Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, I need a complete solution please show the required answer clearly. Direct Computation of Nonoperating Return Balance sheets and income statements for 3M Company

Hi, I need a complete solution please show the required answer clearly. Direct Computation of Nonoperating Return

Balance sheets and income statements for 3M Company follow.

| 3M COMPANY | ||

|---|---|---|

| Consolidated Statements of Income | ||

| For Years ended December 31 ($ millions) | 2018 | 2017 |

| Net sales | $32,765 | $31,657 |

| Operating expenses | ||

| Cost of sales | 16,682 | 16,055 |

| Selling, general and administrative expenses | 7,602 | 6,626 |

| Research, development and related expenses | 1,821 | 1,870 |

| Gain on sale of businesses | (547) | (586) |

| Total operating expenses | 25,558 | 23,965 |

| Operating income | 7,207 | 7,692 |

| Other expense, net* | 207 | 144 |

| Income before income taxes | 7,000 | 7,548 |

| Provision for income taxes | 1,637 | 2,679 |

| Net income including noncontrolling interest | 5,363 | 4,869 |

| Less: Net income attributable to noncontrolling interest | 14 | 11 |

| Net income attributable to 3M | $5,349 | $4,858 |

| *Interest expense, gross | $350 | $322 |

| 3M COMPANY | ||

|---|---|---|

| Consolidated Balance Sheets | ||

| At December 31 ($ millions, except per share amount) | 2018 | 2017 |

| Current Assets | ||

| Cash and cash equivalents | $2,853 | $3,053 |

| Marketable securities | 380 | 1,076 |

| Accounts receivable | 5,020 | 4,911 |

| Total inventories | 4,366 | 4,034 |

| Prepaids | 741 | 937 |

| Other current assets | 349 | 266 |

| Total current assets | 13,709 | 14,277 |

| Property, plant and equipment-net | 8,738 | 8,866 |

| Goodwill | 10,051 | 10,513 |

| Intangible assets-net | 2,657 | 2,936 |

| Other assets | 1,345 | 1,395 |

| Total assets | $36,500 | $37,987 |

| Current liabilities | ||

| Short-term borrowings and current portion of long-term debt | $1,211 | $1,853 |

| Accounts payable | 2,266 | 1,945 |

| Accrued payroll | 749 | 870 |

| Accrued income taxes | 243 | 310 |

| Other current liabilities | 2,775 | 2,709 |

| Total current liabilities | 7,244 | 7,687 |

| Long-term debt | 13,411 | 12,096 |

| Pension and postretirement benefits | 2,987 | 3,620 |

| Other liabilities | 3,010 | 2,962 |

| Total liabilities | 26,652 | 26,365 |

| 3M Company shareholders' equity | ||

| Common stock, par value | 9 | 9 |

| Additional paid-in capital | 5,643 | 5,352 |

| Retained earnings | 40,636 | 39,115 |

| Treasury stock | (29,626) | (25,887) |

| Accumulated other comprehensive income (loss) | (6,866) | (7,026) |

| Total 3M Company shareholders' equity | 9,796 | 11,563 |

| Noncontrolling interest | 52 | 59 |

| Total equity | 9,848 | 11,622 |

| Total liabilities and equity | $36,500 | $37,987 |

| Combined federal and state statutory tax rate | 22.00% | |

| ROE | 50.09% | |

| RNOA | 25.89% |

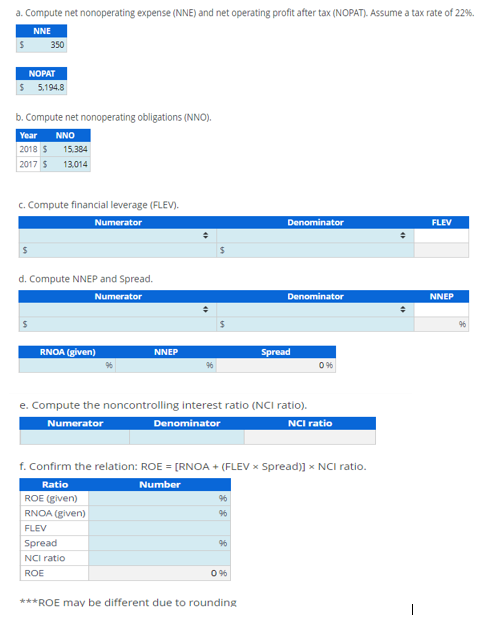

a. Compute net nonoperating expense (NNE) and net operating profit after tax (NOPAT). Assume a tax rate of 22%. b. Compute net nonoperating obligations (NNO). c. Compute financial leverage (FLEV). d. Compute NNEP and Spread. e. Compute the noncontrolling interest ratio ( NCl ratio). f. Confirm the relation: ROE=[RNOA+( FLEV Spread )]NCI ratio. ROE mav be different due to rounding

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started