Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi, i need help with these. thanks in advance! Question 5 1 pts If a firm's quick ratio is 1.5, and the industry has an

hi, i need help with these. thanks in advance!

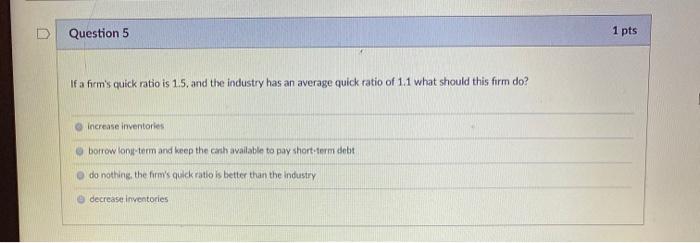

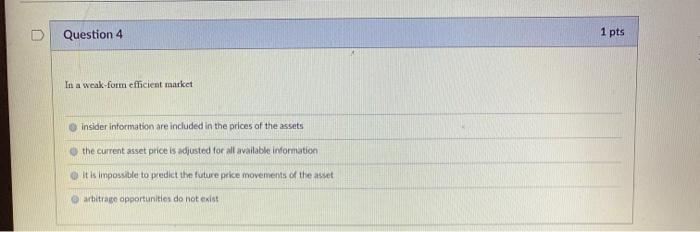

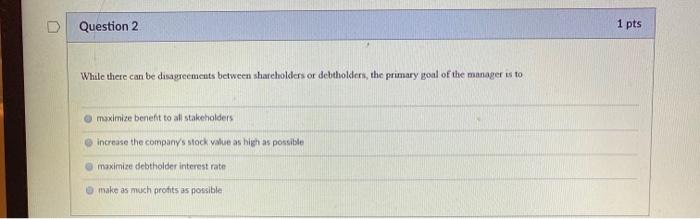

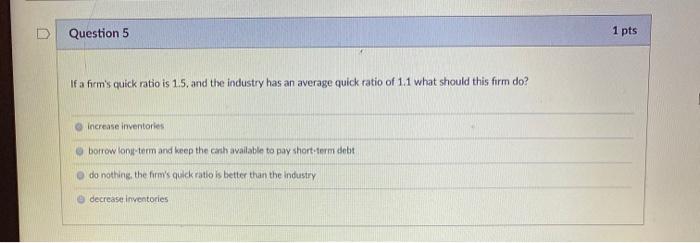

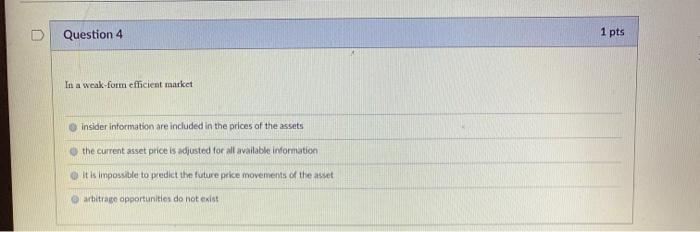

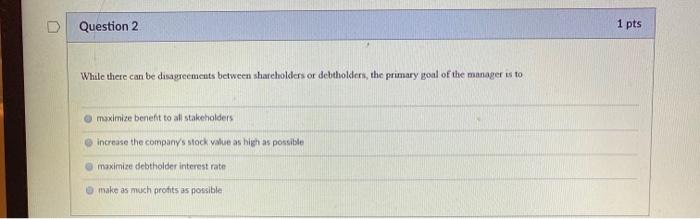

Question 5 1 pts If a firm's quick ratio is 1.5, and the industry has an average quick ratio of 1.1 what should this firm do? increase inventories borrow font-term and keep the cash available to pay short-term debt do nothing, the firm's quick ratio is better than the industry decrease inventories Question 4 1 pts In a weak for efficient market Insider Information are included in the prices of the assets the current asset price is adjusted for all available information It is impossible to predict the future prke movements of the asset arbitrage opportunities do not exist D Question 2 1 pts While there can be disagreements between shareholders or debtholders, the primary goal of the manager is to maximize benefit to all stakeholders increase the company's stock value as high as possible maximize debtholder interest rate make as much profits as possible Question 5 1 pts If a firm's quick ratio is 1.5, and the industry has an average quick ratio of 1.1 what should this firm do? increase inventories borrow font-term and keep the cash available to pay short-term debt do nothing, the firm's quick ratio is better than the industry decrease inventories

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started