Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi PLEASE HELP WITH THE ABOVE IM STUCK **************PLEASE Note****THE BELOW COMPLETED TEMPLATES ARE EXAMPLES FROM Chapter 6 AS STATED ABOVE, THAT IS HOW THE

Hi PLEASE HELP WITH THE ABOVE IM STUCK **************PLEASE

Note****THE BELOW COMPLETED TEMPLATES ARE EXAMPLES FROM Chapter 6 AS STATED ABOVE, THAT IS HOW THE QUESTIONS ARE SUPPOSED TO BE ANSWERED, YOU CAN USE EXCEL OR WORD,I HAVE ATTACHED BLANK TEMPLATES AS WELL.

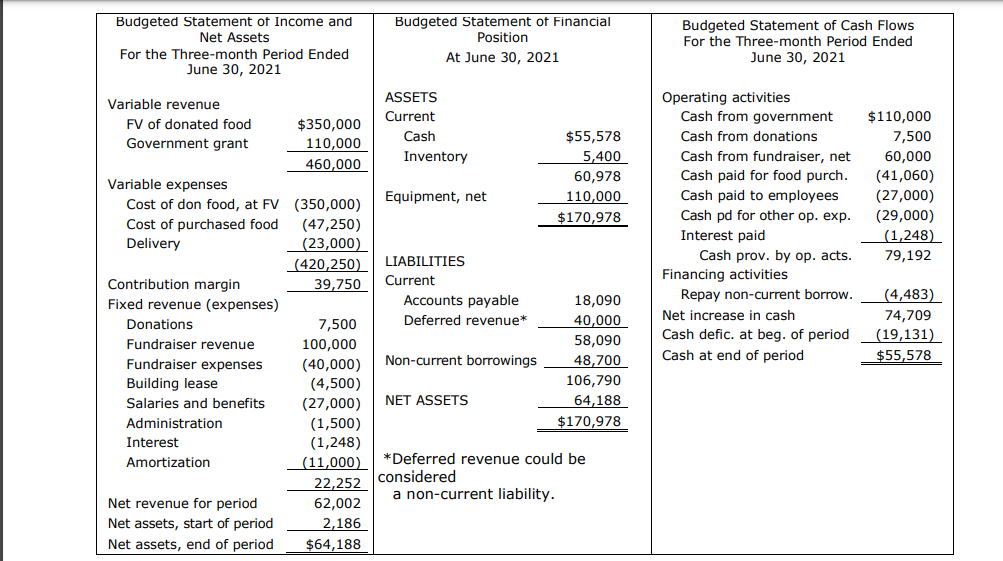

COMPLETED EXAMPLES BELOW

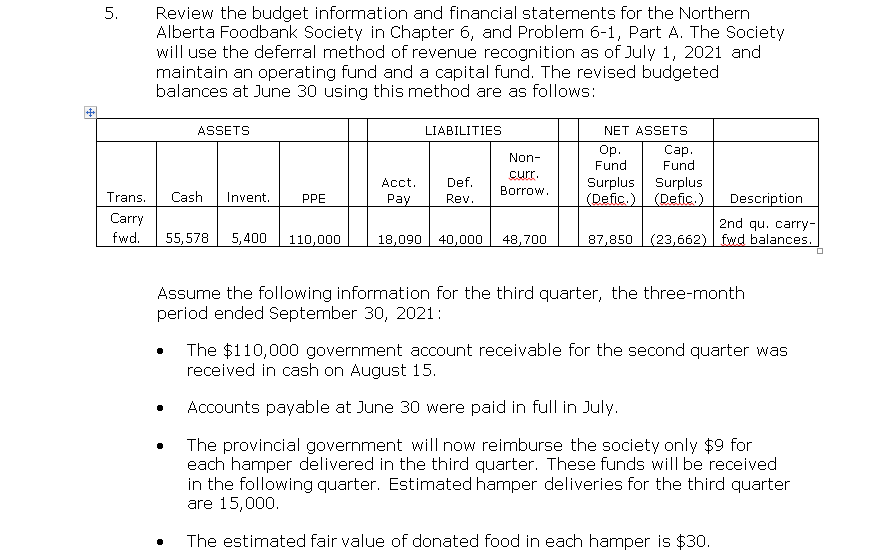

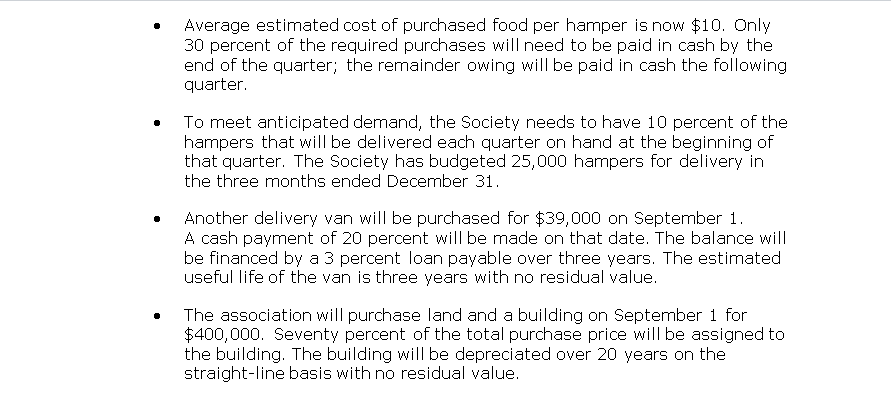

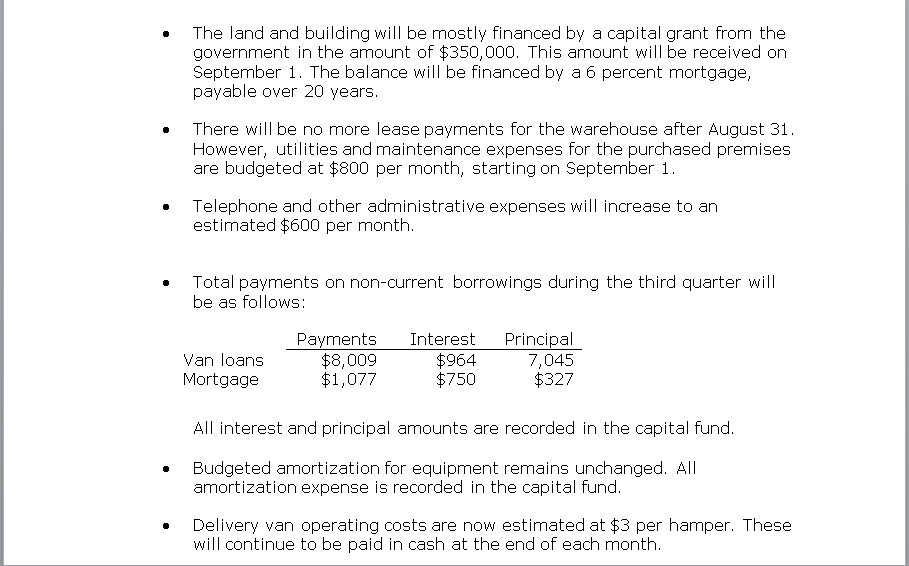

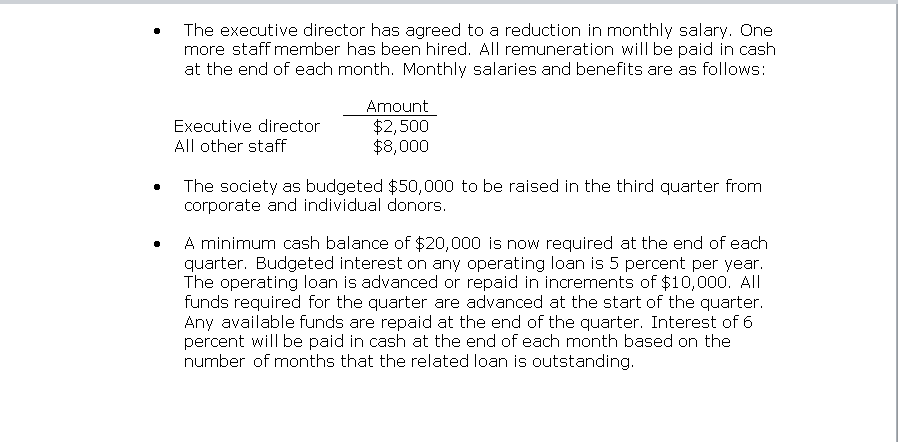

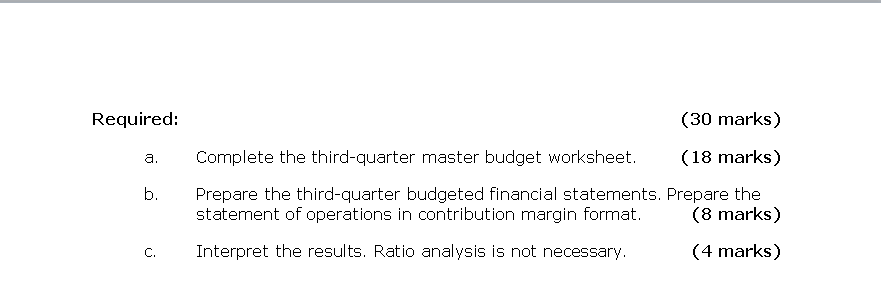

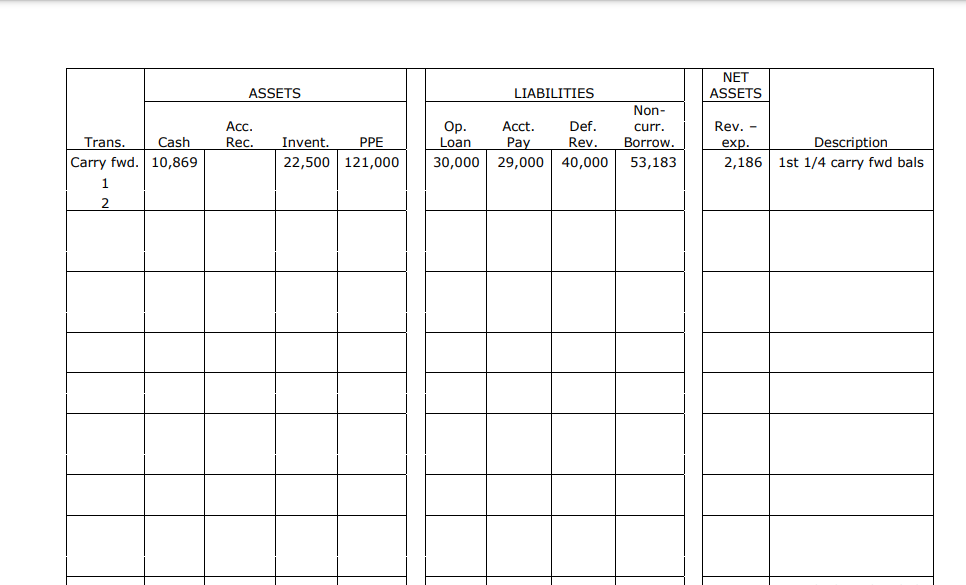

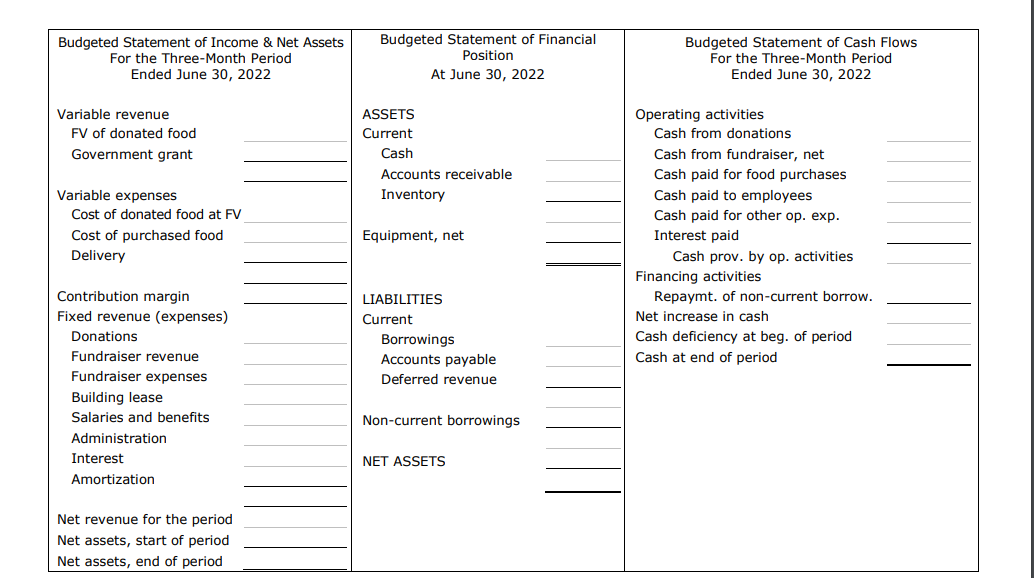

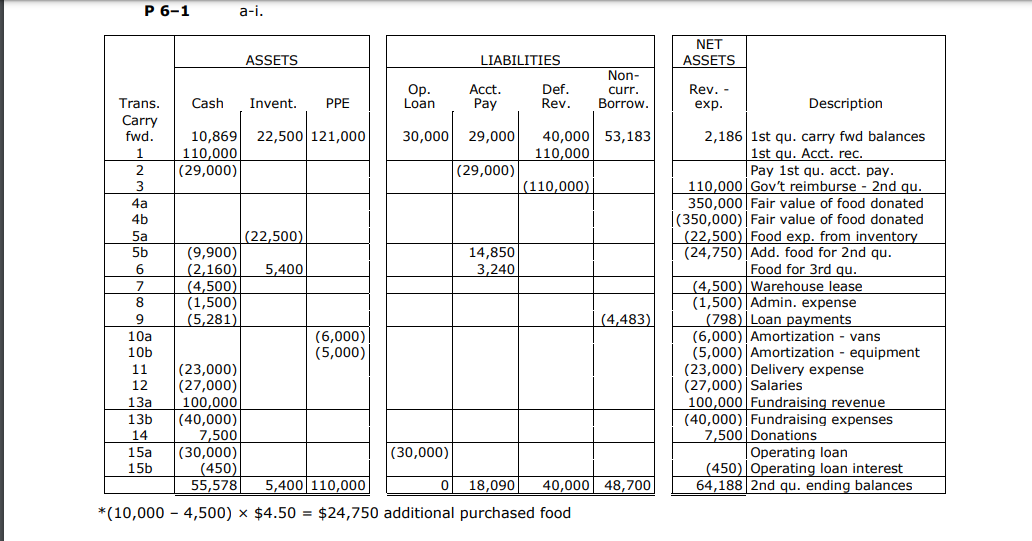

Review the budget information and financial statements for the Northern Alberta Foodbank Society in Chapter 6, and Problem 6-1, Part A. The Society will use the deferral method of revenue recognition as of July 1, 2021 and maintain an operating fund and a capital fund. The revised budgeted balances at June 30 using this method are as follows: Assume the following information for the third quarter, the three-month period ended