Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi! i need help on required 2 and 4 Kingsport Containers Compary makes a single product that is subject to wide seasonal variabons in demand.

hi! i need help on required 2 and 4

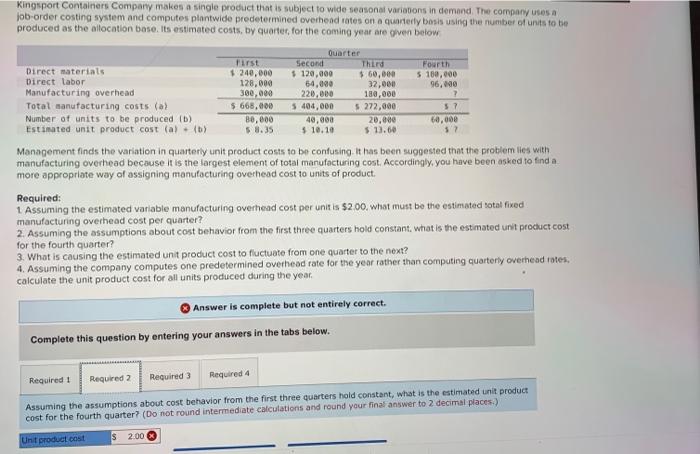

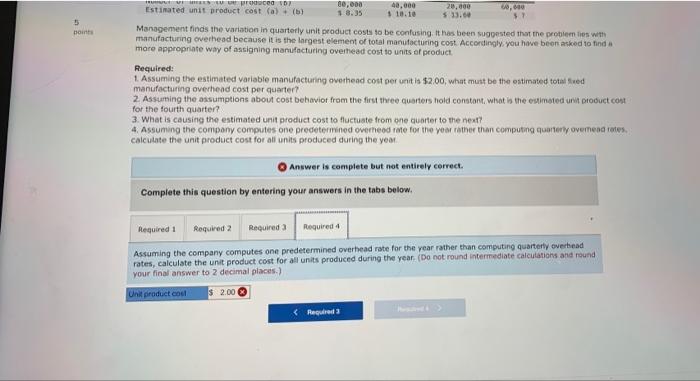

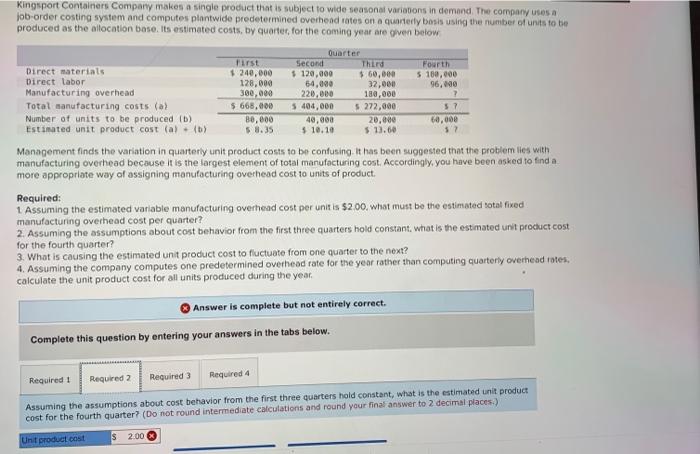

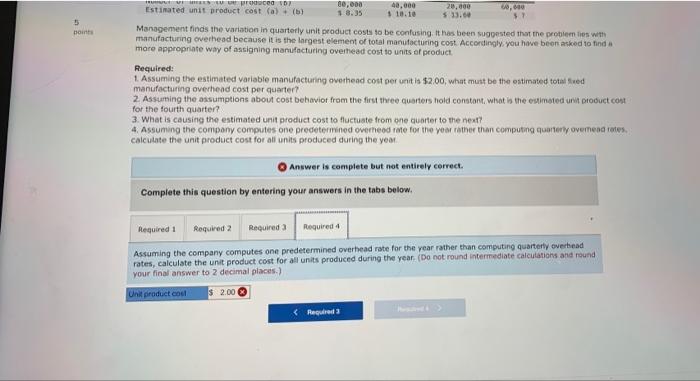

Kingsport Containers Compary makes a single product that is subject to wide seasonal variabons in demand. The compary uses a job-order costing system and computes plantwide predetermined overhend rates on a quanterly bosis using the number of units fo be produced as the allocation base. Its estimated costs, by quarter, for the coming year are gren beiow Management finds the variation in quarterly unit product costs to be confusing it has been suggested that the protlem lies with manufacturing overhead because it is the largest element of total manufocturing cost. Accordingly, you have been asked to find a more appropriate way of assigning manufacturing overhead cost to units of product. Required: 1. Assuming the estimated variable manufacturing overhead cost per unit is $2.00. what must be the estimated sotal fixed manufacturing overhead cost per quarter? 2. Assuming the assumptions about cost behavior from the first three quarters hold constant, what is the estmated unit procuct cost for the fourth quarter? 3. What is causing the estimated unit product cost to fuctuate from one quarter to the next? 4. Assuming the company computes one predetermined overhead rate for the year rather than computing quarterly overhead rates. calculate the unit product cost for all units produced during the year. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Assuming the assumptions about cost behavior from the first three quarters hold constant, what is the estimated unit product cost for the fourth quarter? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Managerient finds the variation in quarterly unit product costs to be confusing. It has been suggnsted that the probleen hes with Manufacturing owerhead because it is the largest element of total manufacturing cost. Accordingly you have beon arkod 10 find a mare appropriate way of assigning manufactuting overthead cost to units of product. Required: 1. Assuming the estimated yariable manufacturing overhend cott ser unit is $2.00, what must be the ostimated total ised manufacturing overthead cost per quarter? 2. Assuming the assumptions about cost behavior from the first three guarters hold constant, what h the eutimated und probuct cost for the sourth quarter? 3. What is causing the estimated unit groduct cost to fluctuate from bne quarter to the nest 4. Assuming the company computes ore predetermined overheod rate for the year rither than computing quarierty overinead rates. calcutate the unit product cost for all units produced during the year. (3) Answer is caeplete but not entirely cerrect. Complete this question by entering your answers in the tabs below. Assuming the company computes one predetermined overhead rate for the year rather than computing quarteriy evertead rates, calculate the unit product cost for all units produced during the year. (Do not round intertediate calcilatiors and round your final answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started