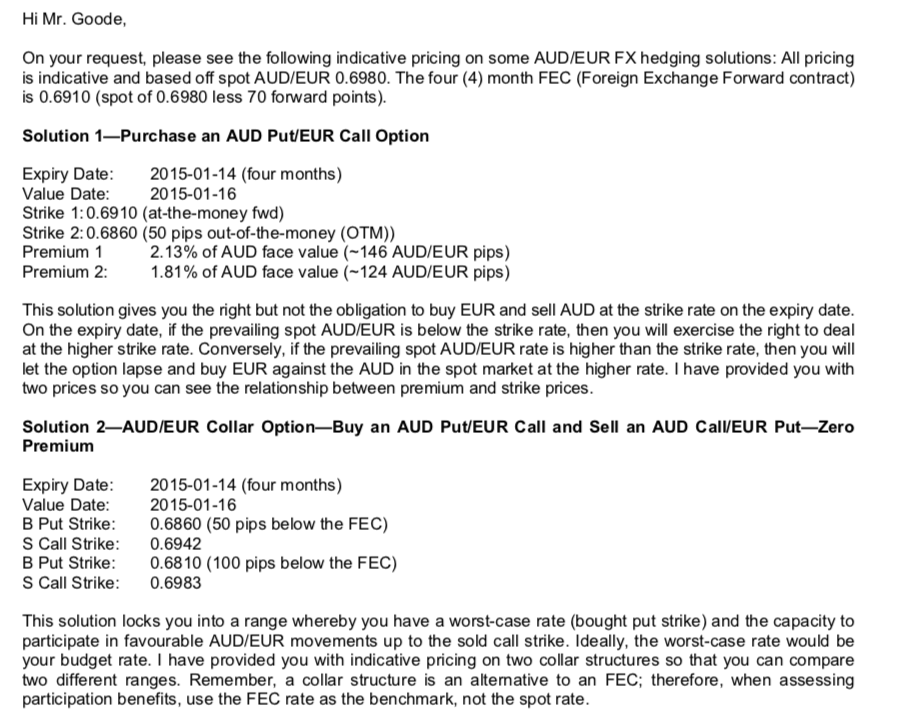

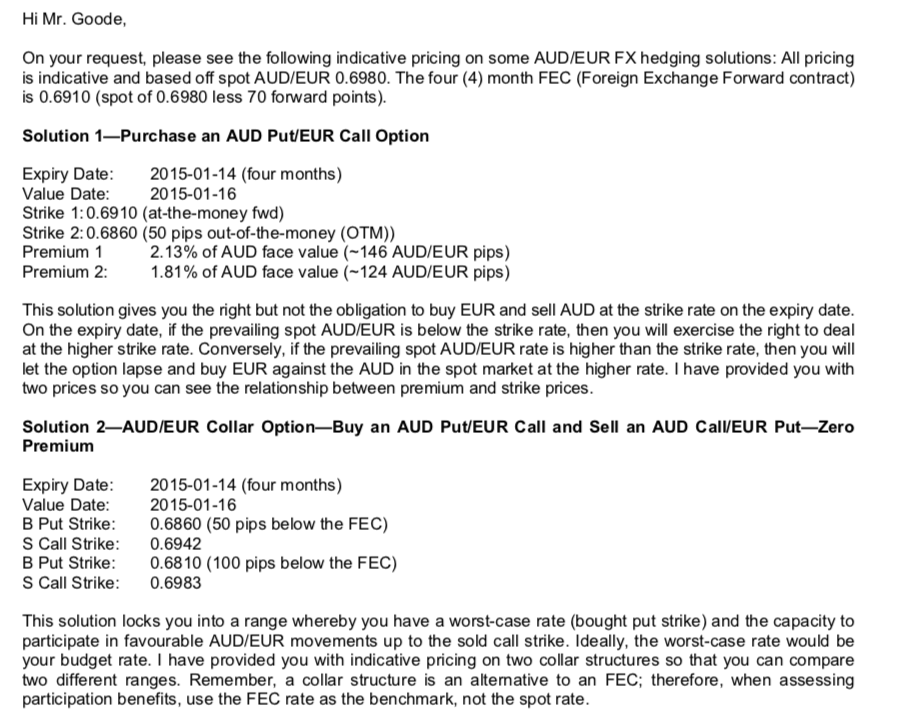

Hi Mr. Goode, On your request, please see the following indicative pricing on some AUD/EUR FX hedging solutions: All pricing is indicative and based off spot AUD/EUR 0.6980. The four (4) month FEC (Foreign Exchange Forward contract) is 0.6910 (spot of 0.6980 less 70 forward points). Solution 1Purchase an AUD Put/EUR Call Option Expiry Date: 2015-01-14 (four months) Value Date: 2015-01-16 Strike 1:0.6910 (at-the-money fwd) Strike 2:0.6860 (50 pips out-of-the-money (OTM)) Premium 1 2.13% of AUD face value (-146 AUD/EUR pips) Premium 2: 1.81% of AUD face value (~124 AUD/EUR pips) This solution gives you the right but not the obligation to buy EUR and sell AUD at the strike rate on the expiry date. On the expiry date, if the prevailing spot AUD/EUR is below the strike rate, then you will exercise the right to deal at the higher strike rate. Conversely, if the prevailing spot AUD/EUR rate is higher than the strike rate, then you will let the option lapse and buy EUR against the AUD in the spot market at the higher rate. I have provided you with two prices so you can see the relationship between premium and strike prices. Solution 2AUD/EUR Collar OptionBuy an AUD Put/EUR Call and Sell an AUD CallEUR PutZero Premium Expiry Date: 2015-01-14 (four months) Value Date: 2015-01-16 B Put Strike: 0.6860 (50 pips below the FEC) S Call Strike: 0.6942 B Put Strike: 0.68 10 (100 pips below the FEC) S Call Strike: 0.6983 This solution locks you into a range whereby you have a worst-case rate (bought put strike) and the capacity to participate in favourable AUD/EUR movements up to the sold call strike. Ideally, the worst-case rate would be your budget rate. I have provided you with indicative pricing on two collar structures so that you can compare two different ranges. Remember, a collar structure is an alternative to an FEC; therefore, when assessing participation benefits, use the FEC rate as the benchmark, not the spot rate. 1. Explain why hedging is important for F. Mayer Imports. Given that the current spot rate is EUR/AUD 0.6980, evaluate whether buying spot now is a viable hedging strategy. 2. Refer to Exhibit 3. Explain how the foreign exchange forward contract (FEC) works. 3. Refer to Exhibit 3. Demonstrate how solutions 1 and 2 may help F. Mayer Imports hedge their foreign currency risk. Include payoff diagrams in your explanation. 