hi there can you please explain and answer questions 7-11 ( disregard scribbles/writting on paper)

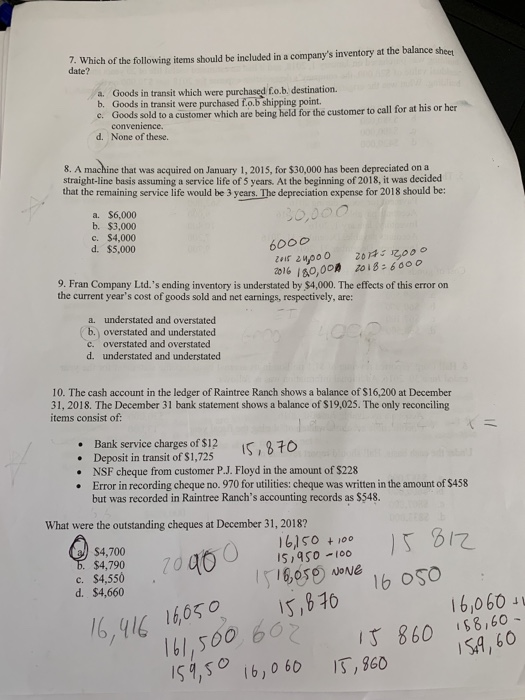

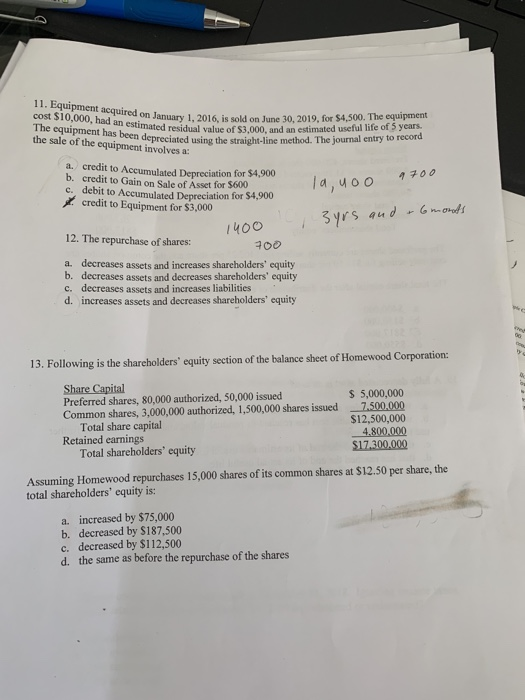

7. Which of the following items should be included in a company's inventory at the balance sheet date? a. Goods in transit which were purchased f.o.b. destination. b. Goods in transit were purchased f.ob shipping point. c. Goods sold to a customer which are being held for the customer to call for at his or her convenience. d. None of these. 8. A machine that was acquired on January 1, 2015. for $30,000 has been depreciated on a straight-line basis assuming a service life of 5 years. At the beginning of 2018, it was decided that the remaining service life would be 3 years. The depreciation expense for 2018 should be: a. $6,000 b. $3,000 c. $4,000 d. $5.000 6000 2018 2400 2016 120,00 20 :00 2018: 6000 9. Fran Company Ltd.'s ending inventory is understated by $4,000. The effects of this error on the current year's cost of goods sold and net earnings, respectively, are: a. understated and overstated (b. overstated and understated c. overstated and overstated d. understated and understated 10. The cash account in the ledger of Raintree Ranch shows a balance of $16,200 at December 31, 2018. The December 31 bank statement shows a balance of $19.025. The only reconciling items consist of: - Bank service charges of $12 15870 Deposit in transit of $1,725 NSF cheque from customer P.J. Floyd in the amount of $228 Error in recording cheque no. 970 for utilities: cheque was written in the amount of $458 but was recorded in Raintree Ranch's accounting records as $548. 812 15 What were the outstanding cheques at December 31, 2018? 16150 +100 $4.700 6. $4,790 c. $4,550 1516050 NONE 16050 d. $4,660 15,950 100 2090 16,050 15, 870 " 16,060th 16,416 16,050 161,500 60% 15860 188,60 - 1549,60 159,50 16,060 15,860 11. Equipment acquired on January 1, 2016, is sold cost $10,000, had an estimated residual value of The equipment has been depreciated using the straig the sale of the equipment involves a: od on January 1. 2016. is sold on June 30. 2019. for $4.500. The equipment estimated residual value of $3.000, and an estimated useful life of 5 years. in depreciated using the straight-line method. The journal entry to record la, uoo 9700 3 yrs and 6 monts a. credit to Accumulated Depreciation for $4.900 b. credit to Gain on Sale of Asset for $600 c. debit to Accumulated Depreciation for $4.900 credit to Equipment for $3,000 I 1400 12. The repurchase of shares: 700 a. decreases assets and increases shareholders' equity b. decreases assets and decreases shareholders' equity c. decreases assets and increases liabilities d. increases assets and decreases shareholders' equity 13. Following is the shareholders' equity section of the balance sheet of Homewood Corporation: Share Capital Preferred shares, 80,000 authorized, 50,000 issued Common shares, 3,000,000 authorized, 1,500,000 shares issued Total share capital Retained earnings Total shareholders' equity $ 5,000,000 7.500.000 $12,500,000 4.800.000 $17.300.000 Assuming Homewood repurchases 15,000 shares of its common shares at $12.50 per share, the total shareholders' equity is: a. increased by $75,000 b. decreased by $187.500 c. decreased by $112,500 d. the same as before the repurchase of the shares