Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, please do both of the questions as they are a part of 1 question. thanks 22 Classic Sound is a start-up company that produces

Hi, please do both of the questions as they are a part of 1 question.

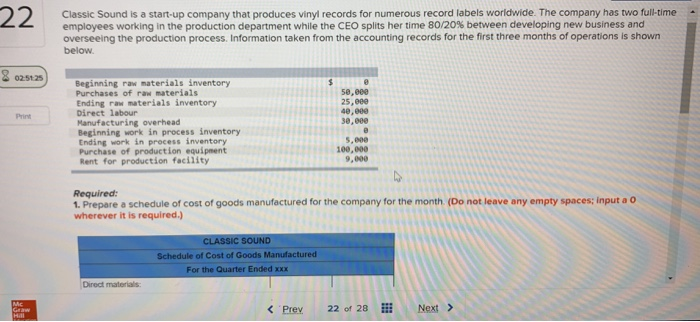

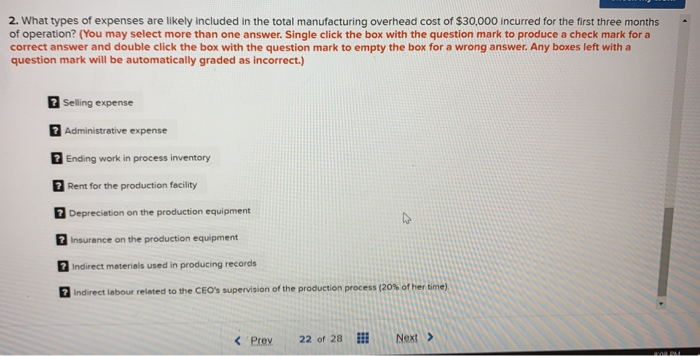

22 Classic Sound is a start-up company that produces vinyl records for numerous record labels worldwide. The company has two full-time employees working in the production department while the CEO splits her time 80/20% between developing new business and overseeing the production process. Information taken from the accounting records for the first three months of operations is shown below. 8 02:51:25 $ Beginning raw materials inventory Purchases of raw materials Ending raw materials inventory Direct labour Manufacturing overhead Beginning work in process inventory Ending work in process inventory Purchase of production equipment Rent for production facility 50,000 25, cee 40,000 30.000 e 5,600 100,000 9.000 Required: 1. Prepare a schedule of cost of goods manufactured for the company for the month (Do not leave any empty spaces; input a 0 wherever it is required.) CLASSIC SOUND Schedule of Cost of Goods Manufactured For the Quarter Ended xxx Direct materials Mc Hall 2. What types of expenses are likely included in the total manufacturing overhead cost of $30,000 incurred for the first three months of operation? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Selling expense 7 Administrative expense Ending work in process inventory Rent for the production facility Depreciation on the production equipment Insurance on the production equipment Indirect materials used in producing records Indirect labour related to the CEO's supervision of the production process (20% of her time) thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started