Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi Please can you assist with a Q2 and Q3. I'm dealing with a private company. I have my dcf model and EV. How do

Hi

Please can you assist with a Q2 and Q3. I'm dealing with a private company. I have my dcf model and EV.

How do I set up a sensitivity analysis How do I work come up with a bidding strategy

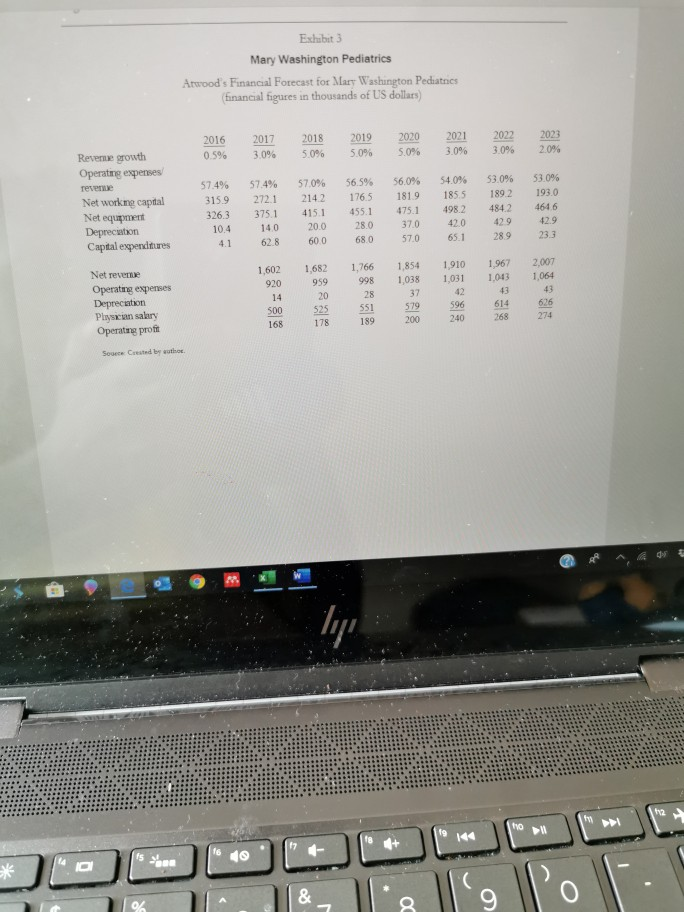

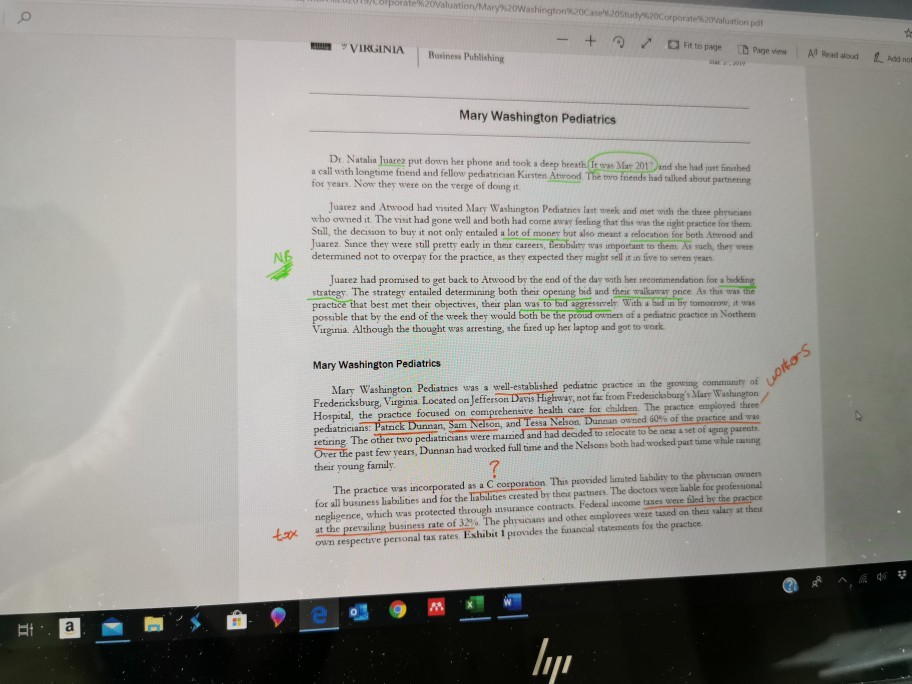

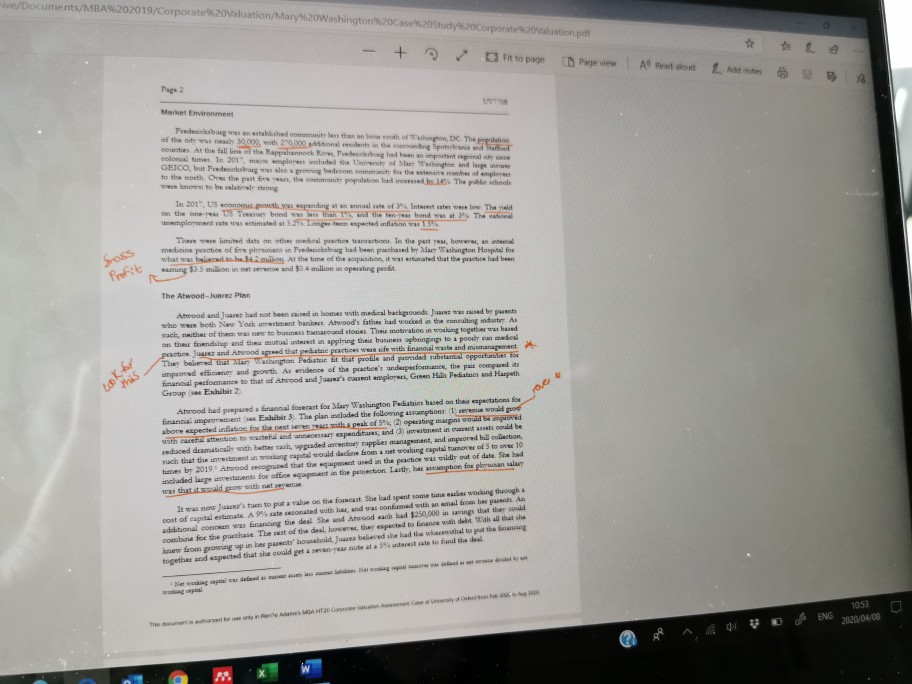

U IS IU UIU. ITU UNTUeynlig ulemes are to assess corporate value in a specific corporate context and to make use of this assessment in strategic and financial decision-making. The marking distribution will reflect the students' grasp and synthesis of economic and financial knowledge gained in the course - that is, their ability to move beyond quantitative financial modelling which relies on management forecasts provided in the case studies to a more nuanced quantitative and qualitative analysis which questions the robustness and plausibility of management forecasts. University of Virginia case # UV7708: Mary Washington Pediatrics is your assessed case study. which you should work on individually and submit by the deadline and method stated above. Please also refer to the Case Study Exhibits on the Assessment Page. Assignment Questions 1. How could you use past internal medicine practice transactions to estimate a credible bid for Mary Washington Pediatrics? (20% of mark including sub-question) a. What are potential benefits and drawbacks of using a transaction multiples approach? 2. How could you use a DCF-based estimate for the practice value? (60% of mark including sub-question) a. Critique the underlying assumptions of the DCF by conducting a sensitivity analysis as follows: examine what happens when a) operating margin remain at 2016 levels, b. NWC turnover remains at 2016 levels and c) revenue growth is more muted. 3. What amount would you recommend that Atwood and Juarez submit as an opening bid on (the practice? If their offer is rejected, how high should they be willing to go? (20% of mark) get to more price. Limbit Mary Washington Pediatrics Financial Statements for Mary Washington Pediatrics in thousands of US dollars) 2015 2016 1,547 1,555 882 893 Net revenue Operating expenses * Physician salary Depreciation Operating profit 496 Taxes Net profit Cash Accounts receivable Medical supplies Other current assets Total current assets Gross equipment Accumulated depreciation Net equipment Total assets Accounts payable Wages payable Other payables Total current liabilities 181 143 Owners' equity 537 642 Operating perses coded office vlasy, medical expense, office applied spensies, and insurance cost to the building UV7708 Page 4 Exhibit 2 Mary Washington Pediatrics Financial Ratios for Select Pediatric Practices (financial figures in thousands of US dollars) Mary Washington Pediatrics Harpeth Group 3,296 1,555 155 Green Hills Pediatrics 2,535 276 183 399 Net revenue Operating profit Net profit 264 361 552 Accounts receivable Total current assets Net equipment Total assets 1,186 1,476 178 296 143 Total current liabilities 10.99 7.26 100% 6.8% 12.196 8.09 Operating margin Net profit margin 6.8 Total asset