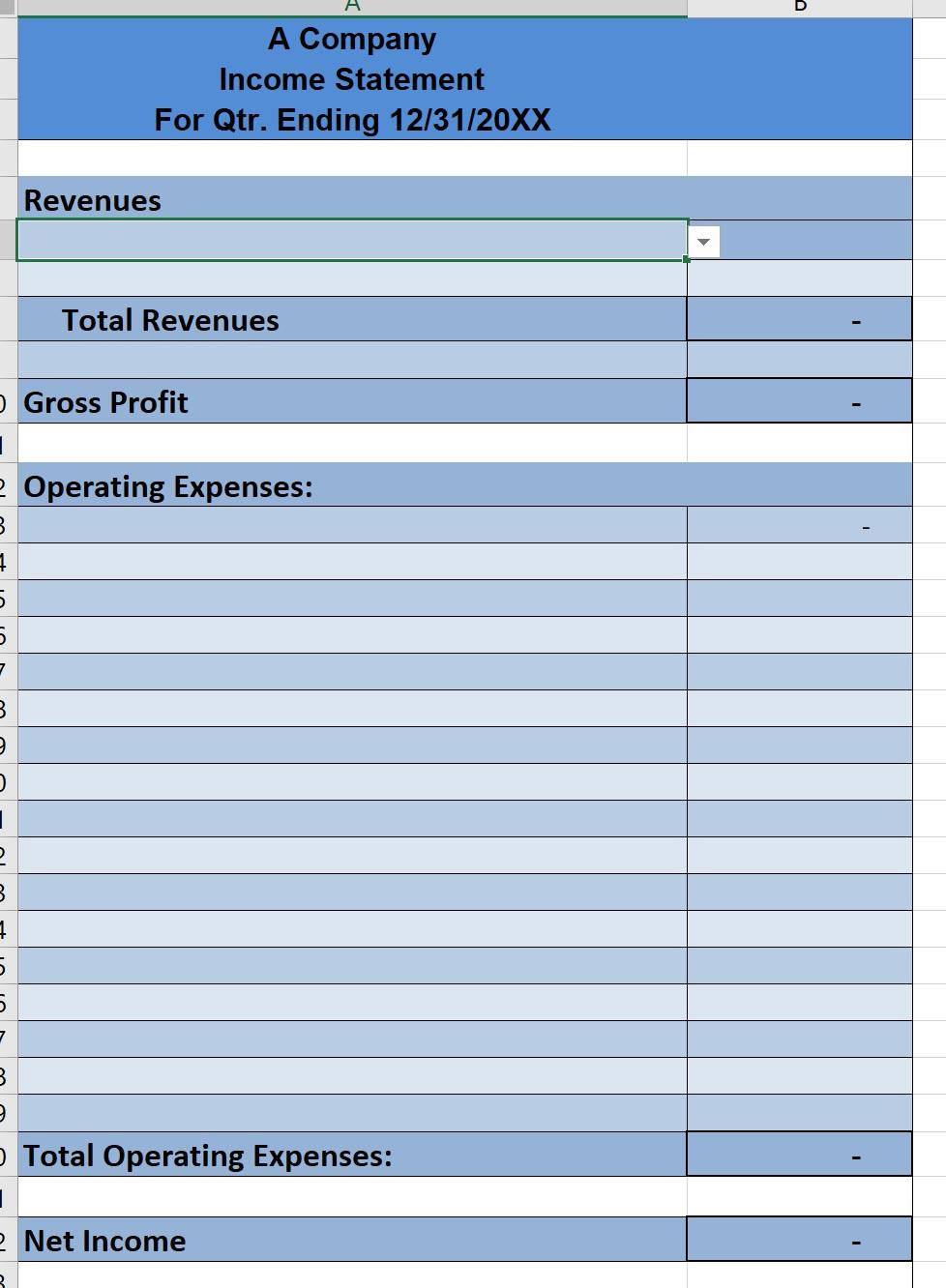

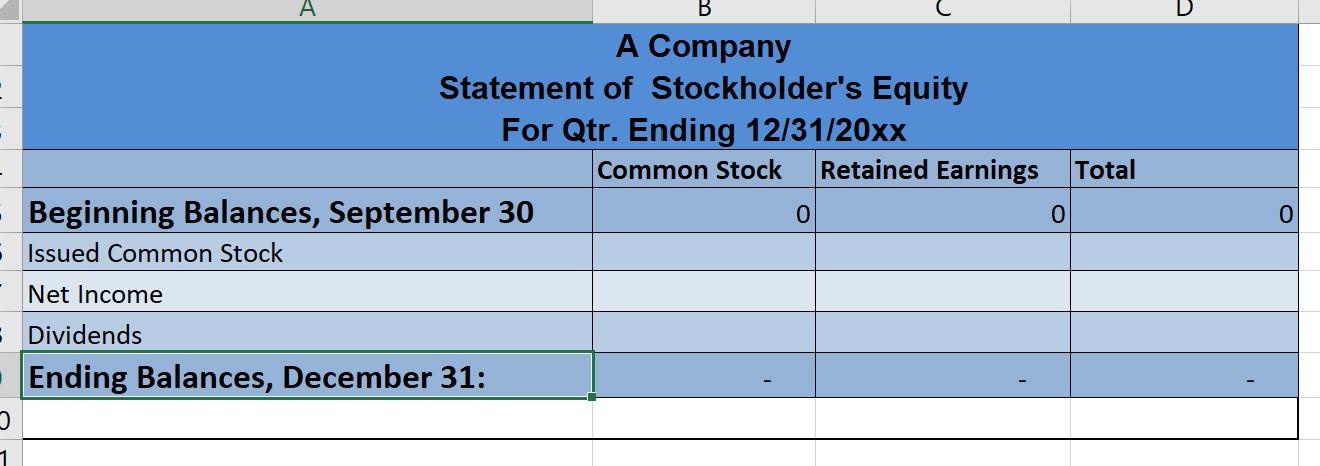

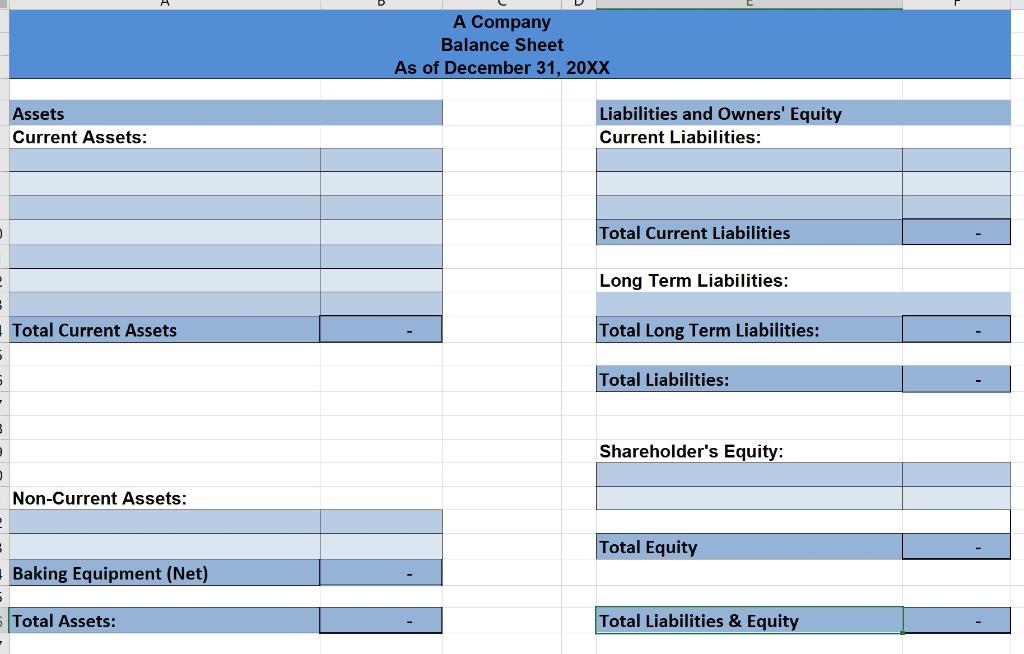

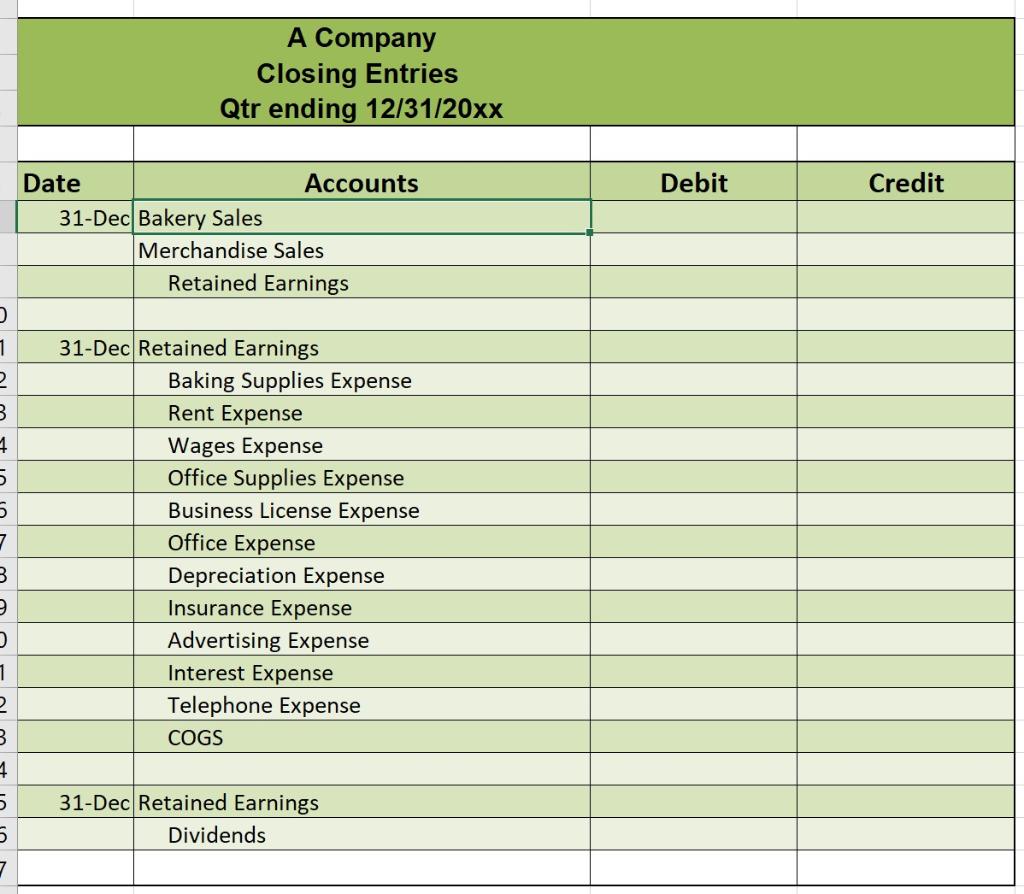

Hi, I need help figuring out my accounting project. my professor made marked the answers wrong in red and yellow. But I'm not sure how to fix and finish the project. I do not understand how to correct or do the math to finish the project. I've added the accounting data appendix and I was confident I did it correctly but now I am not. How do I solve all the charts? What are the corrections for the highlighted yellow and red? and how Do I solve for trial balance, Adjusting entries, Income Statment, Statement of stockholders equity, Balance Sheet, Closing Entries, and the Post-closing Trial Balance?

