Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, I solved part A, I need help with part b. But please provide the details of how you get the numbers. Thanks a lot

Hi, I solved part A, I need help with part b. But please provide the details of how you get the numbers. Thanks a lot for your help!

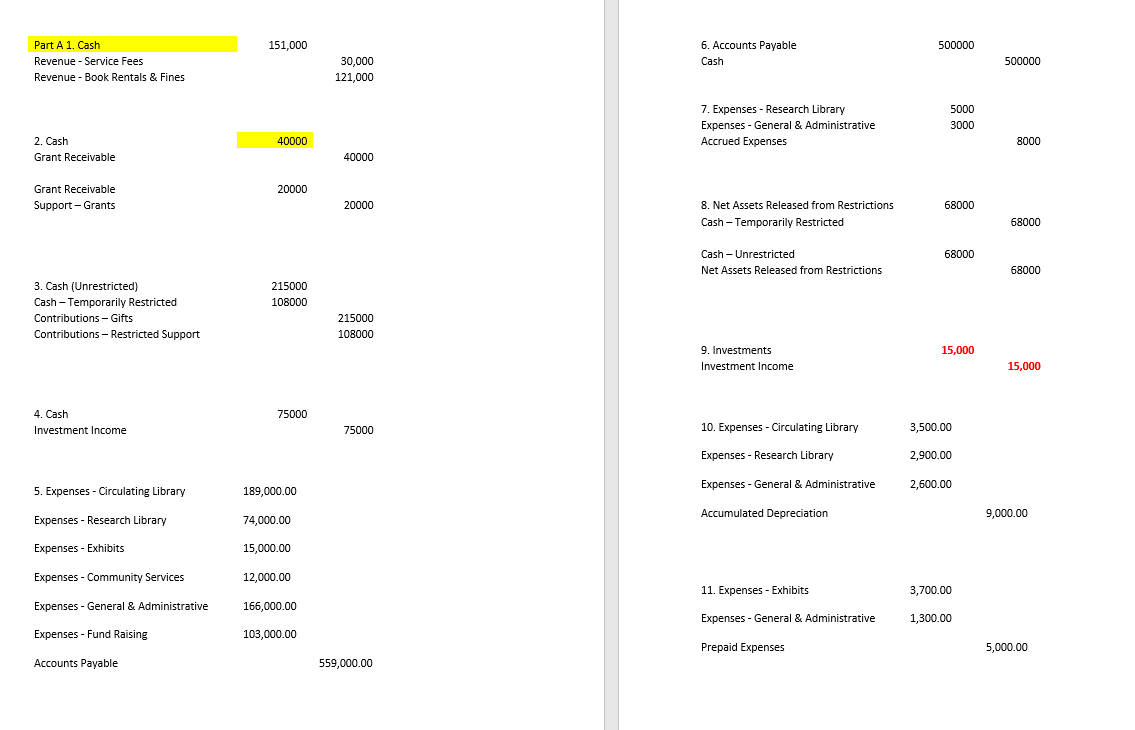

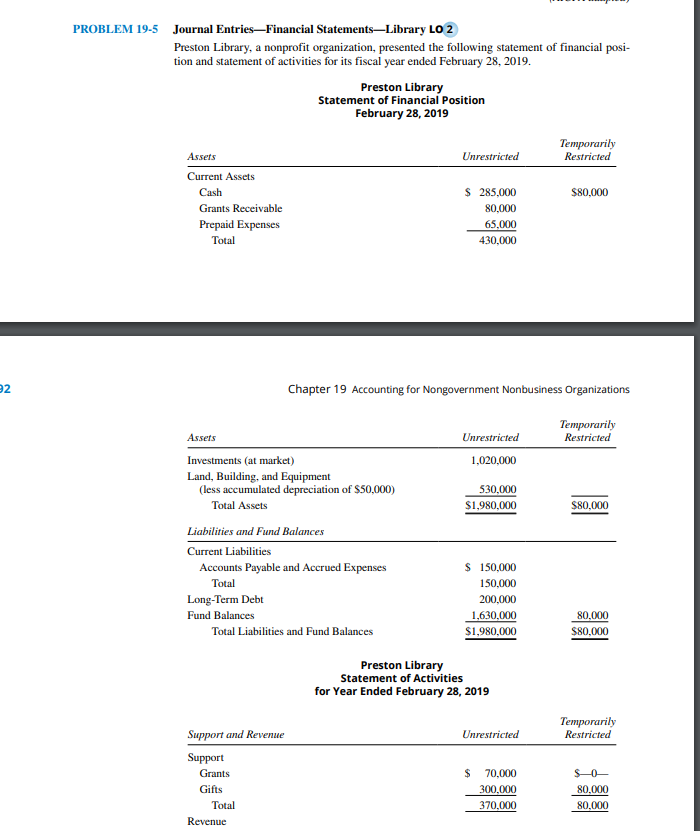

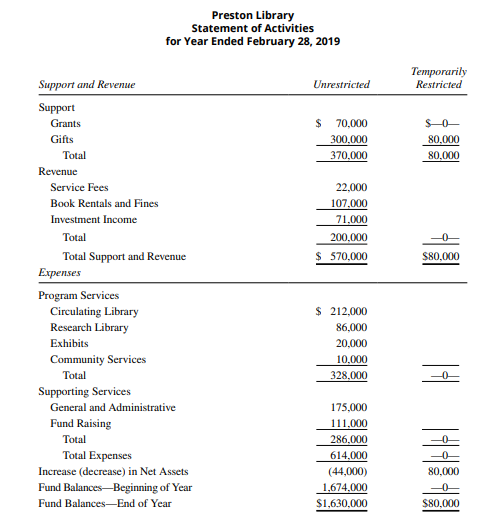

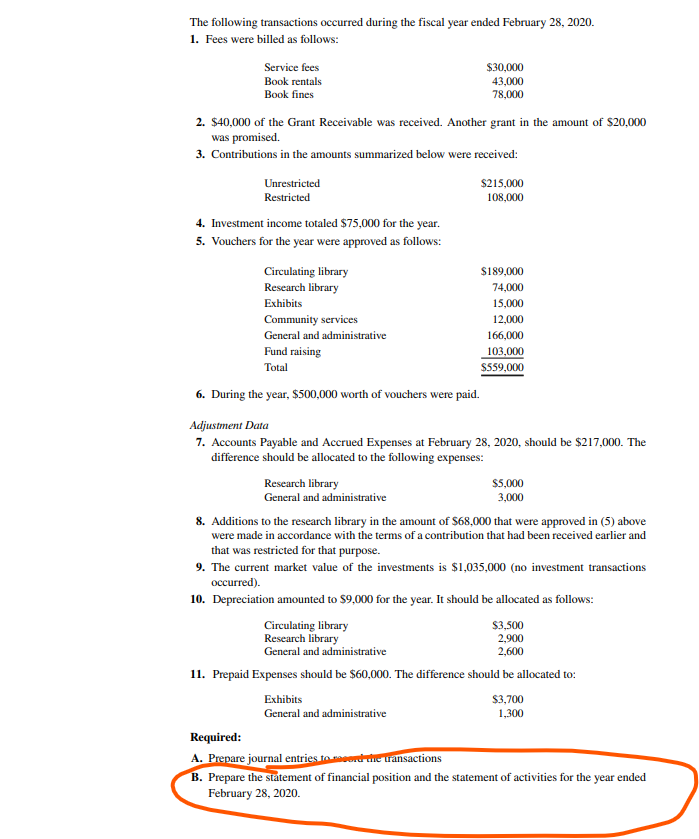

Part A 1. Cash Revenue - Service Fees Revenue - Book Rentals \& Fines 2. Cash Grant Receivable Grant Receivable Support-Grants 3. Cash (Unrestricted) Cash - Temporarily Restricted Contributions - Gifts Contributions - Restricted Support 4. Cash Investment Income 5. Expenses - Circulating Library Expenses - Research Library Expenses - Exhibits Expenses - Community Services Expenses - General \& Administrative Expenses - Fund Raising Accounts Payable 151,000 30,000 121,000 75000 75000 189,000.00 74,000.00 15,000.00 12,000.00 166,000.00 103,000.00 6. Accounts Payable Cash 7. Expenses - Research Library Expenses - General \& Administrative Accrued Expenses 8. Net Assets Released from Restrictions Cash - Temporarily Restricted Cash - Unrestricted Net Assets Released from Restrictions 9. Investments Investment Income 10. Expenses - Circulating Library Expenses - Research Library Expenses - General \& Administrative Accumulated Depreciation 11. Expenses - Exhibits Expenses - General \& Administrative Prepaid Expenses 500000 500000 5000 3000 8000 68000 68000 15,000 15,000 9,000.00 559,000.00 Journal Entries-Financial Statements-Library LO 2 Preston Library, a nonprofit organization, presented the following statement of financial position and statement of activities for its fiscal year ended February 28,2019. Preston Library Statement of Financial Position February 28, 2019 Chapter 19 Accounting for Nongovernment Nonbusiness Organizations Preston Library Statement of Activities for Year Ended February 28, 2019 Preston Library The following transactions occurred during the fiscal year ended February 28,2020 . 