September 30, 2021: - The $110,000 government account receivable for the second quarter was received in cash on August 15. - Accounts payable at June 30 were paid in full in July. - The provincial government will now reimburse the society only $9 for each hamper delivered in the third quarter. These funds will be received in the following quarter. Estimated hamper deliveries for the third quarter are 15,000 . - The estimated fair value of donated food in each hamper is $30. - Average estimated cost of purchased food per hamper is now $10. Only 30 percent of the required purchases will need to be paid in cash by the end of the quarter; the remainder owing will be paid in cash the following quarter. - To meet anticipated demand, the Society needs to have 10 percent of the hampers that will be delivered each quarter on hand at the beginning of that quarter. The Society has budgeted 25,000 hampers for delivery in the three months ended December 31. - Another delivery van will be purchased for $39,000 on September 1 . A cash payment of 20 percent will be made on that date. The balance will be financed by a 3 percent loan payable over three years. The estimated useful life of the van is three vears with no residual value. - The association will purchase land and a building on September 1 for $400,000. Seventy percent of the total purchase price will be assigned to the building. The building will be depreciated over 20 years on the straight-line basis with no residual value. - The land and building will be mostly financed by a capital grant from the government in the amount of $350,000. This amount will be received on September 1 . The balance will be financed by a 6 percent mortgage, payable over 20 years. - There will be no more lease payments for the warehouse after August 31. However, utilities and maintenance expenses for the purchased premises are budgeted at $800 per month, starting on September 1 . - Telephone and other administrative expenses will increase to an estimated $600 per month. - Total payments on non-current borrowings during the third quarter will be as follows: All interest and principal amounts are recorded in the capital fund. - Budgeted amortization for equipment remains unchanged. All amortization expense is recorded in the capital fund. - Delivery van operating costs are now estimated at $3 per hamper. These will continue to be paid in cash at the end of each month. The executive director has agreed to a reduction in monthly salary. One more staff member has been hired. All remuneration will be paid in cash at the end of each month. Monthly salaries and benefits are as follows: The society as budgeted $50,000 to be raised in the third quarter from corporate and individual donors. A minimum cash balance of $20,000 is now required at the end of each quarter. Budgeted interest on any operating loan is 5 percent per year. The operating loan is advanced or repaid in increments of $10,000. All funds required for the quarter are advanced at the start of the quarter. Any available funds are repaid at the end of the quarter. Interest of 6 percent will be paid in cash at the end of each month based on the number of months that the related loan is outstanding. Required: (30 marks) a. Complete the third-quarter master budget worksheet. (18 marks) b. Prepare the third-quarter budgeted financial statements. Prepare the statement of operations in contribution margin format. (8 marks) c. Interpret the results. Ratio analysis is not necessary. (4 marks) (10,0004,500)$4.50=$24,75 iii. The net cash inflow from operations is $79,192. Much of this amount results from the net $40,000 raised from the golf tournament, donations, and government funds received for the first quarter. The total net increase in cash is $74,709. As a result of this significant net cash inflow during the second quarter, there is no operating loan and no cash deficiency. Cash on hand at June 30 is $55,578