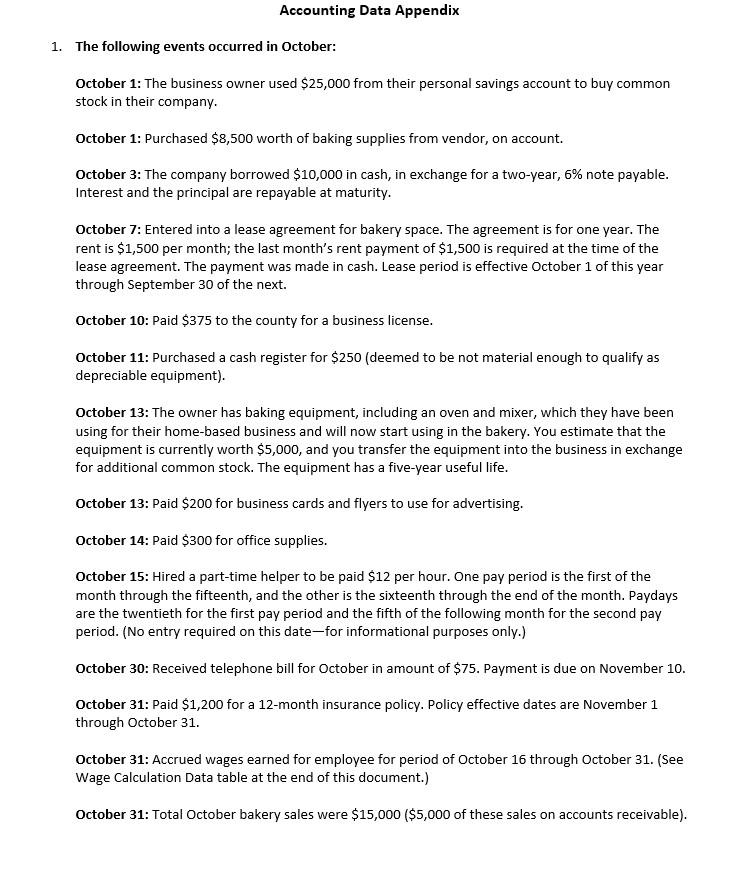

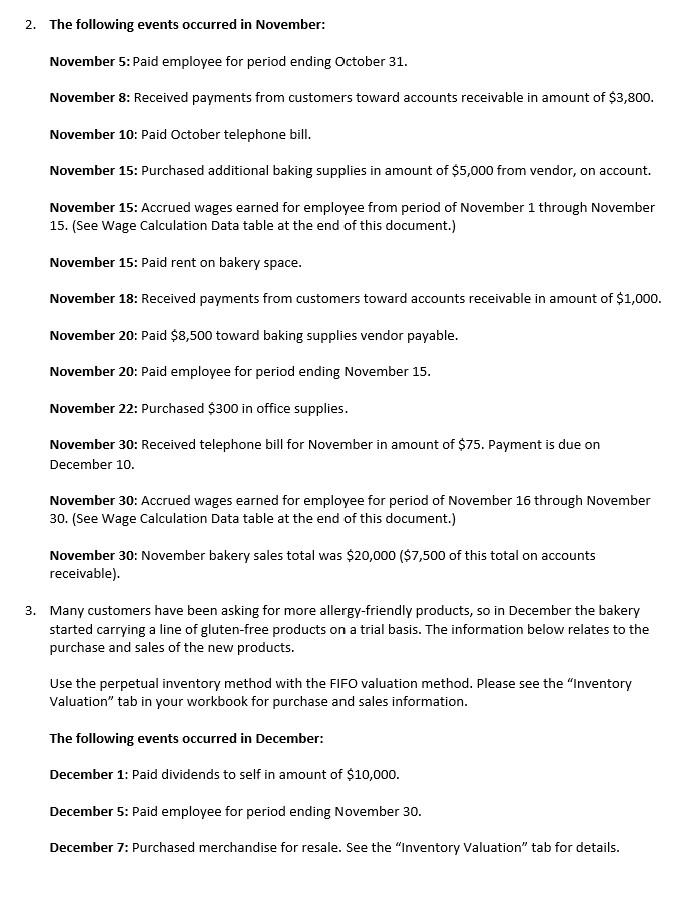

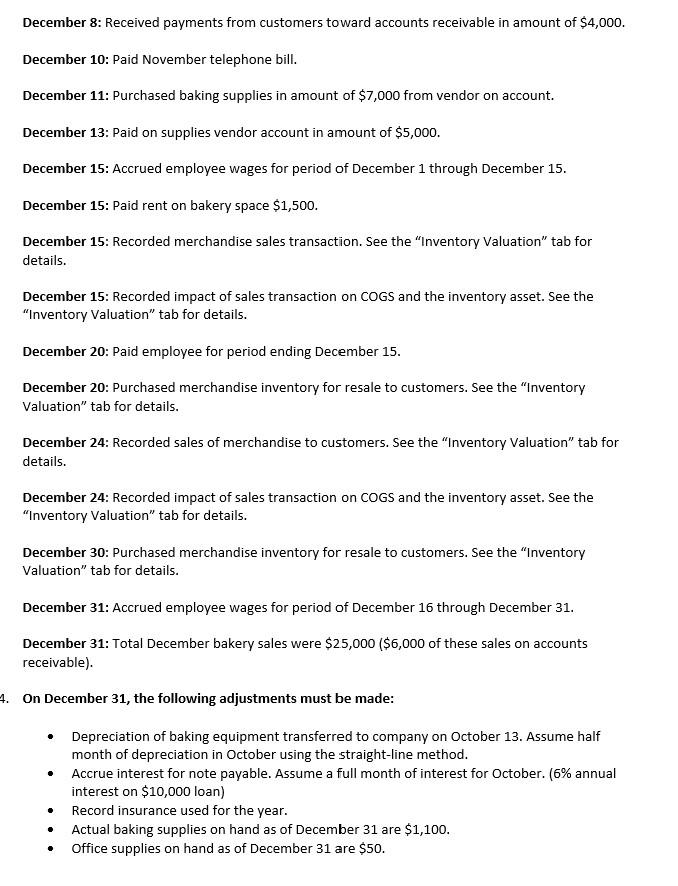

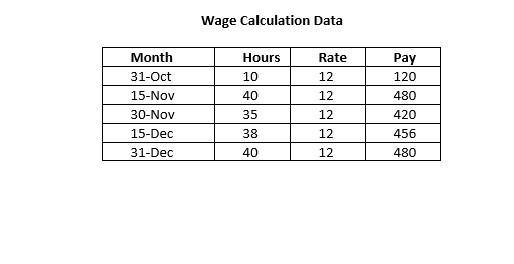

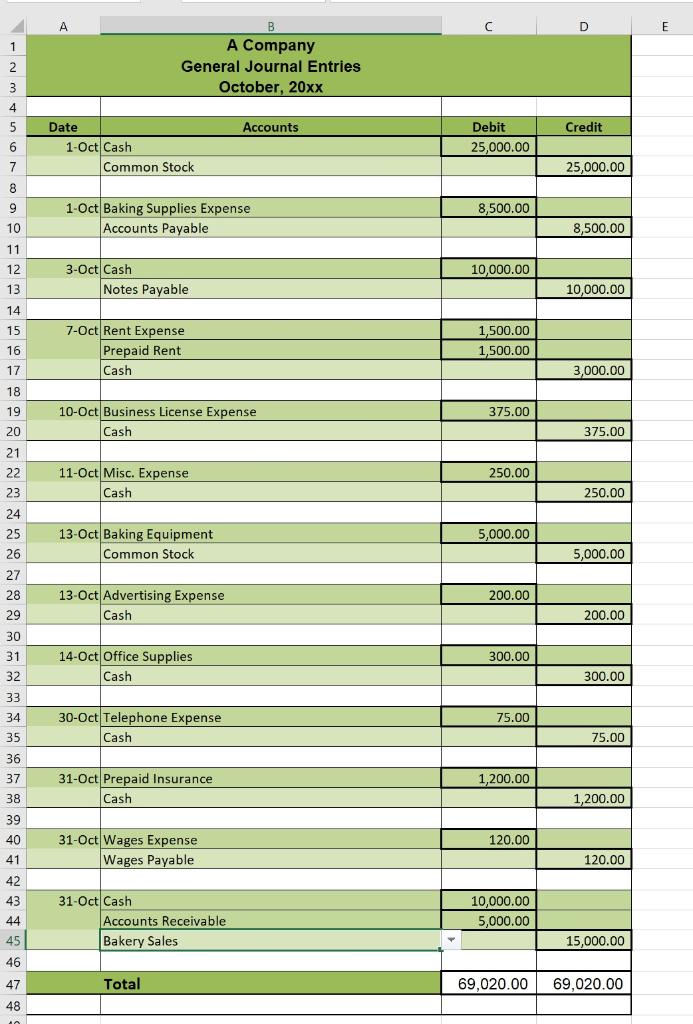

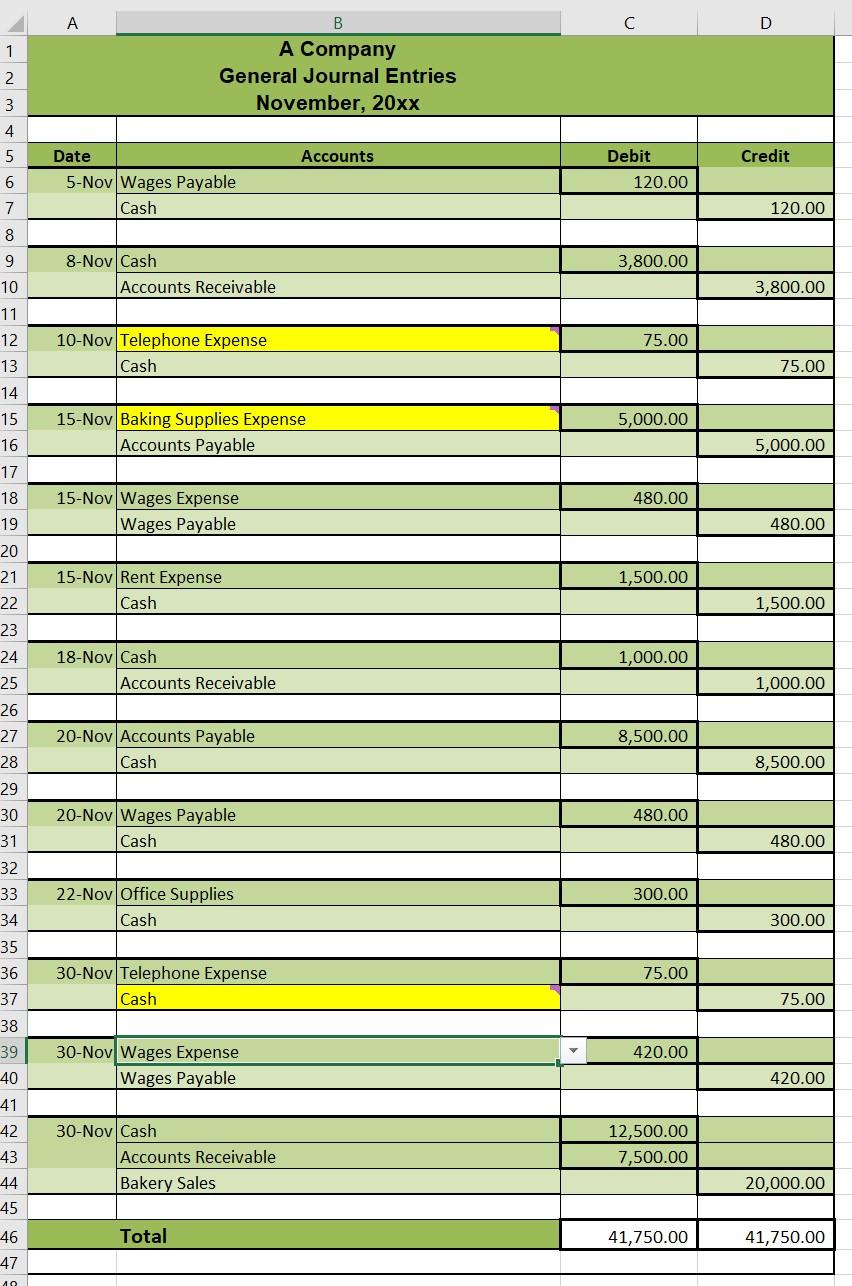

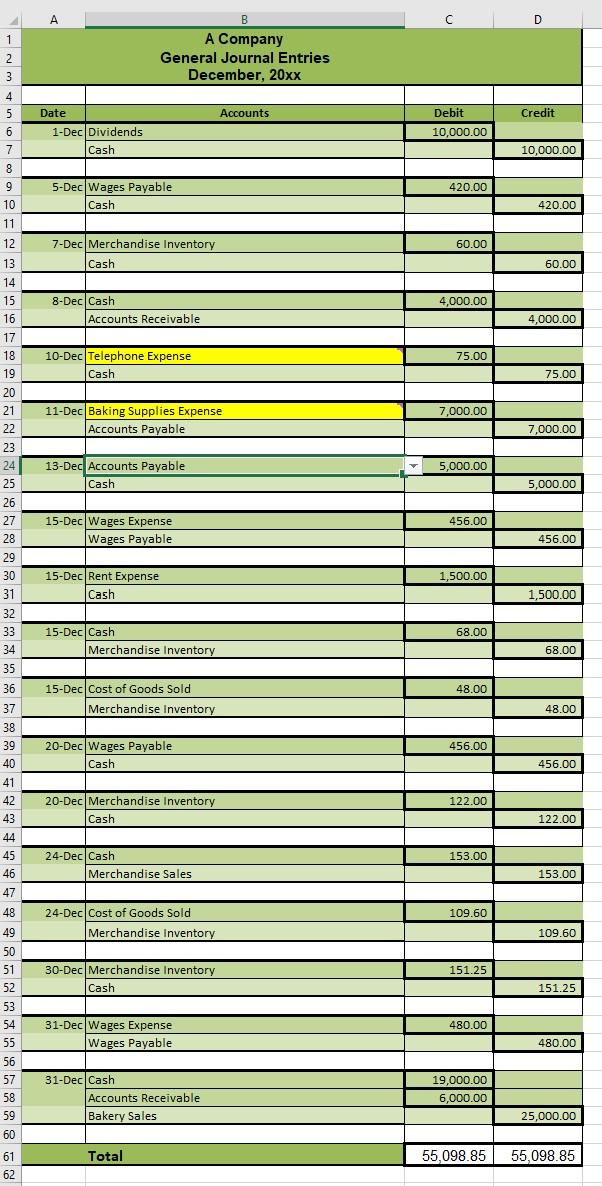

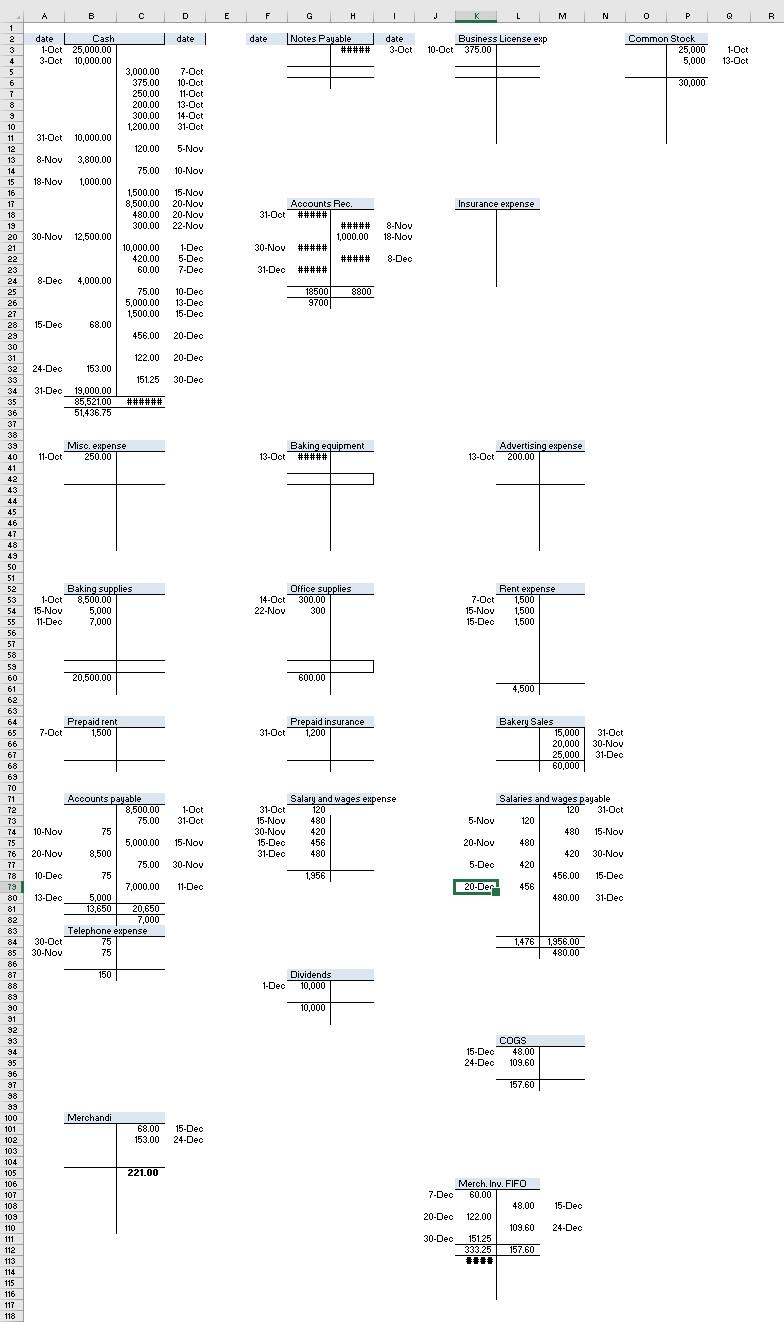

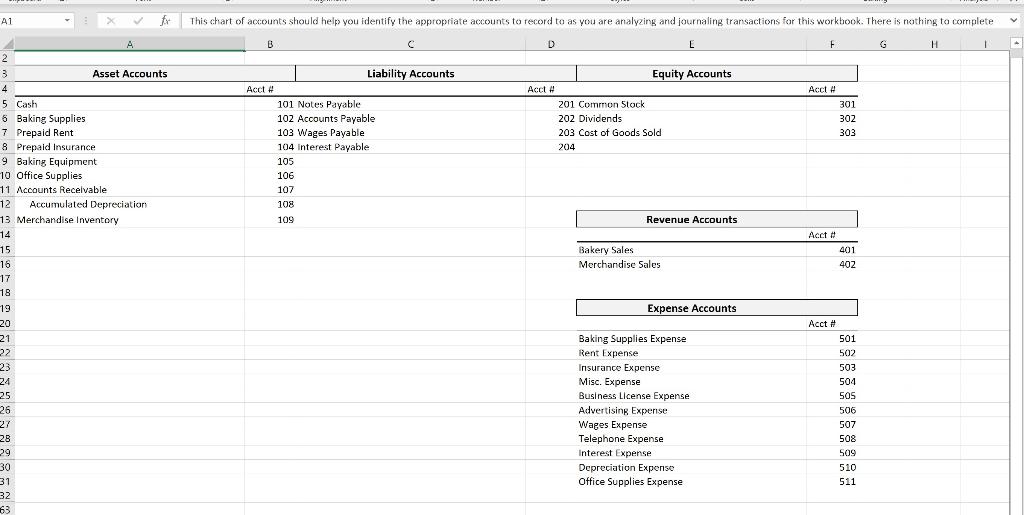

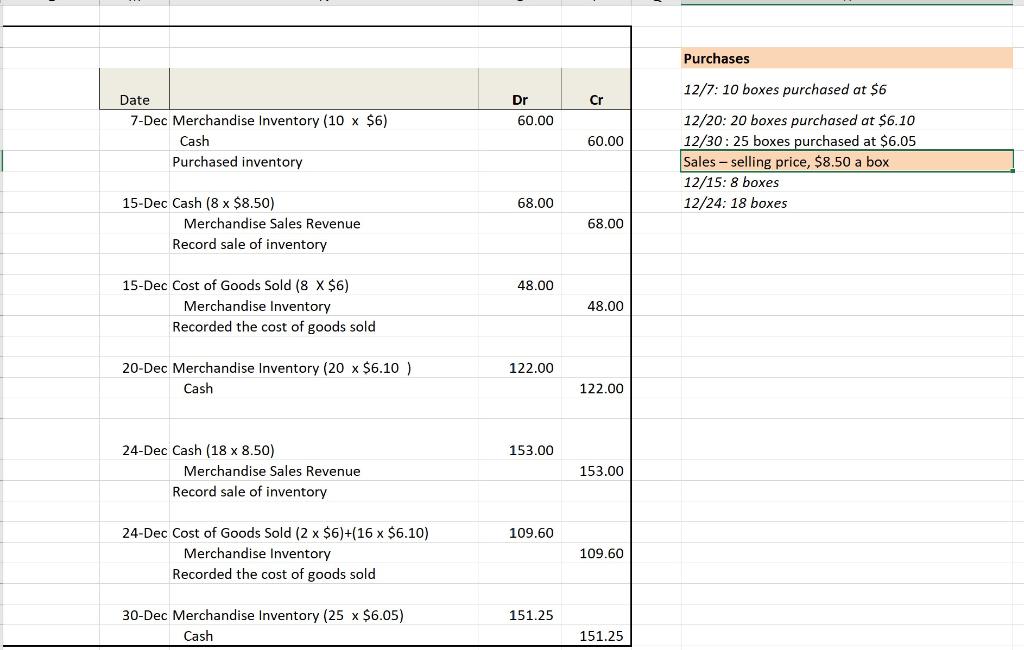

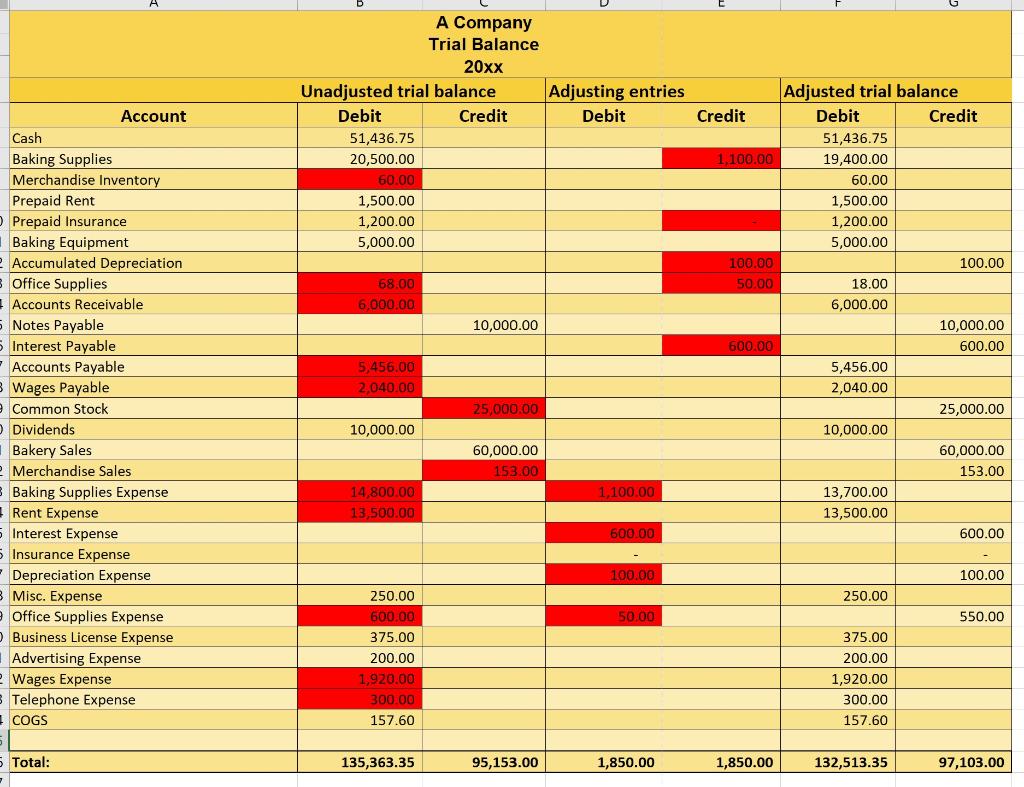

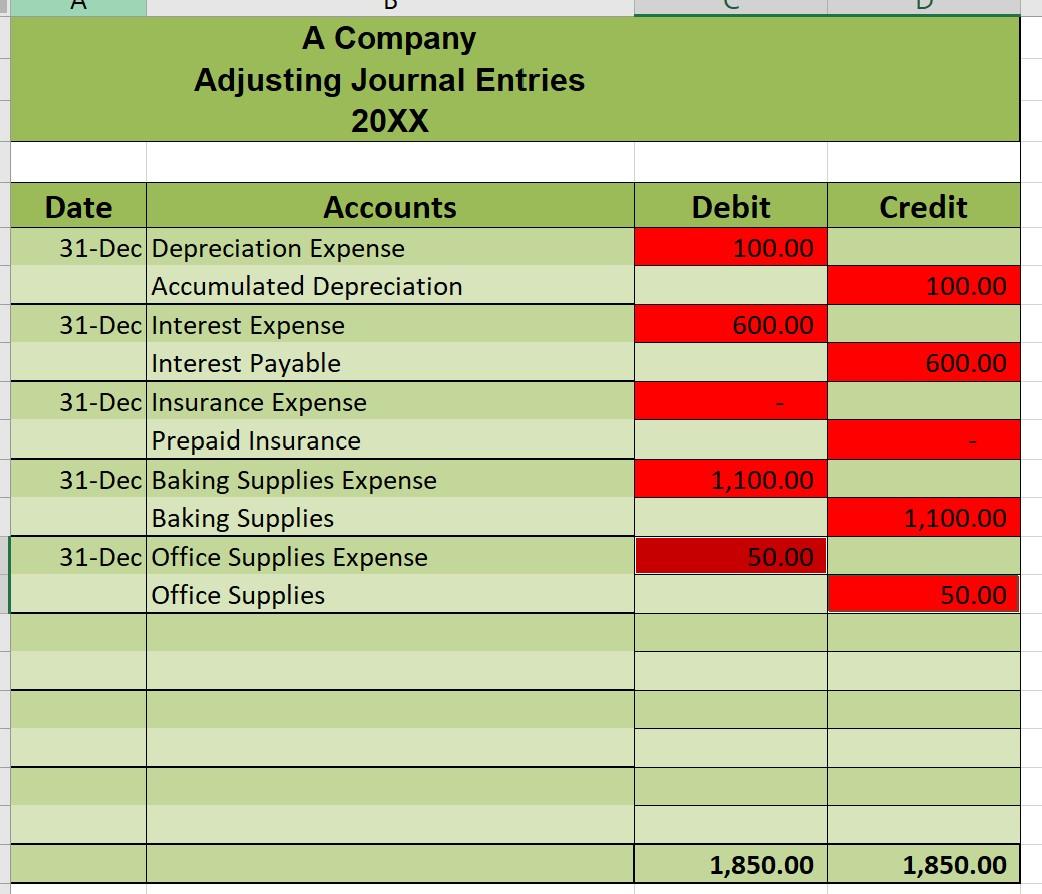

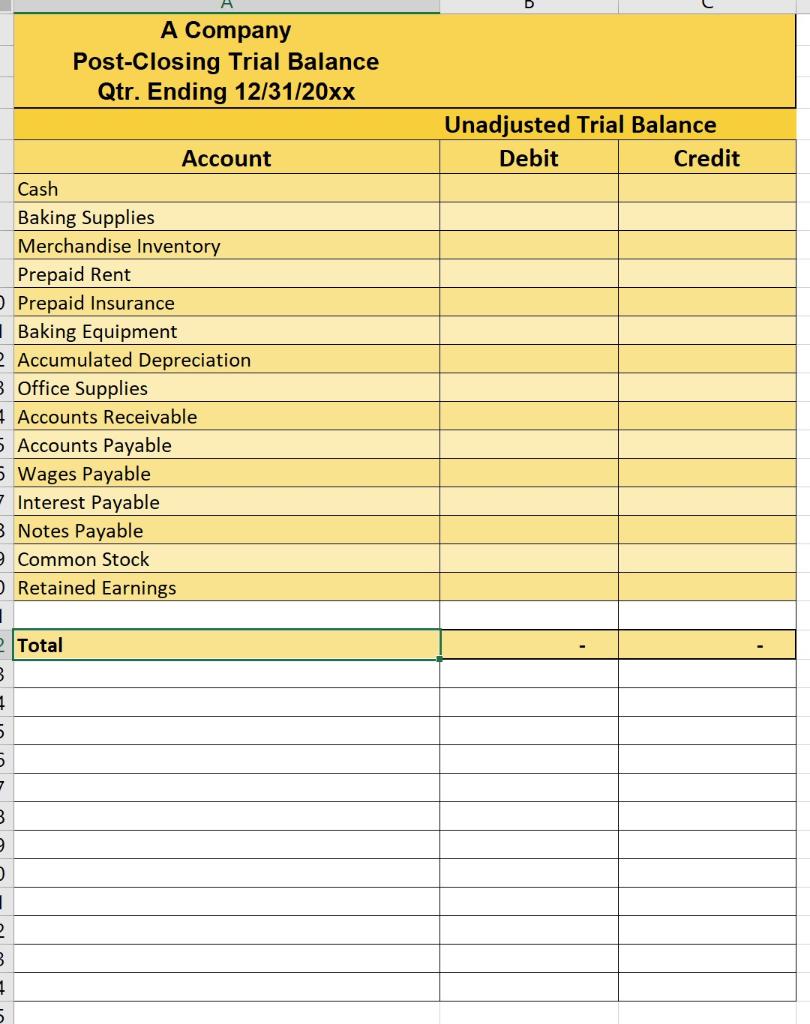

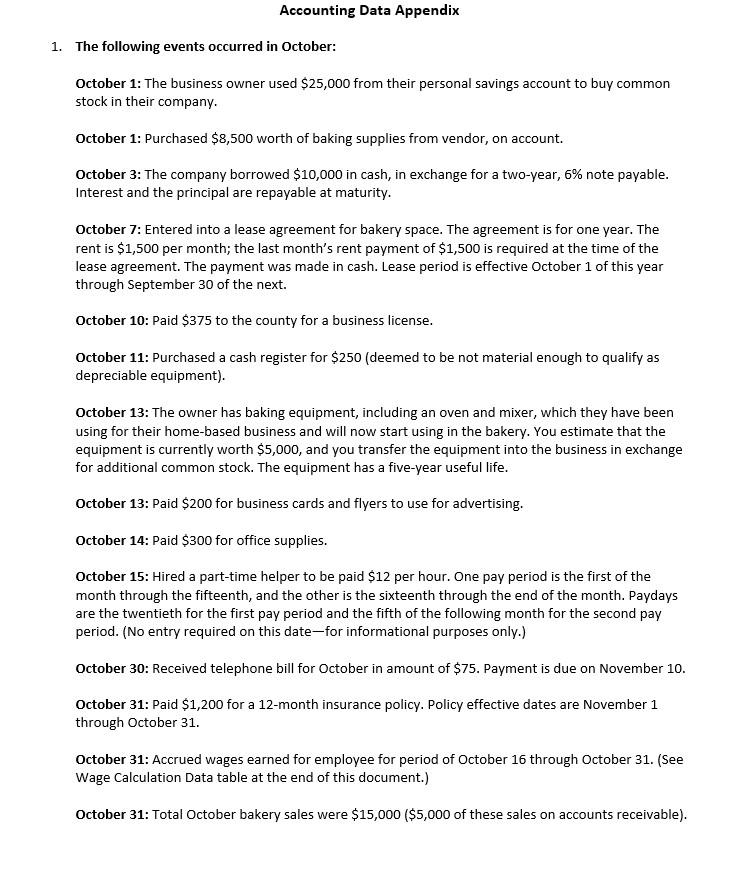

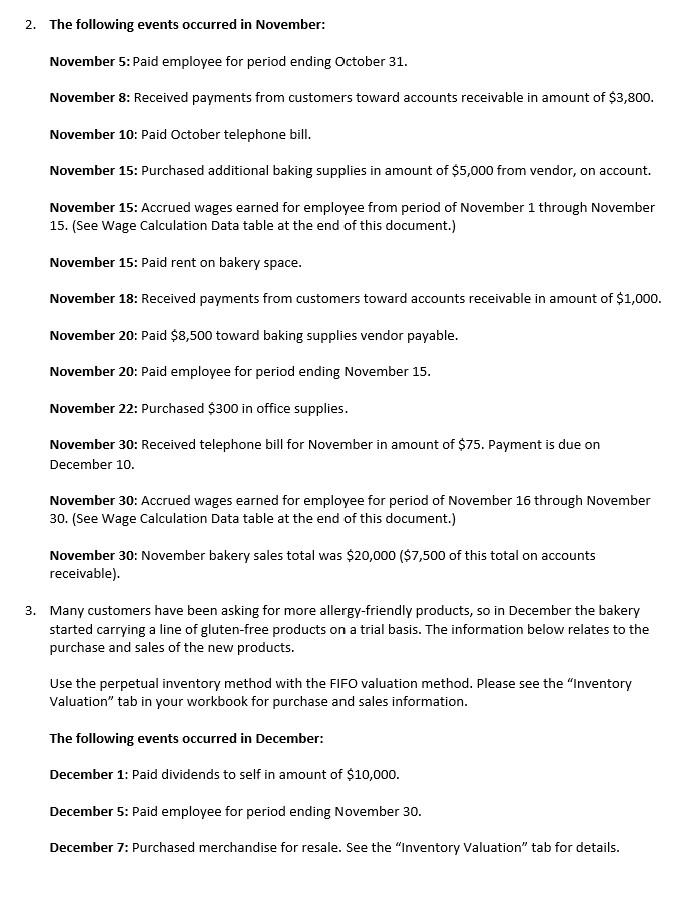

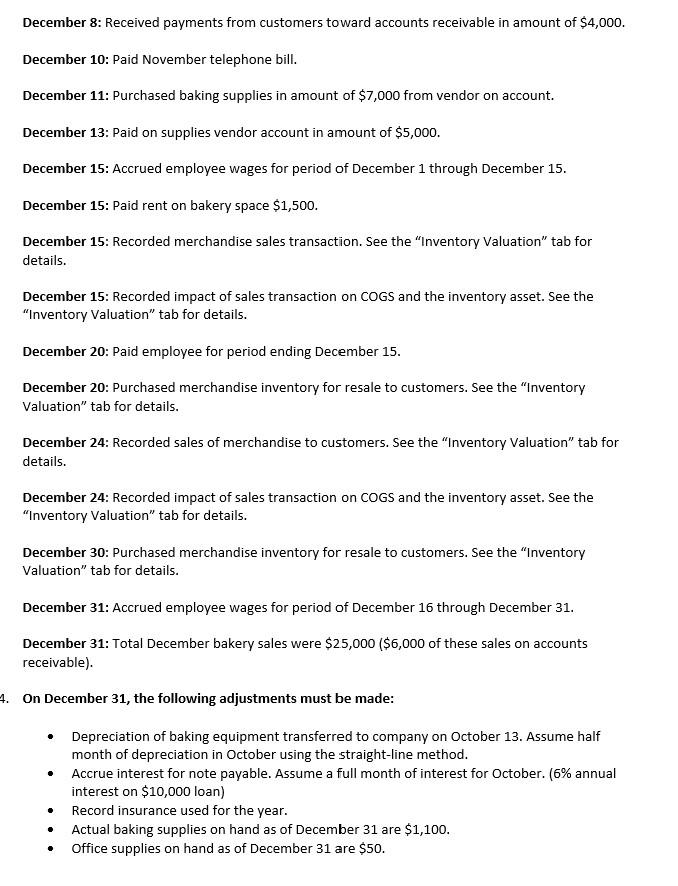

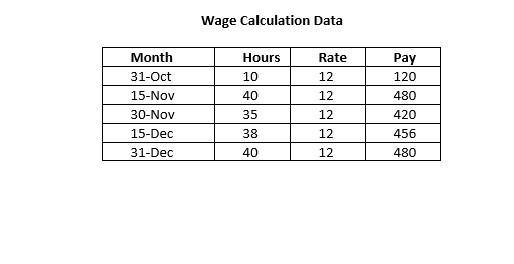

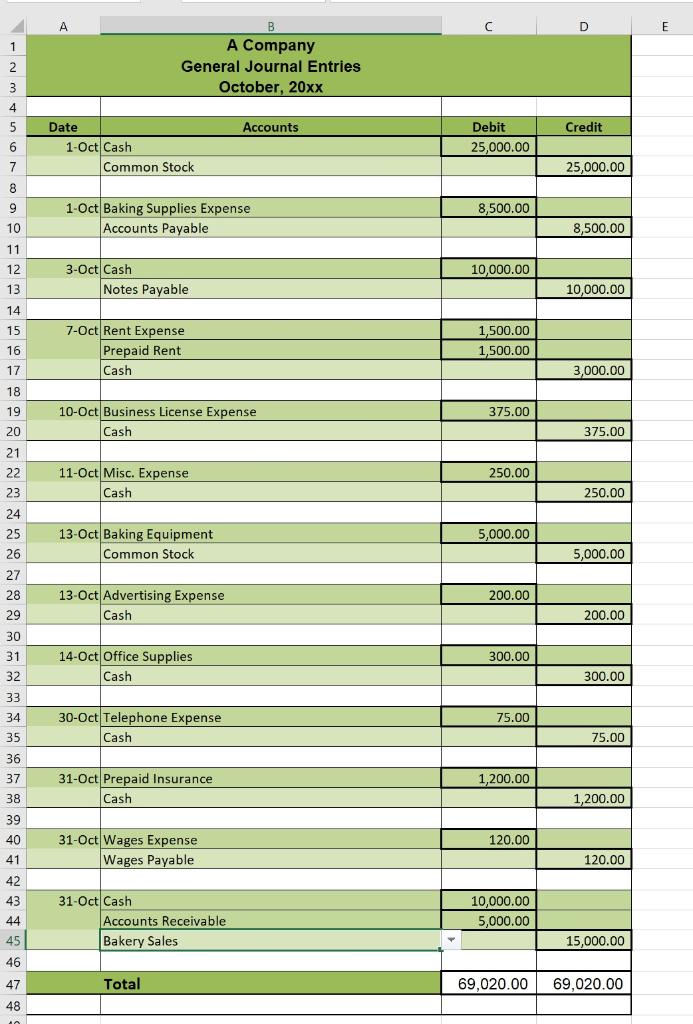

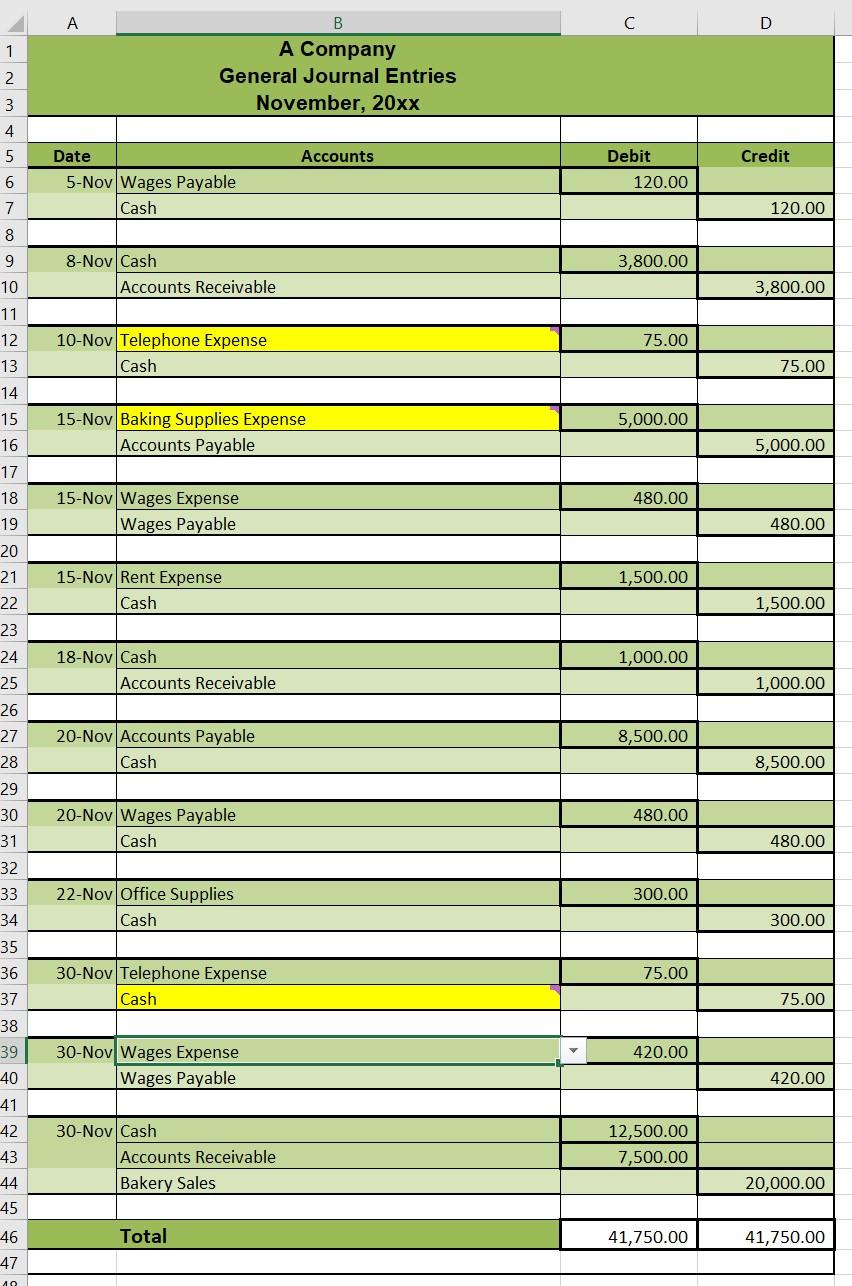

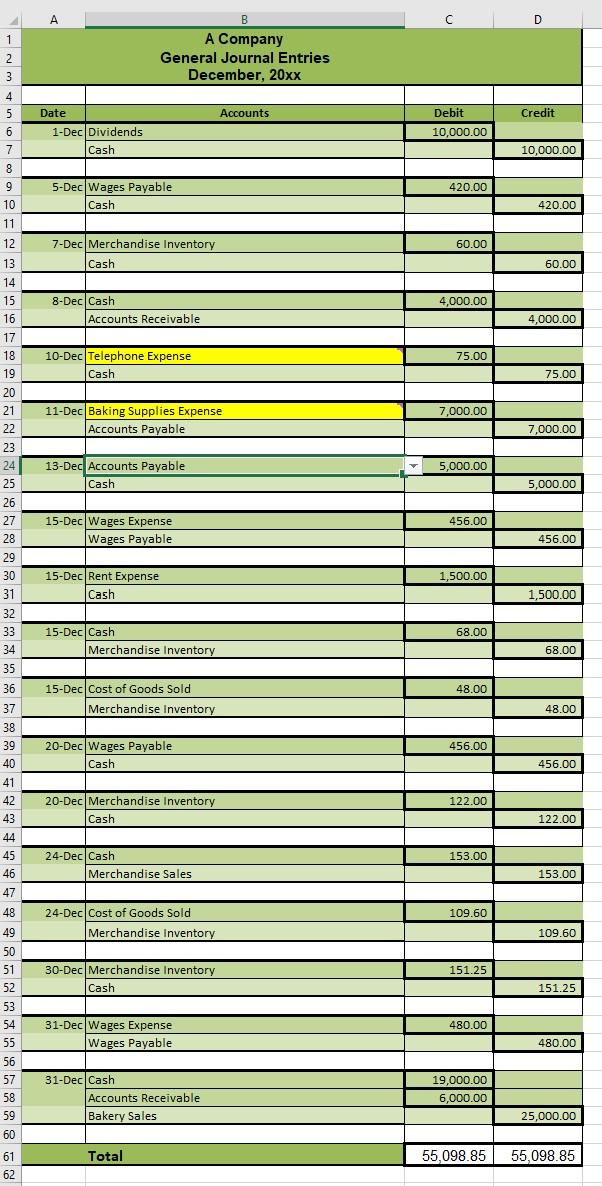

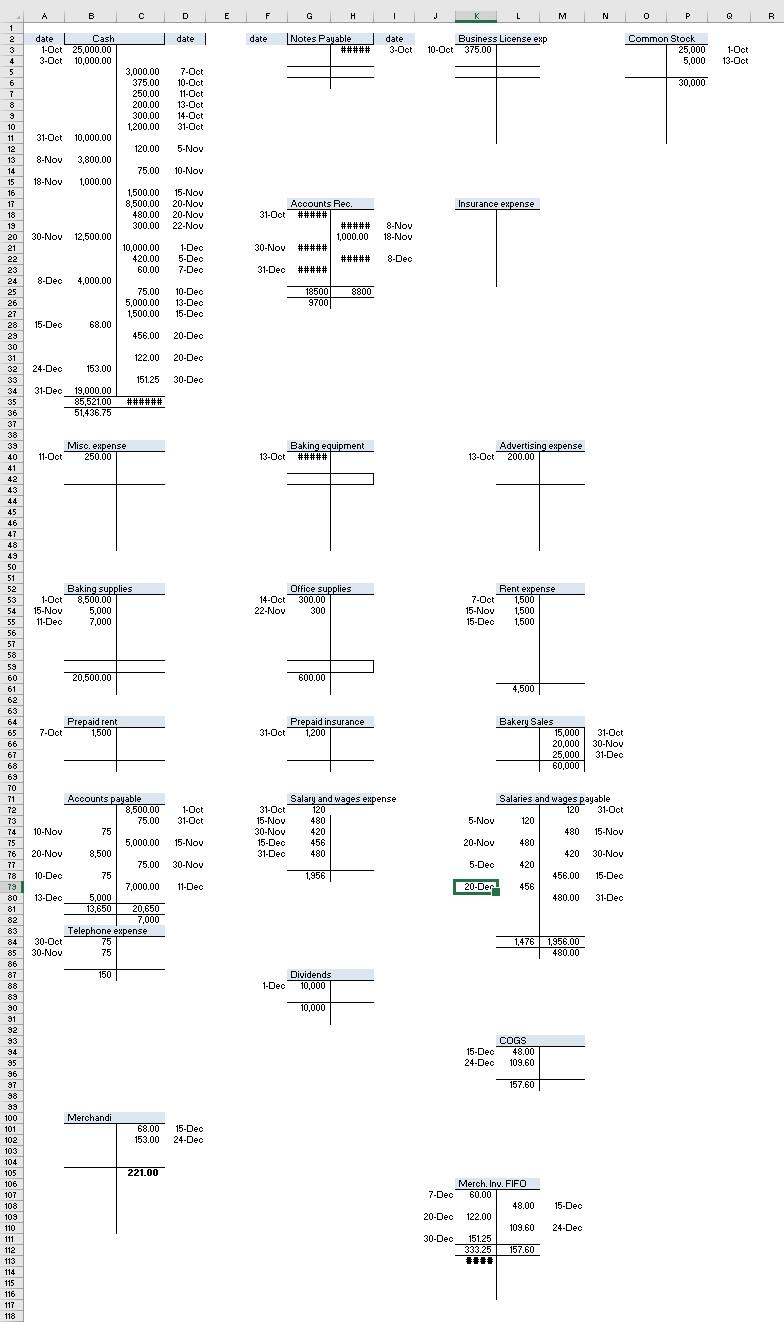

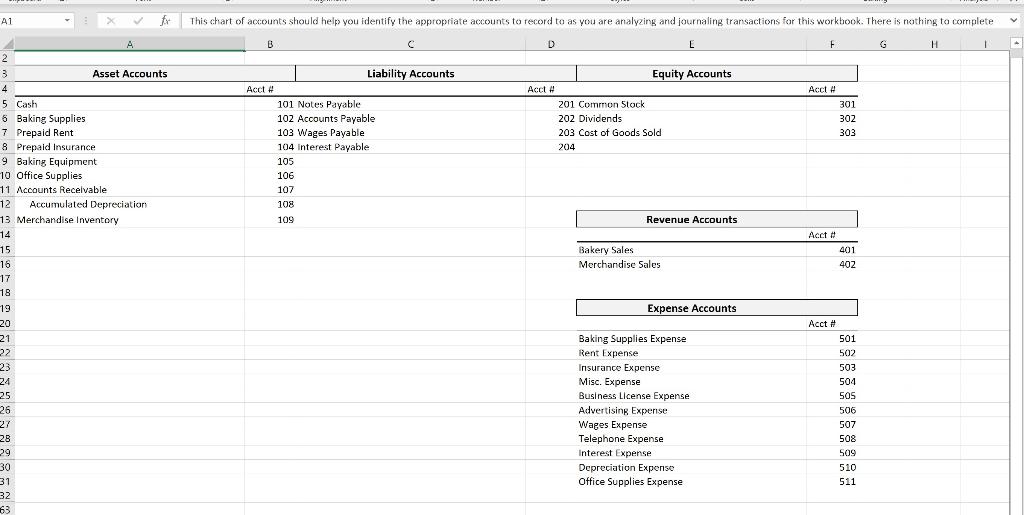

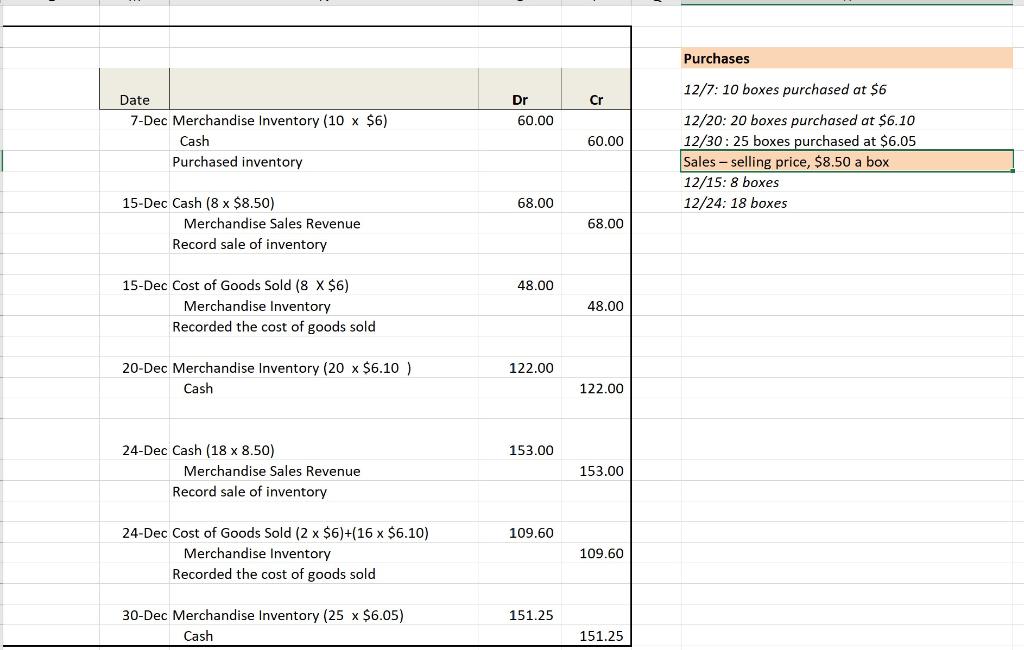

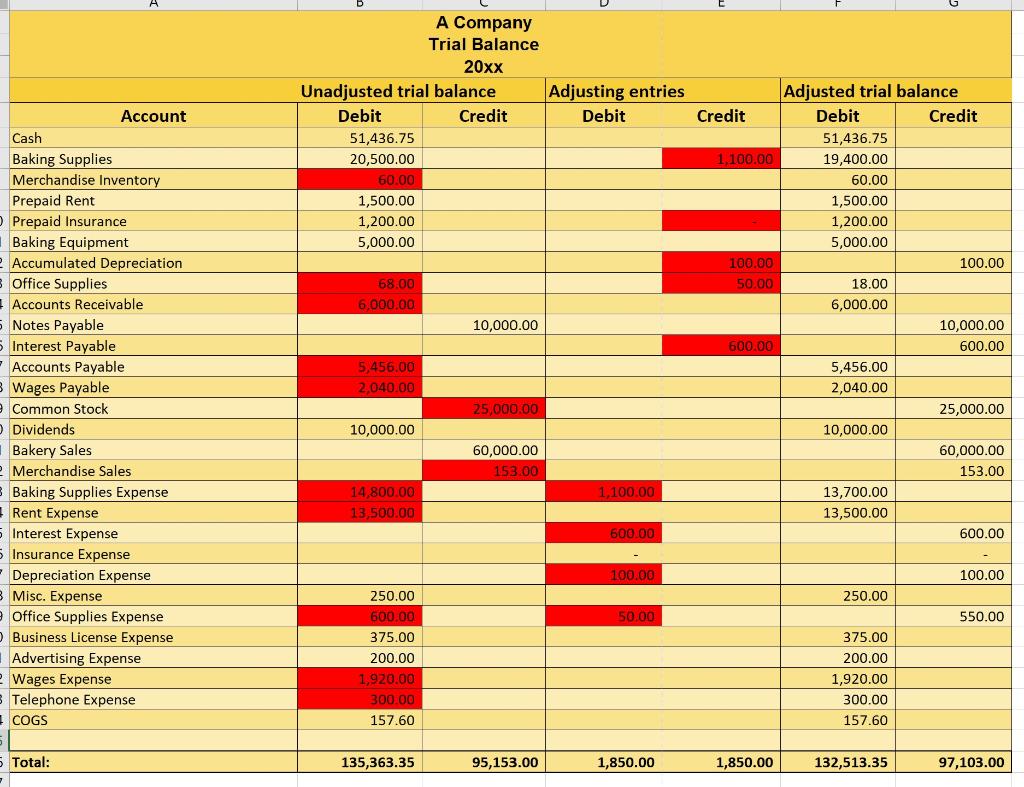

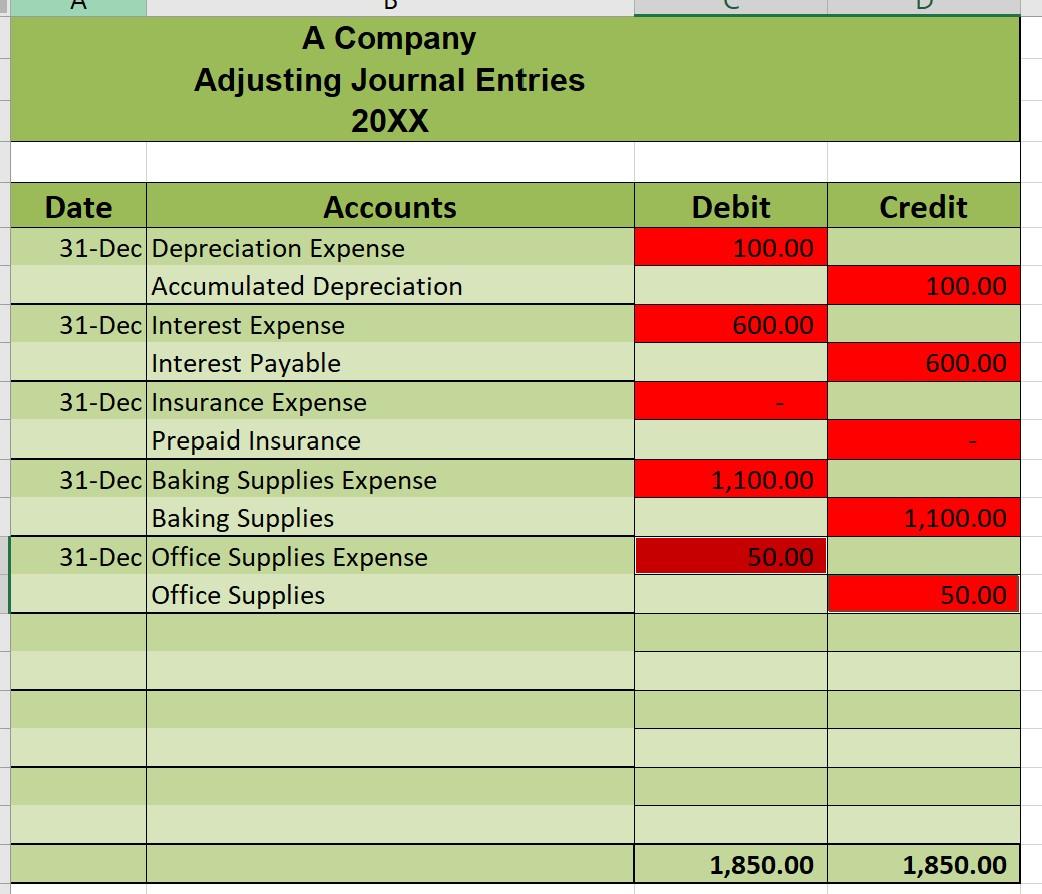

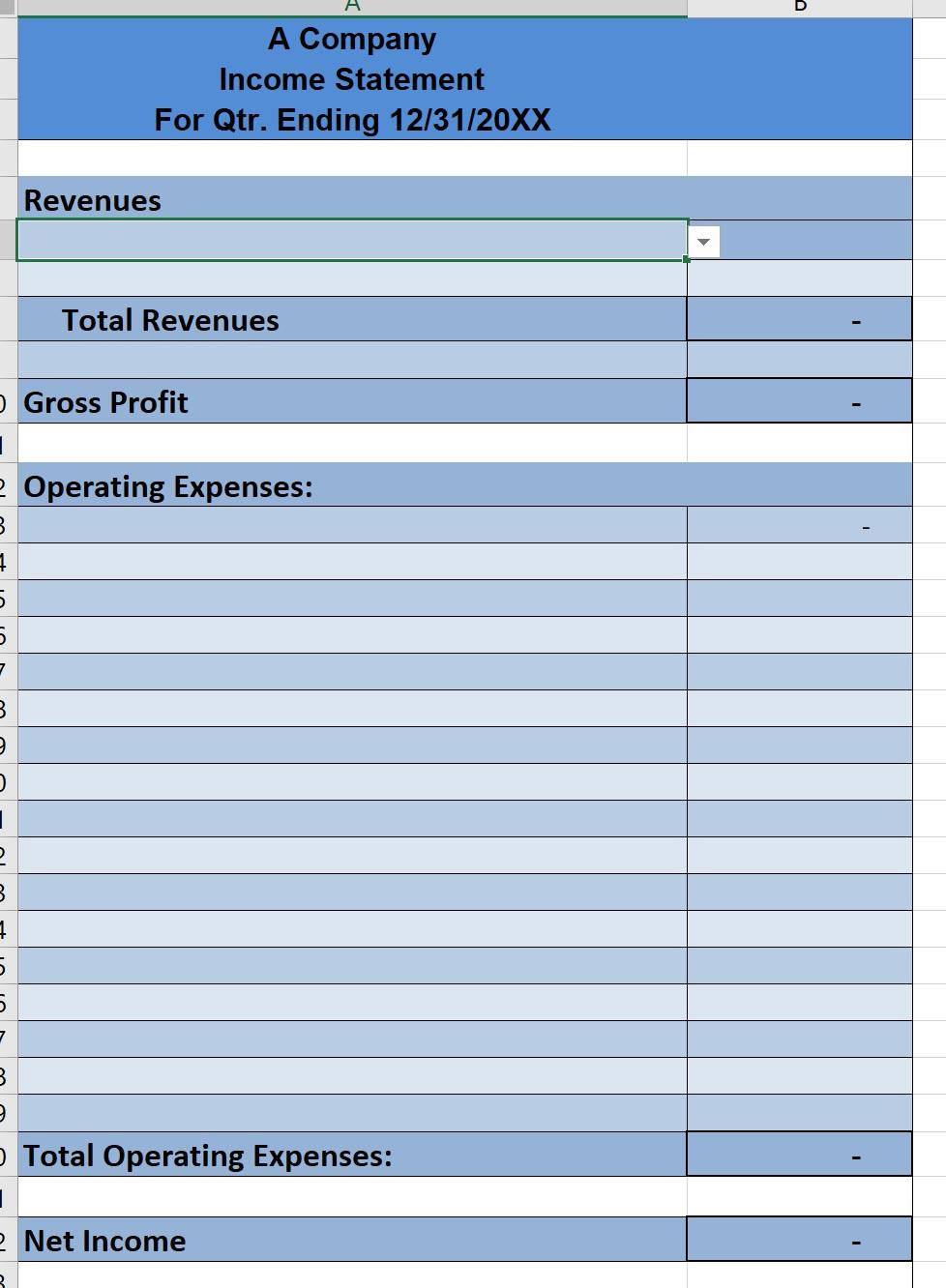

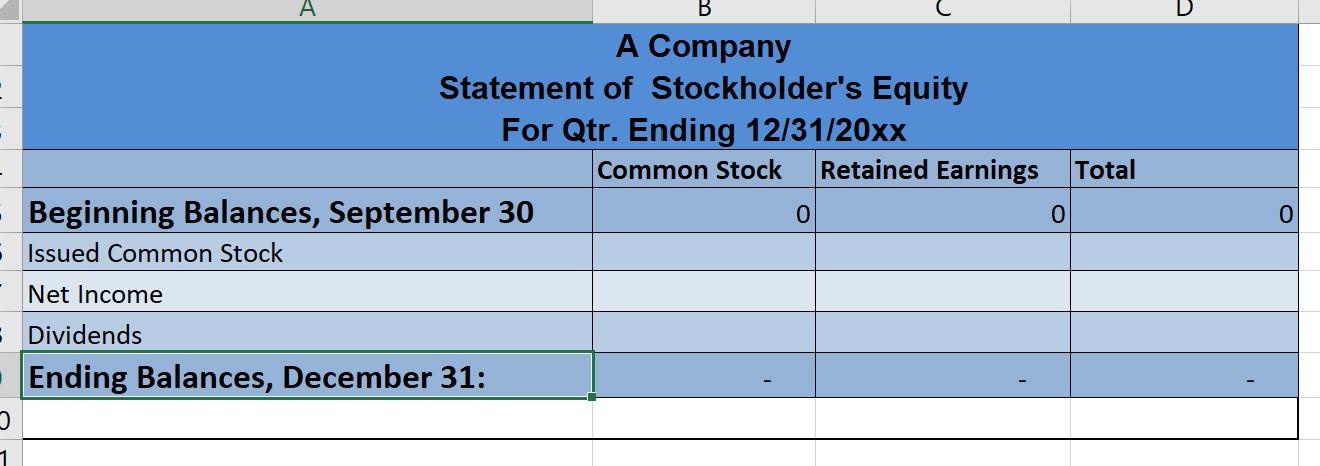

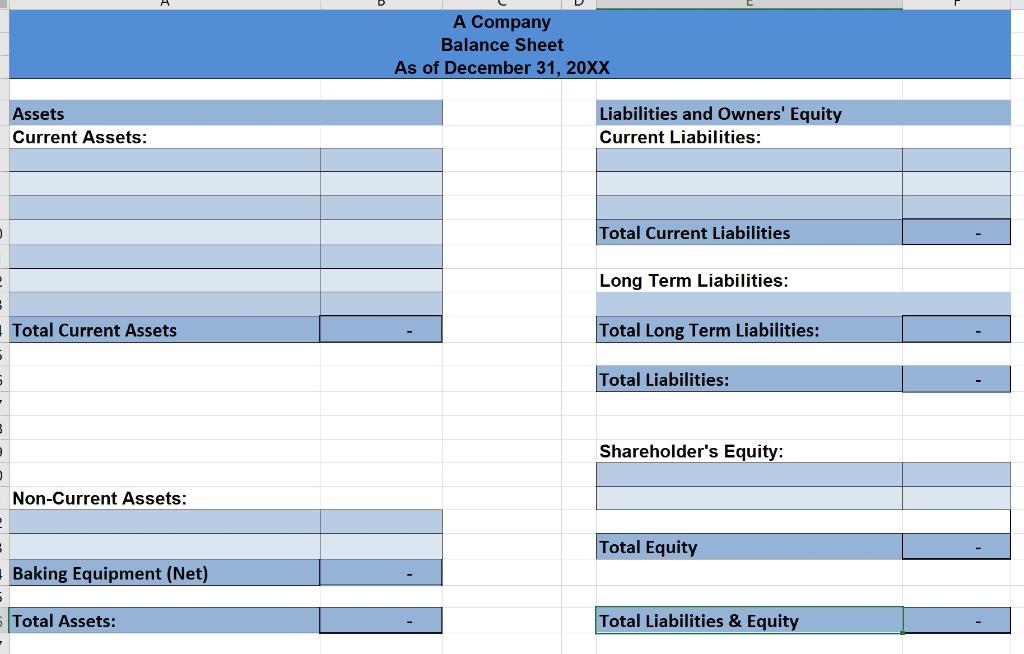

Accounting Data Appendix 1. The following events occurred in October: October 1: The business owner used $25,000 from their personal savings account to buy common stock in their company. October 1: Purchased $8,500 worth of baking supplies from vendor, on account. October 3: The company borrowed $10,000 in cash, in exchange for a two-year, 6% note payable. Interest and the principal are repayable at maturity. October 7: Entered into a lease agreement for bakery space. The agreement is for one year. The rent is $1,500 per month; the last month's rent payment of $1,500 is required at the time of the lease agreement. The payment was made in cash. Lease period is effective October 1 of this year through September 30 of the next October 10: Paid $375 to the county for a business license. October 11: Purchased a cash register for $250 (deemed to be not material enough to qualify as depreciable equipment). October 13: The owner has baking equipment, including an oven and mixer, which they have been using for their home-based business and will now start using in the bakery. You estimate that the equipment is currently worth $5,000, and you transfer the equipment into the