1. Fees were billed as follows: 2. $40,000 of the Grant Receivable was received. Another grant in the amount of $20,000 was promised. 3. Contributions in the amounts summarized below were received: 4. Investment income totaled $75,000 for the year. 5. Vouchers for the year were approved as follows: 6. During the year, $500,000 worth of vouchers were paid. Adjustment Data 7. Accounts Payable and Accrued Expenses at February 28, 2020, should be $217,000. The difference should be allocated to the following expenses: 8. Additions to the research library in the amount of $68,000 that were approved in (5) above were made in accordance with the terms of a contribution that had been received earlier and that was restricted for that purpose. 9. The current market value of the investments is $1,035,000 (no investment transactions occurred). 10. Depreciation amounted to $9,000 for the year. It should be allocated as follows: 11. Prepaid Expenses should be $60,000. The difference should be allocated to: Required: A. Prepare journal entries to toverdrtictransactions B. Prepare the statement of financial position and the statement of activities for the year ended February 28,2020. Part A 1. Cash Revenue - Service Fees Revenue - Book Rentals \& Fines 2. Cash Grant Receivable Grant Receivable Support-Grants 3. Cash (Unrestricted) Cash - Temporarily Restricted Contributions - Gifts Contributions - Restricted Support 4. Cash Investment Income 5. Expenses - Circulating Library Expenses - Research Library Expenses - Exhibits Expenses - Community Services Expenses - General \& Administrative Expenses - Fund Raising Accounts Payable 151,000 30,000 121,000 75000 75000 189,000.00 74,000.00 15,000.00 12,000.00 166,000.00 103,000.00 6. Accounts Payable Cash 7. Expenses - Research Library Expenses - General \& Administrative Accrued Expenses 8. Net Assets Released from Restrictions Cash - Temporarily Restricted Cash - Unrestricted Net Assets Released from Restrictions 9. Investments Investment