Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part B Complete the following tasks using the templates provided in BSBFIA401 AT2_TMP_V1 and the information and data provided in Appendix A for Golden

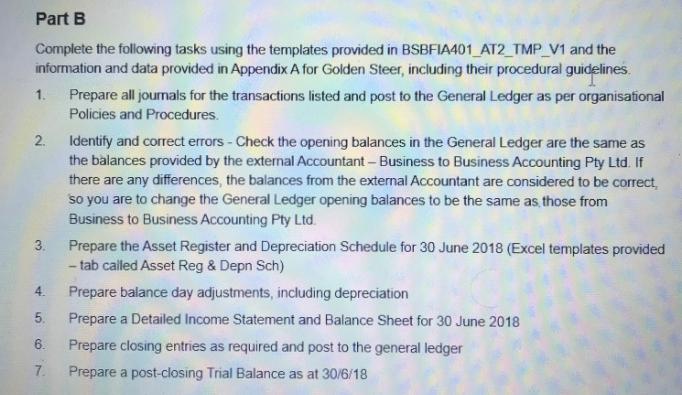

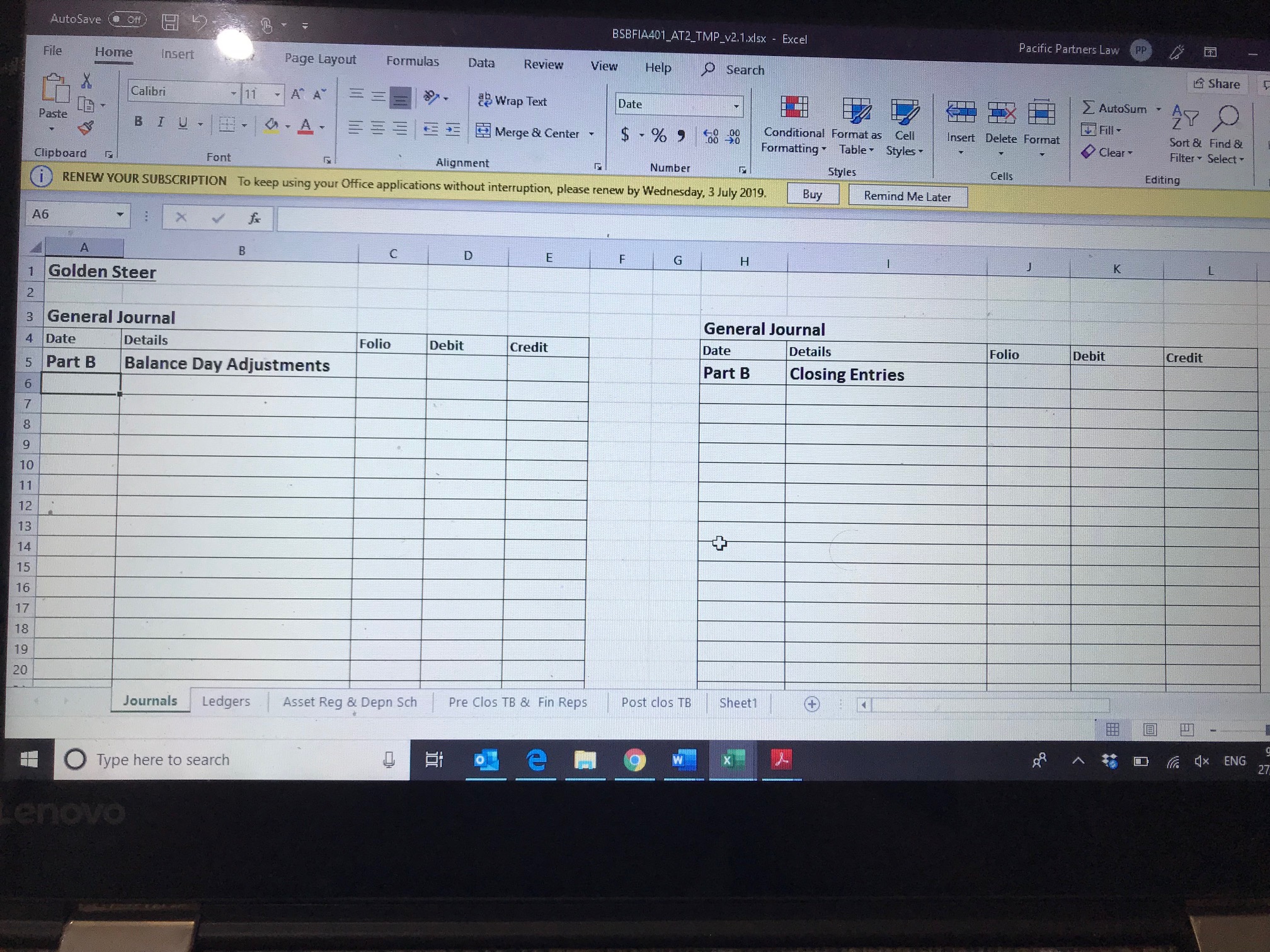

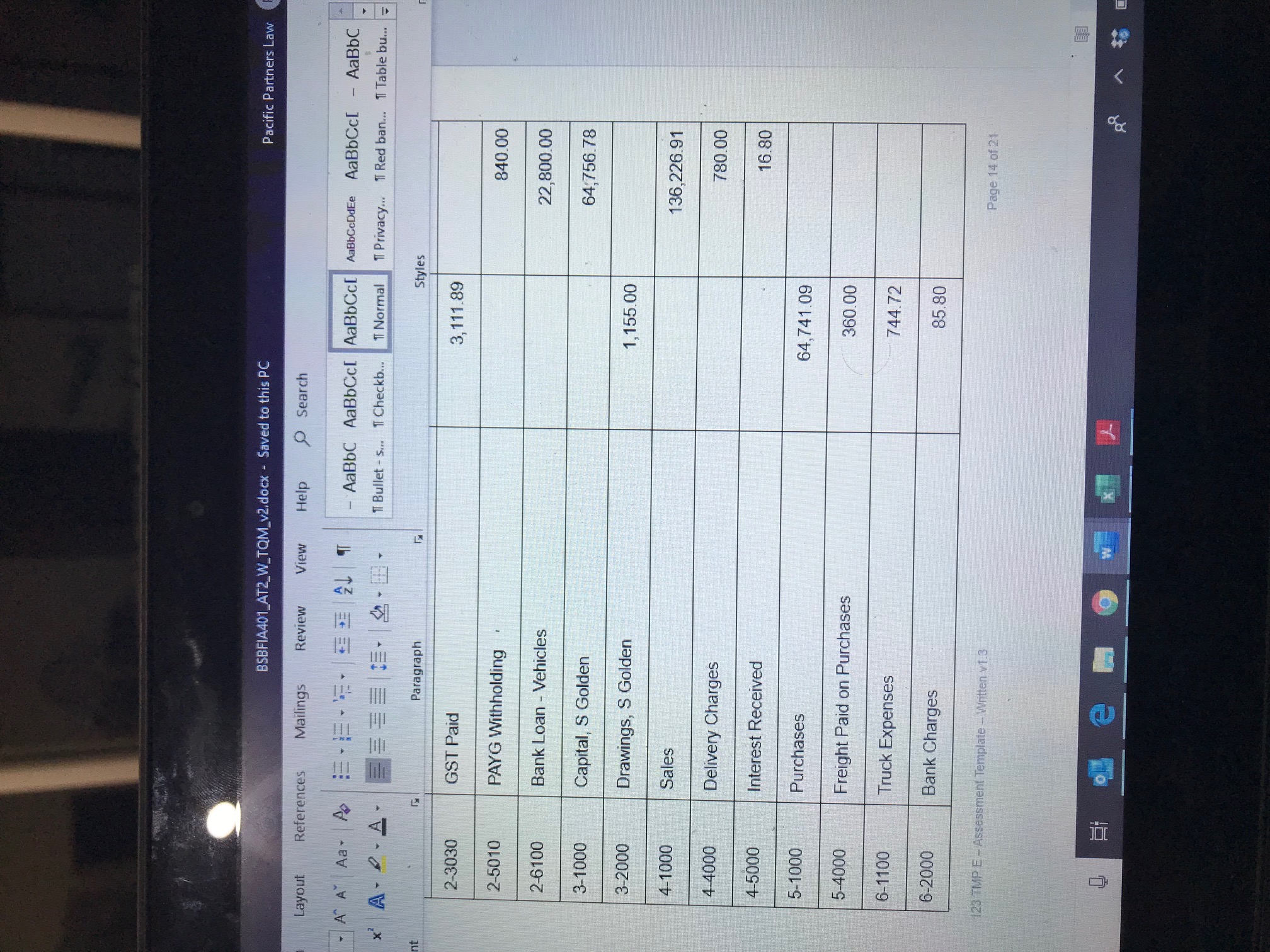

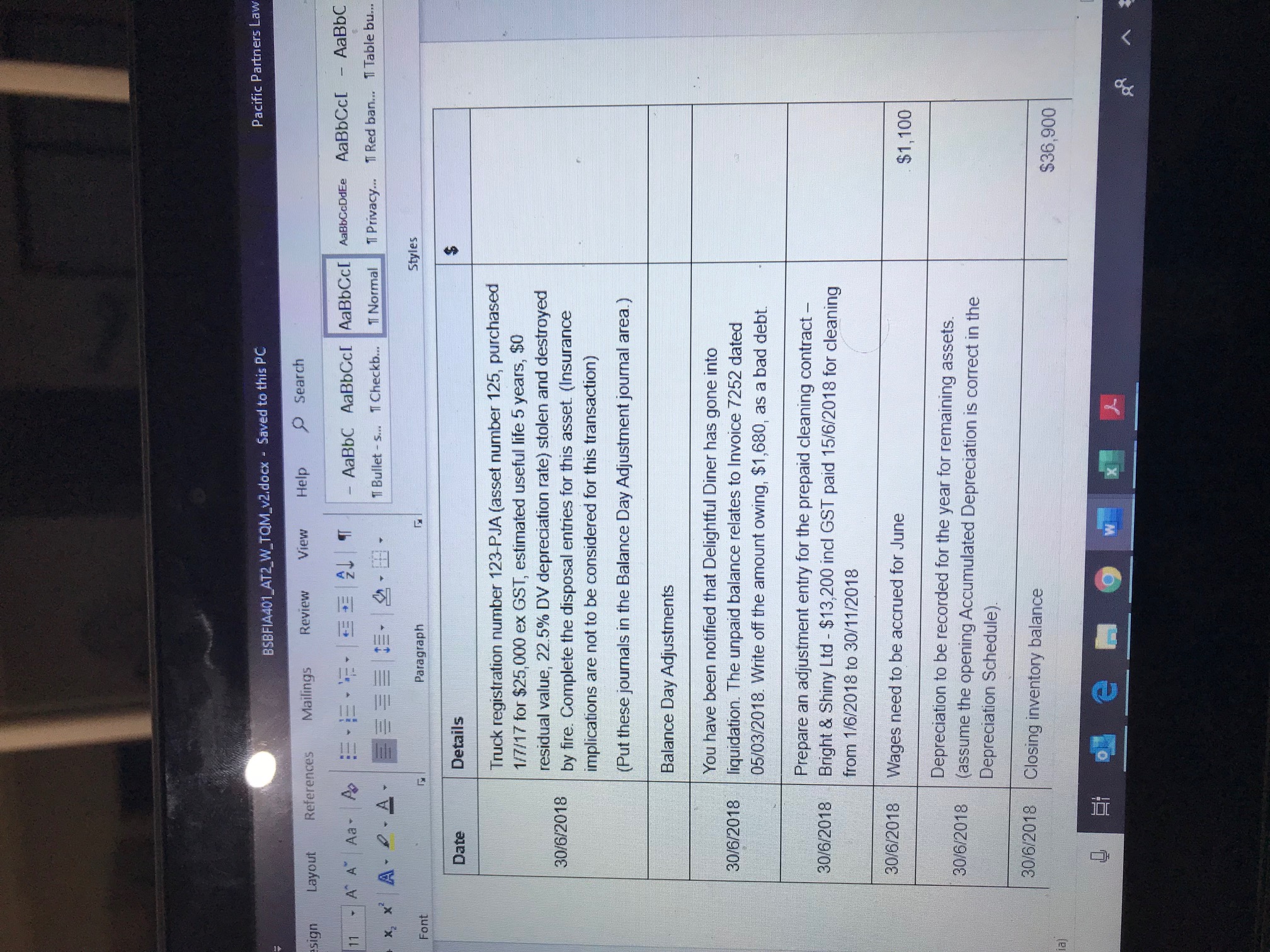

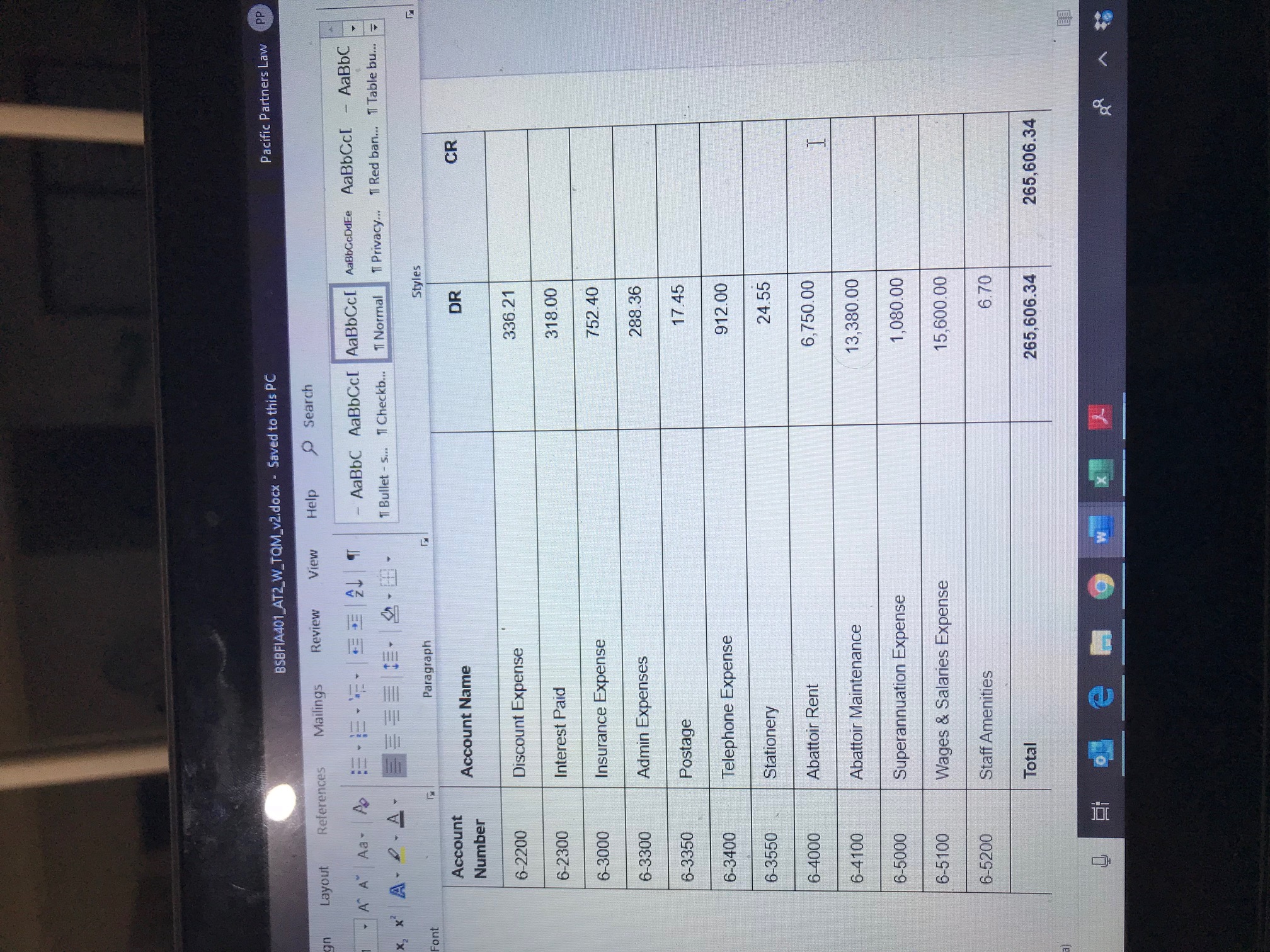

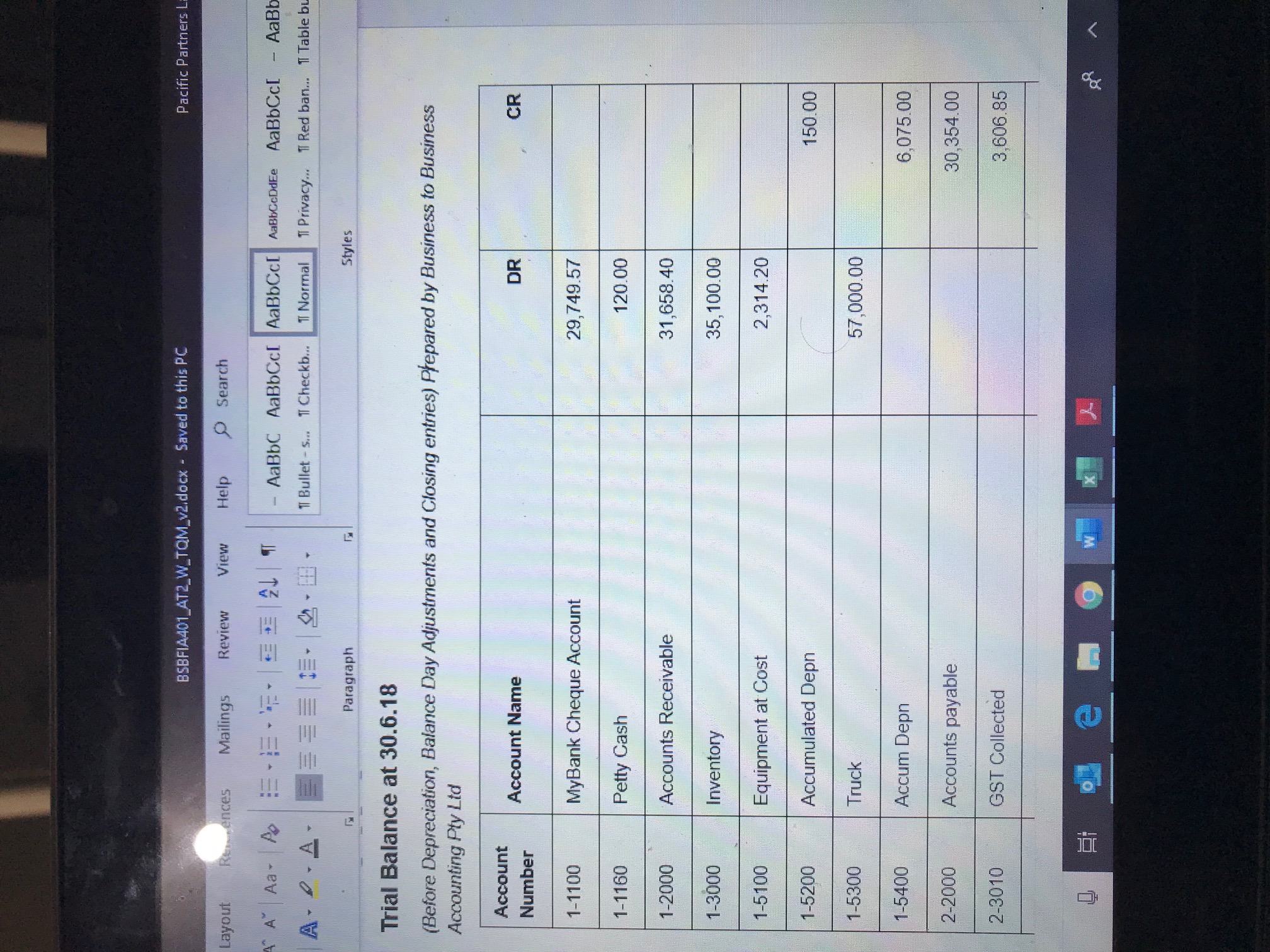

Part B Complete the following tasks using the templates provided in BSBFIA401 AT2_TMP_V1 and the information and data provided in Appendix A for Golden Steer, including their procedural guidelines. 1. 2. 3. Prepare all journals for the transactions listed and post to the General Ledger as per organisational Policies and Procedures. Identify and correct errors - Check the opening balances in the General Ledger are the same as the balances provided by