Review the budget information and financial statements for the Northern Alberta Foodbank Society in Chapter 6, and Problem 6-1, Part A. The Society will use the deferral method of revenue recognition as of July 1, 2021 and maintain an operating fund and a capital fund. The revised budgeted balances at June 30 using this method are as follows: Assume the following information for the third quarter, the three-month period ended September 30, 2021: - The $110,000 government account receivable for the second quarter was received in cash on August 15. - Accounts payable at June 30 were paid in full in July. - The provincial government will now reimburse the society only $9 for each hamper delivered in the third quarter. These funds will be received in the following quarter. Estimated hamper deliveries for the third quarter are 15,000 . - The estimated fair value of donated food in each hamper is $30. - Average estimated cost of purchased food per hamper is now $10. Only 30 percent of the required purchases will need to be paid in cash by the end of the quarter; the remainder owing will be paid in cash the following quarter. - To meet anticipated demand, the Society needs to have 10 percent of the hampers that will be delivered each quarter on hand at the beginning of that quarter. The Society has budgeted 25,000 hampers for delivery in the three months ended December 31. - Another delivery van will be purchased for $39,000 on September 1 . A cash payment of 20 percent will be made on that date. The balance will be financed by a 3 percent loan payable over three years. The estimated useful life of the van is three vears with no residual value. - The association will purchase land and a building on September 1 for $400,000. Seventy percent of the total purchase price will be assigned to the building. The building will be depreciated over 20 years on the straight-line basis with no residual value. - The land and building will be mostly financed by a capital grant from the government in the amount of $350,000. This amount will be received on September 1 . The balance will be financed by a 6 percent mortgage, payable over 20 years. - There will be no more lease payments for the warehouse after August 31. However, utilities and maintenance expenses for the purchased premises are budgeted at $800 per month, starting on September 1 . - Telephone and other administrative expenses will increase to an estimated $600 per month. - Total payments on non-current borrowings during the third quarter will be as follows: All interest and principal amounts are recorded in the capital fund. - Budgeted amortization for equipment remains unchanged. All amortization expense is recorded in the capital fund. - Delivery van operating costs are now estimated at $3 per hamper. These will continue to be paid in cash at the end of each month. The executive director has agreed to a reduction in monthly salary. One more staff member has been hired. All remuneration will be paid in cash at the end of each month. Monthly salaries and benefits are as follows: The society as budgeted $50,000 to be raised in the third quarter from corporate and individual donors. A minimum cash balance of $20,000 is now required at the end of each quarter. Budgeted interest on any operating loan is 5 percent per year. The operating loan is advanced or repaid in increments of $10,000. All funds required for the quarter are advanced at the start of the quarter. Any available funds are repaid at the end of the quarter. Interest of 6 percent will be paid in cash at the end of each month based on the number of months that the related loan is outstanding. Required: (30 marks) a. Complete the third-quarter master budget worksheet. (18 marks) b. Prepare the third-quarter budgeted financial statements. Prepare the statement of operations in contribution margin format. (8 marks) c. Interpret the results. Ratio analysis is not necessary. (4 marks) (10,0004,500)$4.50=$24,75 iii. The net cash inflow from operations is $79,192. Much of this amount results from the net $40,000 raised from the golf tournament, donations, and government funds received for the first quarter. The total net increase in cash is $74,709. As a result of this significant net cash inflow during the second quarter, there is no operating loan and no cash deficiency. Cash on hand at June 30 is $55,578 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started