Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, my subject is Basic Accounting..Can you please help me in analyzing the transactions below? Thank you so much.. :D Thank you for helping me

Hi, my subject is Basic Accounting..Can you please help me in analyzing the transactions below? Thank you so much.. :D

Thank you for helping me :D

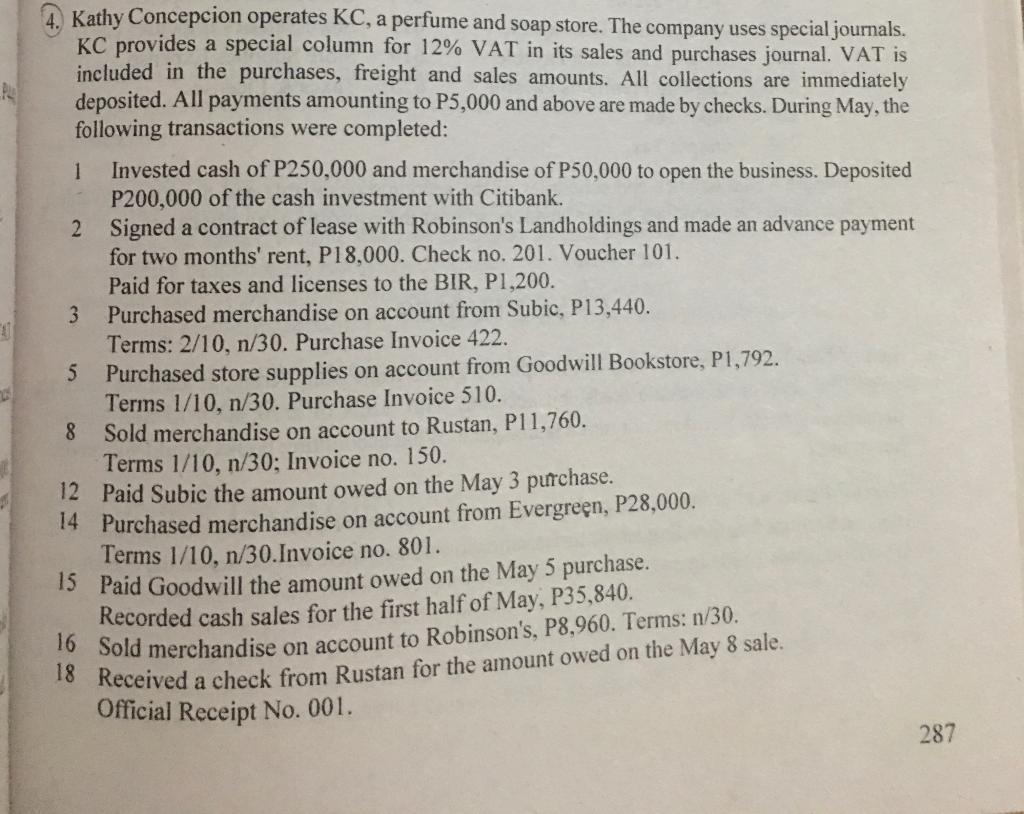

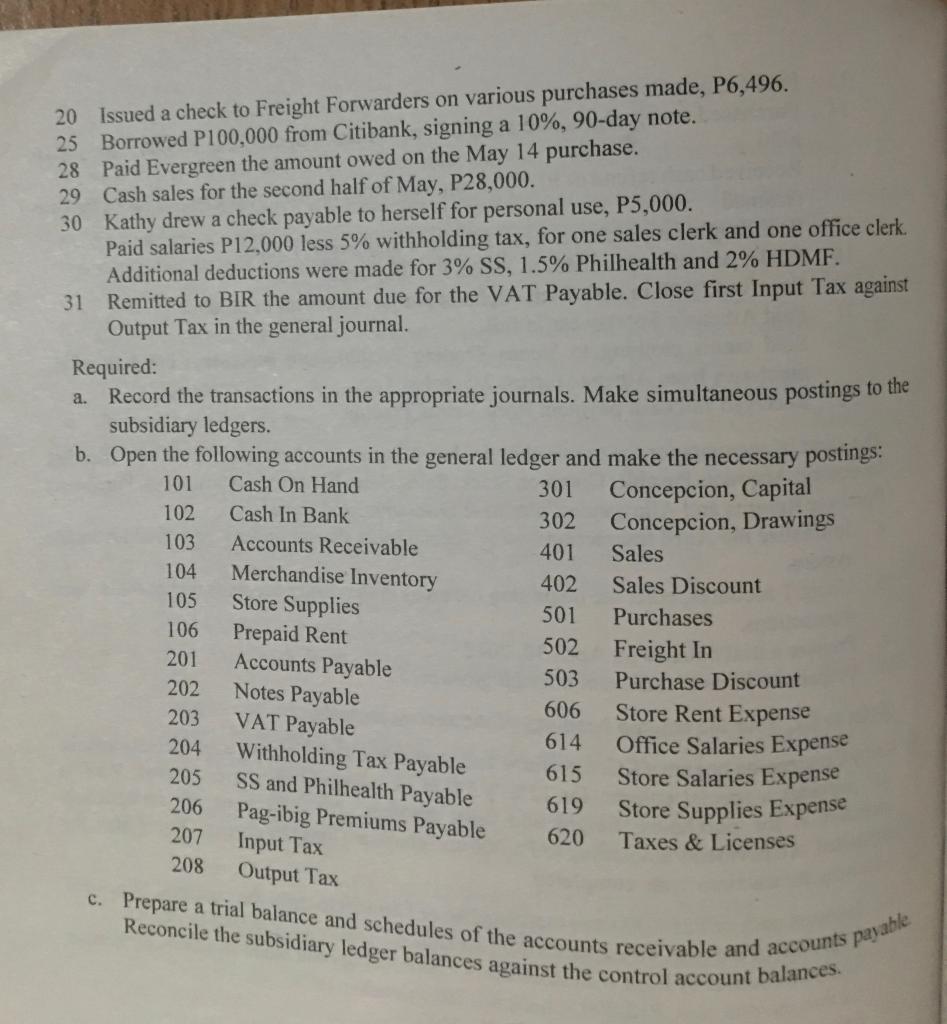

PO 4. Kathy Concepcion operates KC, a perfume and soap store. The company uses special journals. KC provides a special column for 12% VAT in its sales and purchases journal. VAT is included in the purchases, freight and sales amounts. All collections are immediately deposited. All payments amounting to P5,000 and above are made by checks. During May, the following transactions were completed: 1 Invested cash of P250,000 and merchandise of P50,000 to open the business. Deposited P200,000 of the cash investment with Citibank. 2 Signed a contract of lease with Robinson's Landholdings and made an advance payment for two months' rent, P18,000. Check no. 201. Voucher 101. Paid for taxes and licenses to the BIR, P1,200. 3 Purchased merchandise on account from Subic, P13,440. Terms: 2/10, n/30. Purchase Invoice 422. 5 Purchased store supplies on account from Goodwill Bookstore, P1,792. Terms 1/10, n/30. Purchase Invoice 510. 8 Sold merchandise on account to Rustan, P11,760. Terms 1/10, n/30: Invoice no. 150. 12 Paid Subic the amount owed on the May 3 purchase. 14 Purchased merchandise on account from Evergreen, P28,000. Terms 1/10, n/30.Invoice no. 801. 15 Paid Goodwill the amount owed on the May 5 purchase. Recorded cash sales for the first half of May, P35,840. 16 Sold merchandise on account to Robinson's , P8,960. Terms: n/30. 18 Received a check from Rustan for the amount owed on the May 8 sale. Official Receipt No. 001. 287 c. Prepare a trial balance and schedules of the accounts receivable and accounts payable Reconcile the subsidiary ledger balances against the control account balances. 20 Issued a check to Freight Forwarders on various purchases made, P6,496. 