Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi, i need the complete answer for all the requierments. thanks please amswer it correctly. Requirements 1. Compute Trinton's current ratio, debt ratio, and earnings

hi, i need the complete answer for all the requierments. thanks please amswer it correctly.

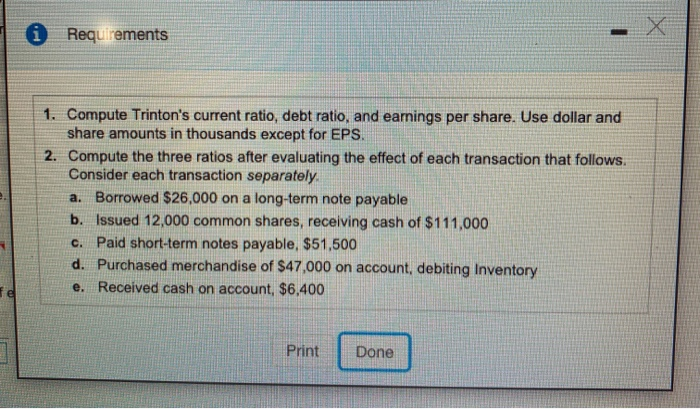

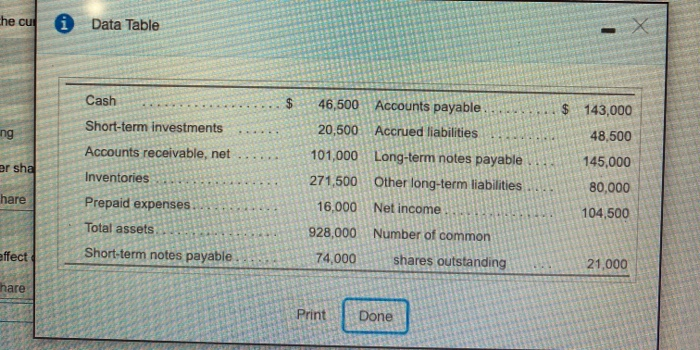

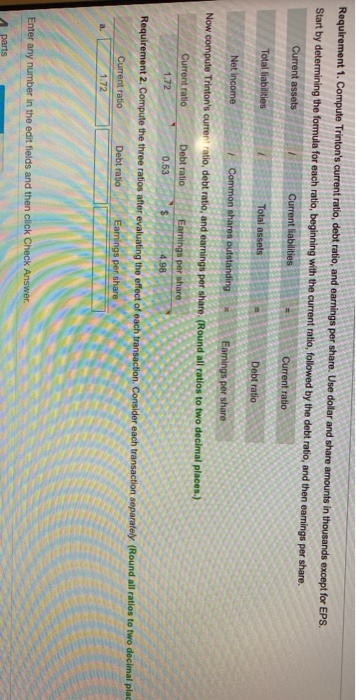

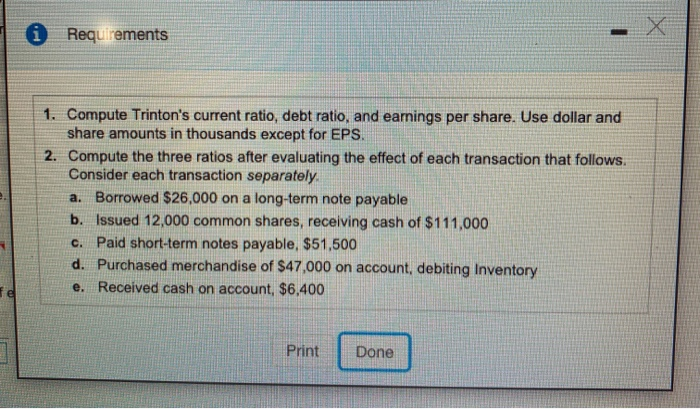

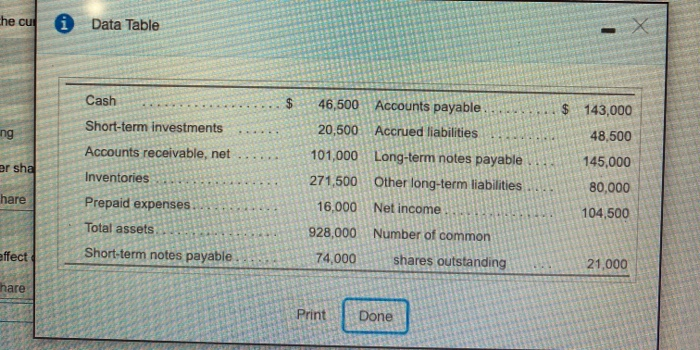

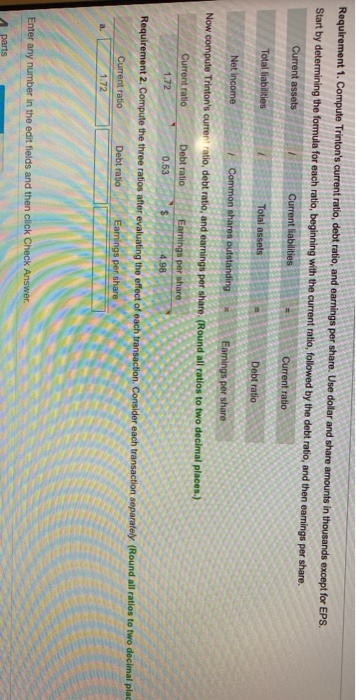

Requirements 1. Compute Trinton's current ratio, debt ratio, and earnings per share. Use dollar and share amounts in thousands except for EPS. 2. Compute the three ratios after evaluating the effect of each transaction that follows. Consider each transaction separately. a. Borrowed $26,000 on a long-term note payable b. Issued 12,000 common shares, receiving cash of $111,000 c. Paid short-term notes payable, $51,500 d. Purchased merchandise of $47,000 on account, debiting Inventory e. Received cash on account, $6,400 fe Print Done he cul i Data Table Cash $ $ 143,000 ng 48,500 Short-term investments Accounts receivable, net Inventories er sha 46,500 Accounts payable 20,500 Accrued liabilities 101,000 Long-term notes payable 271,500 Other long-term liabilities 16,000 Net income 928,000 Number of common 74,000 shares outstanding 145,000 80,000 104,500 hare Prepaid expenses Total assets effect Short-term notes payable 21,000 hare Print Done Requirement 1. Compute Trinton's current ratio, debt ratio, and earnings per share. Use dollar and share amounts in thousands except for EPS. Start by determining the formula for each ratio, beginning with the current ratio, followed by the debt ratio, and then earnings per share Current assets Current liabilities Current ratio Total liabilities Total assets Debt ratio Net Income Common shares outstanding Earnings per share Now compute Trinton's current ratio, debt ratio, and earnings per share. (Round all ratios to two decimal places.) Debt ratio Current ratio 1.72 Earnings per share 4.98 0.53 Requirement 2. Compute the three ratios after evaluating the effect of each transaction. Consider each transaction separately (Round all ratios to two decimal plac Current ratio 1.72 Debt ratio Eamings per share a. Enter any number in the edit fields and then click Check Answer. parts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started