Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, I wanna know those questions how to solve step by step. I put solutions on the below, but I don't know where those numbers

Hi, I wanna know those questions how to solve step by step.

Hi, I wanna know those questions how to solve step by step.

I put solutions on the below, but I don't know where those numbers came?

Is there any ways to calculate them more easily? Thank you.

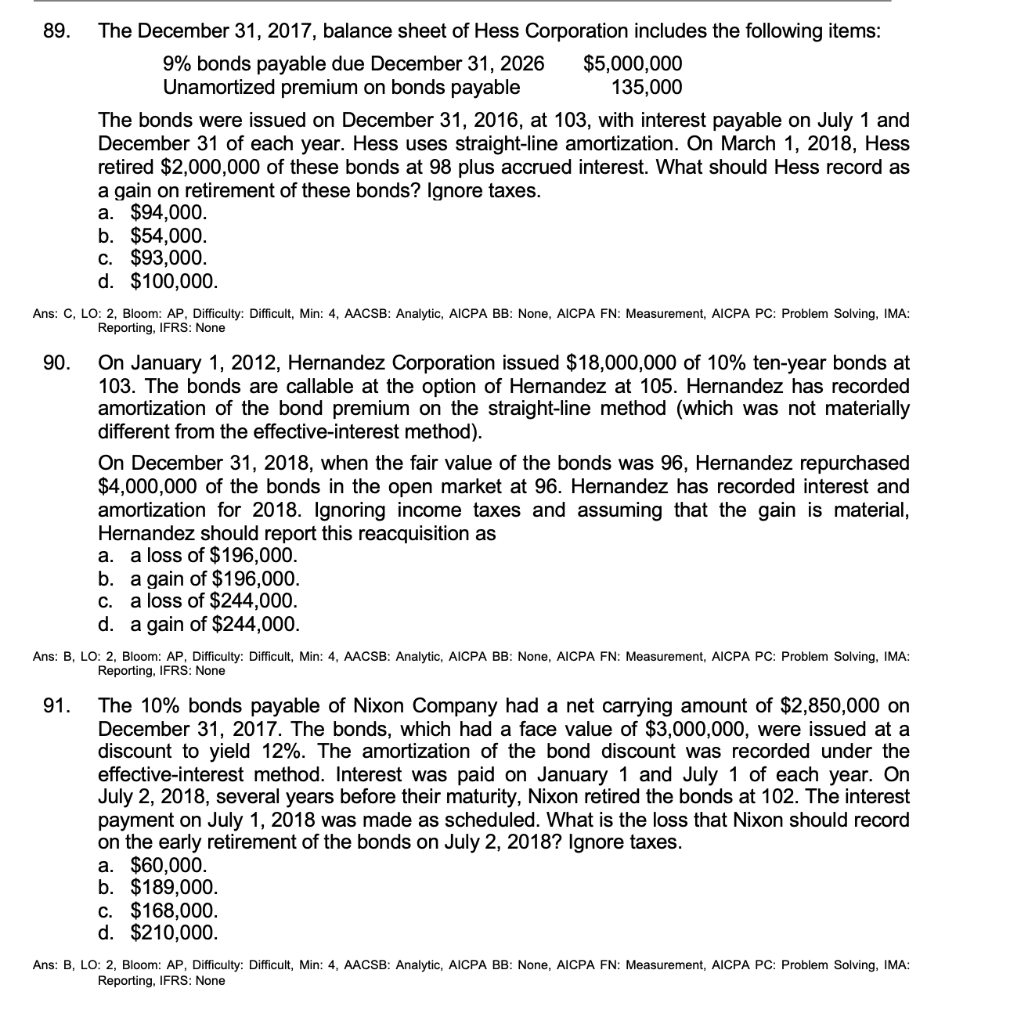

89. c [BC1] = $2,053,000 (CV of retired bonds)

$2,053,000 ($2,000,000 .98) = $93,000.

90. b [BC2] = $4,036,000 (CV of retired bonds)

$4,036,000 ($4,000,000 .96) = $196,000.

91. b $2,850,000 + [($2,850,000 .06) ($3,000,000 .05)] = $2,871,000 (CV of bonds)

$2,871,000 ($3,000,000 1.02) = $189,000.

89. The December 31, 2017, balance sheet of Hess Corporation includes the following items: 9% bonds payable due December 31, 2026 $5,000,000 Unamortized premium on bonds payable 135,000 The bonds were issued on December 31, 2016, at 103, with interest payable on July 1 and December 31 of each year. Hess uses straight-line amortization. On March 1, 2018, Hess retired $2,000,000 of these bonds at 98 plus accrued interest. What should Hess record as a gain on retirement of these bonds? Ignore taxes. a. $94,000. b. $54,000. c. $93,000. d. $100,000. Ans: C, LO: 2, Bloom: AP, Difficulty: Difficult, Min: 4, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 90. On January 1, 2012, Hernandez Corporation issued $18,000,000 of 10% ten-year bonds at 103. The bonds are callable at the option of Hernandez at 105. Hernandez has recorded amortization of the bond premium on the straight-line method (which was not materially different from the effective-interest method). On December 31, 2018, when the fair value of the bonds was 96, Hernandez repurchased $4,000,000 of the bonds in the open market at 96. Hernandez has recorded interest and amortization for 2018. Ignoring income taxes and assuming that the gain is material, Hernandez should report this reacquisition as a. a loss of $196,000. b. a gain of $196,000. c. a loss of $244,000. d. a gain of $244,000. Ans: B, LO: 2, Bloom: AP, Difficulty: Difficult, Min: 4, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 91. The 10% bonds payable of Nixon Company had a net carrying amount of $2,850,000 on December 31, 2017. The bonds, which had a face value of $3,000,000, were issued at a discount to yield 12%. The amortization of the bond discount was recorded under the effective-interest method. Interest was paid on January 1 and July 1 of each year. On July 2, 2018, several years before their maturity, Nixon retired the bonds at 102. The interest payment on July 1, 2018 was made as scheduled. What is the loss that Nixon should record on the early retirement of the bonds on July 2, 2018? Ignore taxes. a. $60,000. b. $189,000. c. $168,000. d. $210,000. Ans: B, LO: 2, Bloom: AP, Difficulty: Difficult, Min: 4, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started