Hi. Please explain me why the answer right and wrong. Make it clear please, thanks!

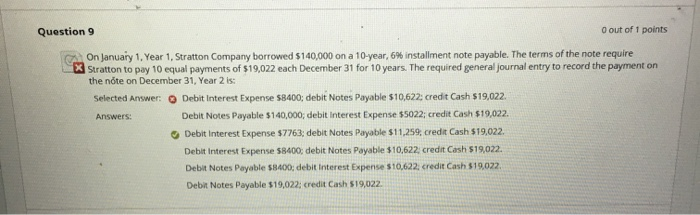

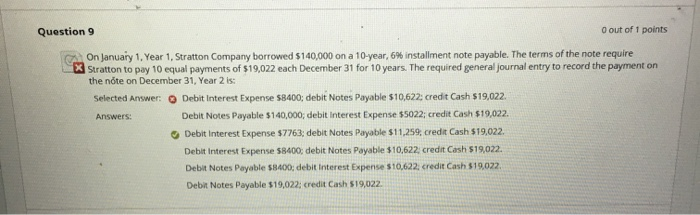

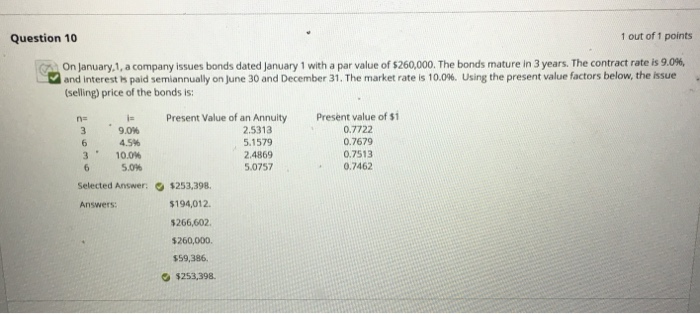

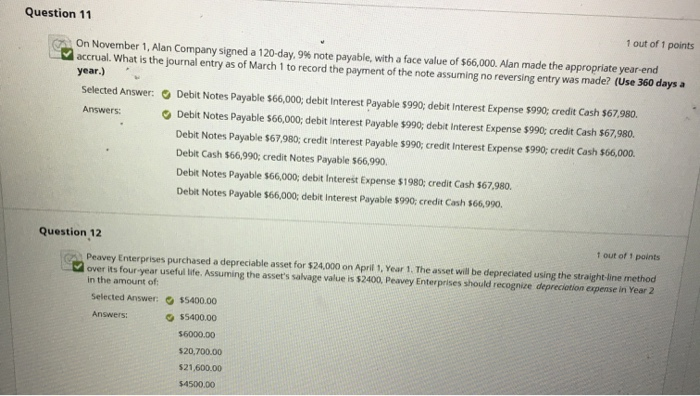

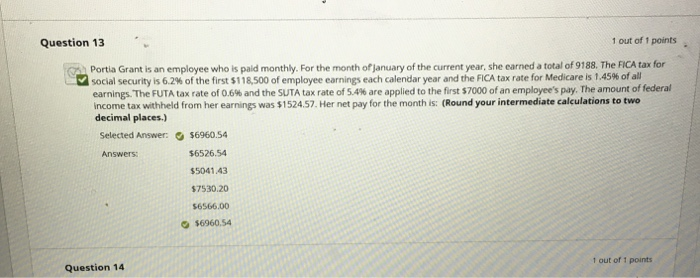

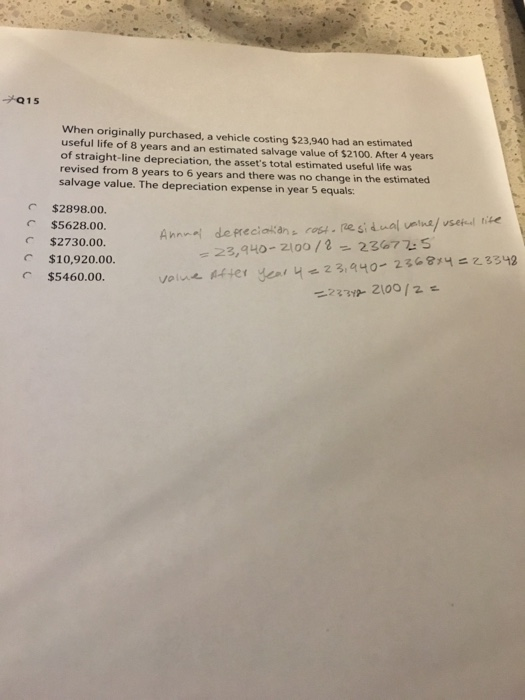

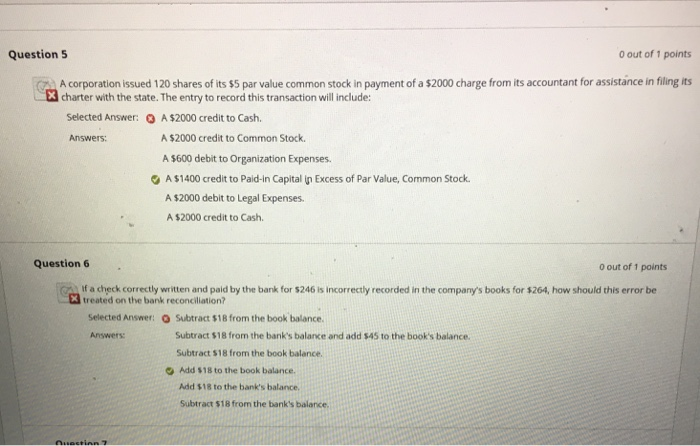

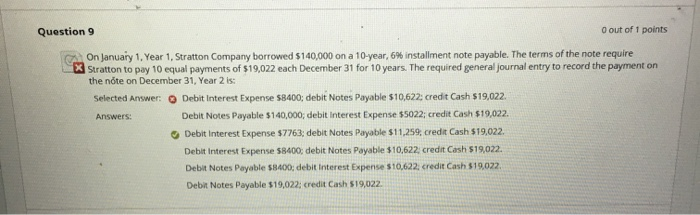

Question 9 0 out of 1 points On anuary 1 Year 1 Stratton Company borrowed $140,000 on a 10-year 6% installment note payable. The terms of the note require Stratton to pay 10 equal payments of $19,022 each December 31 for 10 years. The required general journal entry to record the payment on the nte on December 31, Year 2 is: Debit Interest Expense $8400: debit Notes Payable $10,622; credit Cash $19,022 Debit Notes Payable $140,000; debit interest Expense $5022; credit Cash $19,022 Debit Interest Expense $7763 debit Notes Payable S 11,25% credit Cash S 19.022. Debit Interest Expense 58400; debit Notes Payable $10,622 credit Cash $19,022. Debit Notes Payable $8400; debit Interest Expense $10,622, credit Cash $19,022 Debit Notes Payable $19,022: credit Cash $19,022 Selected Answer: Answers: Question 10 1 out of 1 points On anuary 1, a company issues bonds dated anuary 1 with a par value of S260,0 . The bonds mature in 3 years. The contract rate is 9.0%, and interest s paid semiannually on June 30 and December 31, The market rate is 10.0%. Using the present value factors below, the issue (selling) price of the bonds is: i 9.0% Present Value of an Annuity Present value of $ n- 2.5313 5.1579 2.4869 5.0757 0.7722 0.7679 0.7513 0.7462 64.9% 3, 10.0% 50% Selected Answer: s253,398 $194,012 $266,602 $260,000 $59,386 $253,398. Answers: Question 11 1 out of 1 points On November 1 Alan Company signed a 120-day, 9% note payable with a face value of $66,000. Alan made the appropriate year-end accrual. What is the journal entry as of March 1 to record the payment of the note assuming no reversing entry was made? (Use 360 days a year.) Selected Answer: Debit Notes Payable $66,000, debit Interest Payable $990; debit Interest Expense $990; credit Cash $67,980. Answers: G Debit Notes Payable $66,000; debit Interest Payable $990; debit Interest Expense $990; credit Cash $67,980. Debit Notes Payable $67,980; credit Interest Payable $990; credit Interest Expense $990; credit Cash $66,000 Debit Cash $66,990; credit Notes Payable $66,990 Debit Notes Payable $66,000; debit Interest Expense $1980; credit Cash $67.980. Debit Notes Payable $66,000; debit Interest Payable $990; credit Cash s66,990. Question 12 t out of 1 points Peavey Enterprises purchased a depreciable asset for $24,000 on April 1, Year 1. The asset will be depreciated using the straight-Jine method over its four-year useful life. Assuming the assets salvage value is $2400, Peavey Enterprises should recognize depreciotion expense in Year 2 in the amount of: Selected Answer:$5400.00 Answers: s540000 $6000.00 $20,700.00 $21,600.00 $4500.00 Question 13 1 out of 1 points Portia Grant is an employee who is paid monthly. For the month ofjanuary of the current year, she earned a total of 9188. The FICA tax for social security is 6.2% of the first $118,500 of employee earnings each calendar year and the FICA tax rate for Medicare is 1 45% of all earnings. The FUTA tax rate of 0.6% and the SUTA tax rate of SA% are applied to the first S7000 of an employee's pay. The amount of federal income tax withheld from her earnings was $152457. Her net pay for the month is: (Round your intermediate calculations to two decimal places Selected Answer:$6960.54 $6526.54 $5041.43 $7530.20 $6566.00 $6960,54 Answers: 1 out of 1 points Question 14 15 When originally purchased, a vehicle costing $23,940 had an estimated useful life of 8 years and an estimated salvage value of $2100. After 4 years of straight-line depreciation, the asset's total estimated useful life was revised from 8 years to 6 years and there was no change in the estimated salvage value. The depreciation expense in year 5 equals $2898.00. $5628.00. $2730.00. $10,920.00. $5460.00. 23,940-200/2-22672:S Question 5 0 out of 1 points A corporation issued 120 shares of its $5 par value common stock in payment of a $2000 charge frorn its accountant for assistance in filing its charter with the state. The entry to record this transaction will include: Selected Answer: A$2000 credit to Cash. Answers: A $2000 credit to Common Stock. A $600 debit to Organization Expenses. A $1400 credit to Paid-in Capital In Excess of Par Value, Common Stock A $2000 debit to Legal Expenses. A $2000 credit to Cash Question 6 0 out of 1 points g) If a check correctly written and paid by the bank for $246 is incorrectly recorded in the company's books for $264, how should this error be treated on the bank reconciliation? Selected Answer: ) Subtract %18 from the book balance. Subtract $18 from the bank's balace and add $45 to the book's balance Subtract $18 from the book balance. Add $18 to the book balance. Add $18 to the bank's balance. Subtract $18 from the bank's balance Answers