4. Based on your analysis of hedging strategies covered in questions 1, 2, and 3, recommend one solution to the company. Why do you think your recommendation is the best? Hi Mr. Goode, On your request, please see the following indicative pricing on some AUD/EUR FX hedging solutions: All pricing is indicative and based off spot AUD/EUR 0.6980. The four (4) month FEC (Foreign Exchange Forward contract) is 0.6910 (spot of 0.6980 less 70 forward points). Solution 1Purchase an AUD Put/EUR Call Option Expiry Date: 2015-01-14 (four months) Value Date: 2015-01-16 Strike 1:0.6910 (at-the-money fwd) Strike 2:0.6860 (50 pips out-of-the-money (OTM)) Premium 1 2.13% of AUD face value (-146 AUD/EUR pips) Premium 2: 1.81% of AUD face value (~124 AUD/EUR pips) This solution gives you the right but not the obligation to buy EUR and sell AUD at the strike rate on the expiry date. On the expiry date, if the prevailing spot AUD/EUR is below the strike rate, then you will exercise the right to deal at the higher strike rate. Conversely, if the prevailing spot AUD/EUR rate is higher than the strike rate, then you will let the option lapse and buy EUR against the AUD in the spot market at the higher rate. I have provided you with two prices so you can see the relationship between premium and strike prices. Solution 2AUD/EUR Collar OptionBuy an AUD Put/EUR Call and Sell an AUD CallEUR PutZero Premium Expiry Date: 2015-01-14 (four months) Value Date: 2015-01-16 B Put Strike: 0.6860 (50 pips below the FEC) S Call Strike: 0.6942 B Put Strike: 0.68 10 (100 pips below the FEC) S Call Strike: 0.6983 This solution locks you into a range whereby you have a worst-case rate (bought put strike) and the capacity to participate in favourable AUD/EUR movements up to the sold call strike. Ideally, the worst-case rate would be your budget rate. I have provided you with indicative pricing on two collar structures so that you can compare two different ranges. Remember, a collar structure is an alternative to an FEC; therefore, when assessing participation benefits, use the FEC rate as the benchmark, not the spot rate. 1. Explain why hedging is important for F. Mayer Imports. Given that the current spot rate is EUR/AUD 0.6980, evaluate whether buying spot now is a viable hedging strategy. 2. Refer to Exhibit 3. Explain how the foreign exchange forward contract (FEC) works. 3. Refer to Exhibit 3. Demonstrate how solutions 1 and 2 may help F. Mayer Imports hedge their foreign currency risk. Include payoff diagrams in your explanation. 4. Based on your analysis of hedging strategies covered in questions 1, 2, and 3, recommend one solution to the company. Why do you think your recommendation is the best