Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, I have a question about this exercice: This is a part of the solution but I dont get where the Beta of 1 for

Hi, I have a question about this exercice:

This is a part of the solution but I dont get where the Beta of 1 for the Treasury bills comes from? (According to the internet Beta on treasury bills is always zero.)

Any help will be highly appreciated.

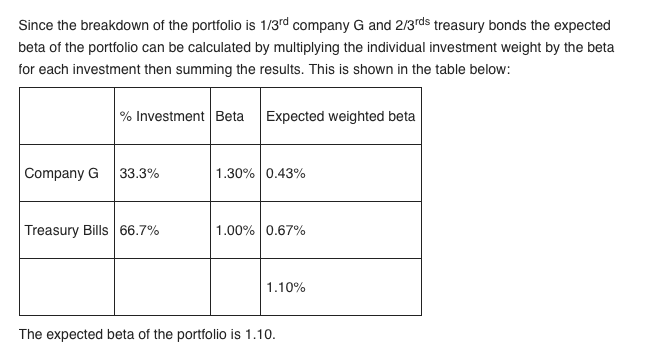

An investor currently has all of his wealth in Treasury bills. He is considering investing one-third of his funds in General Electric, whose beta is 1.30, with the remainder left in Treasury bills. The expected risk-free rate (Treasury bills) is 6 percent and the market risk premium is 8.8 percent. Determine the beta and the expected return on the proposed portfolio. Since the breakdown of the portfolio is 1/3rd company G and 2/3rds treasury bonds the expected beta of the portfolio can be calculated by multiplying the individual investment weight by the beta for each investment then summing the results. This is shown in the table below: % Investment Beta Expected weighted beta Company G 33.3% 1.30% 0.43% Treasury Bills 66.7% 1.00% 0.67% 1.10% The expected beta of the portfolio is 1.10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started