turnover Accounts receivable dars Working capital turnover Net equipment turnover oi 15.4% 13.4 Return on assets A 4 Je" 1$ % Exclubit 3 Mary Washington Pediatrics Atwood's Financial Forecast for Mart Washington Pediatrics financial figures in thousands of US dollars) 2016 0.5% 2017 30% 2018 50% 2019 50% 2020 50% 2021 3.0% 2022 3.0% 2023 2.0% Revenue growth Operating expenses rever Net working capital Net equpment Depreciation Capital expenditures 57.4% 3159 326 3 10.4 57.4% 2721 3751 140 57.0% 2142 4151 20.0 60.0 56 59 1765 455.1 28.0 680 560% 1819 475.1 540% 1855 498 2 42.0 65.1 53.09 1892 4842 429 28.9 53.0% 1930 4646 12.9 23.3 370 62.8 57.0 1,602 1,682 959 1,766 998 Net revenue Operating expenses Deprecation Playsia salary Operating profit 1,854 1,038 1,910 1,031 1.967 1.013 2,007 1.064 20 525 37 551 189 200 596 240 268 274 Sow Crew (CO J o rporate Valuation Marys20Washington 520Case 20Study 20Corporate%20Valuation pdf - + VIRGINIA Fit to page Business Publishing Page View A Read aloud Add non Mary Washington Pediatrics De Natalia Juarez put down her phone and took a deep breath It w Mar 2012 and she had just finished a call with longtime friend and fellow pediatcan Kirsten Atwood. The two friends had talked about partie for years. Now they were on the verge of doing it Juarez and Atwood had visited Mary Washington Pediatrics last week and met with the three physicians who owned it. The visit had gone well and both had come away feeling that this was the night practice for them. Still, the decision to buy it not only entailed a lot of money but also meant a relocation for both Atwood and Juarez. Since they were still pretty early in their careers, flexibility was important to them. As such, they were determined not to overpay for the practice, as they expected they might sell it in five to seven years Juarez had promised to get back to Atwood by the end of the day with her recommendation for a bodeling strategy. The strategy entailed determining both the opening bid and the walkw price As this was the practice that best met their objectives, their plan was to bid agressively with a bid in by tomorrow, it was possible that by the end of the week they would both be the proud owners of a pediatric practice in Northern Vir Although the thought was arresting, she fired up her laptop and got to work Mary Washington Pediatrics LOROS Mary Washington Pediatrics was a well-established pediatre peactice in the growing community of Fredericksburg, Virginia Located on Jefferson Davis Highway, not far from Fredericksburg's Mary Washington Hospital, the practice focused on comprehensive health care for children. The practice employed three pediatricians: Patrick Dunnan, Sam Nelson, and Tessa Nehon. Dunnan owned 50% of the practice and was retiring. The other two pediatricians were manned and had decided to relocate to be bear a set of aging parents Over the past few years, Dunnan had worked full time and the Nelsons both had worked part time while mang their young family The practice was incorporated as a C corporation. This provided limited liability to the physcan owner for all business liabilities and for the liabilities created by the partners. The doctors were liable for professional negligence, which