business in exchange for additional common stock. The equipment has a five-year useful life. October 13: Paid $200 for business cards and flyers to use for advertising. October 14: Paid $300 for office supplies. October 15: Hired a part-time helper to be paid $12 per hour. One pay period is the first of the month through the fifteenth, and the other is the sixteenth through the end of the month. Paydays are the twentieth for the first pay period and the fifth of the following month for the second pay period. (No entry required on this date-for informational purposes only.) October 30: Received telephone bill for October in amount of $75. Payment is due on November 10. October 31: Paid $1,200 for a 12-month insurance policy. Policy effective dates are November 1 through October 31. October 31: Accrued wages earned for employee for period of October 16 through October 31. (See Wage Calculation Data table at the end of this document.) October 31: Total October bakery sales were $15,000 ($5,000 of these sales on accounts receivable). 2. The following events occurred in November: November 5: Paid employee for period ending October 31. November 8: Received payments from customers toward accounts receivable in amount of $3,800. November 10: Paid October telephone bill. November 15: Purchased additional baking supplies in amount of $5,000 from vendor, on account. November 15: Accrued wages earned for employee from period of November 1 through November 15. (See Wage Calculation Data table at the end of this document.) November 15: Paid rent on bakery space. November 18: Received payments from customers toward accounts receivable in amount of $1,000. November 20: Paid $8,500 toward baking supplies vendor payable. November 20: Paid employee for period ending November 15. November 22: Purchased $300 in office supplies. November 30: Received telephone bill for November in amount of $75. Payment is due on December 10. November 30: Accrued wages earned for employee for period of November 16 through November 30. (See Wage Calculation Data table at the end of this document.) November 30: November bakery sales total was $20,000 ($7,500 of this total on accounts receivable) 3. Many customers have been asking for more allergy-friendly products, so in December the bakery started carrying a line of gluten-free products on a trial basis. The