Hi please help me with this exam revision question for macroeconomics , I do not have the model answer for it and it would be of much help if you can help me with it. Thank you so much!!

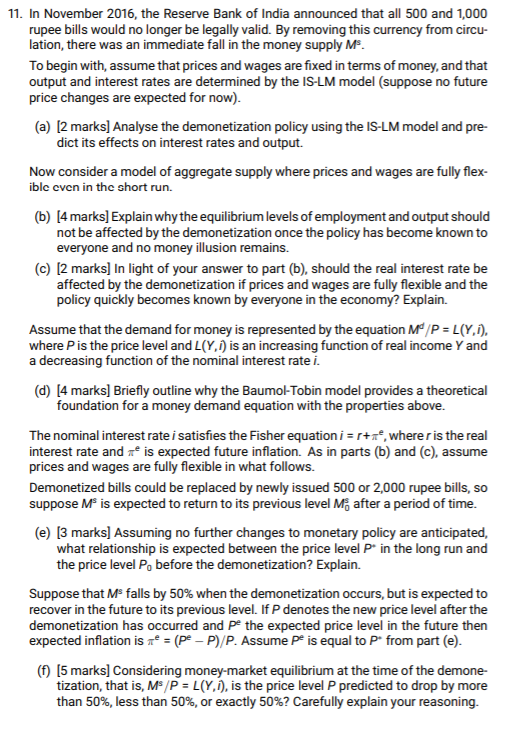

11. In November 2016, the Reserve Bank of India announced that all 500 and 1,000 rupee bills would no longer be legally valid. By removing this currency from circus lation, there was an immediate fall in the money supply M. To begin with, assume that prices and wages are fixed in terms of money, and that output and interest rates are determined by the IS-LM model (suppose no future price changes are expected for now). (a) [2 marks] Analyse the demonetization policy using the IS-LM model and pre- dict its effects on interest rates and output. Now consider a model of aggregate supply where prices and wages are fully flex- ible even in the short run. (b) [4 marks] Explain why the equilibrium levels of employment and output should not be affected by the demonetization once the policy has become known to everyone and no money illusion remains. (c) [2 marks] In light of your answer to part (b), should the real interest rate be affected by the demonetization if prices and wages are fully flexible and the policy quickly becomes known by everyone in the economy? Explain. Assume that the demand for money is represented by the equation M" /P = L(Y,i). where P is the price level and L(Y, i) is an increasing function of real income Y and a decreasing function of the nominal interest rate i. (d) [4 marks] Briefly outline why the Baumol-Tobin model provides a theoretical foundation for a money demand equation with the properties above. The nominal interest rate i satisfies the Fisher equation i = row, where r is the real interest rate and * is expected future inflation. As in parts (b) and (c), assume prices and wages are fully flexible in what follows. Demonetized bills could be replaced by newly issued 500 or 2,000 rupee bills, so suppose M' is expected to return to its previous level M; after a period of time. (e) [3 marks] Assuming no further changes to monetary policy are anticipated, what relationship is expected between the price level P* in the long run and the price level Po before the demonetization? Explain. Suppose that MS falls by 50% when the demonetization occurs, but is expected to recover in the future to its previous level. If P denotes the new price level after the demonetization has occurred and Pe the expected price level in the future then expected inflation is me = (pe - P)/P. Assume Pe is equal to P* from part (e). (f) [5 marks] Considering money-market equilibrium at the time of the demone- tization, that is, MS/P = L(Y, i), is the price level P predicted to drop by more than 50%, less than 50%, or exactly 50%? Carefully explain your reasoning