Hi, I have no idea how they are getting the 20711. I dont use the factor tables so I beed help doing it in excel.

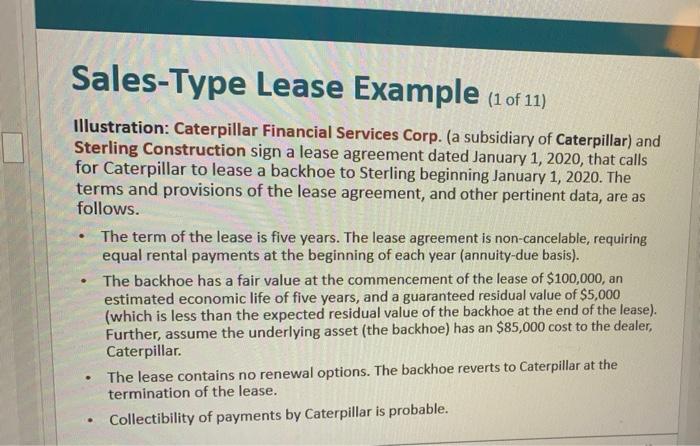

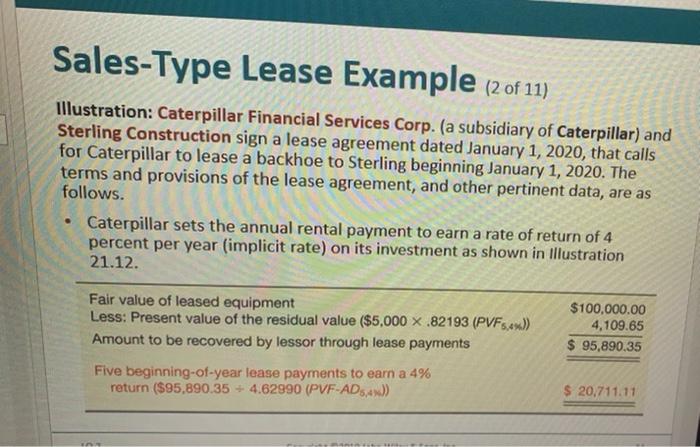

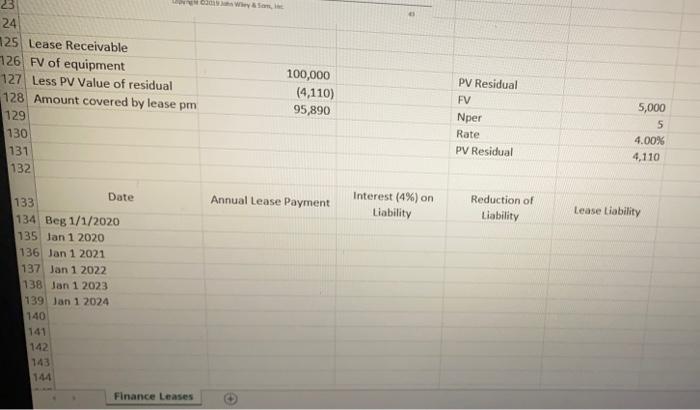

Sales-Type Lease Example (10f 11) Illustration: Caterpillar Financial Services Corp. (a subsidiary of Caterpillar) and Sterling Construction sign a lease agreement dated January 1, 2020, that calls for Caterpillar to lease a backhoe to Sterling beginning January 1, 2020. The terms and provisions of the lease agreement, and other pertinent data, are as follows. The term of the lease is five years. The lease agreement is non-cancelable, requiring equal rental payments at the beginning of each year (annuity-due basis). The backhoe has a fair value at the commencement of the lease of $100,000, an estimated economic life of five years, and a guaranteed residual value of $5,000 (which is less than the expected residual value of the backhoe at the end of the lease). Further, assume the underlying asset (the backhoe) has an $85,000 cost to the dealer, Caterpillar The lease contains no renewal options. The backhoe reverts to Caterpillar at the termination of the lease. Collectibility of payments by Caterpillar is probable. . . Sales-Type Lease Example (2 of 11) Illustration: Caterpillar Financial Services Corp. (a subsidiary of Caterpillar) and Sterling Construction sign a lease agreement dated January 1, 2020, that calls for Caterpillar to lease a backhoe to Sterling beginning January 1, 2020. The terms and provisions of the lease agreement, and other pertinent data, are as follows. Caterpillar sets the annual rental payment to earn a rate of return of 4 percent per year (implicit rate) on its investment as shown in Illustration 21.12. Fair value of leased equipment Less: Present value of the residual value ($5,000 X.82193 (PVF5,-)) Amount to be recovered by lessor through lease payments $100,000.00 4,109.65 $ 95,890.35 Five beginning-of-year lease payments to earn a 4% return ($95,890.35 + 4.62990 (PVF-AD5,4)) $ 20,711.11 Wyom, 23 24 125 Lease Receivable 126 FV of equipment 127 Less PV Value of residual 128 Amount covered by lease pm 129 130 131 132 100,000 (4,110) 95,890 PV Residual FV Nper Rate PV Residual 5,000 5 4.00% 4,110 Annual Lease Payment Interest (4%) on Liability Reduction of Liability Lease Liability Date 133 134 Beg 1/1/2020 135 Jan 1 2020 136 Jan 1 2021 137 Jan 1 2022 138 Jan 1 2023 139 Jan 1 2024 140 141 142 143 TAM Finance Leases