Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi i can't figure out what's the correct answers for the wrong one in red. please help Chapter 14 i Saved Help Save & Exit

hi i can't figure out what's the correct answers for the wrong one in red. please help

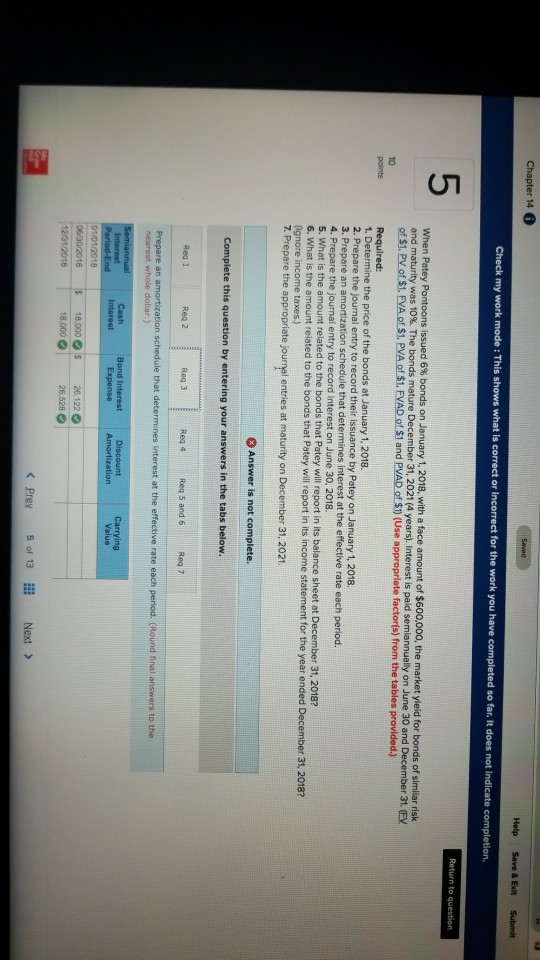

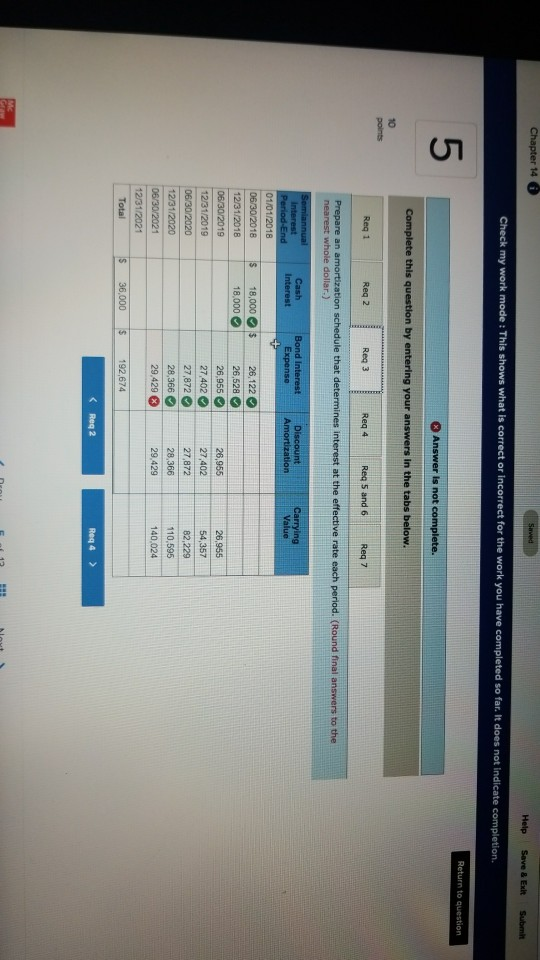

Chapter 14 i Saved Help Save & Exit Submit Check my work mode: This shows what Is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question When Patey Pontoons issued 6 % bonds on January 1, 2018, with a face amount of $600,000, the market yield for bonds of similar risk and maturity was 10 %. The bonds mature December 31, 2021 (4 years). Interest is paid semiannually on June 30 and December 31, (FV of $1, PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 10 Required: 1. Determine the price of the bonds at January 1, 2018. 2. Prepare the journal entry to record their issuance by Patey on January 1, 2018. 3. Prepare an amortization schedule that determines interest at the effective rate each period. 4. Prepare the journal entry to record interest on June 30, 2018. 5. What is the amount related to the bonds that Patey will report in its balance sheet at December 31, 2018? 6. What is the amount related to the bonds that Patey will report in its income statement for the year ended December 31, 2018? (ignore income taxes.) 7. Prepare the appropriate jourryal points entries at maturity on December 31, 2021. Answer is not complete. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 3 Req 4 Reg 5 and 6 Reg 7 Prepare an amortization schedule that determines interest at the effective rate each period. (Round final answers to the nearest whole dollar.) Semiannual Interest Period-End Cash Interest Bond Interest Expense Discount Amortization Carrying Value 01/01/2018 06/30/2018 18,000 S 26.1222 12/31/2018 18.000 26,528 GrawStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started