Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi, please help me solving this problem, thank you! Consider the table given below to answer the following question. Year Asset value Earnings Net investment

hi, please help me solving this problem, thank you!

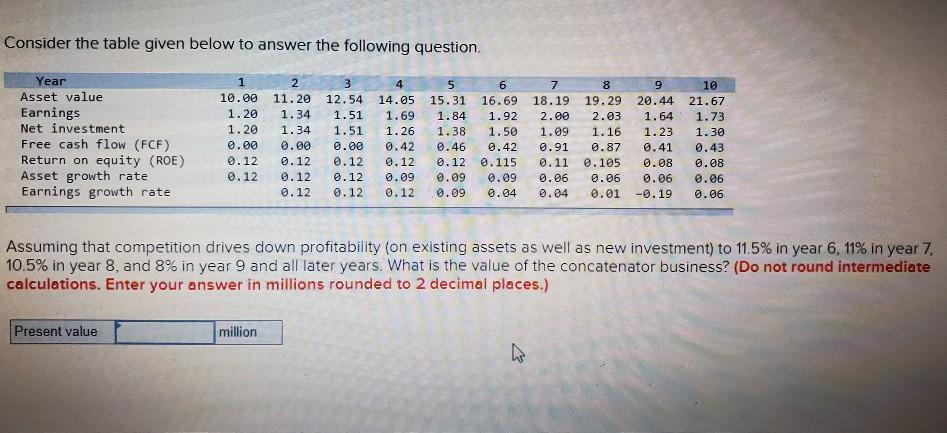

Consider the table given below to answer the following question. Year Asset value Earnings Net investment Free cash flow (FCF) Return on equity (ROE) Asset growth rate Earnings growth rate 1 10.00 1.20 1.20 0.00 0.12 0.12 2 11.20 1.34 1.34 0.00 0.12 0.12 0.12 3 12.54 1.51 1.51 0.00 0.12 0.12 0.12 4 14.05 1.69 1.26 0.42 0.12 0.09 0.12 5 15.31 1.84 1.38 0.46 0.12 0.09 0.09 6 16.69 1.92 1.50 0.42 0.115 0.09 0.04 7 18.19 2.00 1.09 0.91 0.11 0.06 0.04 8 19.29 2.03 1.16 0.87 0.105 0.06 0.01 9 20.44 1.64 1.23 0.41 0.08 0.06 -0.19 10 21.67 1.73 1.30 0.43 0.08 0.06 0.06 Assuming that competition drives down profitability (on existing assets as well as new investment) to 11.5% in year 6,11% in year 7. 10.5% in year 8, and 8% in year 9 and all later years. What is the value of the concatenator business? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Present value million Consider the table given below to answer the following question. Year Asset value Earnings Net investment Free cash flow (FCF) Return on equity (ROE) Asset growth rate Earnings growth rate 1 10.00 1.20 1.20 0.00 0.12 0.12 2 11.20 1.34 1.34 0.00 0.12 0.12 0.12 3 12.54 1.51 1.51 0.00 0.12 0.12 0.12 4 14.05 1.69 1.26 0.42 0.12 0.09 0.12 5 15.31 1.84 1.38 0.46 0.12 0.09 0.09 6 16.69 1.92 1.50 0.42 0.115 0.09 0.04 7 18.19 2.00 1.09 0.91 0.11 0.06 0.04 8 19.29 2.03 1.16 0.87 0.105 0.06 0.01 9 20.44 1.64 1.23 0.41 0.08 0.06 -0.19 10 21.67 1.73 1.30 0.43 0.08 0.06 0.06 Assuming that competition drives down profitability (on existing assets as well as new investment) to 11.5% in year 6,11% in year 7. 10.5% in year 8, and 8% in year 9 and all later years. What is the value of the concatenator business? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Present value millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started