the external Accountant - Business to Business Accounting Pty Ltd. If there are any differences, the balances from the external Accountant are considered to be correct, so you are to change the General Ledger opening balances to be the same as those from Business to Business Accounting Pty Ltd. Prepare the Asset Register and Depreciation Schedule for 30 June 2018 (Excel templates provided -tab called Asset Reg & Depn Sch) 4. Prepare balance day adjustments, including depreciation 5. 6. Prepare a Detailed Income Statement and Balance Sheet for 30 June 2018 Prepare closing entries as required and post to the general ledger 7. Prepare a post-closing Trial Balance as at 30/6/18 AutoSave Off BSBFIA401 AT2 TMP_v2.1.xlsx - Excel Pacific Partners Law PP File Home Insert Page Layout Formulas Data Review View Help Search Share Calibri 11 Paste BIU A A A- Wrap Text Date Font Alignment Clipboard F Conditional Format as Formatting Table Styles RENEW YOUR SUBSCRIPTION To keep using your Office applications without interruption, please renew by Wednesday, 3 July 2019. Styles Cells Buy Remind Me Later Merge & Center $ - % 9 0.00 .000 Number AutoSum 4 Cell Insert Delete Format Fill- Clear Sort & Find & Filter Select Editing A6 fx A B 1 Golden Steer 2 3 General Journal D E F G H J K General Journal Date Details Folio Debit Credit Part B Closing Entries 4 Date Details Folio Debit Credit 5 Part B Balance Day Adjustments 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Journals Ledgers Asset Reg & Depn Sch | Pre Clos TB & Fin Reps Post clos TB Sheet1 Type here to search Lenovo 9 4 ENG 27 BSBFIA401 AT2_W_TQM_v2.docx - Saved to this PC Pacific Partners Law Layout References Mailings Review View Help Search A A Aa AEE T x AA AaBbC 1 Bullet-s... T Checkb... 1 Normal 11 Privacy... 