information below relates to the purchase and sales of the new products. Use the perpetual inventory method with the FIFO valuation method. Please see the "Inventory Valuation" tab in your workbook for purchase and sales information. The following events occurred in December: December 1: Paid dividends to self in amount of $10,000. December 5: Paid employee for period ending November 30. December 7: Purchased merchandise for resale. See the "Inventory Valuation" tab for details. December 8: Received payments from customers toward accounts receivable in amount of $4,000. December 10: Paid November telephone bill. December 11: Purchased baking supplies in amount of $7,000 from vendor on account. December 13: Paid on supplies vendor account in amount of $5,000. December 15: Accrued employee wages for period of December 1 through December 15. December 15: Paid rent on bakery space $1,500. December 15: Recorded merchandise sales transaction. See the "Inventory Valuation" tab for details. December 15: Recorded impact of sales transaction on COGS and the inventory asset. See the "Inventory Valuation" tab for details. December 20: Paid employee for period ending December 15. December 20: Purchased merchandise inventory for resale to customers. See the "Inventory Valuation" tab for details. December 24: Recorded sales of merchandise to customers. See the "Inventory Valuation" tab for details. December 24: Recorded impact of sales transaction on COGS and the inventory asset. See the "Inventory Valuation" tab for details. December 30: Purchased merchandise inventory for resale to customers. See the "Inventory Valuation" tab for details. December 31: Accrued employee wages for period of December 16 through December 31. December 31: Total December bakery sales were $25,000 ($6,000 of these sales on accounts receivable) 4. On December 31, the following adjustments must be made: Depreciation of baking equipment transferred to company on October 13. Assume half month of depreciation in October using the straight-line method. Accrue interest for note payable. Assume a full month of interest for October. (6% annual interest on $10,000 loan) Record insurance used for the year. Actual baking supplies on hand as of December 31 are $1,100. Office supplies on hand as of December 31 are $50. . Wage Calculation Data Hours 10 Rate 12 40 12 Month 