Answered step by step

Verified Expert Solution

Question

1 Approved Answer

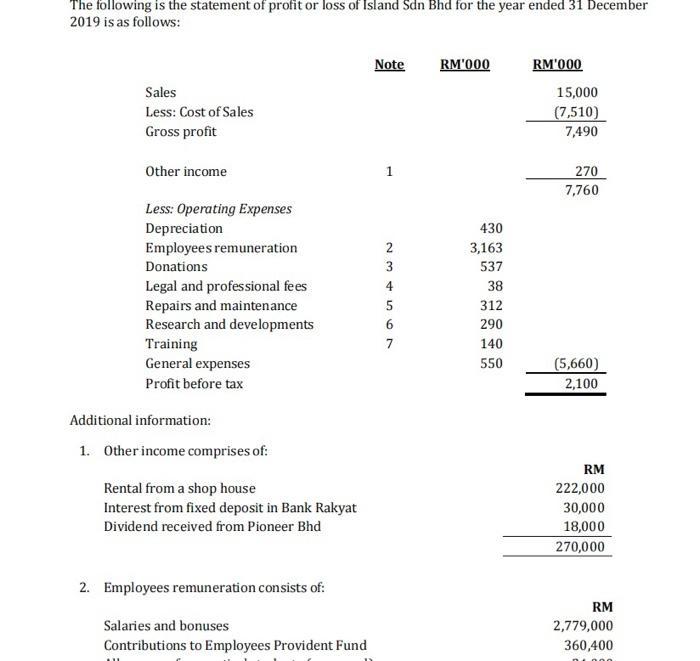

The following is the statement of profit or loss of Island Sdn Bhd for the year ended 31 December 2019 is as follows: Sales

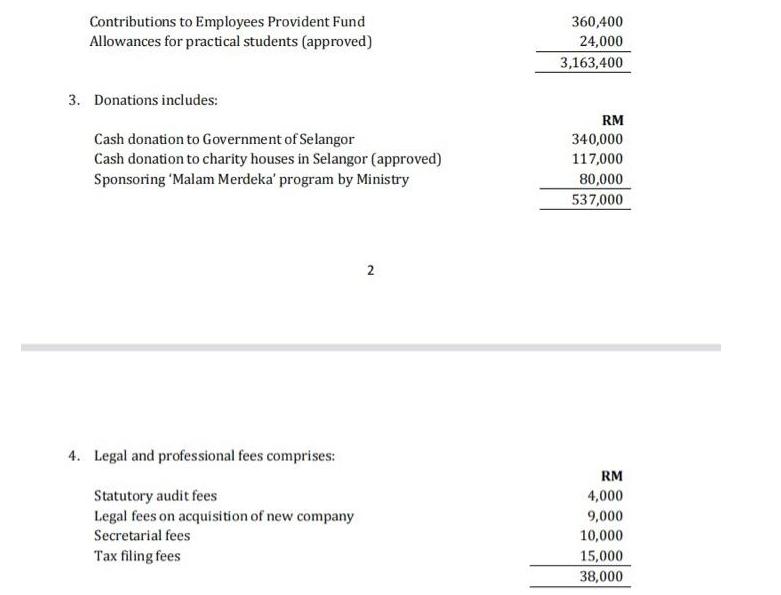

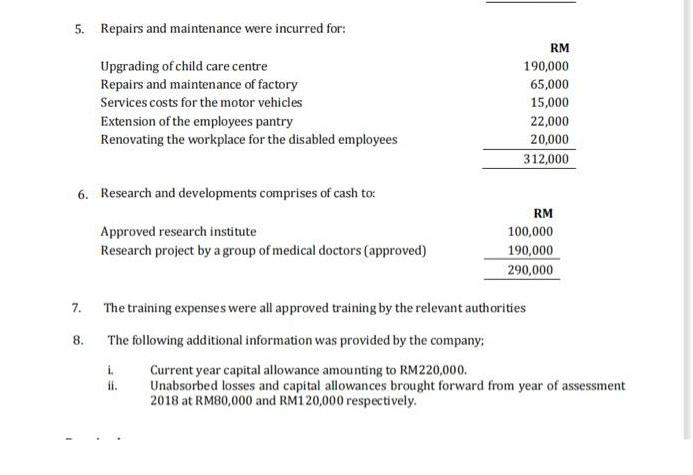

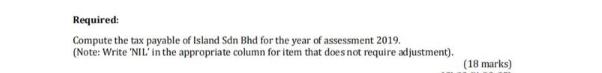

The following is the statement of profit or loss of Island Sdn Bhd for the year ended 31 December 2019 is as follows: Sales Less: Cost of Sales Gross profit Other income Less: Operating Expenses Depreciation Employees remuneration Donations Legal and professional fees Repairs and maintenance Research and developments Training General expenses Profit before tax Additional information: 1. Other income comprises of: Rental from a shop house Interest from fixed deposit in Bank Rakyat Dividend received from Pioneer Bhd 2. Employees remuneration consists of: Salaries and bonuses Contributions to Employees Provident Fund Note 1 234567 RM'000 430 3,163 537 38 312 290 140 550 RM'000 15,000 (7,510) 7,490 270 7,760 (5,660) 2,100 RM 222,000 30,000 18,000 270,000 RM 2,779,000 360,400 Contributions to Employees Provident Fund Allowances for practical students (approved) 3. Donations includes: Cash donation to Government of Selangor Cash donation to charity houses in Selangor (approved) Sponsoring 'Malam Merdeka' program by Ministry 4. Legal and professional fees comprises: Statutory audit fees Legal fees on acquisition of new company Secretarial fees Tax filing fees 2 360,400 24,000 3,163,400 RM 340,000 117,000 80,000 537,000 RM 4,000 9,000 10,000 15,000 38,000 5. Repairs and maintenance were incurred for: 6. Research and developments comprises of cash to: 7. Upgrading of child care centre Repairs and maintenance of factory Services costs for the motor vehicles Extension of the employees pantry Renovating the workplace for the disabled employees 8. Approved research institute Research project by a group of medical doctors (approved) RM 190,000 65,000 15,000 22,000 20,000 312,000 RM 100,000 190,000 290,000 The training expenses were all approved training by the relevant authorities The following additional information was provided by the company: L Current year capital allowance amounting to RM220,000. ii. Unabsorbed losses and capital allowances brought forward from year of assessment 2018 at RM80,000 and RM120,000 respectively. Required: Compute the tax payable of Island Sdn Bhd for the year of assessment 2019. (Note: Write "NIL' in the appropriate column for item that does not require adjustment). (18 marks)

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Here is a summary confirmation question that could be used to verify the buying condit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started