Answered step by step

Verified Expert Solution

Question

1 Approved Answer

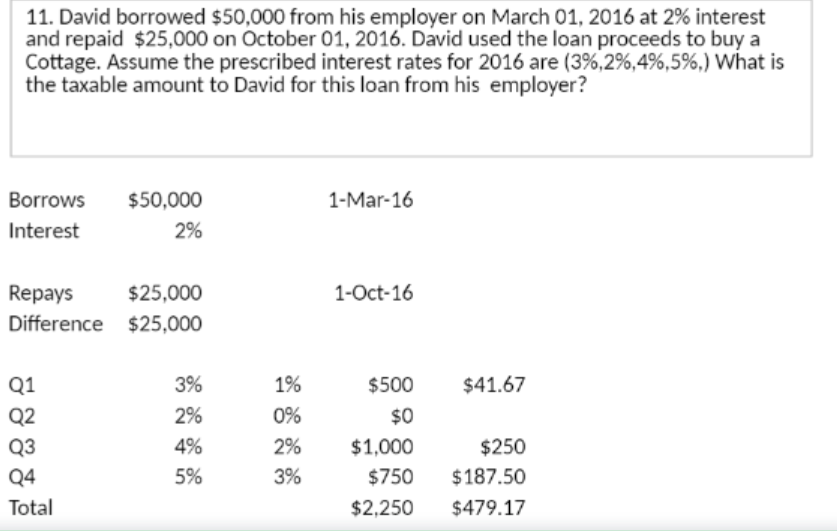

Hi, I was just hoping for some help on a question. I dont understand how they got the second set of numbers. The 500, 0,

Hi, I was just hoping for some help on a question. I dont understand how they got the second set of numbers. The 500, 0, 1000, and 750 makes sense but I'm confused about the 41.67, 250, 185.50

11. David borrowed $50,000 from his employer on March 01, 2016 at 2% interest and repaid $25,000 on October 01, 2016. David used the loan proceeds to buy a Cottage. Assume the prescribed interest rates for 2016 are ( 3%, 2% ,4%,5%, ) What is the taxable amount to David for this loan from his employer? Borrows $50,000 Interest 2% Repays $25,000 Difference $25,000 Q1 Q2 Q3 Q4 Total 3% 2% 4% 5% 1% 0% 2% 3% 1-Mar-16 1-Oct-16 $500 $0 $1,000 $750 $2,250 $41.67 $250 $187.50 $479.17

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Interest as per Market Rate Q1 50000 1 500 Q2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started