was protected throuph insurance contacts Federal income taxes were filed by the practice at the prevailing business rate of 32%. The physicians and other employees were taxed on the salary at the own respective personal tax rates Exhibit I provides the financial statements for the practice tox e/Documents/MBA%202019/Corporate 20Valuation/Mary20Washington20Cases20Study20Corporate20aluation de - + to page Page View All Beadwood Actres s Market Environment Fredensborgan shed w i thin the root grow . The price of the 30,000, with 20,000 and the Stu d io cates. At the fall line of the Rappan had been important penal colonial times. In 201", mai amples included the Uni o n and are GEICO, but Fredericksbog o g bedroom for the basemple to the north Over the past five the community population needs The e n to be relatively wrong In 201", US onomic growth as expanding an annual ute of Interest te los. The vald on the onere US Treasu bond s than and the tan bond w o The national plementate estimated t o Longer expected inflation There were limited data on the medial patteetations. In the past year, ho , an a l medicine pepotice of free pl an in Fredecibang had been prachased by Marr Washington Hospital for what was based the million. At the time of the season, it was stated that the practice had been amung $3.5 million in retenue and $0.4 million operating profit Gross Be The Atwood - Juarez Plan Cook to Atwood and learnt had not been raised in homes with medical backgrounds foars was who were both New Yock nestment bas. Atwood's fathes had worked in the consulting industry. As by parents sach neither of them was to business around stories. The motrations in wong together was based on their friendship and the mutual interest in appling their business upbringing to a poochron mal practice Juarez and Anwood agreed that pediatrie practices were life wits finansal waste and mismanagement They belied that ar washington Pediatrie it that profile and pronde Tubutas opportunities for proved ett er and prouth Asendence of the practice's underperformance, the pait compuests financial performance to that of Atood and war's cutent employers, Green Hills Pediatries and Harputh Grove Exhibit 2 Atwood had prepared a cal forecast for Mary Washington Pediatries based on the expectations for financial improvements Exhibit 3 The plan inchaded the follosing assumptions: 1) world of abore expected to for the next weer e sta peak of 5% operating margina wood d the attention to stand expenditures, and (3) investment in c a ses o be redaced dramatically with better cash, pradedamento supplies management, and improved bull collection, such that the ment song capital soald decline from a networking capital omover of 5 to over 10 tumes by 2019 Atwood recognised that the equipment used in the praction was wildly out of date. She had included lase estents for office s p ent in the projection. Lastly, has seption for plan It was now 's tanto put on the forest She had spent some time and working though cost of capital estimate A9% rate sesonated with her and was confirmed with a small her per additional con financing the deal She and Atwood each had 1250,000 was that they combine for the purchase. The rest of the deal, how they