Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, pls help me with this problem. I really need it asap. Thank you so much. On January 1, 2022, ABC company purchased 100% of

Hi, pls help me with this problem. I really need it asap. Thank you so much.

you so much.

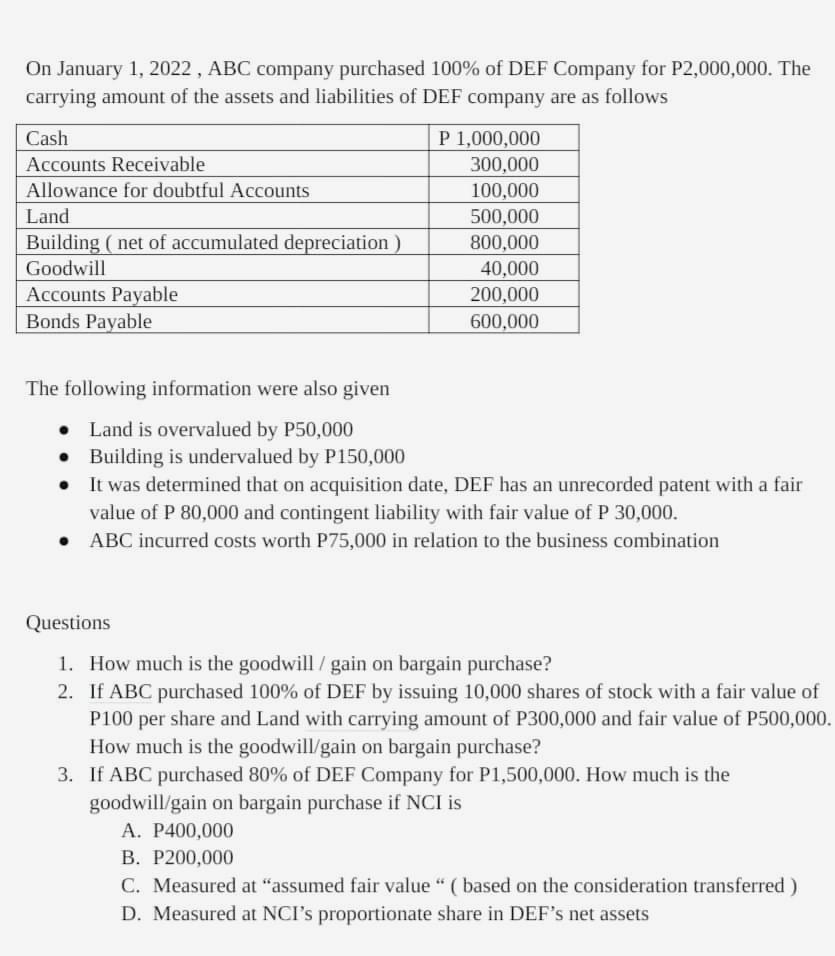

On January 1, 2022, ABC company purchased 100% of DEF Company for P2,000,000. The carrying amount of the assets and liabilities of DEF company are as follows Cash Accounts Receivable Allowance for doubtful Accounts Land Building ( net of accumulated depreciation ) Goodwill Accounts Payable Bonds Payable P 1,000,000 300,000 100,000 500,000 800,000 40,000 200,000 600,000 The following information were also given Land is overvalued by P50,000 Building is undervalued by P150,000 It was determined that on acquisition date, DEF has an unrecorded patent with a fair value of P 80,000 and contingent liability with fair value of P 30,000. ABC incurred costs worth P75,000 in relation to the business combination Questions 1. How much is the goodwill / gain on bargain purchase? 2. If ABC purchased 100% of DEF by issuing 10,000 shares of stock with a fair value of P100 per share and Land with carrying amount of P300,000 and fair value of P500,000. How much is the goodwill gain on bargain purchase? 3. If ABC purchased 80% of DEF Company for P1,500,000. How much is the goodwill/gain on bargain purchase if NCI is A. P400,000 B. P200,000 C. Measured at "assumed fair value (based on the consideration transferred ) D. Measured at NCI's proportionate share in DEF's net assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started