Question

Hi, please help me on how to do this question? I need an explanation about the question as well. Thanks. The borrowing of Cora PLC

Hi, please help me on how to do this question? I need an explanation about the question as well. Thanks.

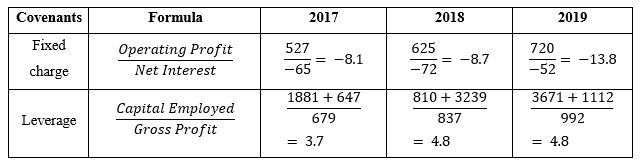

The borrowing of Cora PLC is subject to financial covenants tested on a yearly basis. The first covenant is a fixed charge covenant, calculated as operating profit over net interest. The second covenant is a leverage covenant, calculated as capital employed over gross profit. Calculate and briefly comment on the performance of Cora PLC in relation to these covenants (i.e., covenant slack) from 2017 to 2019, if the minimum threshold for the fixed charge covenant is 7 and for the leverage, the covenant is 3.5.

Covenants Formula 2017 2018 2019 Fixed Operating Profit Net Interest 527 -65 = -8.1 625 -72 = -8.7 720 = -13.8 -52 charge Capital Employed Gross Profit Leverage 1881 + 647 679 = 3.7 810 + 3239 837 3671 + 1112 992 = 4.8 = 4.8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started