Question: Hi, please answer these questions it will be appreciated :) Thanks! Can you also please check my answers :) Consider the case of Badger Corp.

Hi, please answer these questions it will be appreciated :) Thanks!

Can you also please check my answers :)

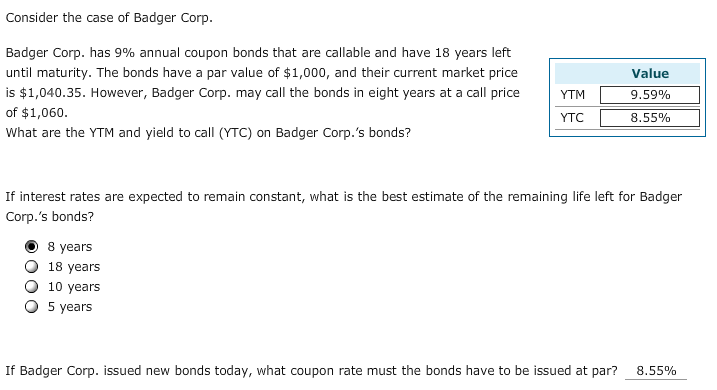

Consider the case of Badger Corp. Badger Corp. has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000, and their current market price is $1,040.35. However, Badger Corp. may call the bonds in eight years at a call price of $1,060 What are the YTM and yield to call (YTC) on Badger Corp.'s bonds? Value 9.59% 8.55% YTM | YTC If interest rates are expected to remain constant, what is the best estimate of the remaining life left for Badger Corp.'s bonds? 8 years O 18 years O 10 years 5 years If Badger Corp. issued new bonds today, what coupon rate must the bonds have to be issued at par? 8.55%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts