Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi just after the multiple choice answer to these homework questions so i can cross check. TIA Question 13). Below is a list of various

Hi just after the multiple choice answer to these homework questions so i can cross check. TIA

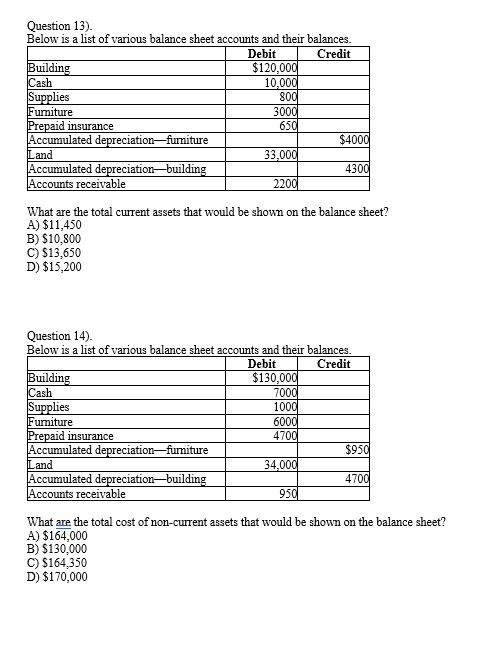

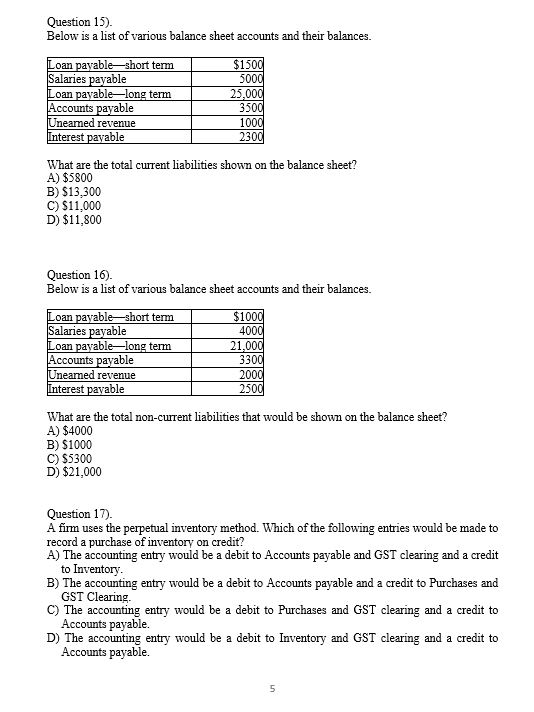

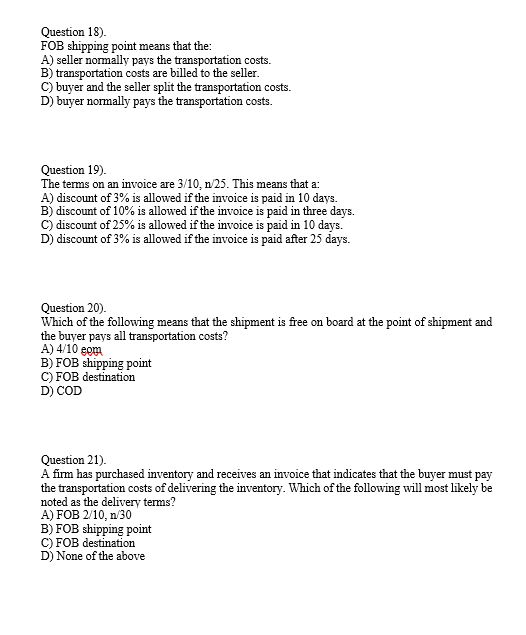

Question 13). Below is a list of various balance sheet accounts and their balances. Debit Credit Building $120,000 Cash 10,000 Supplies 800 Furniture 3000 Prepaid insurance 650 Accumulated depreciation-furniture $4000 Land 33,000 Accumulated depreciation-building 4300 Accounts receivable 2200 What are the total current assets that would be shown on the balance sheet? A) $11,450 B) $10,800 C) $13,650 D) $15,200 Question 14). Below is a list of various balance sheet accounts and their balances. Debit Credit Building $130,000 Cash 7000 Supplies 1000 Furniture 6000 Prepaid insurance 4700 Accumulated depreciationfurniture $950 Land 34.000 Accumulated depreciation-building 4700 Accounts receivable 950 What are the total cost of non-current assets that would be shown on the balance sheet? A) $164,000 B) S130,000 C) $164,350 D) $170,000 Question 15). Below is a list of various balance sheet accounts and their balances. Loan payableshort term $1500 Salaries payable 5000 Loan payable-long term 25,000 Accounts payable 3500 Uneamed revenue 1000 Interest payable 23001 What are the total current liabilities shown on the balance sheet? A) $5800 B) $13,300 C) $11,000 D) $11,800 Question 16). Below is a list of various balance sheet accounts and their balances. Loan payableshort term $1000 Salaries payable 4000 Loan payable-long term 21,000 Accounts payable 3300 Unearned revenue 2000 Interest payable 2500 What are the total non-current liabilities that would be shown on the balance sheet? A) $4000 B) $1000 C) $5300 D) $21,000 Question 17). A firm uses the perpetual inventory method. Which of the following entries would be made to record a purchase of inventory on credit? A) The accounting entry would be a debit to Accounts payable and GST clearing and a credit to Inventory. B) The accounting entry would be a debit to Accounts payable and a credit to Purchases and GST Clearing. C) The accounting entry would be a debit to Purchases and GST clearing and a credit to Accounts payable. D) The accounting entry would be a debit to Inventory and GST clearing and a credit to Accounts payable. 5 Question 18). FOB shipping point means that the: A) seller normally pays the transportation costs. B) transportation costs are billed to the seller. C) buyer and the seller split the transportation costs. D) buyer normally pays the transportation costs. Question 19). The terms on an invoice are 3/10, n 25. This means that a: A) discount of 3% is allowed if the invoice is paid in 10 days. B) discount of 10% is allowed if the invoice is paid in three days. C) discount of 25% is allowed if the invoice is paid in 10 days. D) discount of 3% is allowed if the invoice is paid after 25 days. Question 20). Which of the following means that the shipment is free on board at the point of shipment and the buyer pays all transportation costs? A) 4/10 eom B) FOB shipping point C) FOB destination D) COD Question 21). A firm has purchased inventory and receives an invoice that indicates that the buyer must pay the transportation costs of delivering the inventory. Which of the following will most likely be noted as the delivery terms? A) FOB 2/10, n/30 B) FOB shipping point C) FOB destination D) None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started