1 Red ban... T Table bu... AaBbC AaBbCcl AaBbCc[ AaBbCcDdEe AaBbCc[ nt Paragraph 2-3030 GST Paid Styles 3,111.89 2-5010 PAYG Withholding ' 840.00 2-6100 Bank Loan - Vehicles 22,800.00 3-1000 Capital, S Golden 64,756.78 3-2000 Drawings, S Golden 1,155.00 4-1000 Sales 136,226.91 4-4000 Delivery Charges 780.00 4-5000 Interest Received 16.80 5-1000 Purchases 64,741.09 5-4000 Freight Paid on Purchases 360.00 6-1100 Truck Expenses 744.72 6-2000 Bank Charges 85.80 123 TMP E-Assessment Template - Written v1.3 Page 14 of 21 esign Layout BSBFIA401_AT2_W_TQM_v2.docx - Saved to this PC AaBbCcDdEe References Mailings Review View Help Search " EET E- AaBbC AaBbCc[ AaBbCcE 1 Bullet-s... T Checkb... T Normal 4 + E Styles 11 A A Aa- x x AA Font Paragraph Date Details 30/6/2018 30/6/2018 Truck registration number 123-PJA (asset number 125, purchased 1/7/17 for $25,000 ex GST, estimated useful life 5 years, $0 residual value, 22.5% DV depreciation rate) stolen