a tough time this year. Market conditions have been difficult so you have been looking at other avenues besides stock-picking. You think you have identifled an arbitrage opportunity. However, since index arbitrage is a new area for your firm, you have to convince your boss that it is riskless. The following information is available. FBM KLC 3-month FBM KLCI futures rf rate (3-month KLIBOR) Annual dividend yield for FBM KLCI-2.5% = 864 points = 8815 points 5% a. Show that there is sufficient mispricing to enable arbitrage. b. Outline the appropriate arbitrage strategy. c. Assuming you could arbitrage up to 10 SIF d. Briefly explain how you would convince your boss that your strategy is riskless. contracts equivalent, show the profit attainable. 112 FINANCIAL DERIVATIVES: MARKETS AND APPLICATIONS IN MALAYSIA 14. As fund manager, you have had a tough time this year. Market conditions have been difficult so you have been looking at other avenues besides stock-picking. You think you have identifled an arbitrage opportunity. However, since index arbitrage is a new area for your firm, you have to convince your boss that it is riskless. The following information is available. FBM KLC 3-month FBM KLCI futures rf rate (3-month KLIBOR) Annual dividend yield for FBM KLCI-2.5% = 864 points = 8815 points 5% a. Show that there is sufficient mispricing to enable arbitrage. b. Outline the appropriate arbitrage strategy. c. Assuming you could arbitrage up to 10 SIF d. Briefly explain how you would convince your boss that your strategy is riskless. contracts equivalent, show the profit attainableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started