Hi, please answer all questions for a thumbs up. Thanks in advance!

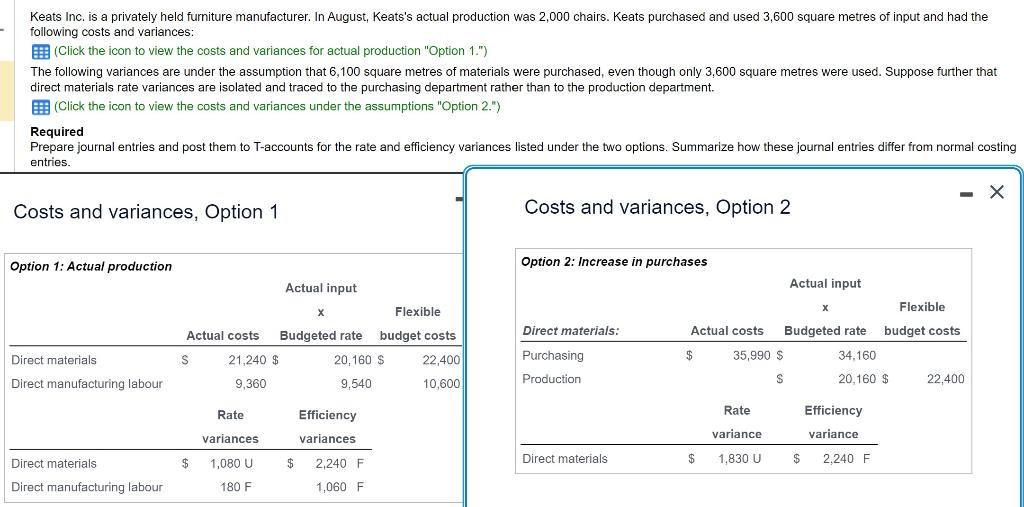

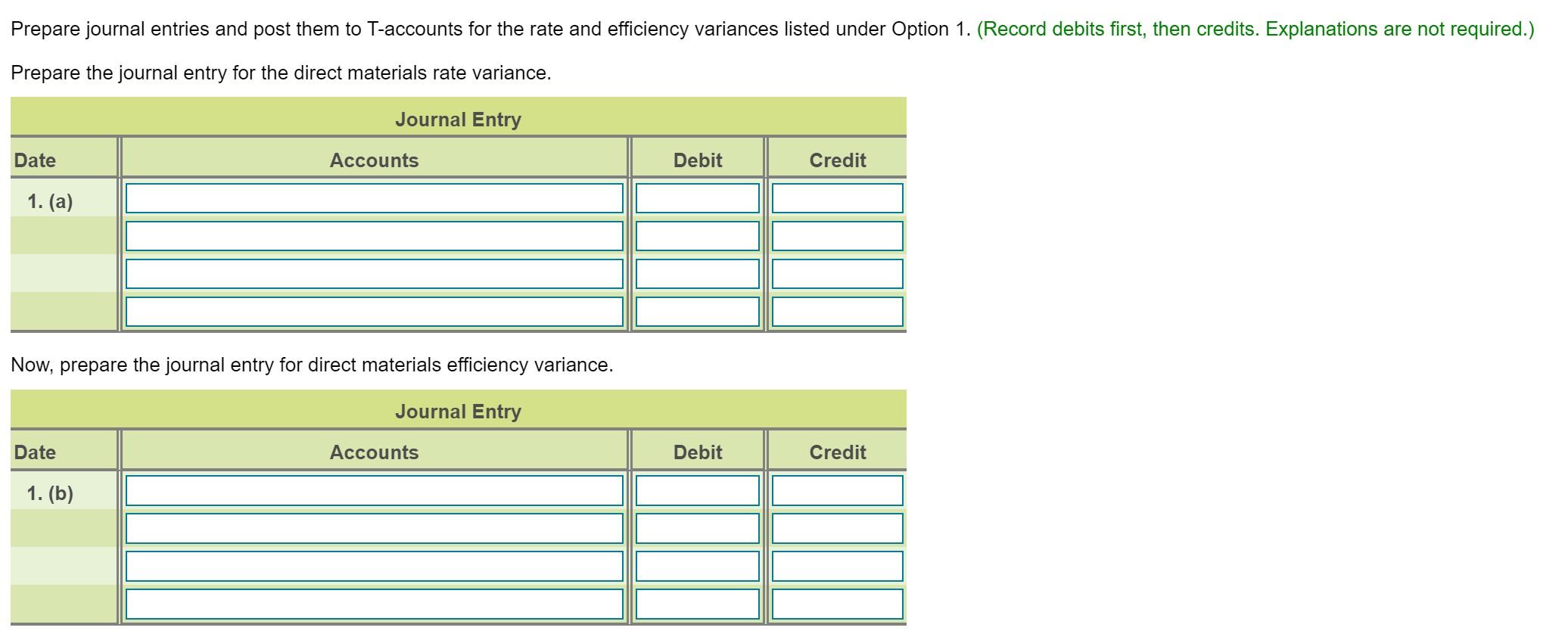

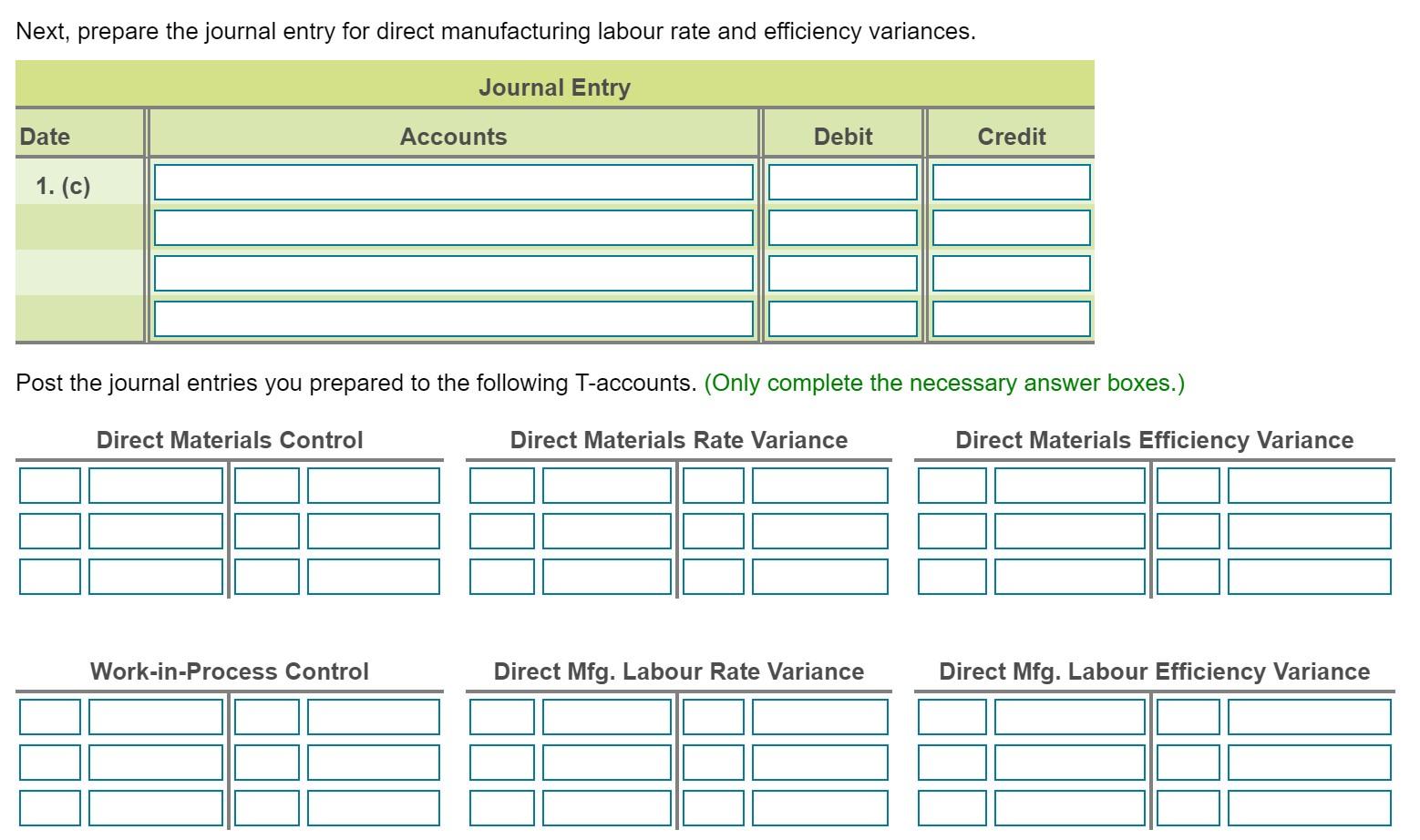

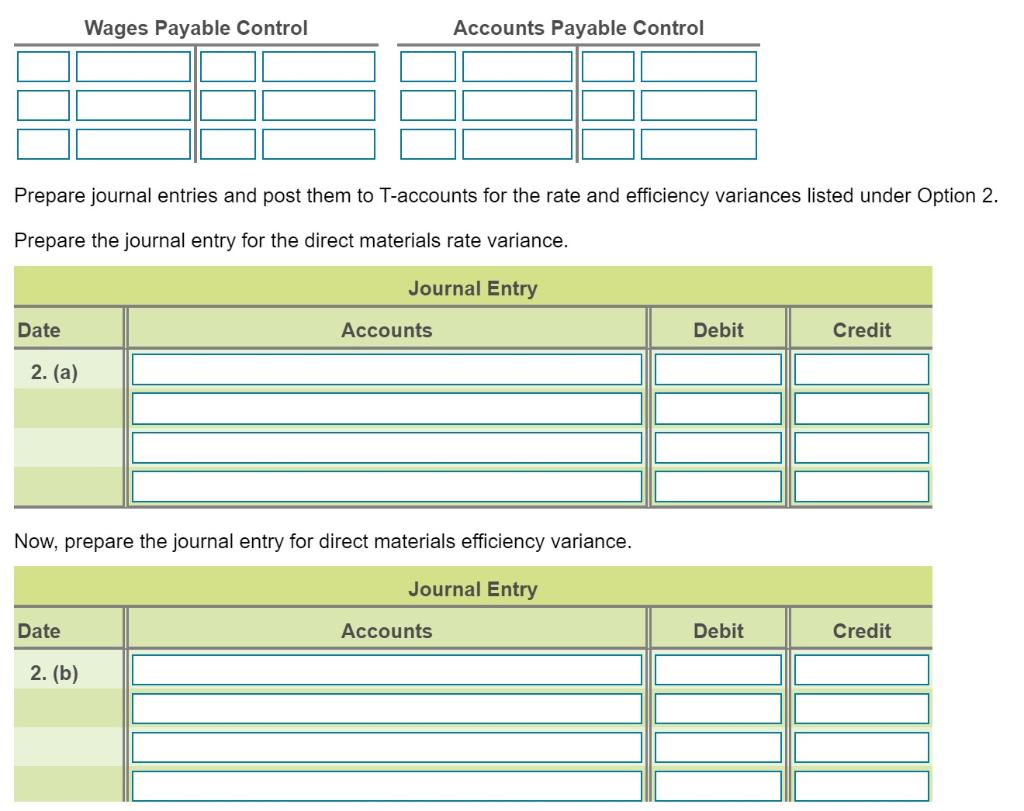

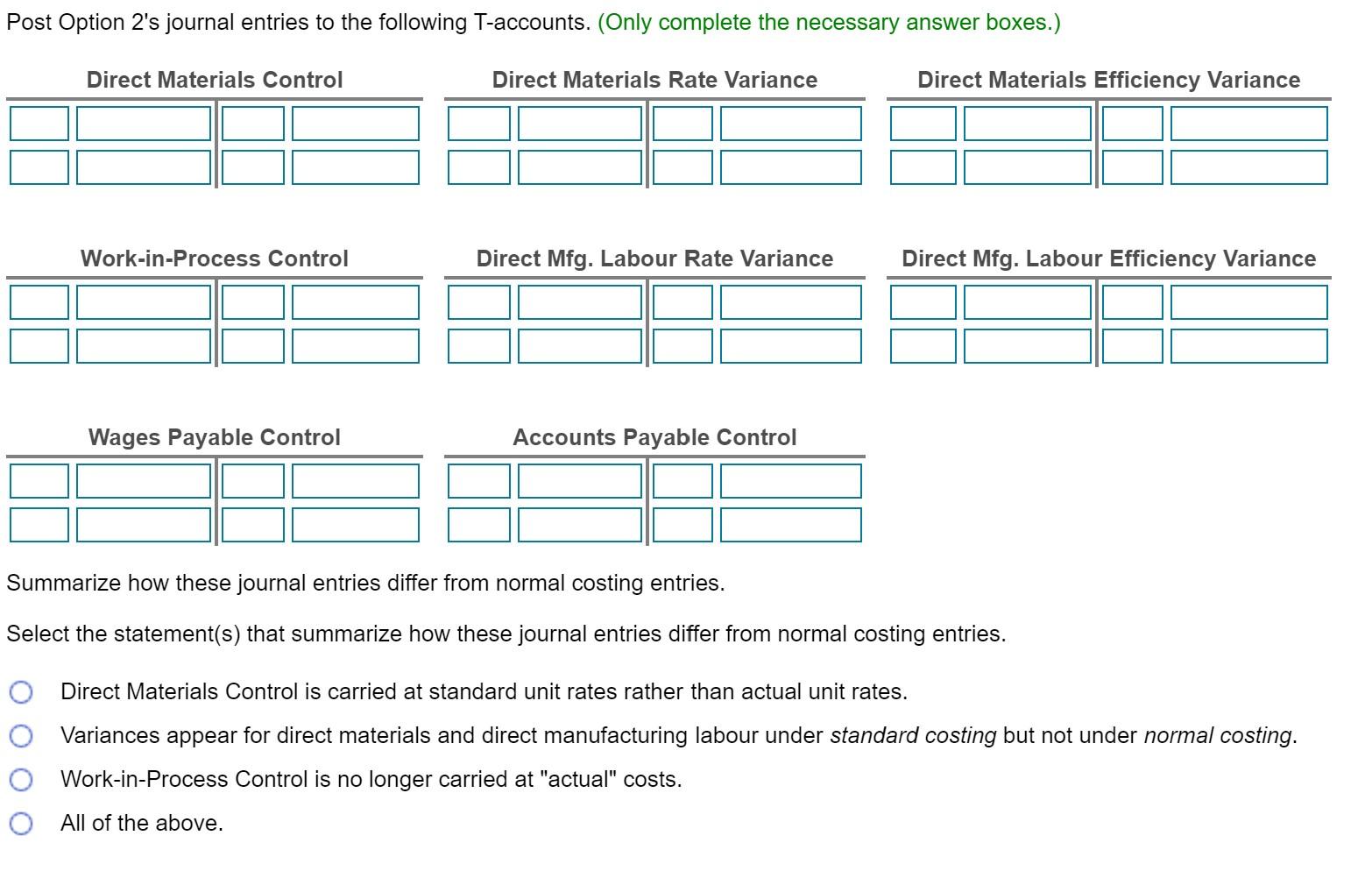

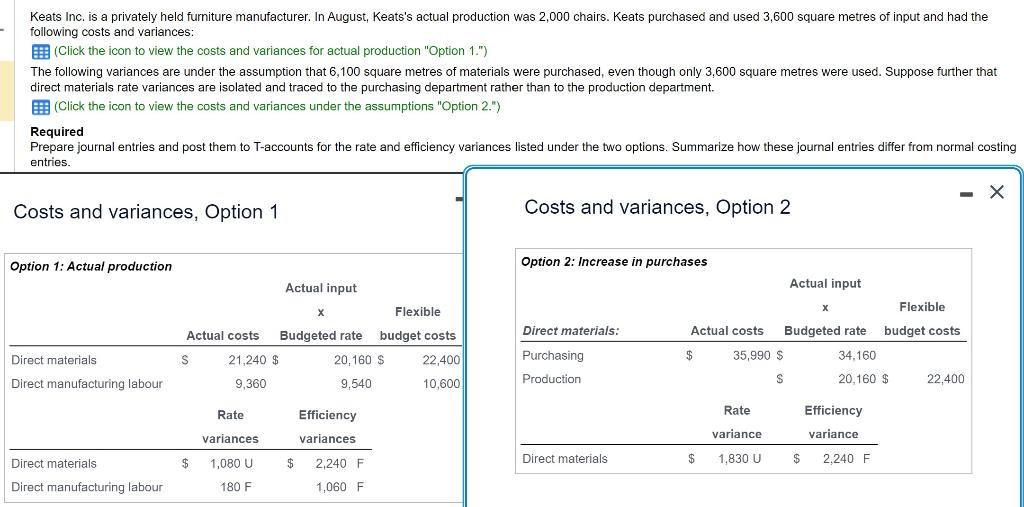

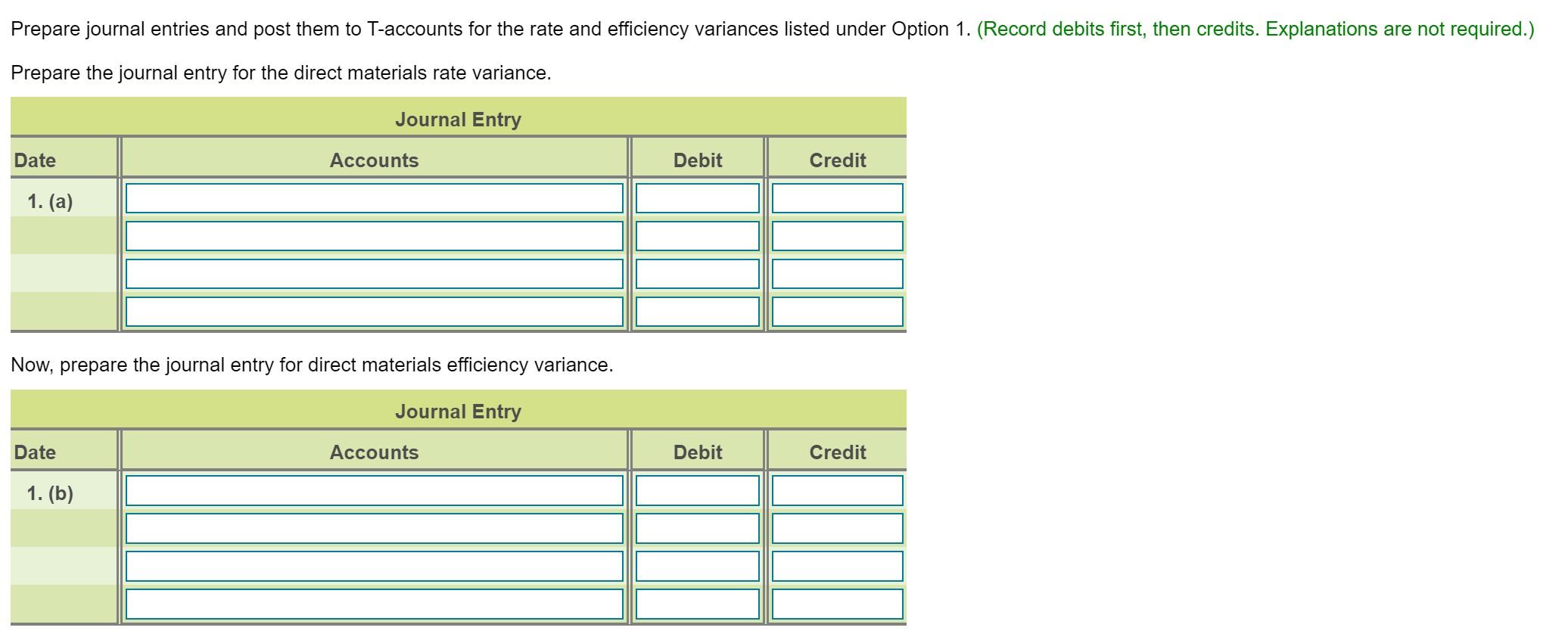

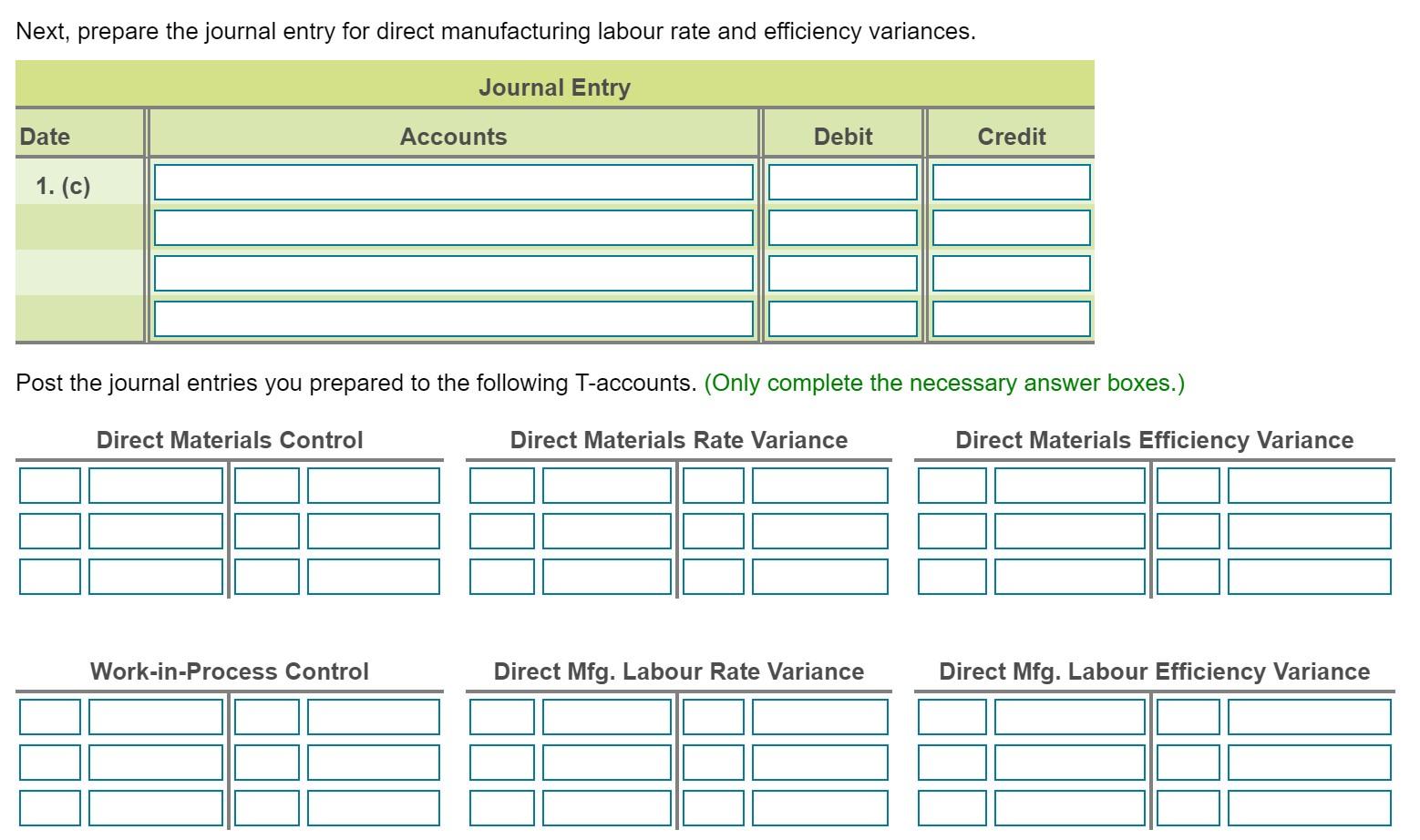

following costs and variances: (Click the icon to view the costs and variances for actual production "Option 1.") direct materials rate variances are isolated and