Hi, I really need help with the adjusting entries please. I already did the adjusting entries. I attached my solution down along with the question. I just want to make sure I did them right. Thank you.

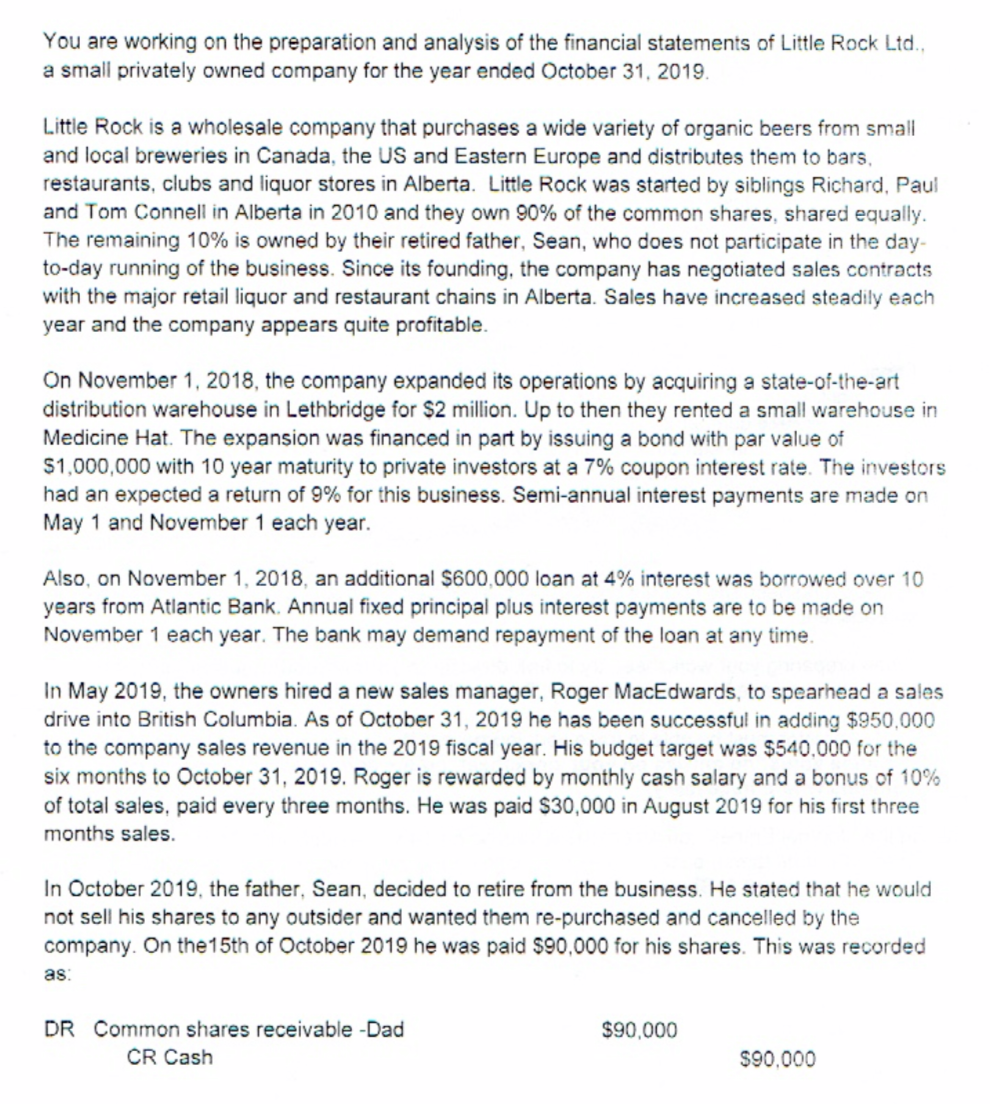

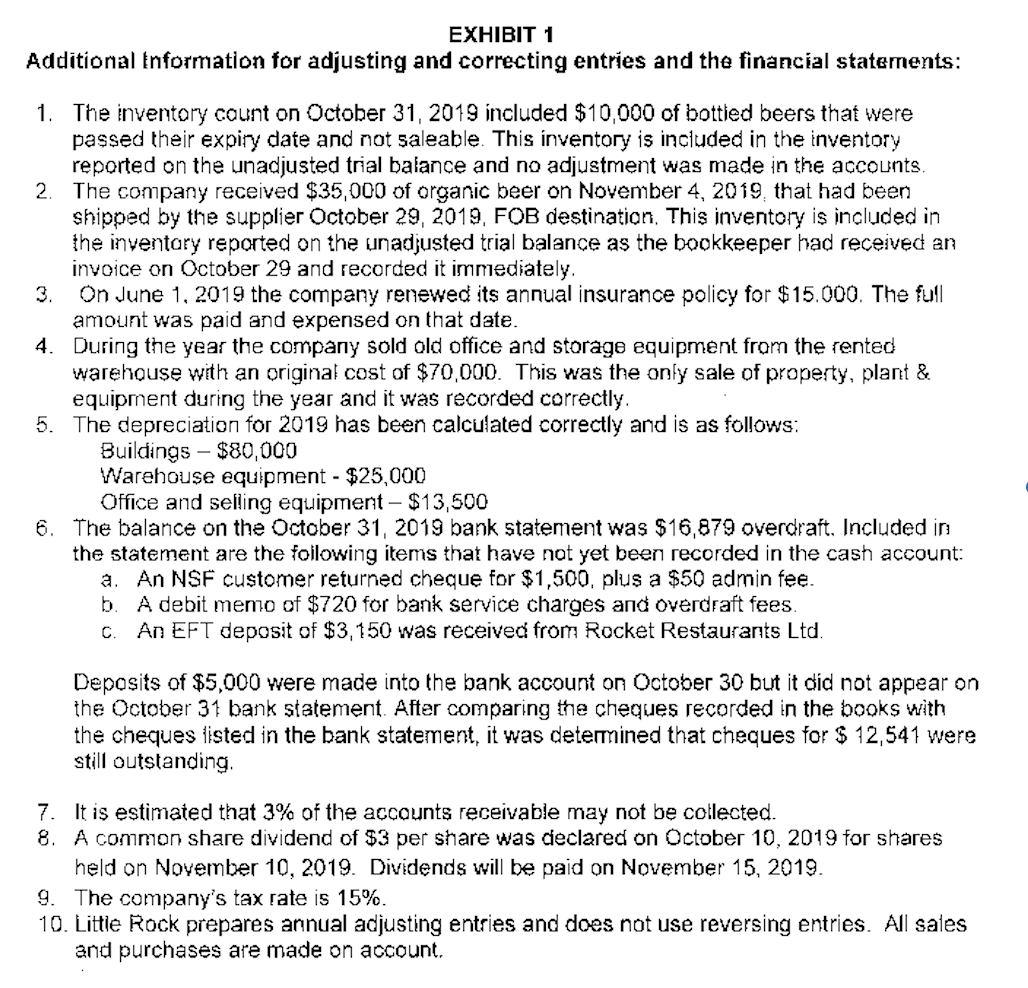

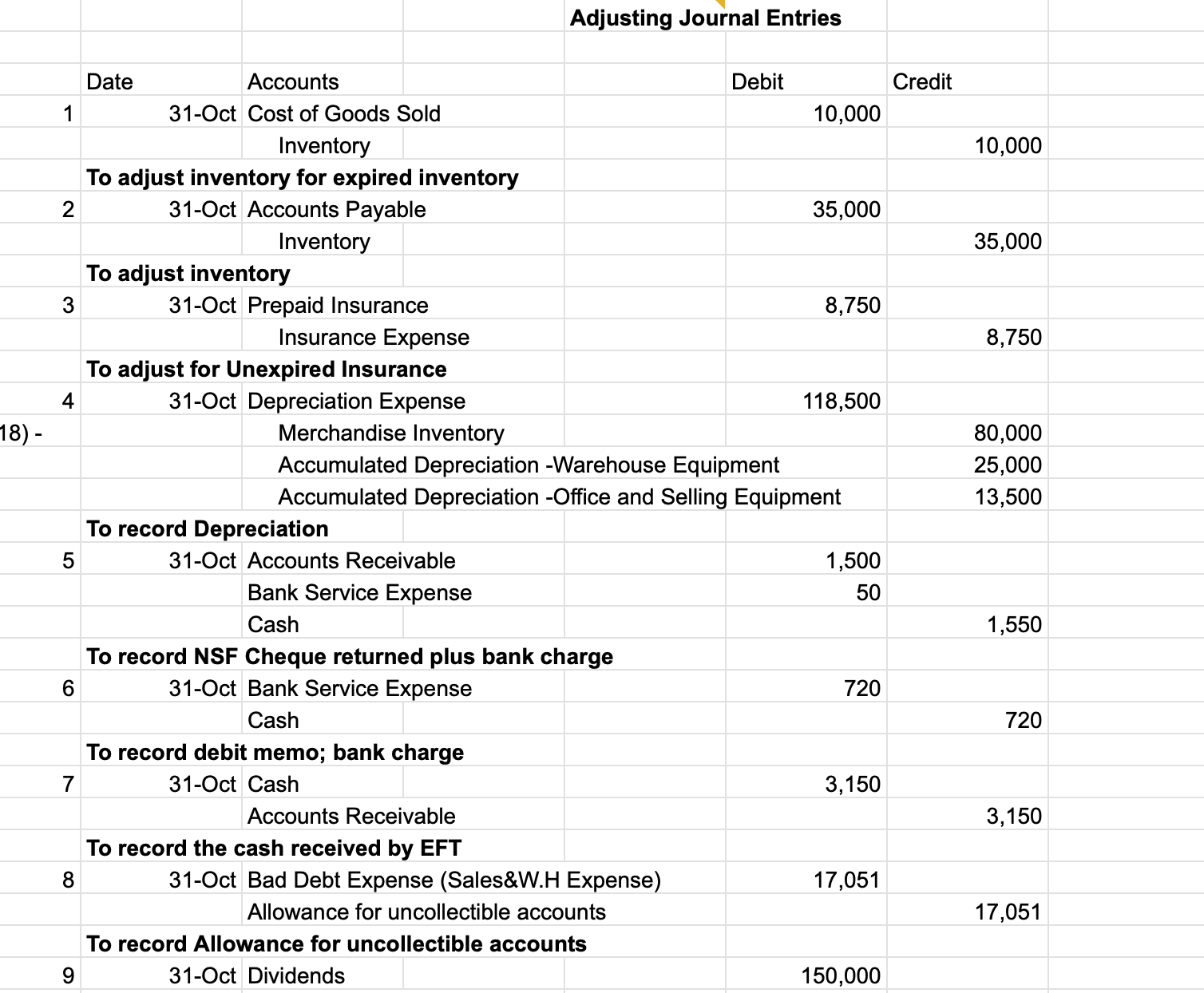

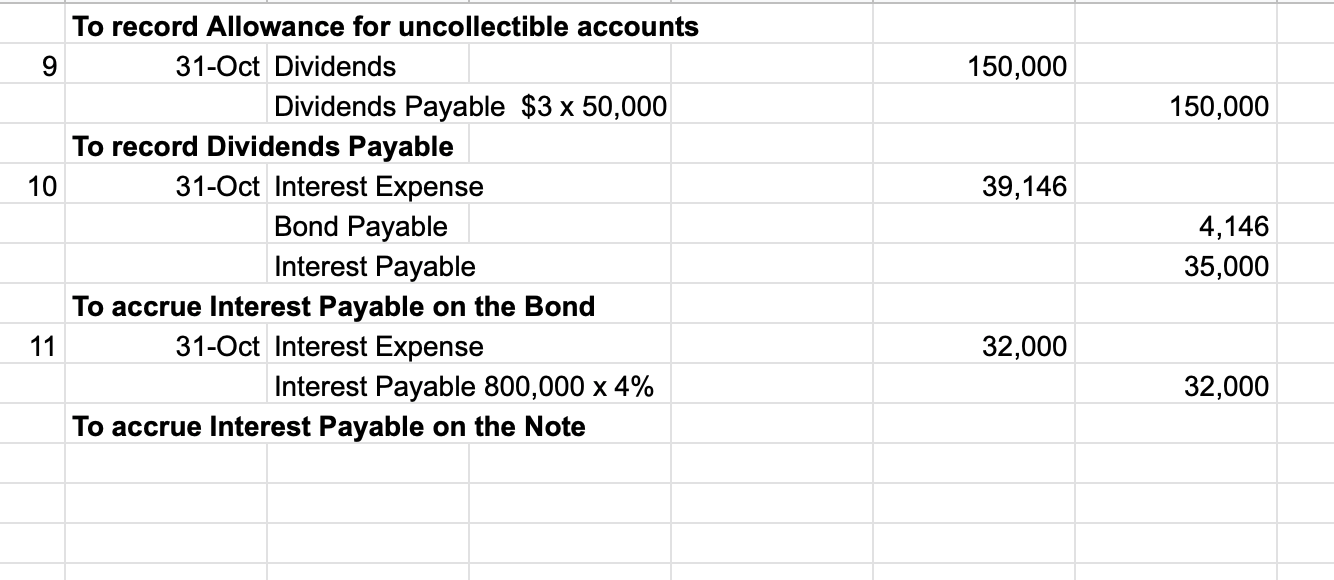

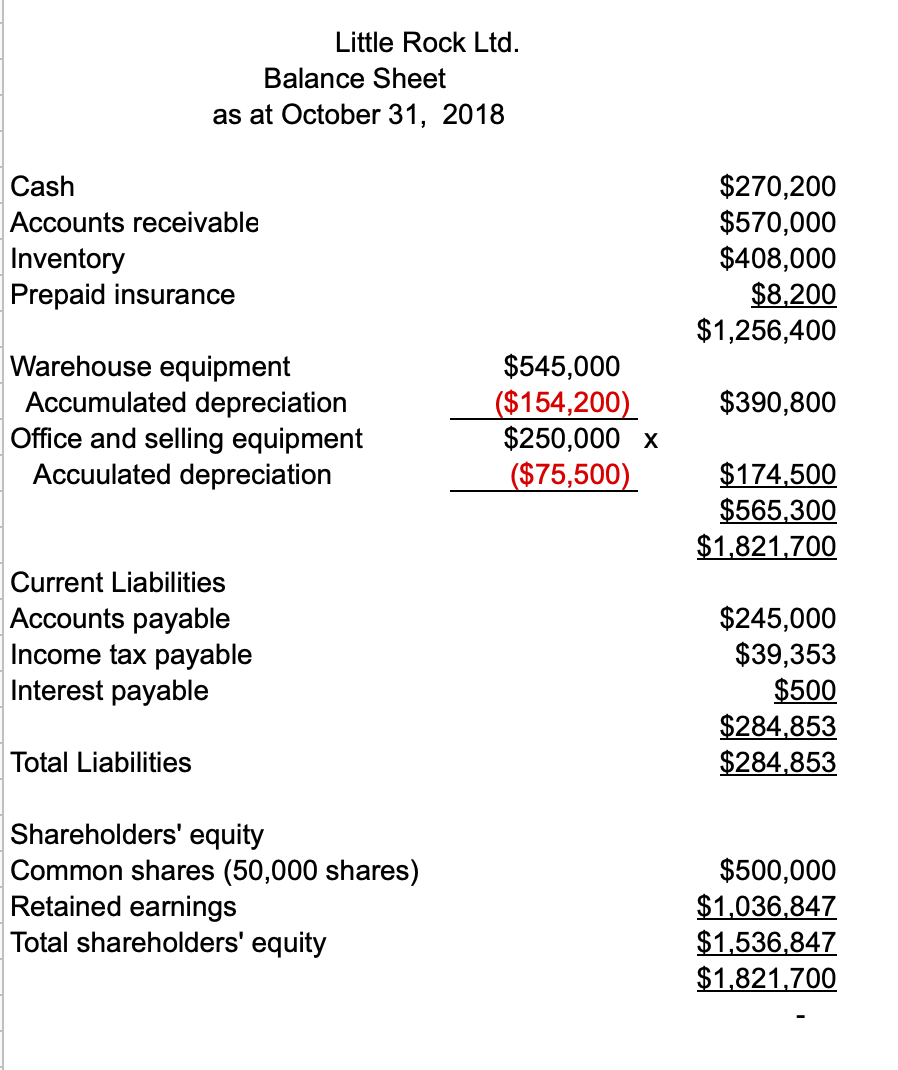

You are working on the preparation and analysis of the nancial statements of Little Rock Ltd. a small privately owned company for the year ended October 31. 2019. Little Rock is a wholesale oornpany that purchases a wide variety of organic beers from small and local breweries in Canada. the US and Eastern Europe and distributes them to bars. restaurants. clubs and liquor stores in Alberta. Little Rock was started by siblings Richard. Paul and Tom Conneit in Alberta in 2010 and they own 90% of the common shares. shared equally. The remaining 10% is owned by their retired father. Sean. who does not participate in the day today running of the business. Since its founding. the company has negotiated sales contracts with the major retail liquor and restaurant chains in Alberta. Sales have increased steadily each year and the company appears quite protable. On November 1. 