and destroyed by fire. Complete the disposal entries for this asset. (Insurance implications are not to be considered for this transaction) (Put these journals in the Balance Day Adjustment journal area.) Balance Day Adjustments You have been notified that Delightful Diner has gone into liquidation. The unpaid balance relates to Invoice 7252 dated 05/03/2018. Write off the amount owing, $1,680, as a bad debt. 30/6/2018 Prepare an adjustment entry for the prepaid cleaning contract - Bright & Shiny Ltd - $13,200 incl GST paid 15/6/2018 for cleaning from 1/6/2018 to 30/11/2018 30/6/2018 Wages need to be accrued for June 30/6/2018 Depreciation to be recorded for the year for remaining assets. (assume the opening Accumulated Depreciation is correct in the Depreciation Schedule). 30/6/2018 Closing inventory balance la) W Pacific Partners Law AaBbCc[ AaBbC 1 Privacy... T Red ban... 1 Table bu... $1,100 $36,900 a] gn Layout BSBFIA401 AT2_W_TQM_v2.docx - Saved to this PC References Mailings Review View Help += 2 T A A Aa Po Search Pacific Partners Law PP AaBbC AaBbCc[ AaBbCcE TT Bullet - s... T Checkb... 1 Normal AaBbCcDdEe AaBbCc[ AaBbC 11 Privacy... 1 Red ban... T Table bu... x, x A + A Font Account Paragraph Account Name Styles DR CR Number 6-2200 Discount Expense 336.21 6-2300 Interest Paid 318.00 6-3000 Insurance Expense 752.40 6-3300 Admin Expenses 288.36 6-3350 Postage 17.45 6-3400 Telephone Expense 912.00 6-3550 Stationery 24.55 6-4000 Abattoir Rent 6,750.00 I 6-4100 Abattoir Maintenance 13,380.00 6-5000 Superannuation Expense 1,080.00 6-5100 Wages & Salaries Expense 15,600.00 6-5200 Staff Amenities 6.70 Total 265,606.34 265,606.34 BSBFIA401_AT2_W_TQM_v2.docx - Saved to this PC Pacific Partners La Layout Reences Mailings Review View Help Search AA Aa AEE - 4 2 T AaBbC AaBbCcl AaBbCc[ AaBbCcDdEe AaBbCc - AaBb A-A 4 v 1 Bullet s... T Checkb... T Normal 11 Privacy... T Red ban... T Table bu Paragraph Styles Trial Balance at 30.6.18 (Before Depreciation, Balance Day Adjustments and Closing entries) Prepared by Business to Business Accounting Pty Ltd Account Account Name DR CR Number 1-1100 MyBank Cheque Account 29,749.57 1-1160 Petty Cash 120.00 1-2000 Accounts Receivable 31,658.40 1-3000 Inventory 35,100.00 1-5100 Equipment at Cost 2,314.20 1-5200 Accumulated Depn 150.00 1-5300 Truck 57,000.00 1-5400 Accum Depn 6,075.00 2-2000 Accounts payable 30,354.00 2-3010 GST Collected 3,606.85

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres a complete stepbystep solution for Part B of your task following the headings and a realtime example approach StepbyStep Solution for Part B Step 1 Prepare All Journals for Transactions Prepare ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started