Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, I need help understanding problem #4, please skip #1-3. The interest rate change mentioned in the problem is from 8% to 12%. ( r0

Hi, I need help understanding problem #4, please skip #1-3. The interest rate change mentioned in the problem is from 8% to 12%. ( r0 = 0.08 and r1 = r2 = 0.12 ) Thank you for your time.

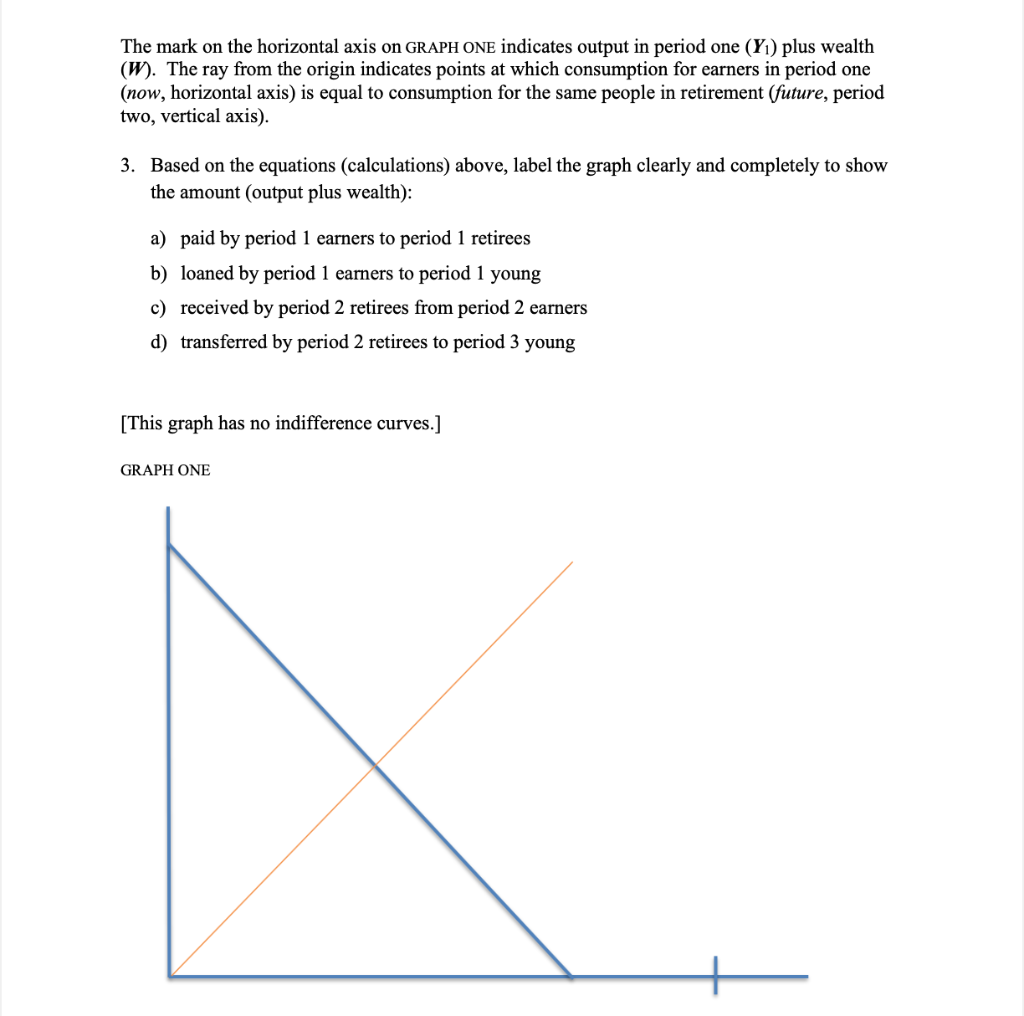

Yo = 70 gY=0.08 Y = Cyoung + Cearners + Cretired + 1; rogy x=0.125 z=0.28 = (x+z)Y 1+r Y = (1+gy)Y(1-1) Cretired = (1+r)*B(t-1) - XY, Cearners = Yt - (1+r)* B(t-1) - Bt Cyoung = Bt - XY 1. Complete TABLE ONE. TABLE ONE Coy young Cearners Czretired 12 2. Consider an increase in the interest rate (r). Specifically, ro = 0.08 and r 1 = r2 = 0.12. All other parameters are unchanged. Complete TABLE TWO. TABLE TWO Coy young earners Czretired 12 The mark on the horizontal axis on GRAPH ONE indicates output in period one (Yl) plus wealth (W). The ray from the origin indicates points at which consumption for earners in period one (now, horizontal axis) is equal to consumption for the same people in retirement (future, period two, vertical axis). 3. Based on the equations (calculations) above, label the graph clearly and completely to show the amount (output plus wealth): a) paid by period 1 earners to period 1 retirees b) loaned by period 1 earners to period 1 young c) received by period 2 retirees from period 2 earners d) transferred by period 2 retirees to period 3 young [This graph has no indifference curves.] GRAPH ONE Consider the interest rate increase from question #2. The interest rate change has consequences, but all other parameters (e.g., growth rate of output) are unchanged. 4. On the same GRAPH ONE, add clear and complete labels to show the consequences of the higher interest rate. Specifically, 1) the new interte ral budget line and the amount (output plus wealth): 2) paid by period 1 earners to period 1 retirees 3) loaned by period 1 earners to period 1 young 4) received by period 2 retirees from period 2 earners 5) transferred by period 2 retirees to period 3 young Yo = 70 gY=0.08 Y = Cyoung + Cearners + Cretired + 1; rogy x=0.125 z=0.28 = (x+z)Y 1+r Y = (1+gy)Y(1-1) Cretired = (1+r)*B(t-1) - XY, Cearners = Yt - (1+r)* B(t-1) - Bt Cyoung = Bt - XY 1. Complete TABLE ONE. TABLE ONE Coy young Cearners Czretired 12 2. Consider an increase in the interest rate (r). Specifically, ro = 0.08 and r 1 = r2 = 0.12. All other parameters are unchanged. Complete TABLE TWO. TABLE TWO Coy young earners Czretired 12 The mark on the horizontal axis on GRAPH ONE indicates output in period one (Yl) plus wealth (W). The ray from the origin indicates points at which consumption for earners in period one (now, horizontal axis) is equal to consumption for the same people in retirement (future, period two, vertical axis). 3. Based on the equations (calculations) above, label the graph clearly and completely to show the amount (output plus wealth): a) paid by period 1 earners to period 1 retirees b) loaned by period 1 earners to period 1 young c) received by period 2 retirees from period 2 earners d) transferred by period 2 retirees to period 3 young [This graph has no indifference curves.] GRAPH ONE Consider the interest rate increase from question #2. The interest rate change has consequences, but all other parameters (e.g., growth rate of output) are unchanged. 4. On the same GRAPH ONE, add clear and complete labels to show the consequences of the higher interest rate. Specifically, 1) the new interte ral budget line and the amount (output plus wealth): 2) paid by period 1 earners to period 1 retirees 3) loaned by period 1 earners to period 1 young 4) received by period 2 retirees from period 2 earners 5) transferred by period 2 retirees to period 3 young

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started