Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi! Please answer this question as soon as possible (Prefer within 2 hours). This is just MC. I will make sure to give good rating.

Hi! Please answer this question as soon as possible (Prefer within 2 hours). This is just MC. I will make sure to give good rating. Thank you so much !!

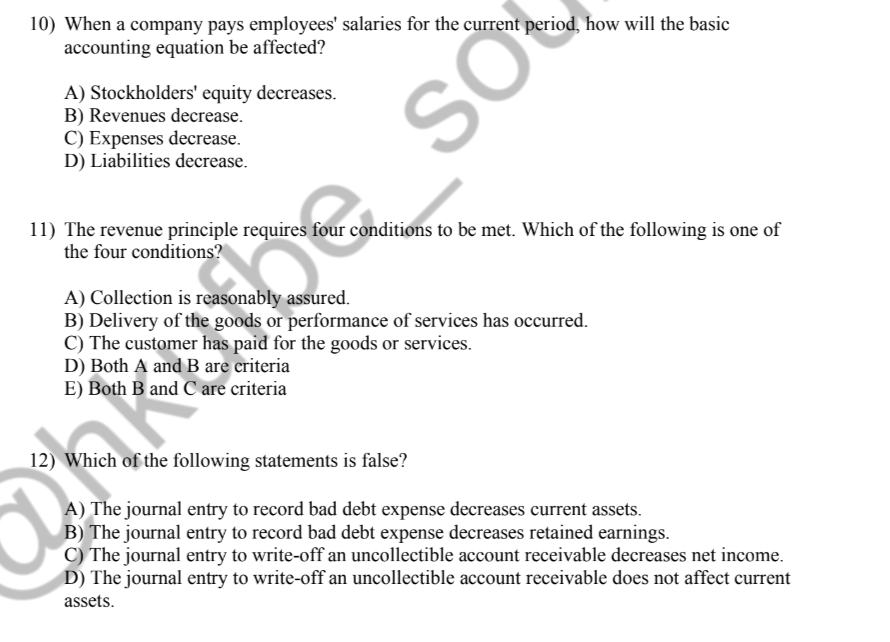

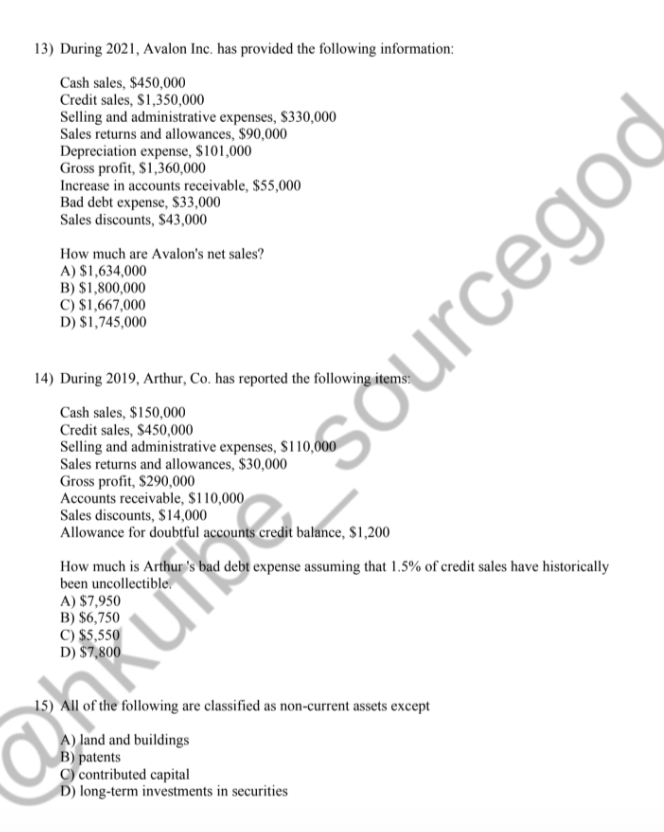

10) When a company pays employees' salaries for the current period, how will the basic accounting equation be affected? A) Stockholders' equity decreases. B) Revenues decrease. C) Expenses decrease. D) Liabilities decrease. 11) The revenue principle requires four conditions to be met. Which of the following is one of the four conditions? A) Collection is reasonably assured. B) Delivery of the goods or performance of services has occurred. C) The customer has paid for the goods or services. D) Both A and B are criteria E) Both B and C are criteria 12) Which of the following statements is false? A) The journal entry to record bad debt expense decreases current assets. B) The journal entry to record bad debt expense decreases retained earnings. C) The journal entry to write-off an uncollectible account receivable decreases net income. D) The journal entry to write-off an uncollectible account receivable does not affect current assets. 13) During 2021, Avalon Inc. has provided the following information: Cash sales, $450,000 Credit sales, $1,350,000 Selling and administrative expenses, $330,000 Sales returns and allowances, $90,000 Depreciation expense, $101,000 Gross profit, $1,360,000 Increase in accounts receivable, $55,000 Bad debt expense, $33,000 Sales discounts, $43,000 How much are Avalon's net sales? A) $1,634,000 B) $1,800,000 C) $1,667,000 D) $1,745,000 14) During 2019, Arthur, Co. has reported the following items: Cash sales, $150,000 Credit sales, $450,000 Selling and administrative expenses, $110,000 Sales returns and allowances, $30,000 Gross profit, \$290,000 Accounts receivable, $110,000 Sales discounts, $14,000 Allowance for doubtful accounts credit balance, $1,200 How much is Arthur's bad debt expense assuming that 1.5% of credit sales have historically been uncollectible. A) $7,950 B) $6,750 C) $5,550 D) $7,800 15) All of the following are classified as non-current assets except A) land and buildings B) patents C) contributed capital D) long-term investments in securities

10) When a company pays employees' salaries for the current period, how will the basic accounting equation be affected? A) Stockholders' equity decreases. B) Revenues decrease. C) Expenses decrease. D) Liabilities decrease. 11) The revenue principle requires four conditions to be met. Which of the following is one of the four conditions? A) Collection is reasonably assured. B) Delivery of the goods or performance of services has occurred. C) The customer has paid for the goods or services. D) Both A and B are criteria E) Both B and C are criteria 12) Which of the following statements is false? A) The journal entry to record bad debt expense decreases current assets. B) The journal entry to record bad debt expense decreases retained earnings. C) The journal entry to write-off an uncollectible account receivable decreases net income. D) The journal entry to write-off an uncollectible account receivable does not affect current assets. 13) During 2021, Avalon Inc. has provided the following information: Cash sales, $450,000 Credit sales, $1,350,000 Selling and administrative expenses, $330,000 Sales returns and allowances, $90,000 Depreciation expense, $101,000 Gross profit, $1,360,000 Increase in accounts receivable, $55,000 Bad debt expense, $33,000 Sales discounts, $43,000 How much are Avalon's net sales? A) $1,634,000 B) $1,800,000 C) $1,667,000 D) $1,745,000 14) During 2019, Arthur, Co. has reported the following items: Cash sales, $150,000 Credit sales, $450,000 Selling and administrative expenses, $110,000 Sales returns and allowances, $30,000 Gross profit, \$290,000 Accounts receivable, $110,000 Sales discounts, $14,000 Allowance for doubtful accounts credit balance, $1,200 How much is Arthur's bad debt expense assuming that 1.5% of credit sales have historically been uncollectible. A) $7,950 B) $6,750 C) $5,550 D) $7,800 15) All of the following are classified as non-current assets except A) land and buildings B) patents C) contributed capital D) long-term investments in securities Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started