Hi really appreciate the help for these MC questions :)

Hi really appreciate the help for these MC questions :)

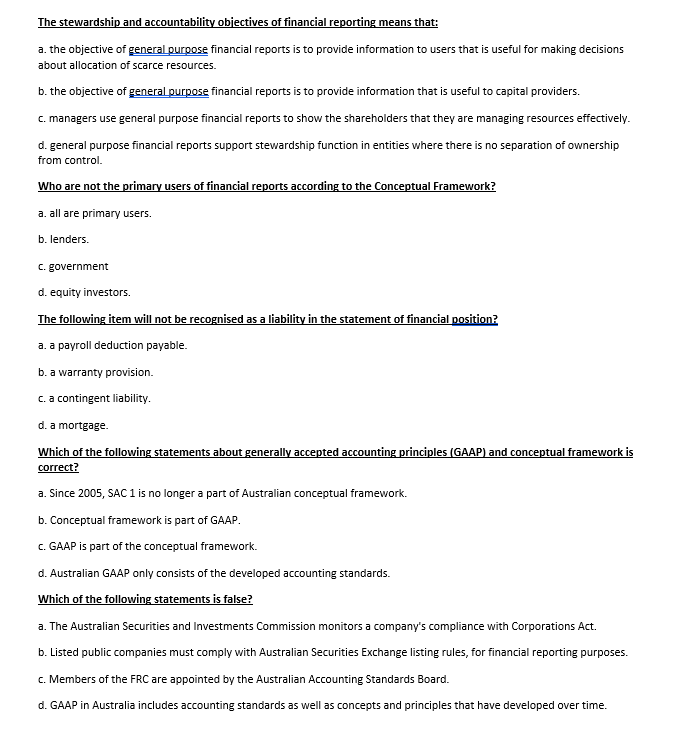

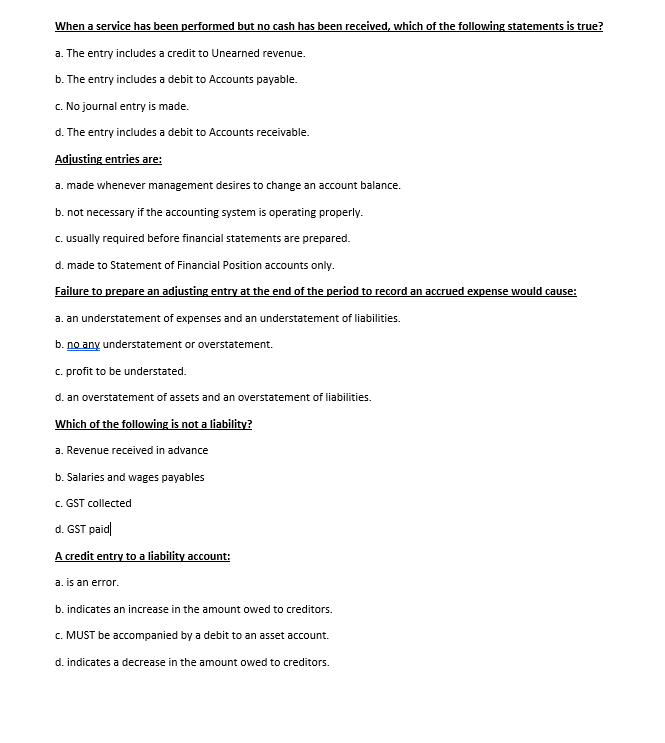

Which invoice layout in MYOB is most appropriate when recording inventory transactions? a. Service b. Professional c. Item d. Miscellaneous The Undeposited Funds Account in MYOB: a. Is cleared when the amounts receipted are actually banked b. Is used to assist with the reconciliation of the bank account C. All of these options d. Is a temporary clearing account recording each individual cash receipt When customer records are set up in MYOB to track accounts receivable, payments received from customers can be processed as: a. a general journal entry in Accounts module b. "Receive Money" in Banking module C. "Receive Payments" in the Sales Module d. All of these options A business has set up MYOB to use a perpetual inventory system. When a purchases of inventory on credit is processed the accounting result is: a. Dr Purchases, Dr GST Paid, Cr Accounts Payable b. Dr Inventory, Dr GST Paid, Cr Accounts Payable c. Dr Purchases, Dr GST Collected, Cr Accounts Payable d. Dr Inventory, Dr GST Collected, Cr Accounts Payable After navigating to the Purchases command centre and then selecting Pay Bills, MYOB allows users to record the following transactions: a. Cash payments made to suppliers b. None of these options c. Purchases on credit d. Cash receipts from suppliers The stewardship and accountability objectives of financial reporting means that: a. the objective of general purpose financial reports is to provide information to users that is useful for making decisions about allocation of scarce resources. b. the objective of general purpose financial reports is to provide information that is useful to capital providers. C. managers use general purpose financial reports to show the shareholders that they are managing resources effectively. d. general purpose financial reports support stewardship function in entities where there is no separation of ownership from control. Who are not the primary users of financial reports according to the Conceptual Framework? a. all are primary users. b. lenders. C. government d. equity investors. The following item will not be recognised as a liability in the statement of financial position? a. a payroll deduction payable. b. a warranty provision. c. a contingent liability d. a mortgage. Which of the following statements about generally accepted accounting principles (GAAP) and conceptual framework is correct? a. Since 2005, SAC 1 is no longer a part of Australian conceptual framework. b. Conceptual framework is part of GAAP. C. GAAP is part of the conceptual framework d. Australian GAAP only consists of the developed accounting standards. Which of the following statements is false? a. The Australian Securities and Investments Commission monitors a company's compliance with Corporations Act. b. Listed public companies must comply with Australian Securities Exchange listing rules, for financial reporting purposes. c. Members of the FRC are appointed by the Australian Accounting Standards Board. d. GAAP in Australia includes accounting standards as well as concepts and principles that have developed over time. When a service has been performed but no cash has been received, which of the following statements is true? a. The entry includes a credit to Unearned revenue. b. The entry includes a debit to Accounts payable. C. No journal entry is made. d. The entry includes a debit to Accounts receivable. Adjusting entries are: a. made whenever management desires to change an account balance. b. not necessary if the accounting system is operating properly. C. Usually required before financial statements are prepared. d. made to Statement of Financial Position accounts only. Failure to prepare an adjusting entry at the end of the period to record an accrued expense would cause: a. an understatement of expenses and an understatement of liabilities. b. no any understatement or overstatement. c. profit to be understated. d. an overstatement of assets and an overstatement of liabilities. Which of the following is not a liability? a. Revenue received in advance b. Salaries and wages payables C. GST collected d. GST paid A credit entry to a liability account: a. is an error b. indicates an increase in the amount owed to creditors. C. MUST be accompanied by a debit to an asset account. d. indicates a decrease in the amount owed to creditors

Hi really appreciate the help for these MC questions :)

Hi really appreciate the help for these MC questions :)