Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi plz help me with this error correction problem. ASAP. plz and thsnk you 4. In March 2023, Smith, Inc. is having its December 31,

Hi plz help me with this error correction problem. ASAP. plz and thsnk you

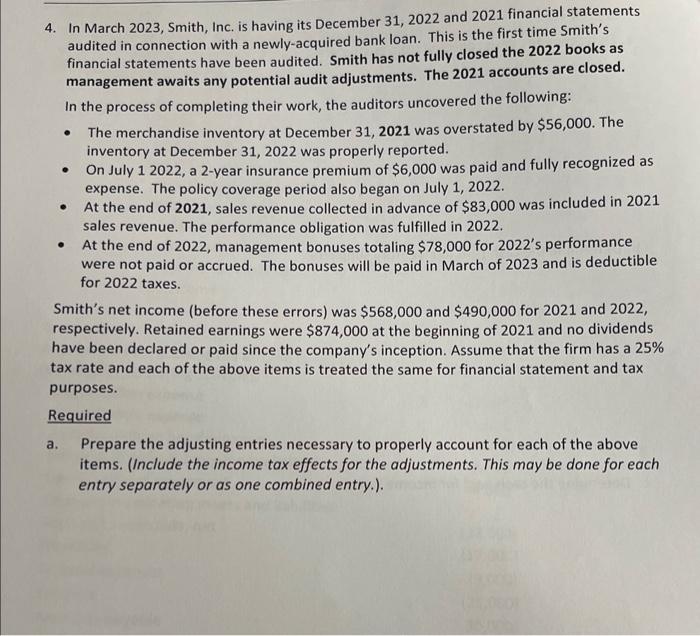

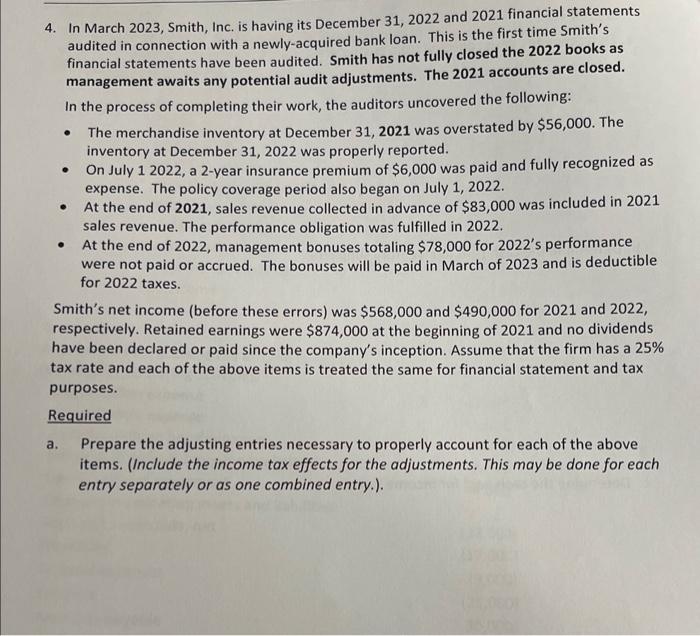

4. In March 2023, Smith, Inc. is having its December 31, 2022 and 2021 financial statements audited in connection with a newly-acquired bank loan. This is the first time Smith's financial statements have been audited. Smith has not fully closed the 2022 books as management awaits any potential audit adjustments. The 2021 accounts are closed. In the process of completing their work, the auditors uncovered the following: - The merchandise inventory at December 31,2021 was overstated by $56,000. The inventory at December 31,2022 was properly reported. - On July 12022 , a 2-year insurance premium of $6,000 was paid and fully recognized as expense. The policy coverage period also began on July 1,2022. - At the end of 2021, sales revenue collected in advance of $83,000 was included in 2021 sales revenue. The performance obligation was fulfilled in 2022. - At the end of 2022, management bonuses totaling $78,000 for 2022's performance were not paid or accrued. The bonuses will be paid in March of 2023 and is deductible for 2022 taxes. Smith's net income (before these errors) was $568,000 and $490,000 for 2021 and 2022 , respectively. Retained earnings were $874,000 at the beginning of 2021 and no dividends have been declared or paid since the company's inception. Assume that the firm has a 25% tax rate and each of the above items is treated the same for financial statement and tax purposes. Required a. Prepare the adjusting entries necessary to properly account for each of the above items. (Include the income tax effects for the adjustments. This may be done for each entry separately or as one combined entry.). Prepare the adjusted comparative statements of retained earnings for 2021 and 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started