hi. I need help in part E,F,G,H,and I.

please give me right answer.

I dont want to post my queation again.

thanks

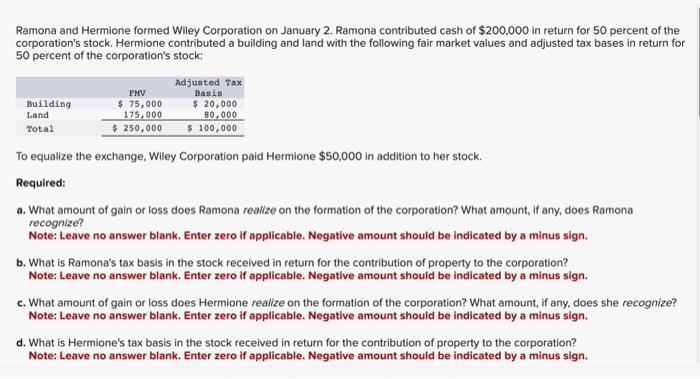

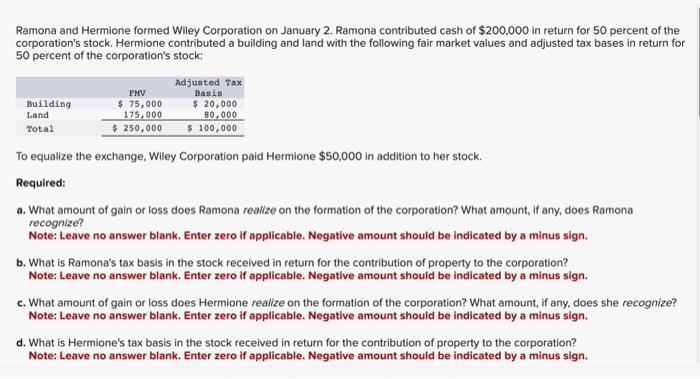

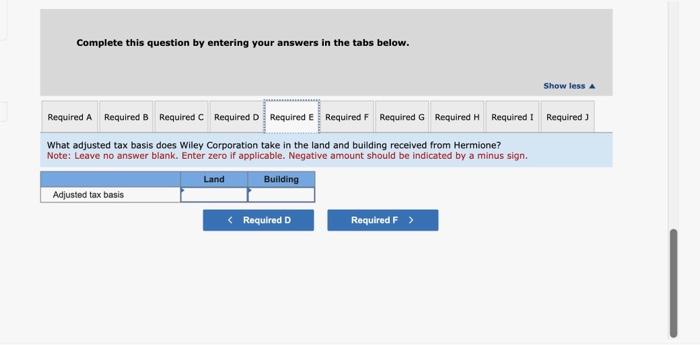

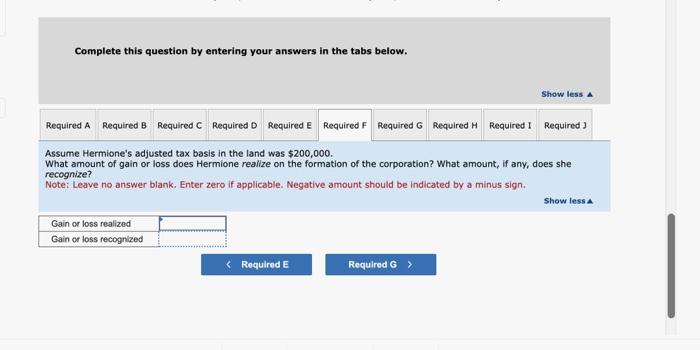

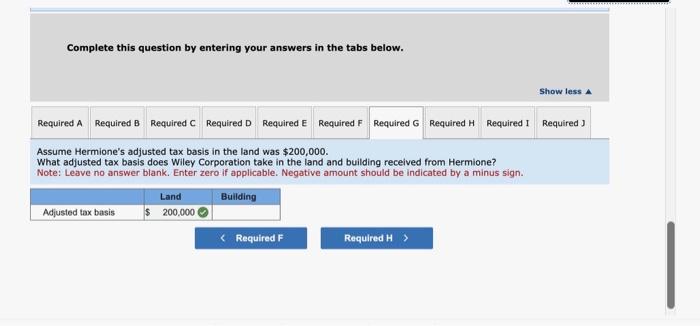

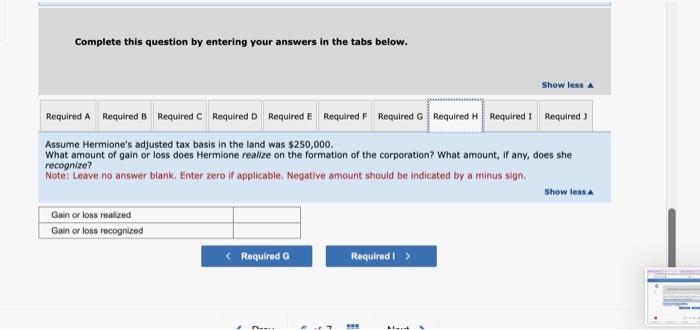

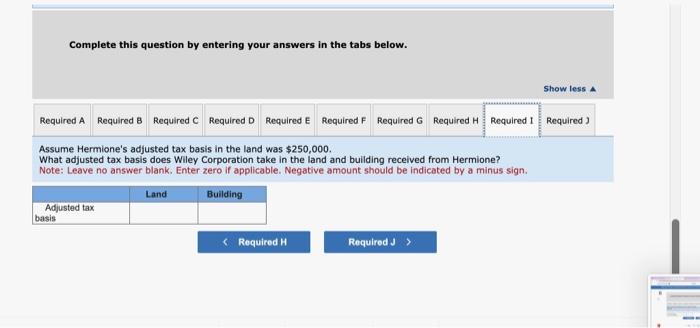

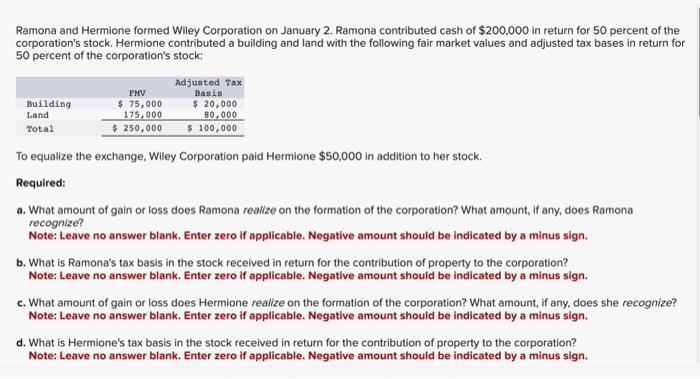

Ramona and Hermione formed Wiley Corporation on January 2. Ramona contributed cash of $200,000 in return for 50 percent of the corporation's stock. Hermione contributed a building and land with the following fair market values and adjusted tax bases in return for 50 percent of the corporation's stock: To equalize the exchange, Wiley Corporation paid Hermione $50,000 in addition to her stock. Required: a. What amount of gain or loss does Ramona realize on the formation of the corporation? What amount, If any, does Ramona recognize? Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. b. What is Ramona's tax basis in the stock received in return for the contribution of property to the corporation? Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. c. What amount of gain or loss does Hermione realize on the formation of the corporation? What amount, if any, does she recognize? Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. d. What is Hermione's tax basis in the stock received in return for the contribution of property to the corporation? Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. Complete this question by entering your answers in the tabs below. What adjusted tax basis does Wiley Corporation take in the land and building received from Hermione? Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. Complete this question by entering your answers in the tabs below. Assume Hermione's adjusted tax basis in the land was $200,000. What amount of gain or loss does Hermione realize on the formation of the corporation? What amount, if any, does she recognize? Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. Complete this question by entering your answers in the tabs below. Assume Hermione's adjusted tax basis in the land was $200,000. What adjusted tax basis does Wiley Corporation take in the land and building received from Hermione? Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. Complete this question by entering your answers in the tabs below. Assume Hermione's adjusted tax basis in the land was $250,000. What amount of gain or loss does Hermione realize on the formation of the corporation? What amount, if any, does she recognize? Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. Complete this question by entering your answers in the tabs below. Assume Hermione's adjusted tax basis in the land was $250,000. What adjusted tax basis does Wiley Corporation take in the land and building received from Hermione? Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign