Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, There are FOUR parts in the case. First part had been answered already. I need answers to parts 2,3 and 4. It's due soon.

Hi, There are FOUR parts in the case. First part had been answered already. I need answers to parts 2,3 and 4. It's due soon. Thanks in advance.

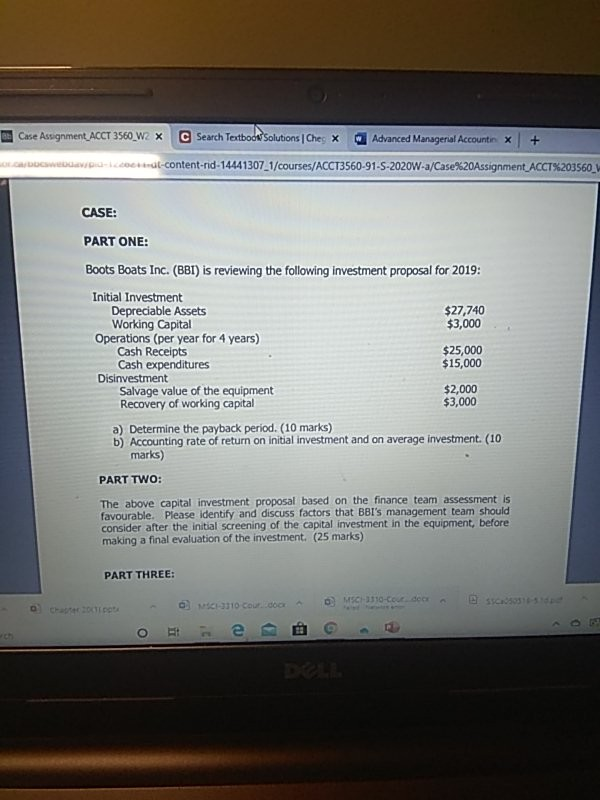

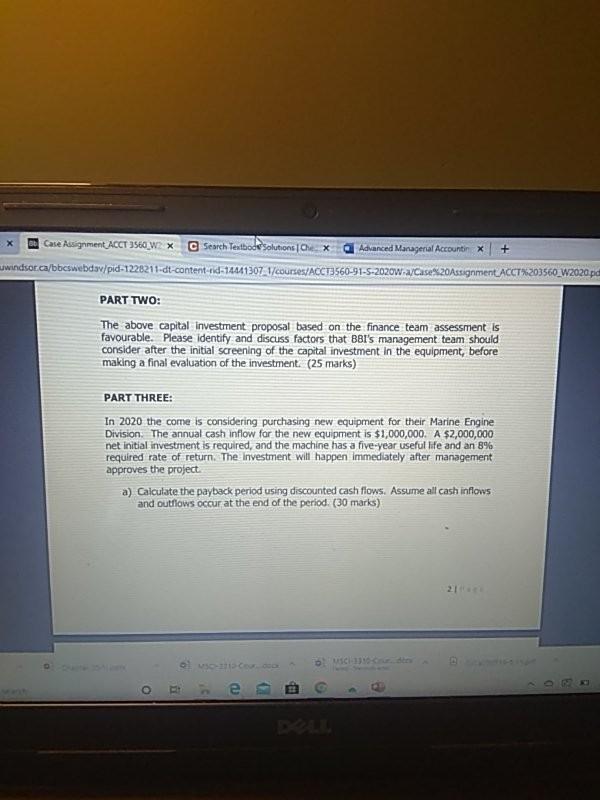

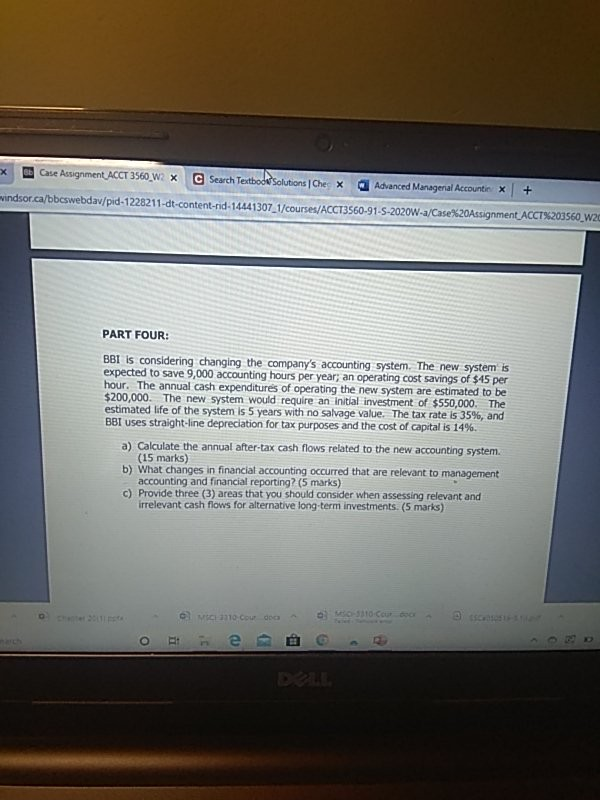

m Case Assignment_ACCT 3560_W2 X Search Textboon Solutions Ches * Advanced Managerial Account | + D V D -content-rid-14441307_1/courses/ACCT3560-91-5-2020W-a/Case%20Assignment ACCT%203560_W CASE: PART ONE: Boots Boats Inc. (BBI) is reviewing the following Investment proposal for 2019: $27,740 $3,000 Initial Investment Depreciable Assets Working Capital Operations (per year for 4 years) Cash Receipts Cash expenditures Disinvestment Salvage value of the equipment Recovery of working capital $25,000 $15,000 $2,000 $3,000 a) Determine the payback period. (10 marks) b) Accounting rate of return on initial investment and on average Investment. (10 marks) PART TWO: The above capital investment proposal based on the finance team assessment is favourable. Please identify and discuss factors that BBI's management team should consider after the initial screening of the capital investment in the equipment before making a final evaluation of the investment. (25 marks) PART THREE: - O Courses Care Assignment ACCT 380 W X Search Textbode solutions O. Advanced Manageral Accountir x + wwindsor.ca/bbcswebdav/pid-1228211-dt-content-rid-144413071/courses/ACCT3560-91-5-2020W-a/Case%20Assignment_ACCT%203560_W2020 pd PART TWO: The above capital Investment proposal based on the finance team assessment is favourable. Please identify and discuss factors that BBI's management team should consider after the initial screening of the capital investment in the equipment, before making a final evaluation of the investment. (25 marks) PART THREE: In 2020 the come is considering purchasing new equipment for their Marine Engine Division. The annual cash inflow for the new equipment is $1,000,000. A $2,000,000 net initial investment is required, and the machine has a five-year useful life and an 8% required rate of return. The Investment will happen immediately after management approves the project a) Calculate the payback period using discounted cash flows. Assume all cash inflows and outflows occur at the end of the period. (30 marks) * Case Assignment ACCT 3560 W X Search Textbook Solutions | Che X a Advanced Managerial Accountie x + windsor.ca/bbcswebdav/pid-1228211-dt-content-rid-14441307_1/courses/ACCT3560-91-5-2020W-a/Case%20Assignment ACCT%203560_W20 PART FOUR: BBT is considering changing the company's accounting system. The new system is expected to save 9,000 accounting hours per year; an operating cost savings of $45 per hour. The annual cash expenditures of operating the new system are estimated to be $200,000. The new system would require an initial investment of $550,000. The estimated life of the system is 5 years with no salvage value. The tax rate is 35%, and BBI uses straight-line depreciation for tax purposes and the cost of capital is 14%. a) Calculate the annual after-tax cash flows related to the new accounting system. (15 marks) b) What changes in financial accounting occurred that are relevant to management accounting and financial reporting? (5 marks) C) Provide three (3) areas that you should consider when assessing relevant and irrelevant cash flows for alternative long term investments (5 marks) D el McCour dooooooooo m Case Assignment_ACCT 3560_W2 X Search Textboon Solutions Ches * Advanced Managerial Account | + D V D -content-rid-14441307_1/courses/ACCT3560-91-5-2020W-a/Case%20Assignment ACCT%203560_W CASE: PART ONE: Boots Boats Inc. (BBI) is reviewing the following Investment proposal for 2019: $27,740 $3,000 Initial Investment Depreciable Assets Working Capital Operations (per year for 4 years) Cash Receipts Cash expenditures Disinvestment Salvage value of the equipment Recovery of working capital $25,000 $15,000 $2,000 $3,000 a) Determine the payback period. (10 marks) b) Accounting rate of return on initial investment and on average Investment. (10 marks) PART TWO: The above capital investment proposal based on the finance team assessment is favourable. Please identify and discuss factors that BBI's management team should consider after the initial screening of the capital investment in the equipment before making a final evaluation of the investment. (25 marks) PART THREE: - O Courses Care Assignment ACCT 380 W X Search Textbode solutions O. Advanced Manageral Accountir x + wwindsor.ca/bbcswebdav/pid-1228211-dt-content-rid-144413071/courses/ACCT3560-91-5-2020W-a/Case%20Assignment_ACCT%203560_W2020 pd PART TWO: The above capital Investment proposal based on the finance team assessment is favourable. Please identify and discuss factors that BBI's management team should consider after the initial screening of the capital investment in the equipment, before making a final evaluation of the investment. (25 marks) PART THREE: In 2020 the come is considering purchasing new equipment for their Marine Engine Division. The annual cash inflow for the new equipment is $1,000,000. A $2,000,000 net initial investment is required, and the machine has a five-year useful life and an 8% required rate of return. The Investment will happen immediately after management approves the project a) Calculate the payback period using discounted cash flows. Assume all cash inflows and outflows occur at the end of the period. (30 marks) * Case Assignment ACCT 3560 W X Search Textbook Solutions | Che X a Advanced Managerial Accountie x + windsor.ca/bbcswebdav/pid-1228211-dt-content-rid-14441307_1/courses/ACCT3560-91-5-2020W-a/Case%20Assignment ACCT%203560_W20 PART FOUR: BBT is considering changing the company's accounting system. The new system is expected to save 9,000 accounting hours per year; an operating cost savings of $45 per hour. The annual cash expenditures of operating the new system are estimated to be $200,000. The new system would require an initial investment of $550,000. The estimated life of the system is 5 years with no salvage value. The tax rate is 35%, and BBI uses straight-line depreciation for tax purposes and the cost of capital is 14%. a) Calculate the annual after-tax cash flows related to the new accounting system. (15 marks) b) What changes in financial accounting occurred that are relevant to management accounting and financial reporting? (5 marks) C) Provide three (3) areas that you should consider when assessing relevant and irrelevant cash flows for alternative long term investments (5 marks) D el McCour doooooooooStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started