Income 10. Expenses - Circulating Library Expenses - Research Library Expenses - General \& Administrative Accumulated Depreciation 11. Expenses - Exhibits Expenses - General \& Administrative Prepaid Expenses 500000 500000 5000 3000 8000 68000 68000 15,000 15,000 9,000.00 559,000.00 Journal Entries-Financial Statements-Library LO 2 Preston Library, a nonprofit organization, presented the following statement of financial position and statement of activities for its fiscal year ended February 28,2019. Preston Library Statement of Financial Position February 28, 2019 Chapter 19 Accounting for Nongovernment Nonbusiness Organizations Preston Library Statement of Activities for Year Ended February 28, 2019 Preston Library The following transactions occurred during the fiscal year ended February 28,2020 . 1. Fees were billed as follows: 2. $40,000 of the Grant Receivable was received. Another grant in the amount of $20,000 was promised. 3. Contributions in the amounts summarized below were received: 4. Investment income totaled $75,000 for the year. 5. Vouchers for the year were approved as follows: 6. During the year, $500,000 worth of vouchers were paid. Adjustment Data 7. Accounts Payable and Accrued Expenses at February 28, 2020, should be $217,000. The difference should be allocated to the following expenses: 8. Additions to the research library in the amount of $68,000 that were approved in (5) above were made in accordance with the terms of a contribution that had been received earlier and that was restricted for that purpose. 9. The current market value of the investments is $1,035,000 (no investment transactions occurred). 10. Depreciation amounted to $9,000 for the year. It should be allocated as follows: 11. Prepaid Expenses should be $60,000. The difference should be allocated to: Required: A. Prepare journal entries to toverdrtictransactions B. Prepare the statement of financial position and the statement of activities for the year ended February 28,2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started