expected to finance with debt with the new from group in besparenthood, we believed she had the wh o put the together and expected that she could get a seven-yente a n tes de to the deal 1053 E NG 2000/01/08 OR A U IS IU UIU. ITU UNTUeynlig ulemes are to assess corporate value in a specific corporate context and to make use of this assessment in strategic and financial decision-making. The marking distribution will reflect the students' grasp and synthesis of economic and financial knowledge gained in the course - that is, their ability to move beyond quantitative financial modelling which relies on management forecasts provided in the case studies to a more nuanced quantitative and qualitative analysis which questions the robustness and plausibility of management forecasts. University of Virginia case # UV7708: Mary Washington Pediatrics is your assessed case study. which you should work on individually and submit by the deadline and method stated above. Please also refer to the Case Study Exhibits on the Assessment Page. Assignment Questions 1. How could you use past internal medicine practice transactions to estimate a credible bid for Mary Washington Pediatrics? (20% of mark including sub-question) a. What are potential benefits and drawbacks of using a transaction multiples approach? 2. How could you use a DCF-based estimate for the practice value? (60% of mark including sub-question) a. Critique the underlying assumptions of the DCF by conducting a sensitivity analysis as follows: examine what happens when a) operating margin remain at 2016 levels, b. NWC turnover remains at 2016 levels and c) revenue growth is more muted. 3. What amount would you recommend that Atwood and Juarez submit as an opening bid on (the practice? If their offer is rejected, how high should they be willing to go? (20% of mark) get to more price. Limbit Mary Washington Pediatrics Financial Statements for Mary Washington Pediatrics in thousands of US dollars) 2015 2016 1,547 1,555 882 893 Net revenue Operating expenses * Physician salary Depreciation Operating profit 496 Taxes Net profit Cash Accounts receivable Medical supplies Other current assets Total current assets Gross equipment Accumulated depreciation Net equipment Total assets Accounts payable Wages payable Other payables Total current liabilities 181 143 Owners' equity 537 642 Operating perses coded office vlasy, medical expense, office applied spensies, and insurance cost to the building UV7708 Page 4 Exhibit 2 Mary Washington Pediatrics Financial Ratios for Select Pediatric Practices (financial figures in thousands of US dollars) Mary Washington Pediatrics Harpeth Group 3,296 1,555 155 Green Hills Pediatrics 2,535 276 183 399 Net revenue Operating profit Net profit 264 361 552 Accounts receivable Total current assets Net equipment Total assets 1,186 1,476 178 296 143 Total current liabilities 10.99 7.26 100% 6.8% 12.196 8.09 Operating margin Net profit margin 6.8 Total asset turnover Accounts receivable dars Working capital turnover Net equipment turnover oi 15.4% 13.4 Return on assets A 4 Je" 1$ % Exclubit 3 Mary Washington Pediatrics Atwood's Financial Forecast for Mart Washington Pediatrics financial figures in thousands of US dollars) 2016 0.5% 