31-Oct 15-Nov 30-Nov 15-Dec 31-Dec Pay 120 480 420 456 480 12 35 38 12 12 40 A C D E 1 B A Company General Journal Entries October, 20xx 2 3 4 5 Accounts Credit Date 1-Oct Cash Common Stock Debit 25,000.00 6 7 25,000.00 8 9 10 8,500.00 1-Oct Baking Supplies Expense Accounts Payable 8,500.00 11 12 10,000.00 3-Oct Cash Notes Payable 13 10,000.00 14 15 7-Oct Rent Expense Prepaid Rent Cash 1,500.00 1,500.00 16 17 3,000.00 18 19 375.00 10-Oct Business License Expense Cash 20 375.00 21 250.00 22 23 24 11-Oct Misc. Expense Cash 250.00 5,000.00 13-Oct Baking Equipment Common Stock 5,000.00 25 26 27 28 200.00 13-Oct Advertising Expense Cash 29 200.00 30 31 32 300.00 14-Oct Office Supplies Cash 300.00 33 34 75.00 30-Oct Telephone Expense Cash 35 75.00 36 37 1,200.00 31-Oct Prepaid Insurance Cash 38 1,200.00 39 40 120.00 31-Oct Wages Expense Wages Payable 41 120.00 42 43 44 45 31-Oct Cash Accounts Receivable Bakery Sales 10,000.00 5,000.00 15,000.00 46 47 Total 69,020.00 69,020.00 48 . C D 1 B A Company General Journal Entries November, 20xx 2 3 4 5 Accounts Debit Credit 6 Date 5-Nov Wages Payable Cash 120.00 7 120.00 8 9 3,800.00 8-Nov Cash Accounts Receivable 10 3,800.00 11 12 75.00 10-Nov Telephone Expense Cash 75.00 5,000.00 13 14 15 16 17 18 19 15-Nov Baking Supplies Expense Accounts Payable 5,000.00 480.00 15-Nov Wages Expense Wages Payable 480.00 20 21 1,500.00 15-Nov Rent Expense Cash 1,500.00 22 23 24 1,000.00 18-Nov Cash Accounts Receivable 1,000.00 25 26 27 8,500.00 20-Nov Accounts Payable Cash 28 8,500.00 29 30 480.00 20-Nov Wages Payable Cash 480.00 31 32 33 34 300.00 22-Nov Office Supplies Cash 300.00 35 36 75.00 30-Nov Telephone Expense Cash 75.00 420.00 37 38 39 40 41 42 30-Nov Wages Expense Wages Payable 420.00 30-Nov Cash Accounts Receivable Bakery Sales 12,500.00 7,500.00 43 44 20,000.00 45 46 Total 41,750.00 41,750.00 47 12 A C D B A Company General Journal Entries December, 20xx 1 2 3 4 5 6 7 Accounts Credit Date 1-Dec Dividends Cash Debit 10,000.00 10,000.00 420.00 5-Dec Wages Payable Cash 420.00 60.00 7-Dec Merchandise Inventory Cash 60.00 4,000.00 8-Dec Cash Accounts Receivable 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 4,000.00 75.00 10-Dec Telephone Expense Cash 75.00 7,000.00 11-Dec Baking Supplies Expense Accounts Payable 7,000.00 5,000.00 13-Dec Accounts Payable Cash 5,000.00 26 27 28 456.00 15-Dec Wages Expense Wages Payable 456.00 1,500.00 15-Dec Rent Expense Cash 1,500.00 29 30 31 32 33 34 35 36 68.00 15-Dec Cash Merchandise Inventory 68.00 48.00 15-Dec Cost of Goods Sold Merchandise Inventory 48.00 37 38 39 456.00 20-Dec Wages Payable Cash 456.00 40 41 122.00 20-Dec Merchandise Inventory Cash 122.00 42 43 44 45 46 47 153.00 24-Dec Cash Merchandise Sales 153.00 109.60 24-Dec Cost of Goods Sold Merchandise Inventory 109.60 151.25 30-Dec Merchandise Inventory Cash 151.25 48 49 50 51 52 53 54 55 56 57 58 59 60 480.00 31-Dec Wages Expense Wages Payable 480.00 19,000.00 31-Dec Cash Accounts Receivable Bakery Sales 6,000.00 25,000.00 Total 55,098.85 55,098.85 61 62 A B D E F G H 1 J M N 0 P Q R date 1 date date Cash 1-Oct 25,000.00 3-Oct 10,000.00 Notes Payable ##### date 3-Oct Business License exp 10-Oct 375.00 Common Stock 25,000 5,000 1-Oct 13-Oct 30,000 3,000.00 375.00 250.00 200.00 300.00 1,200.00 7-Oct 10-Oct 11-Oct 13-Oct 14-Oot 31-Oct 31-Oct 10,000.00 120.00 5-Nov 8-Nov 3,800.00 75.00 10-Nov 18-Nov 1,000.00 1,500.00 8,500.00 480.00 300.00 15-NOY 20-Nov 20-Nov 22-Nov Insurance expense 30-Nov 12,500.00 Accounts Rec 31-Oct ##### ##### 1,000.00 30-Nov ##### ##### 31-Dec ##### 8-Nov 18-Nov 10,000.00 420.00 60.00 1-Dec 5-Dec 7-Dec 8-Dec 8-Dec 4,000.00 8800 75.00 5,000.00 1,500.00 10-Dec 13-Dec 15-Dec 18500 9700 15-Dec 68.00 456.00 20-Dec 122.00 20-Dec 24-Dec 153.00 151.25 30-Dec 31-Dec 19,000.00 85,521.00 51,436.75 ###### Misc. expense 11-Oct 250.007 Baking equipment 13-Oot ##### Advertising expense 13-Oct 200.00 1 2 3 4 5 6 7 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 30 91 92 93 94 95 96 97 98 99 100 101 102 103 Baking supplies 1-Oct 8,500.00 15-Nov 5,000 11-Deo 7,000 Office supplies 14-Oct 300.00 22-Nov 300 7-Oct 15-Nov 15-Dec Rent expense 1.500 1,500 1,500 20,500.00 600.00 4,500 Prepaid rent 1,500 Prepaid insurance 1,200 7 7-Oct 31-Oct Bakery Sales 15,000 31-Oct 20,000 30-Nov 25,000 31-Dec 60,000 1-Oct 31-Oct 15-Nov 30-Nov 15-Dec 31-Dec Salary and wages expense 120 480 420 456 480 Accounts payable 8,500.00 75.00 31-Oct 10-Nov 75 5,000.00 15-Nov 20-Nov 8,500 75.00 30-Nov 10-Dec 75 7,000.00 11-Dec 13-Dec 5,000 13.650 20.650 7,000 Telephone expense 30-Oct 75 30-Nov 75 Salaries and wages payable 120 31-Oct 5-Nov 120 480 15-Nov 20-Nov 480 420 30-Nov 5-Dec 420 456.00 15-Dec 20-Der 456 480.00 