Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi ! i need answer for question 7 and 8 7. If the company will be willing to settle the loan earlier (after 7 years),

hi ! i need answer for question 7 and 8

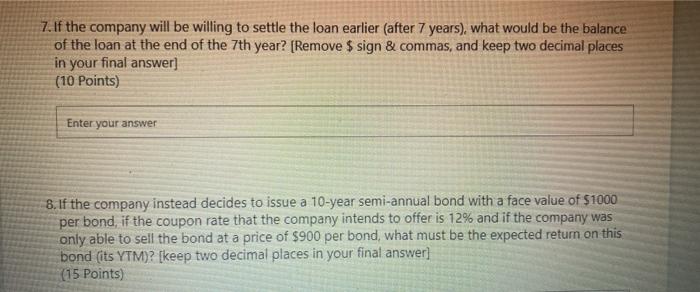

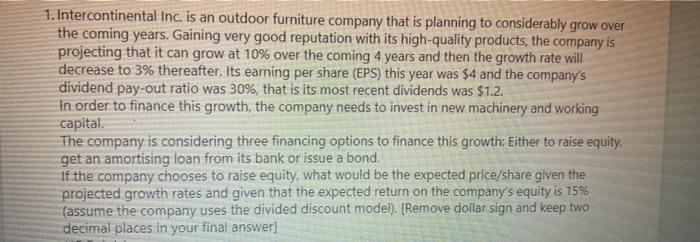

7. If the company will be willing to settle the loan earlier (after 7 years), what would be the balance of the loan at the end of the 7th year? [Remove $ sign & commas, and keep two decimal places in your final answer] (10 Points) Enter your answer 8. If the company instead decides to issue a 10-year semi-annual bond with a face value of $1000 per bond, if the coupon rate that the company intends to offer is 12% and if the company was only able to sell the bond at a price of $900 per bond, what must be the expected return on this bond (its YTM)? [keep two decimal places in your final answer] (15 Points) 1. Intercontinental Inc. is an outdoor furniture company that is planning to considerably grow over the coming years. Gaining very good reputation with its high-quality products, the company is projecting that it can grow at 10% over the coming 4 years and then the growth rate will decrease to 3% thereafter. Its earning per share (EPS) this year was $4 and the company's dividend pay-out ratio was 30%, that is its most recent dividends was $1.2. In order to finance this growth, the company needs to invest in new machinery and working capital. The company is considering three financing options to finance this growth: Either to raise equity. get an amortising loan from its bank or issue a bond. if the company chooses to raise equity, what would be the expected price/share given the projected growth rates and given that the expected return on the company's equity is 15% (assume the company uses the divided discount model). [Remove dollar sign and keep two decimal places in your final answer] 7. If the company will be willing to settle the loan earlier (after 7 years), what would be the balance of the loan at the end of the 7th year? [Remove $ sign & commas, and keep two decimal places in your final answer] (10 Points) Enter your answer 8. If the company instead decides to issue a 10-year semi-annual bond with a face value of $1000 per bond, if the coupon rate that the company intends to offer is 12% and if the company was only able to sell the bond at a price of $900 per bond, what must be the expected return on this bond (its YTM)? [keep two decimal places in your final answer] (15 Points) 1. Intercontinental Inc. is an outdoor furniture company that is planning to considerably grow over the coming years. Gaining very good reputation with its high-quality products, the company is projecting that it can grow at 10% over the coming 4 years and then the growth rate will decrease to 3% thereafter. Its earning per share (EPS) this year was $4 and the company's dividend pay-out ratio was 30%, that is its most recent dividends was $1.2. In order to finance this growth, the company needs to invest in new machinery and working capital. The company is considering three financing options to finance this growth: Either to raise equity. get an amortising loan from its bank or issue a bond. if the company chooses to raise equity, what would be the expected price/share given the projected growth rates and given that the expected return on the company's equity is 15% (assume the company uses the divided discount model). [Remove dollar sign and keep two decimal places in your final answer] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started