2017 30% 2018 50% 2019 50% 2020 50% 2021 3.0% 2022 3.0% 2023 2.0% Revenue growth Operating expenses rever Net working capital Net equpment Depreciation Capital expenditures 57.4% 3159 326 3 10.4 57.4% 2721 3751 140 57.0% 2142 4151 20.0 60.0 56 59 1765 455.1 28.0 680 560% 1819 475.1 540% 1855 498 2 42.0 65.1 53.09 1892 4842 429 28.9 53.0% 1930 4646 12.9 23.3 370 62.8 57.0 1,602 1,682 959 1,766 998 Net revenue Operating expenses Deprecation Playsia salary Operating profit 1,854 1,038 1,910 1,031 1.967 1.013 2,007 1.064 20 525 37 551 189 200 596 240 268 274 Sow Crew (CO J o rporate Valuation Marys20Washington 520Case 20Study 20Corporate%20Valuation pdf - + VIRGINIA Fit to page Business Publishing Page View A Read aloud Add non Mary Washington Pediatrics De Natalia Juarez put down her phone and took a deep breath It w Mar 2012 and she had just finished a call with longtime friend and fellow pediatcan Kirsten Atwood. The two friends had talked about partie for years. Now they were on the verge of doing it Juarez and Atwood had visited Mary Washington Pediatrics last week and met with the three physicians who owned it. The visit had gone well and both had come away feeling that this was the night practice for them. Still, the decision to buy it not only entailed a lot of money but also meant a relocation for both Atwood and Juarez. Since they were still pretty early in their careers, flexibility was important to them. As such, they were determined not to overpay for the practice, as they expected they might sell it in five to seven years Juarez had promised to get back to Atwood by the end of the day with her recommendation for a bodeling strategy. The strategy entailed determining both the opening bid and the walkw price As this was the practice that best met their objectives, their plan was to bid agressively with a bid in by tomorrow, it was possible that by the end of the week they would both be the proud owners of a pediatric practice in Northern Vir Although the thought was arresting, she fired up her laptop and got to work Mary Washington Pediatrics LOROS Mary Washington Pediatrics was a well-established pediatre peactice in the growing community of Fredericksburg, Virginia Located on Jefferson Davis Highway, not far from Fredericksburg's Mary Washington Hospital, the practice focused on comprehensive health care for children. The practice employed three pediatricians: Patrick Dunnan, Sam Nelson, and Tessa Nehon. Dunnan owned 50% of the practice and was retiring. The other two pediatricians were manned and had decided to relocate to be bear a set of aging parents Over the past few years, Dunnan had worked full time and the Nelsons both had worked part time while mang their young family The practice was incorporated as a C corporation. This provided limited liability to the physcan owner for all business liabilities and for the liabilities created by the partners. The doctors were liable for professional negligence, which was protected throuph insurance contacts Federal income taxes were filed by the practice at the prevailing business rate of 32%. The physicians and other employees were taxed on the salary at the own respective personal tax rates Exhibit I provides the financial statements