31-Dec 1,956 1,476 1,956.00 480.00 150 Dividends 1-Dec 10,000 10,000 COGS 15-Dec 48.00 24-Dec 109.60 157.60 Merchandi 68.00 15-Dec 153.00 24-Dec 104 221.00 15-Dec 105 106 107 108 109 110 111 112 113 114 115 116 117 118 Merch Inv. FIFO 7-Dec 60.00 48.00 20-Dec 122.00 109.60 30-Dec 151.25 333.25 157.60 24-Dec A1 > This chart of accounts should help you identify the appropriate accounts to record to as you are analyzing and journaling transactions for this workbook. There is nothing to complete B L F G H Liability Accounts Acct # 101 Notes Payable 102 Accounts Payable 103 Wages Payable 104 Interest Payable 105 106 107 108 109 Equity Accounts Acct 4 201 Common Stock 202 Dividends 203 Cost of Goods Sold 204 Acct # 301 302 303 Revenue Accounts Bakery Sales Merchandise Sales Acct # 401 402 A 2 3 Asset Accounts 4 5 Cash 6 Baking Supplies 7 Prepaid Rent 8 Prepaid Insurance 9 Baking Equipment 10 Office Supplies 11 Accounts Receivable 12 Accumulated Depreciation 13 Merchandise Inventory 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 63 Expense Accounts Acct # Baking Supplies Expense Rent Expense Insurance Expense Misc. Expense Business License Expense Advertising Expense Wages Expense Telephone Expense Interest Expense Depreciation Expense Office Supplies Expense 501 502 503 504 505 506 507 508 509 510 511 Purchases 12/7: 10 boxes purchased at $6 Cr Dr 60.00 Date 7-Dec Merchandise Inventory (10 x $6) Cash Purchased inventory 60.00 12/20: 20 boxes purchased at $6.10 12/30: 25 boxes purchased at $6.05 Sales - selling price, $8.50 a box 12/15: 8 boxes 12/24: 18 boxes 68.00 15-Dec Cash (8 x $8.50) Merchandise Sales Revenue Record sale of inventory 68.00 48.00 15-Dec Cost of Goods Sold (8 X $6) Merchandise Inventory Recorded the cost of goods sold 48.00 122.00 20-Dec Merchandise Inventory (20 x $6.10 ) Cash 122.00 153.00 24-Dec Cash (18 x 8.50) Merchandise Sales Revenue Record sale of inventory 153.00 109.60 24-Dec Cost of Goods Sold (2 x $6)+(16 x $6.10) Merchandise Inventory Recorded the cost of goods sold 109.60 30-Dec Merchandise Inventory (25 x $6.05) Cash 151.25 151.25 Debit A Company Trial Balance 20xx Unadjusted trial balance Adjusting entries Debit Credit Debit 51,436.75 20,500.00 60.00 1,500.00 1,200.00 5,000.00 68.00 6,000.00 Adjusted trial balance Credit Credit 51,436.75 1,100.00 19,400.00 60.00 1,500.00 1,200.00 