Hi! I have this assignment from Accounting 1020 and I need help A) checking my answers and B) working on part C. Any help is Appreciated!!!

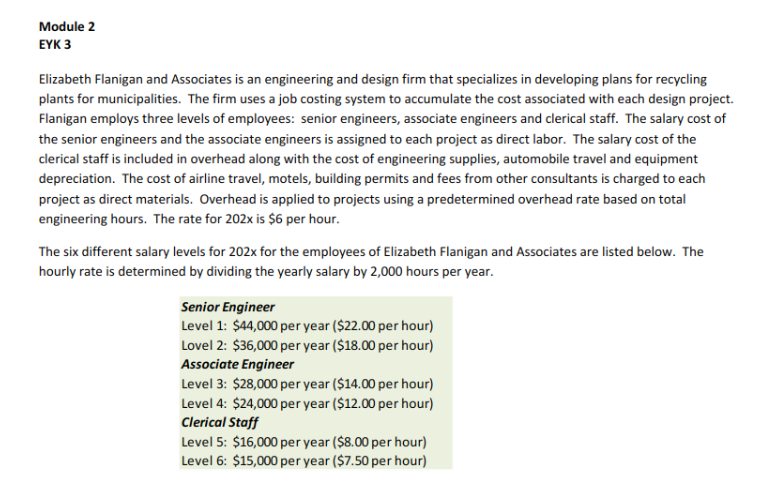

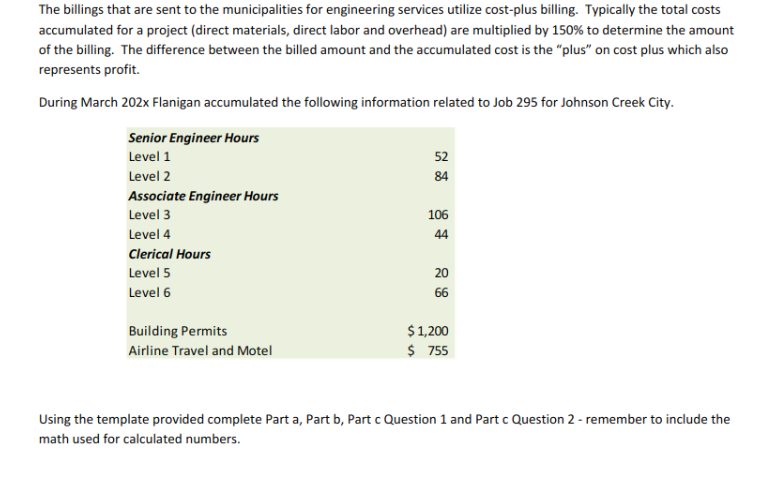

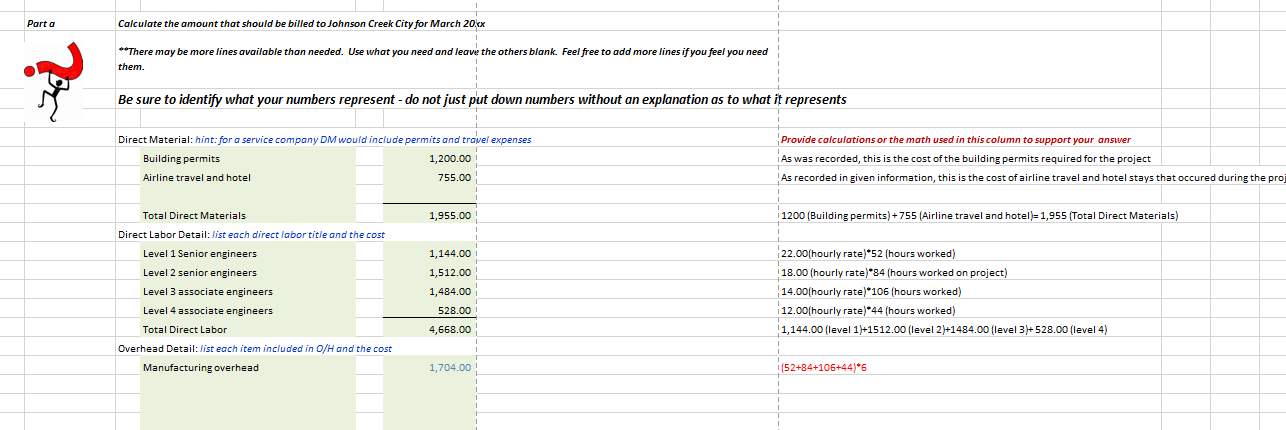

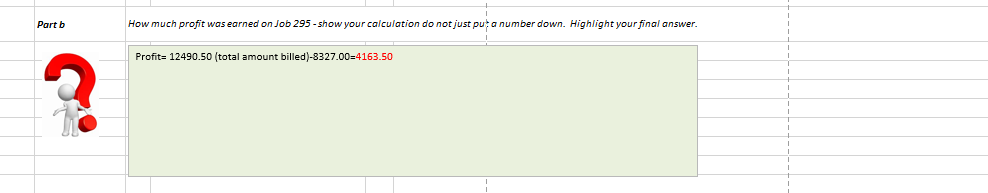

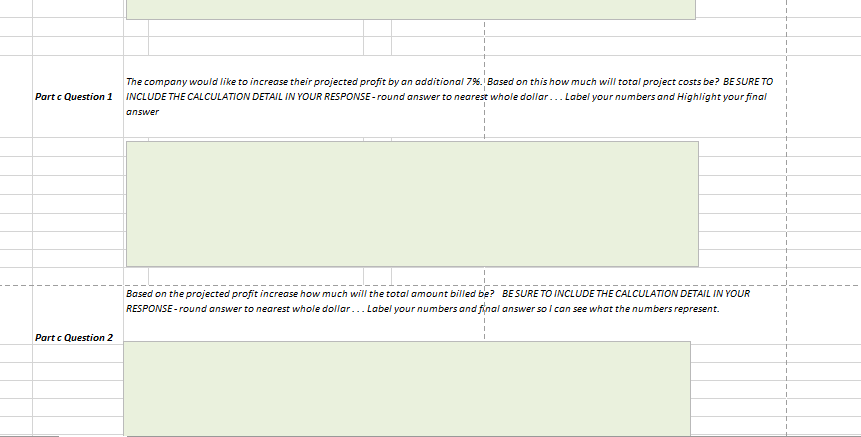

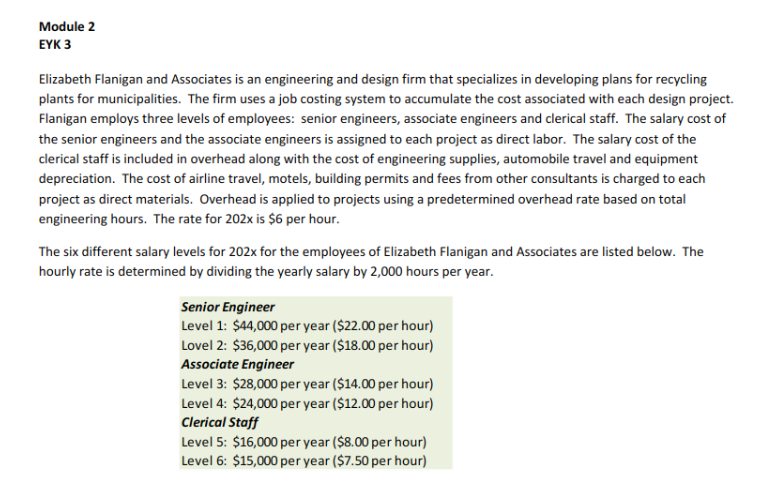

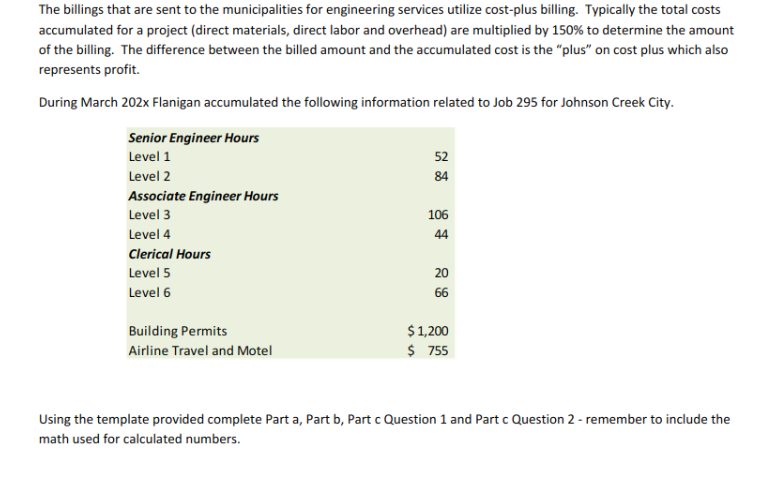

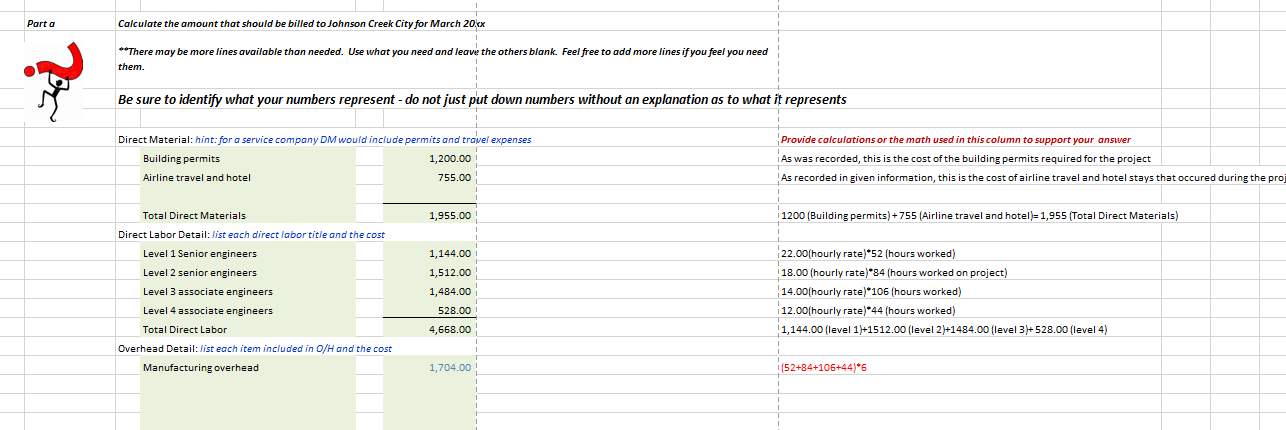

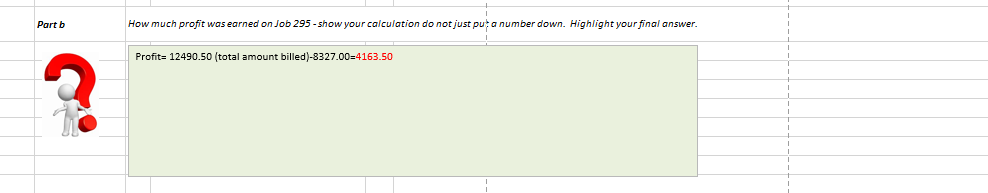

Module 2 EYK 3 Elizabeth Flanigan and Associates is an engineering and design firm that specializes in developing plans for recycling plants for municipalities. The firm uses a job costing system to accumulate the cost associated with each design project. Flanigan employs three levels of employees: senior engineers, associate engineers and clerical staff. The salary cost of the senior engineers and the associate engineers is assigned to each project as direct labor. The salary cost of the clerical staff is included in overhead along with the cost of engineering supplies, automobile travel and equipment depreciation. The cost of airline travel, motels, building permits and fees from other consultants is charged to each project as direct materials. Overhead is applied to projects using a predetermined overhead rate based on total engineering hours. The rate for 202x is $6 per hour. The six different salary levels for 202x for the employees of Elizabeth Flanigan and Associates are listed below. The hourly rate is determined by dividing the yearly salary by 2,000 hours per year. Senior Engineer Level 1: $44,000 per year ($22.00 per hour) Lovel 2: $36,000 per year ($18.00 per hour) Associate Engineer Level 3: $28,000 per year ($14.00 per hour) Level 4: $24,000 per year ($12.00 per hour) Clerical Staff Level 5: $16,000 per year ($8.00 per hour) Level 6: $15,000 per year ($7.50 per hour) The billings that are sent to the municipalities for engineering services utilize cost-plus billing. Typically the total costs accumulated for a project (direct materials, direct labor and overhead) are multiplied by 150% to determine the amount of the billing. The difference between the billed amount and the accumulated cost is the "plus" on cost plus which also represents profit. During March 202x Flanigan accumulated the following information related to Job 295 for Johnson Creek City. Senior Engineer Hours Level 1 52 Level 2 84 Associate Engineer Hours Level 3 106 Level 4 44 Clerical Hours Level 5 20 Level 6 66 Building Permits $ 1,200 Airline Travel and Motel $ 755 Using the template provided complete Part a, Part b, Part c Question 1 and Part c Question 2 - remember to include the math used for calculated numbers. Part a Calculate the amount that should billed to Johnson Creek City for March 20.xx **There may be more lines available than needed. Use what you need and leave the others blank. Feel free to add more lines if you feel you need them. Be sure to identify what your numbers represent - do not just put down numbers without an explanation as to what it represents Direct Material: hint: for a service company DM would include permits and travel expenses Building permits 1,200.00 755.00 Airline travel and hotel Total Direct Materials 1,955.00 Direct Labor Detail: list each direct labor title and the cost Level 1 Senior engineers 1,144.00 Level 2 senior engineers 1,512.00 Level 3 associate engineers 1,484.00 Level 4 associate engineers 528.00 Total Direct Labor 4,668.00 Overhead Detail: list each item included in O/H and the cost Manufacturing overhead 1,704.00 Provide calculations or the math used in this column to support your answer As was recorded, this is the cost of the building permits required for the project As recorded in given information, this is the cost of airline travel and hotel stays that occured during the proj 1200 (Building permits)+755 (Airline travel and hotel)= 1,955 (Total Direct Materials) 22.00(hourly rate)*52 (hours worked) 18.00 (hourly rate)*84 (hours worked on project) 14.00(hourly rate)*106 (hours worked) 12.00(hourly rate) 44 (hours worked) 1,144.00 (level 1)+1512.00 (level 2)+1484.00 (level 3)+528.00 (level 4) (52+84+106+44)*6 Part b How much profit was earned on Job 295 - show your calculation do not just put a number down. Highlight your final answer. Profit=12490.50 (total amount billed)-8327.00=4163.50 Part c Question 1 Part c Question 2 The company would like to increase their projected profit by an additional 7%. Based on this how much will total project costs be? BE SURE TO INCLUDE THE CALCULATION DETAIL IN YOUR RESPONSE-round answer to nearest whole dollar... Label your numbers and Highlight your final answer Based on the projected profit increase how much will the total amount billed be? BE SURE TO INCLUDE THE CALCULATION DETAIL IN YOUR RESPONSE-round answer to nearest whole dollar... Label your numbers and final answer so I can see what the numbers represent