25 Borrowed P100,000 from Citibank, signing a 10%, 90-day note. 28 Paid Evergreen the amount owed on the May 14 purchase. 29 Cash sales for the second half of May, P28,000. 30 Kathy drew a check payable to herself for personal use, P5,000. Paid salaries P12,000 less 5% withholding tax, for one sales clerk and one office clerk. Additional deductions were made for 3% SS, 1.5% Philhealth and 2% HDMF. 31 Remitted to BIR the amount due for the VAT Payable. Close first Input Tax against Output Tax in the general journal. Required: a. Record the transactions in the appropriate journals. Make simultaneous postings to the subsidiary ledgers. b. Open the following accounts in the general ledger and make the necessary postings: 101 Cash On Hand 301 Concepcion, Capital 102 Cash In Bank 302 Concepcion, Drawings 103 Accounts Receivable 401 Sales 104 402 Sales Discount 105 501 Purchases 106 Prepaid Rent 502 201 Freight In 202 503 Purchase Discount 203 606 Store Rent Expense 204 614 Office Salaries Expense 205 Store Salaries Expense 206 Store Supplies Expense 620 Taxes & Licenses 208 Merchandise Inventory Store Supplies Accounts Payable Notes Payable VAT Payable Withholding Tax Payable SS and Philhealth Payable Pag-ibig Premiums Payable Input Tax Output Tax 615 619 207 PO 4. Kathy Concepcion operates KC, a perfume and soap store. The company uses special journals. KC provides a special column for 12% VAT in its sales and purchases journal. VAT is included in the purchases, freight and sales amounts. All collections are immediately deposited. All payments amounting to P5,000 and above are made by checks. During May, the following transactions were completed: 1 Invested cash of P250,000 and merchandise of P50,000 to open the business. Deposited P200,000 of the cash investment with Citibank. 2 Signed a contract of lease with Robinson's Landholdings and made an advance payment for two months' rent, P18,000. Check no. 201. Voucher 101. Paid for taxes and licenses to the BIR, P1,200. 3 Purchased merchandise on account from Subic, P13,440. Terms: 2/10, n/30. Purchase Invoice 422. 5 Purchased store supplies on account from Goodwill Bookstore, P1,792. Terms 1/10, n/30. Purchase Invoice 510. 