5,000.00 100.00 100.00 50.00 18.00 6,000.00 10,000.00 600.00 600.00 5,456.00 2,040.00 25,000.00 10,000.00 60,000.00 153.00 13,700.00 13,500.00 600.00 10,000.00 5,456.00 2,040.00 Account Cash Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Baking Equipment Accumulated Depreciation Office Supplies Accounts Receivable 5 Notes Payable 5 Interest Payable Accounts Payable Wages Payable Common Stock Dividends Bakery Sales Merchandise Sales Baking Supplies Expense Rent Expense 5 Interest Expense Insurance Expense Depreciation Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense COGS 25,000.00 10,000.00 60,000.00 153.00 1,100.00 14,800.00 13,500.00 600.00 100.00 100.00 250.00 50.00 550.00 250.00 600.00 375.00 200.00 1.920.00 300.00 157.60 375.00 200.00 1,920.00 300.00 157.60 Total: 135,363.35 95,153.00 1,850.00 1,850.00 132,513.35 97,103.00 A Company Income Statement For Qtr. Ending 12/31/20XX Revenues Total Revenues Gross Profit Operating Expenses: B 1 5 7 3 2 B 1 5 7 B 2 Total Operating Expenses: Net Income B A Company Statement of Stockholder's Equity For Qtr. Ending 12/31/20xx Common Stock Retained Earnings Beginning Balances, September 30 Issued Common Stock Total 0 0 0 Net Income Dividends Ending Balances, December 31: A Company Balance Sheet As of December 31, 20XX Assets Current Assets: Liabilities and Owners' Equity Current Liabilities: Total Current Liabilities Long Term Liabilities: Total Current Assets Total Long Term Liabilities: Total Liabilities: Shareholder's Equity: Non-Current Assets: Total Equity Baking Equipment (Net) Total Assets: Total Liabilities & Equity A Company Closing Entries Qtr ending 12/31/20xx Debit Credit Date Accounts 31-Dec Bakery Sales Merchandise Sales Retained Earnings 1 2 3 1 5 7 B 2 31-Dec Retained Earnings Baking Supplies Expense Rent Expense Wages Expense Office Supplies Expense Business License Expense Office Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense COGS 1 2 3 1 31-Dec Retained Earnings Dividends 5 7 A Company Post-Closing Trial Balance Qtr. Ending 12/31/20xx Unadjusted Trial Balance Debit Credit Account Cash Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Baking Equipment Accumulated Depreciation 3 Office Supplies 1 Accounts Receivable 5 Accounts Payable 5 Wages Payable - Interest Payable B Notes Payable Common Stock Retained Earnings Total B 1 5 7 B 2 1 2 3 1