Hi, I need help please!

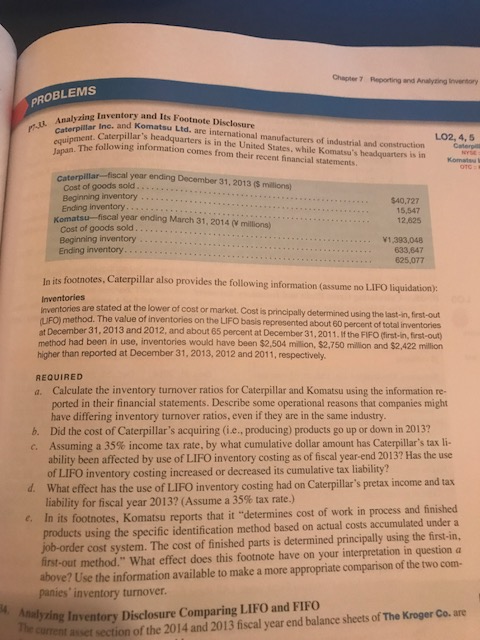

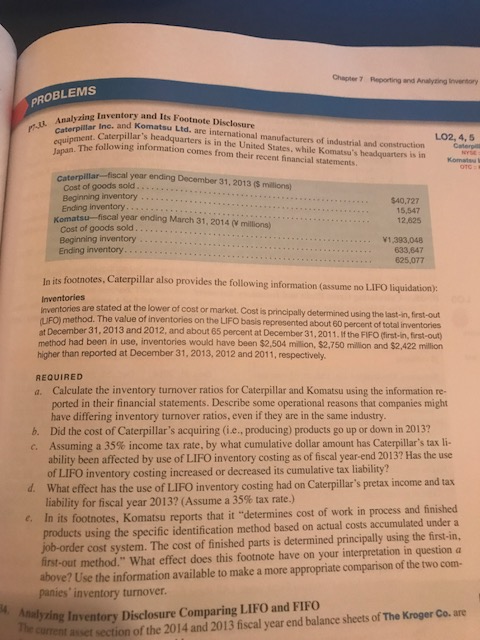

Chapter 7 Reporting and Analyting lnventory PROBLEMS Inventory and Its Footnote Disclosure Azar Inc. and Komatsu Ltd. are international manufacturers of industrial and construction rd Gaterpinit Caterp in illar's headquarters is in the United States, while Komatsu's headquartersis L02, 4, 5 equipment The following information comes from their recent financial statements Caterpil Caterpillar -fiscal year ending December 31, 2013 (S millions) Cost of goods sold Beginning inventory Ending inventory Komatsu- fiscal year ending March 31,2014 (V millions) $40,727 15,547 12,625 Cost of goods sold Beginning inventory V1,393,048 633,847 625,077 Ending inventory In its footnotes, Caterpillar also provides the following information (assume no LIFO liquidation): Inventories inven LIFO) method. The value of inventories on the LIF at December 31,2013 and 2012, and about 65 percent at December 31,2011. f the FIFO (first-in, first-out) method had been in use, inventories would have been $2,504 million, $2,750 million and $2,422 million higher than reported at December 31, 2013, 2012 and 2011, respectively are stated at the lower of cost or market. Cost is principally determined using the last-in, first-out O basis represented about 60 percent of total inventories REQUIRED Calculate the inventory turnover ratios for Caterpillar and Komatsu using the information re- ported in their financial statements. Describe some operational reasons that companies might a. have differing inventory turnover ratios, even if they are in the same industry b. Did the cost of Caterpillar's acquiring (i.e., producing) products go up or down in 2013? Assuming a 35% income tax rate, by what cumulative dollar amount has Caterpillar's tax li- ability been affected by use of LIFO inventory costing as of fiscal year-end 2013? Has the use of LIFO inventory costing increased or decreased its cumulative tax liability? d. What effect has the use of LIFO inventory costing had on Caterpillar's pretax income and tax. liability for fiscal year 2013? (Assume a 35% tax rate.) c. In its footnotes, Komatsu reports that it "determines cost of work in process and finished products using the specific identification method based on actual costs accumulated under a job-order cost system. The cost of finished parts is determined principally using the first-ir, first-out method." What effect does this footnote have on your interpretation in question a above? Use the information available to make a more appropriate comparison of the two com- panies inventory turnover. zing Inventory Disclosure Comparing LIFO and FIFO current asset section of the 2014 and 2013 fiscal year end balance sheets of The Kroger Co. are