8 Sold merchandise on account to Rustan, P11,760. Terms 1/10, n/30: Invoice no. 150. 12 Paid Subic the amount owed on the May 3 purchase. 14 Purchased merchandise on account from Evergreen, P28,000. Terms 1/10, n/30.Invoice no. 801. 15 Paid Goodwill the amount owed on the May 5 purchase. Recorded cash sales for the first half of May, P35,840. 16 Sold merchandise on account to Robinson's , P8,960. Terms: n/30. 18 Received a check from Rustan for the amount owed on the May 8 sale. Official Receipt No. 001. 287 c. Prepare a trial balance and schedules of the accounts receivable and accounts payable Reconcile the subsidiary ledger balances against the control account balances. 20 Issued a check to Freight Forwarders on various purchases made, P6,496. 25 Borrowed P100,000 from Citibank, signing a 10%, 90-day note. 28 Paid Evergreen the amount owed on the May 14 purchase. 29 Cash sales for the second half of May, P28,000. 30 Kathy drew a check payable to herself for personal use, P5,000. Paid salaries P12,000 less 5% withholding tax, for one sales clerk and one office clerk. Additional deductions were made for 3% SS, 1.5% Philhealth and 2% HDMF. 31 Remitted to BIR the amount due for the VAT Payable. Close first Input Tax against Output Tax in the general journal. Required: a. Record the transactions in the appropriate journals. Make simultaneous postings to the subsidiary ledgers. b. Open the following accounts in the general ledger and make the necessary postings: 101 Cash On Hand 301 Concepcion, Capital 102 Cash In Bank 302 Concepcion, Drawings 103 Accounts Receivable 401 Sales 104 402 Sales Discount 105 501 Purchases 106 Prepaid Rent 502 201 Freight In 202 503 Purchase Discount 203 606 Store Rent Expense 204 614 Office Salaries Expense 205 Store Salaries Expense 206 Store Supplies Expense 620 Taxes & Licenses 208 Merchandise Inventory Store Supplies Accounts Payable Notes Payable VAT Payable Withholding Tax Payable SS and Philhealth Payable Pag-ibig Premiums Payable Input Tax Output Tax 615 619 207Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started