2018. the company expanded its operations by acquiring a stateoi-the-art distribution warehouse in Lelhbridge for $2 million. Up to then they rented a small warehouse in Medicine Hat. The expansion was nanced in part by issuing a bond with par value of 51.000000 with 10 year maturity to private investors at a 7% coupon interest rate. The investors had an expected a return of 9% for this business. Semi-annual interest payments are made on May 1 and November 1 each year. Aiso. on November 1. 2018, an additional $600,000 loan at 4% interest was borrowed over 10 years from Atlantic Bank. Annual xed principal plus interest payments are to be made on November 1 com year. The bank may demand repayment of the loan at any time. In May 2019. the owners hired a new sales manager. Roger MacEdwards. to spearhead a sales drive into British Columbia. As of October 31. 2019 he has been successful in adding $950,000 to the company sales revenue in the 2019 scal year. His budget target was 5540.000 for the six months to October 311 2019. Roger is rewarded by monthly cash salary and a bonus of 10% of total sales, paid every three months. He was paid $30000 in August 2019 for his first three months sales. In October 2019. the father. Sean. decided to retire from the business. He stated that he would not sell his shares to any outsider and wanted them re-purcnased and cancelled by the company. 0n the15th of October 2019 he was paid 590.000 for his shares. This was recorded as: DR Common shares receivable -Dad 390.000 CR Cash 390.000 EXHIBIT 1 Additional tnformation [or adjusting and correcting entries and the nancial statements: 1 . 5797'\" The inventoryr count on October 31. 2019 included $10000 of bottled beers that were passed their expiry date and not saleable. This interment.l is included in the inventory reported on the unadjusted trial balance and no adiuslment was made in the accounts. The company received $35000 of organic beer on November 4. 2019. that had been shipped by the supplier October 29. 2019. FOB destination. This inventor}.r is included in the inventory reported on the unadjusted trial balance as the bookkeeper had received an invoice on October 29 and recorded it immediately. On June \"I. 2019 the company renewed its annual insurance policy for $15000. The full amount was paid and expensed on that date. During the year the Olimpia"? sold old ofce and storage equipment from the rented warehouse with an original cost of $70,000. This was the only sale of property. plant 8: equipment during the year and it was recorded correctly. ' The depreciation for 2019 has been calculated correctly and is as follows: Buildings $80,000 Warehouse equipment - $25,000 Ofce and selling equipment $13,500 . The balance on the October 31. 2019 bank statement was $16.8?9 overdraft. Included in the statement are the following items that have not yet been recorded in the cash account: a. An NSF customer returned cheque for $1,500. plus a $50 admin tee. b. A debit memo of $T20 for bank service charges and overdraft fees. c. An EFT deposit of $3,150 was received from Rocket Restaurants Ltd. Deposits of $5.000 were made into the bank account on October 30 but it did not appear on the October 31 bank statement. After comparing the cheques recorded in the books with the cheques listed in the bank statement. it was determined that cheques for 3 12.54'l were Still ontstending. It is estimated that 3% of the accounts receivable may not be collected A common share dividend of $3 per share was declared on October 10, 2019 for shares held on November 10, 2019. Dividends will be paid on November 15. 2019. The company's tax rate is 15%. . Little Rock prepares annual adjusting entries and does not use reversing entries. All sales and purchases are made on account. Adjusting Journal Entries Date Accounts Debit Credit 31-Oct Cost of Goods Sold 10,000 Inventory 10,000 To adjust inventory for expired inventory 2 31-Oct Accounts Payable 35,000 Inventory 35,000 To adjust inventory 3 31-Oct Prepaid Insurance 8,750 Insurance Expense 8,750 To adjust for Unexpired Insurance 4 31-Oct Depreciation Expense 118,500 18) - Merchandise Inventory 80,000 Accumulated Depreciation -Warehouse Equipment 25,000 Accumulated Depreciation -Office and Selling Equipment 13,500 To record Depreciation 5 