traced to the purchasing department rather than to the production department. (Click the icon to view the costs and variances under the assumptions "Option 2.") Required entries. Costs and variances, Option 2 Prepare journal entries and post them to T-accounts for the rate and efficiency variances listed under Option 1 . (Record debits first, then credits. Explanations are not required.) Prepare the journal entry for the direct materials rate variance. Now, prepare the journal entry for direct materials efficiency variance. Next, prepare the journal entry for direct manufacturing labour rate and efficiency variances. Prepare journal entries and post them to T-accounts for the rate and efficiency variances listed under Option Prepare the journal entry for the direct materials rate variance. Now, prepare the journal entry for direct materials efficiency variance. Summarize how these journal entries differ from normal costing entries. Select the statement(s) that summarize how these journal entries differ from normal costing entries. Direct Materials Control is carried at standard unit rates rather than actual unit rates. Variances appear for direct materials and direct manufacturing labour under standard costing but not under normal costing. Work-in-Process Control is no longer carried at "actual" costs. All of the above. following costs and variances: (Click the icon to view the costs and variances for actual production "Option 1.") direct materials rate variances are isolated and traced to the purchasing department rather than to the production department. (Click the icon to view the costs and variances under the assumptions "Option 2.") Required entries. Costs and variances, Option 2 Prepare journal entries and post them to T-accounts for the rate and efficiency variances listed under Option 1 . (Record debits first, then credits. Explanations are not required.) Prepare the journal entry for the direct materials rate variance. Now, prepare the journal entry for direct materials efficiency variance. Next, prepare the journal entry for direct manufacturing labour rate and efficiency variances. Prepare journal entries and post them to T-accounts for the rate and efficiency variances listed under Option Prepare the journal entry for the direct materials rate variance. Now, prepare the journal entry for direct materials efficiency variance. Summarize how these journal entries differ from normal costing entries. Select the statement(s) that summarize how these journal entries differ from normal costing entries. Direct Materials Control is carried at standard unit rates rather than actual unit rates. Variances appear for direct materials and direct manufacturing labour under standard costing but not under normal costing. Work-in-Process Control is no longer carried at "actual" costs. All of the above