Hi there, can you help with these practice questions. I am confused.

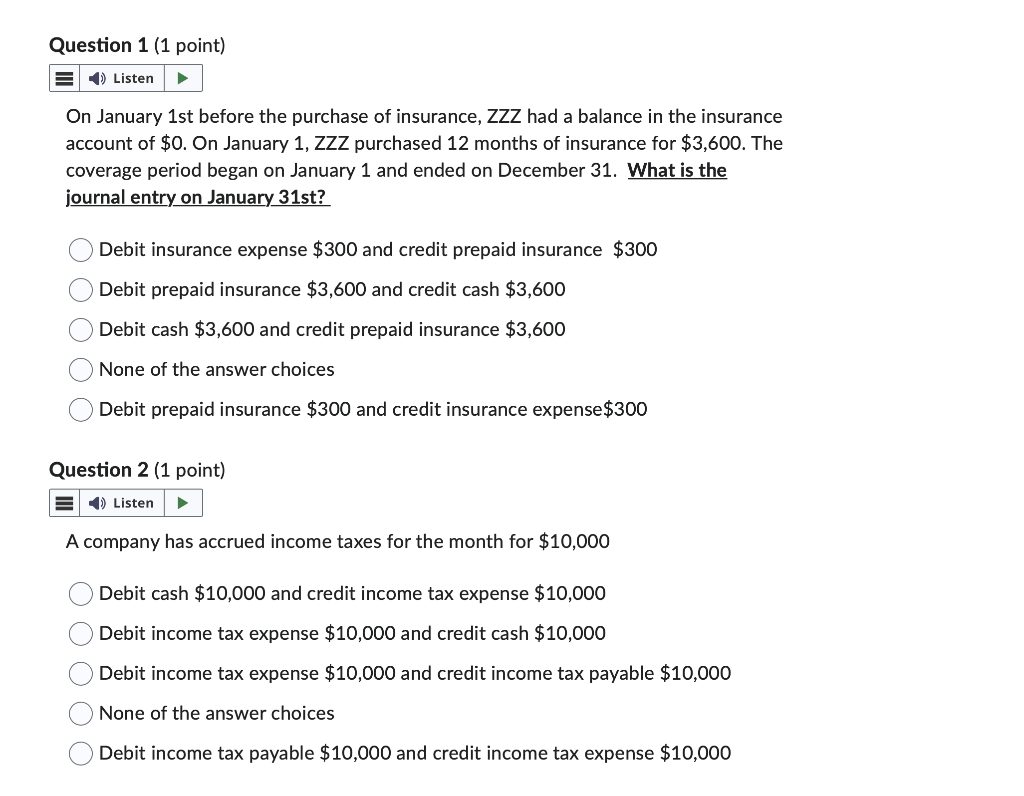

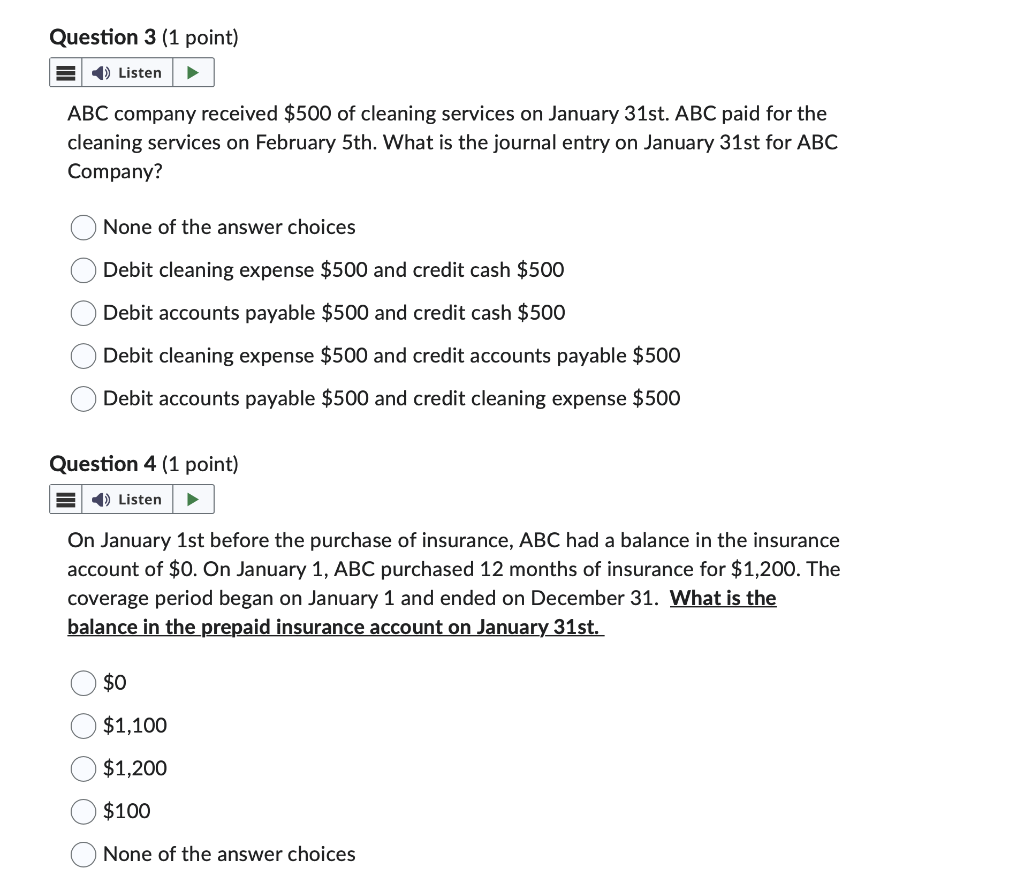

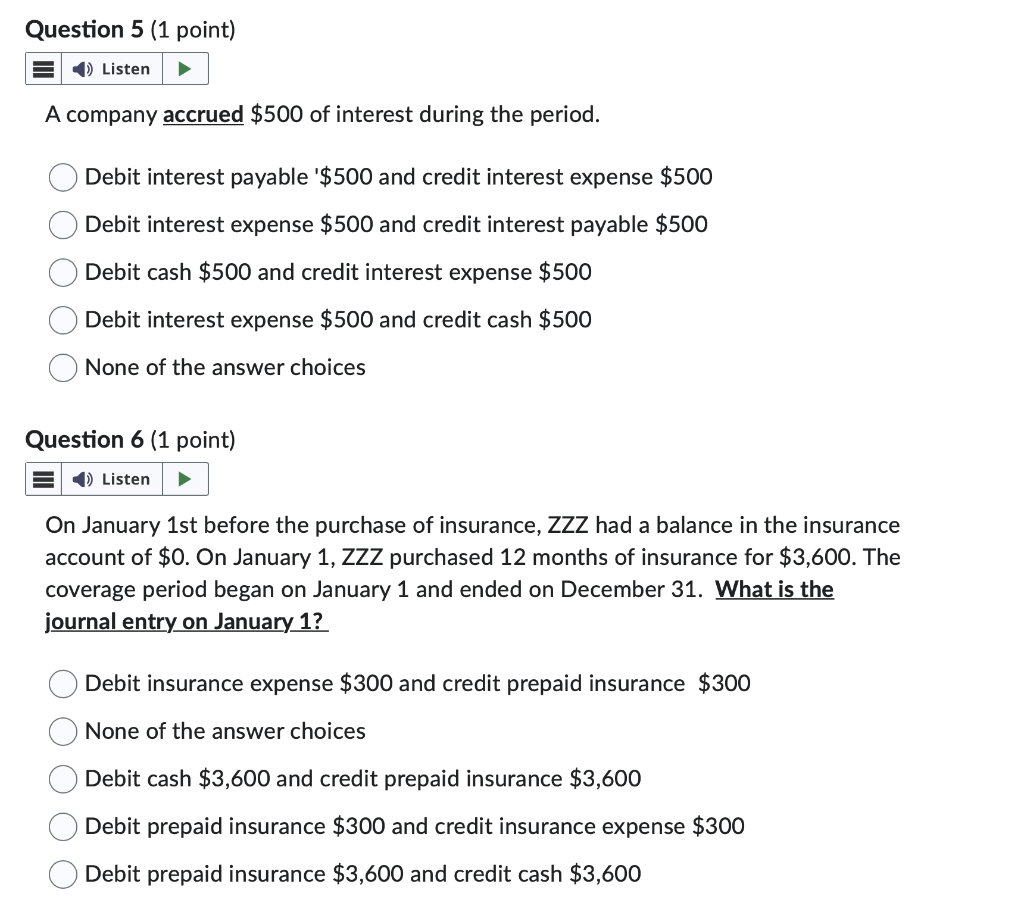

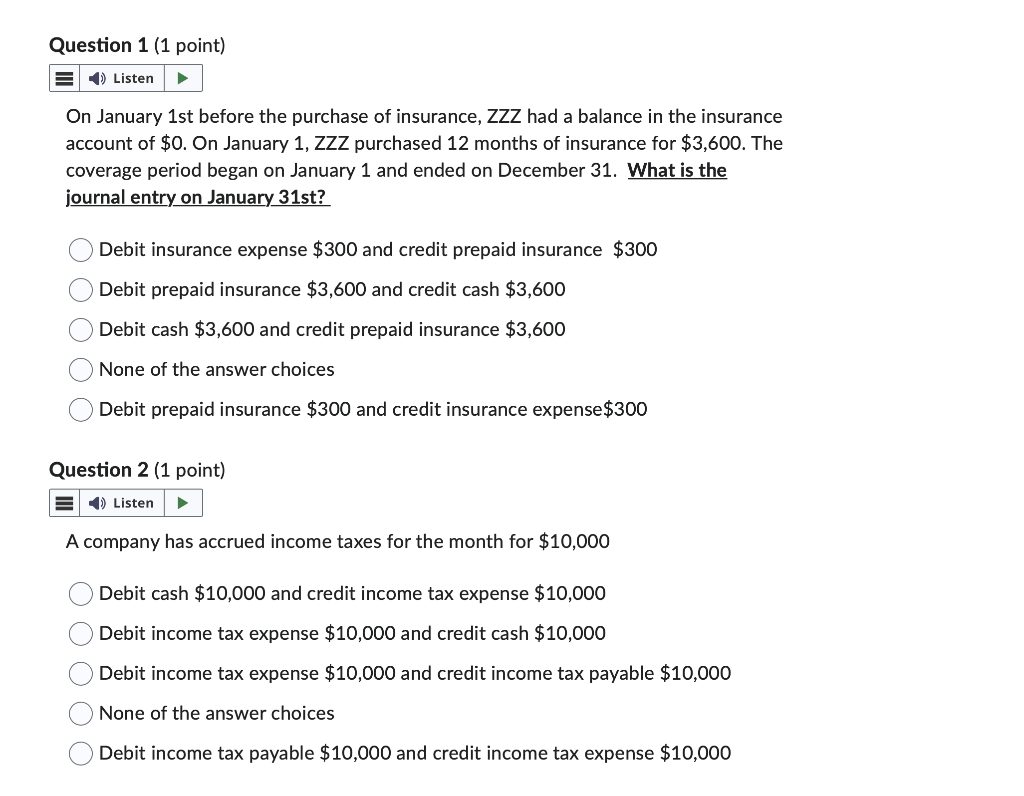

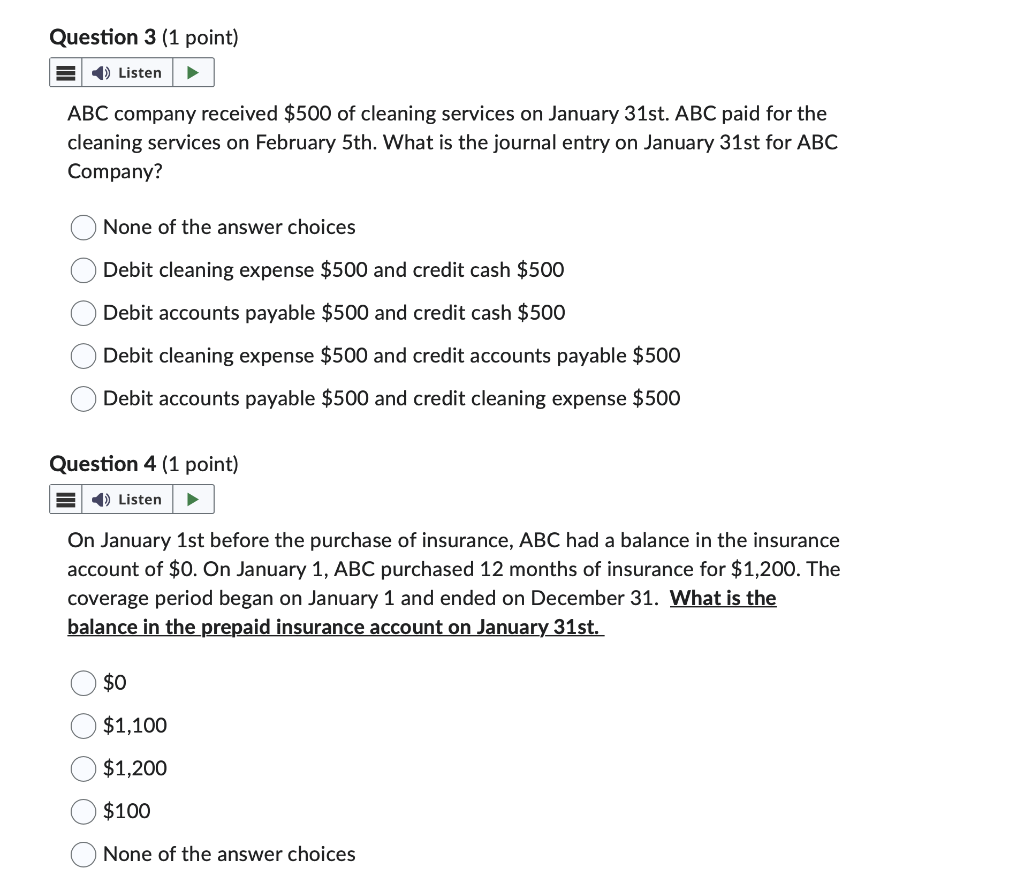

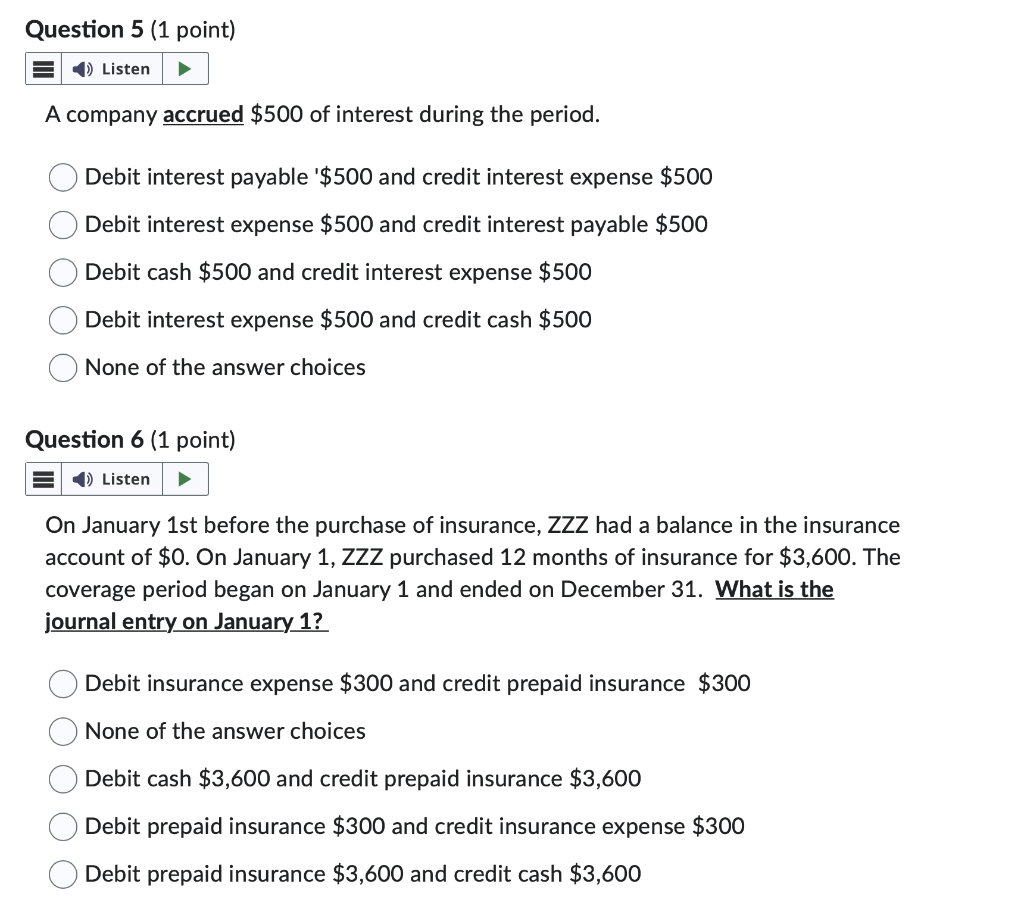

On January 1st before the purchase of insurance, ZZZ had a balance in the insurance account of $0. On January 1 , ZZZ purchased 12 months of insurance for $3,600. The coverage period began on January 1 and ended on December 31 . What is the journal