31-Oct Accounts Receivable 1,500 Bank Service Expense 50 Cash 1,550 To record NSF Cheque returned plus bank charge 6 31-Oct Bank Service Expense 720 Cash 720 To record debit memo; bank charge 7 31-Oct Cash 3, 150 Accounts Receivable 3, 150 To record the cash received by EFT 8 31-Oct Bad Debt Expense (Sales&W.H Expense) 17,051 Allowance for uncollectible accounts 17,051 To record Allowance for uncollectible accounts 9 31-Oct Dividends 150,000To record Allowance for uncollectible accounts 9 31-Oct Dividends 150.000 Dividends Payable $3 x 50,000 150,000 To record Dividends Payable 10 31-Oct Interest Expense 39.146 Bond Payable 4,146 Interest Payable 35,000 To accrue Interest Payable on the Bond 11 31-Oct Interest Expense 32,000 Interest Payable 800,000 x 4% 32,000 To accrue Interest Payable on the Note Little Rock Ltd. Balance Sheet as at October 31, 2018 Cash $270,200 Accounts receivable $570,000 Inventory $408,000 Prepaid insurance $8,200 $1,256,400 Warehouse equipment $545,000 Accumulated depreciation ($154,200) $390,800 Ofce and selling equipment $250,000 x Accuulated depreciation {$75,500} $174,500 $565,300 $1,821,700 Current Liabilities Accounts payable $245,000 Income tax payable $39,353 Interest payable 3500 284 853 Total Liabilities 284 853 Shareholders' equity Common shares (50,000 shares) $500,000 Retained earnings $1,036,847 Total Shareholders' equity $1,536,847 $1,821 ,700