Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi. I have difficulties solving d and e. I have the answers from the solution: d. 7.343 e. 9.198. For you information is the other

Hi.

I have difficulties solving d and e. I have the answers from the solution: d. 7.343 e. 9.198.

For you information is the other answers: FCF 16 3.75 4.25 3.5 3.5 5 5 5.75 6.5 13.25 b. We know that ru = 0.045+1.250.04 = 0.095 and rwacc = ru D E+D C rD = 0.0915. c. 7.839

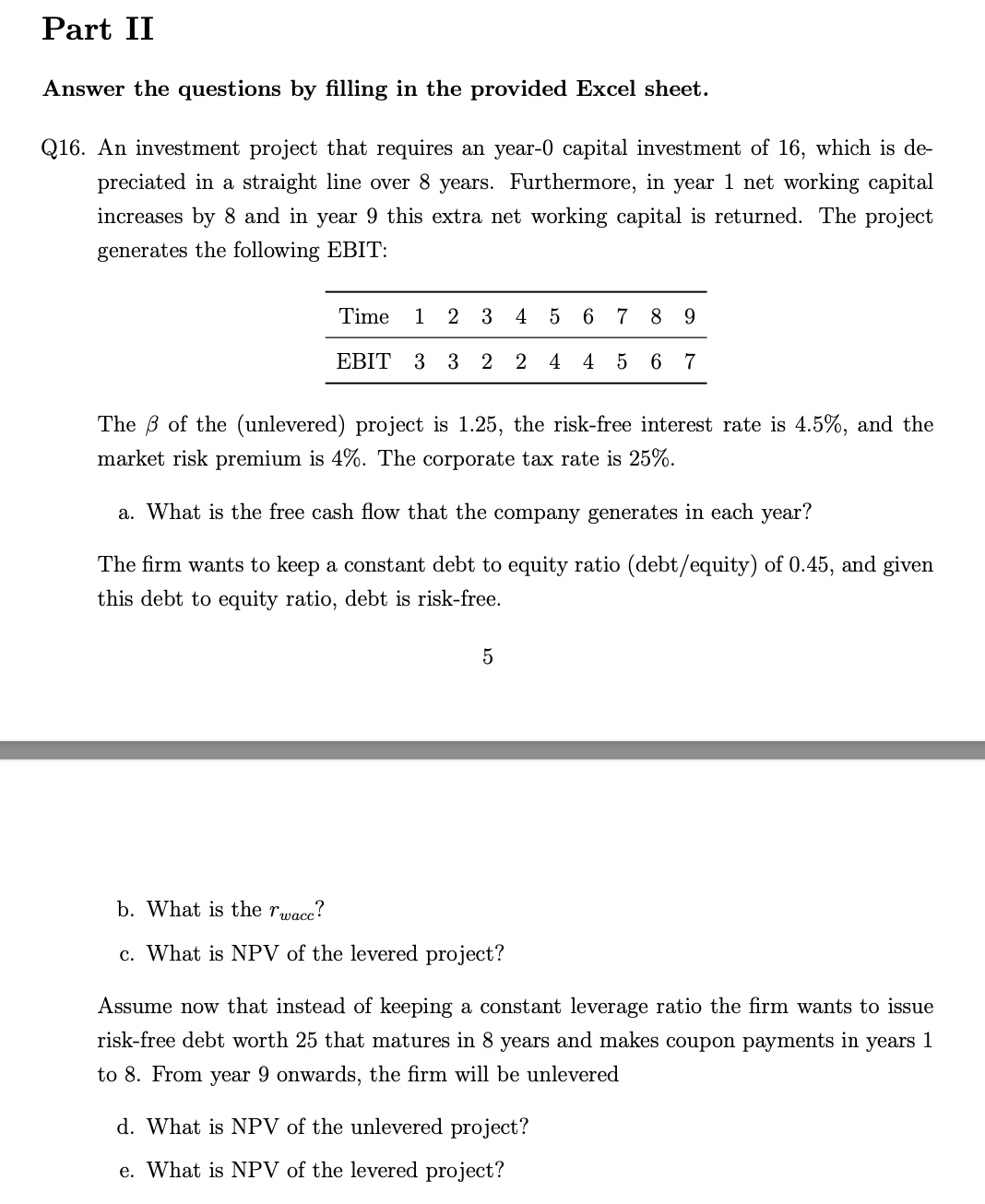

Answer the questions by filling in the provided Excel sheet. Q16. An investment project that requires an year-0 capital investment of 16 , which is depreciated in a straight line over 8 years. Furthermore, in year 1 net working capital increases by 8 and in year 9 this extra net working capital is returned. The project generates the following EBIT: The of the (unlevered) project is 1.25 , the risk-free interest rate is 4.5%, and the market risk premium is 4%. The corporate tax rate is 25%. a. What is the free cash flow that the company generates in each year? The firm wants to keep a constant debt to equity ratio (debt/equity) of 0.45 , and given this debt to equity ratio, debt is risk-free. 5 b. What is the rwacc ? c. What is NPV of the levered project? Assume now that instead of keeping a constant leverage ratio the firm wants to issue risk-free debt worth 25 that matures in 8 years and makes coupon payments in years 1 to 8 . From year 9 onwards, the firm will be unlevered d. What is NPV of the unlevered project? e. What is NPV of the levered projectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started