entry on January 31 st? Debit insurance expense $300 and credit prepaid insurance $300 Debit prepaid insurance $3,600 and credit cash $3,600 Debit cash $3,600 and credit prepaid insurance $3,600 None of the answer choices Debit prepaid insurance $300 and credit insurance expense $300 Question 2 (1 point) A company has accrued income taxes for the month for $10,000 Debit cash $10,000 and credit income tax expense $10,000 Debit income tax expense $10,000 and credit cash $10,000 Debit income tax expense $10,000 and credit income tax payable $10,000 None of the answer choices Debit income tax payable $10,000 and credit income tax expense $10,000 ABC company received $500 of cleaning services on January 31st. ABC paid for the cleaning services on February 5 th. What is the journal entry on January 31st for ABC Company? None of the answer choices Debit cleaning expense $500 and credit cash $500 Debit accounts payable $500 and credit cash $500 Debit cleaning expense $500 and credit accounts payable $500 Debit accounts payable $500 and credit cleaning expense $500 Question 4 (1 point) On January 1st before the purchase of insurance, ABC had a balance in the insurance account of $0. On January 1,ABC purchased 12 months of insurance for $1,200. The coverage period began on January 1 and ended on December 31 . What is the balance in the prepaid insurance account on January 31 st. $0 $1,100 $1,200 $100 None of the answer choices A company accrued $500 of interest during the period. Debit interest payable ' $500 and credit interest expense $500 Debit interest expense $500 and credit interest payable $500 Debit cash $500 and credit interest expense $500 Debit interest expense $500 and credit cash $500 None of the answer choices Question 6 (1 point) On January 1st before the purchase of insurance, ZZZ had a balance in the insurance account of $0. On January 1, ZZZ purchased 12 months of insurance for $3,600. The coverage period began on January 1 and ended on December 31 . What is the journal entry on January 1? Debit insurance expense $300 and credit prepaid insurance $300 None of the answer choices Debit cash $3,600 and credit prepaid insurance $3,600 Debit prepaid insurance $300 and credit insurance expense $300 Debit prepaid insurance $3,600 and credit cash $3,600