Hi, please answer these questions.

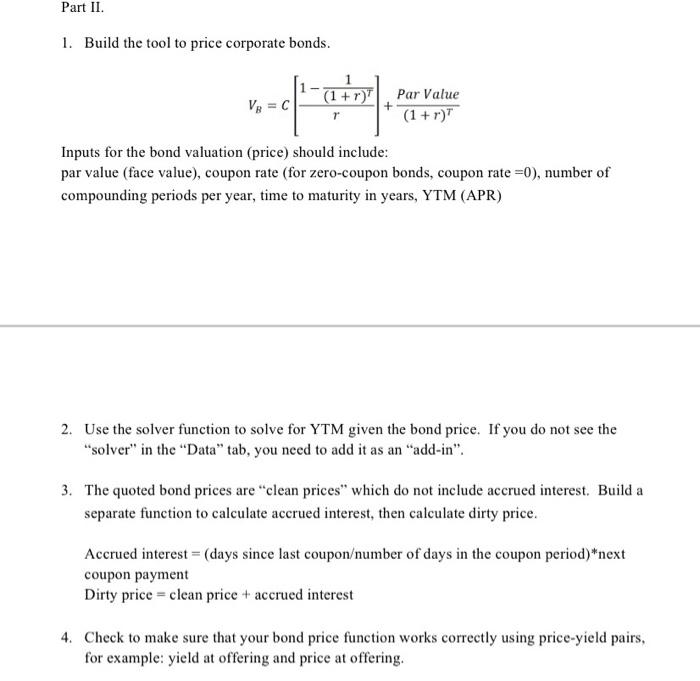

In this assignment, you are to 1) choose a company of interest and research main features of ONE corporate bond of that company; and 2) build a tool using Excel or other programming languages or software to price bonds, and to calculate the yield to maturity YTM for a given bond price. Assignments should be submitted in the format of an Excel file or other formats if you use other programming languages. Please see one example (pricing tool not included) which meets the minimal requirements of this assignment. Part I. You can find information on corporate issued debt securities from a variety of resources. Here are just a few free resources: Prospectuses for registered corporate bond offerings can be found on the SEC's EDGAR website. 1) Use company name or ticker to find the company of your choice. 2) at the bar of "Filter results:", set "Filing Type" to 424B2 then click "search" to find Prospectus. FINRA's market data center Use the "search" tab and Bond Type "Corporate" to find corporate bonds. Use issuer name in the quick search to find all bond issues. If you know the CUSIP of the bond, you can find the specific issue. Present the main features of the bond in a clear way (see it presented in excel in the example file) Part II. 1. Build the tool to price corporate bonds. Vo = C -clean (1 + r). Par Value (1 + r)" Inputs for the bond valuation (price) should include: par value (face value), coupon rate (for zero-coupon bonds, coupon rate=0), number of compounding periods per year, time to maturity in years, YTM (APR) 2. Use the solver function to solve for YTM given the bond price. If you do not see the solver" in the Data" tab, you need to add it as an add-in". 3. The quoted bond prices are clean prices" which do not include accrued interest. Build a separate function to calculate accrued interest, then calculate dirty price. Accrued interest = (days since last couponumber of days in the coupon period)*next coupon payment Dirty price = clean price + accrued interest 4. Check to make sure that your bond price function works correctly using price-yield pairs, for example: yield at offering and price at offering. In this assignment, you are to 1) choose a company of interest and research main features of ONE corporate bond of that company; and 2) build a tool using Excel or other programming languages or software to price bonds, and to calculate the yield to maturity YTM for a given bond price. Assignments should be submitted in the format of an Excel file or other formats if you use other programming languages. Please see one example (pricing tool not included) which meets the minimal requirements of this assignment. Part I. You can find information on corporate issued debt securities from a variety of resources. Here are just a few free resources: Prospectuses for registered corporate bond offerings can be found on the SEC's EDGAR website. 1) Use company name or ticker to find the company of your choice. 2) at the bar of "Filter results:", set "Filing Type" to 424B2 then click "search" to find Prospectus. FINRA's market data center Use the "search" tab and Bond Type "Corporate" to find corporate bonds. Use issuer name in the quick search to find all bond issues. If you know the CUSIP of the bond, you can find the specific issue. Present the main features of the bond in a clear way (see it presented in excel in the example file) Part II. 1. Build the tool to price corporate bonds. Vo = C -clean (1 + r). Par Value (1 + r)" Inputs for the bond valuation (price) should include: par value (face value), coupon rate (for zero-coupon bonds, coupon rate=0), number of compounding periods per year, time to maturity in years, YTM (APR) 2. Use the solver function to solve for YTM given the bond price. If you do not see the solver" in the Data" tab, you need to add it as an add-in". 3. The quoted bond prices are clean prices" which do not include accrued interest. Build a separate function to calculate accrued interest, then calculate dirty price. Accrued interest = (days since last couponumber of days in the coupon period)*next coupon payment Dirty price = clean price + accrued interest 4. Check to make sure that your bond price function works correctly using price-yield pairs, for example: yield at offering and price at offering