Answered step by step

Verified Expert Solution

Question

1 Approved Answer

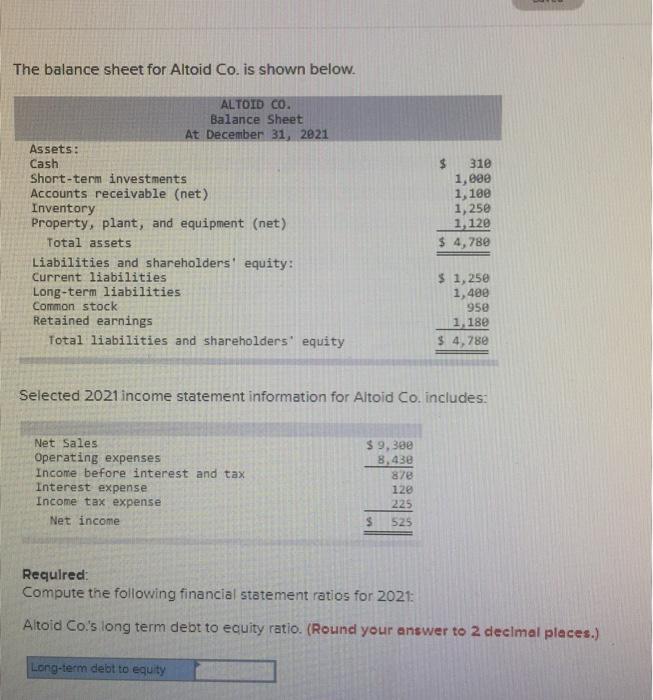

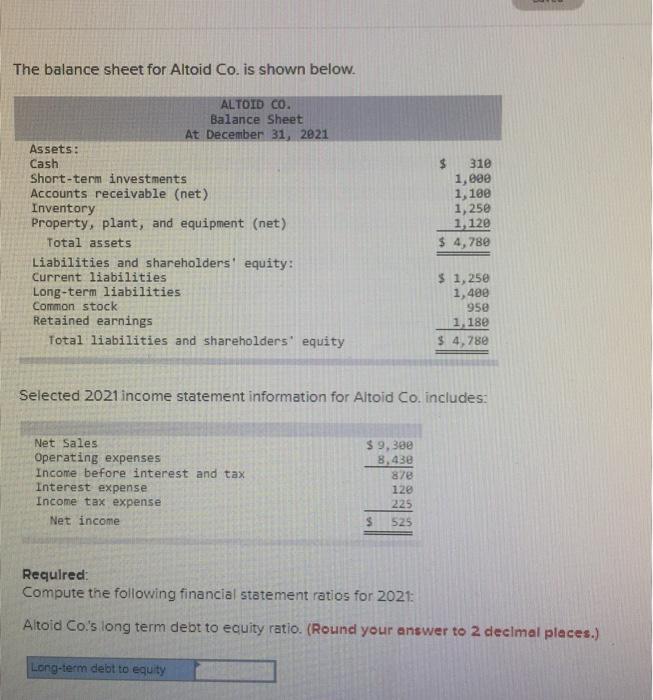

Hi I need help answering the following question thank you The balance sheet for Altoid Co. is shown below. ALTOID CO. Balance Sheet At December

Hi I need help answering the following question thank you

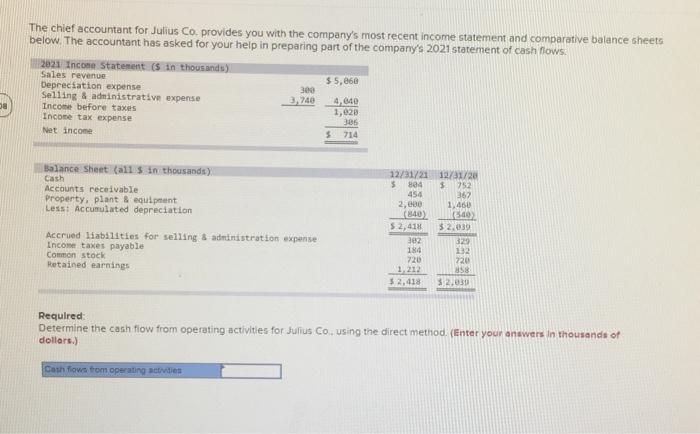

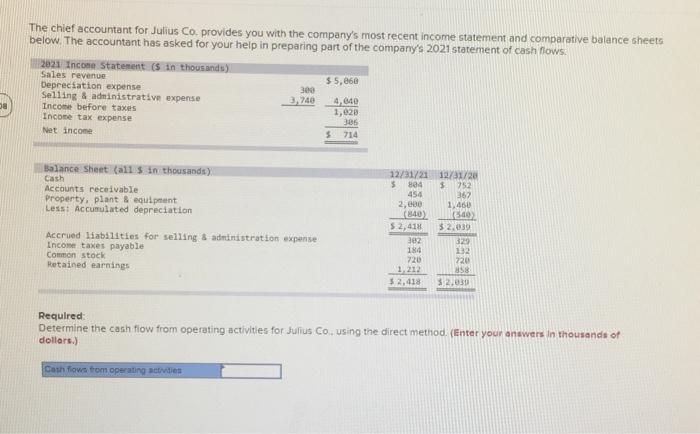

The balance sheet for Altoid Co. is shown below. ALTOID CO. Balance Sheet At December 31, 2021 Assets: Cash Short-term investments Accounts receivable (net) Inventory Property, plant, and equipment (net) Total assets Liabilities and shareholders' equity: Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and shareholders' equity 310 1,000 1,100 1,250 1,120 $ 4,780 $ 1,250 1,40e 950 1,180 $ 4,780 Selected 2021 income statement information for Altoid Co. includes: Net Sales Operating expenses Income before interest and tax Interest expense Income tax expense Net income $ 9,300 8.430 87e 128 225 $ 525 Required: Compute the following financial statement ratios for 2021: Altoid Co.'s long term debt to equity ratio. (Round your answer to 2 decimal places.) Long-term debt to equity The chief accountant for Julius Co provides you with the company's most recent income statement and comparative balance sheets below. The accountant has asked for your help in preparing part of the company's 2021 statement of cash flows. 2021 Income Statement is in thousands Sales revenue $5,060 Depreciation expense 300 Selling & administrative expense 3,740 Income before taxes 1,020 Income tax expense $ 714 4.000 385 Net income Balance Sheet (all sin thousands) Cash Accounts receivable Property, plant & equipent Less: Accumulated depreciation Accrued liabilities for selling & administration expense Income taxes payable Common stock Retained earnings 12/31/21 12/31/20 $ 1804 3752 454 362 2,000 1.450 (840) Ked 52,418 $2.00 382 320 184 12 720 720 1.212 $ 2.418 $ 2.839 Required Determine the cash flow from operating activities for Julius Co., using the direct method. (Enter your answers in thousands of dollars. Cash flows from operating activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started