for the practice tox e/Documents/MBA%202019/Corporate 20Valuation/Mary20Washington20Cases20Study20Corporate20aluation de - + to page Page View All Beadwood Actres s Market Environment Fredensborgan shed w i thin the root grow . The price of the 30,000, with 20,000 and the Stu d io cates. At the fall line of the Rappan had been important penal colonial times. In 201", mai amples included the Uni o n and are GEICO, but Fredericksbog o g bedroom for the basemple to the north Over the past five the community population needs The e n to be relatively wrong In 201", US onomic growth as expanding an annual ute of Interest te los. The vald on the onere US Treasu bond s than and the tan bond w o The national plementate estimated t o Longer expected inflation There were limited data on the medial patteetations. In the past year, ho , an a l medicine pepotice of free pl an in Fredecibang had been prachased by Marr Washington Hospital for what was based the million. At the time of the season, it was stated that the practice had been amung $3.5 million in retenue and $0.4 million operating profit Gross Be The Atwood - Juarez Plan Cook to Atwood and learnt had not been raised in homes with medical backgrounds foars was who were both New Yock nestment bas. Atwood's fathes had worked in the consulting industry. As by parents sach neither of them was to business around stories. The motrations in wong together was based on their friendship and the mutual interest in appling their business upbringing to a poochron mal practice Juarez and Anwood agreed that pediatrie practices were life wits finansal waste and mismanagement They belied that ar washington Pediatrie it that profile and pronde Tubutas opportunities for proved ett er and prouth Asendence of the practice's underperformance, the pait compuests financial performance to that of Atood and war's cutent employers, Green Hills Pediatries and Harputh Grove Exhibit 2 Atwood had prepared a cal forecast for Mary Washington Pediatries based on the expectations for financial improvements Exhibit 3 The plan inchaded the follosing assumptions: 1) world of abore expected to for the next weer e sta peak of 5% operating margina wood d the attention to stand expenditures, and (3) investment in c a ses o be redaced dramatically with better cash, pradedamento supplies management, and improved bull collection, such that the ment song capital soald decline from a networking capital omover of 5 to over 10 tumes by 2019 Atwood recognised that the equipment used in the praction was wildly out of date. She had included lase estents for office s p ent in the projection. Lastly, has seption for plan It was now 's tanto put on the forest She had spent some time and working though cost of capital estimate A9% rate sesonated with her and was confirmed with a small her per additional con financing the deal She and Atwood each had 1250,000 was that they combine for the purchase. The rest of the deal, how they expected to finance with debt with the new from group in besparenthood, we believed she had the wh o put the together and expected that she could get a seven-yente a n tes de to the deal 1053 E NG 2000/01/08 OR A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started