Question

Hi there, could you please help me answer this question? Building a Bigger Castle It was Tuesday morning and Sarah Bains had cleared her schedule

Hi there, could you please help me answer this question?

Building a Bigger Castle

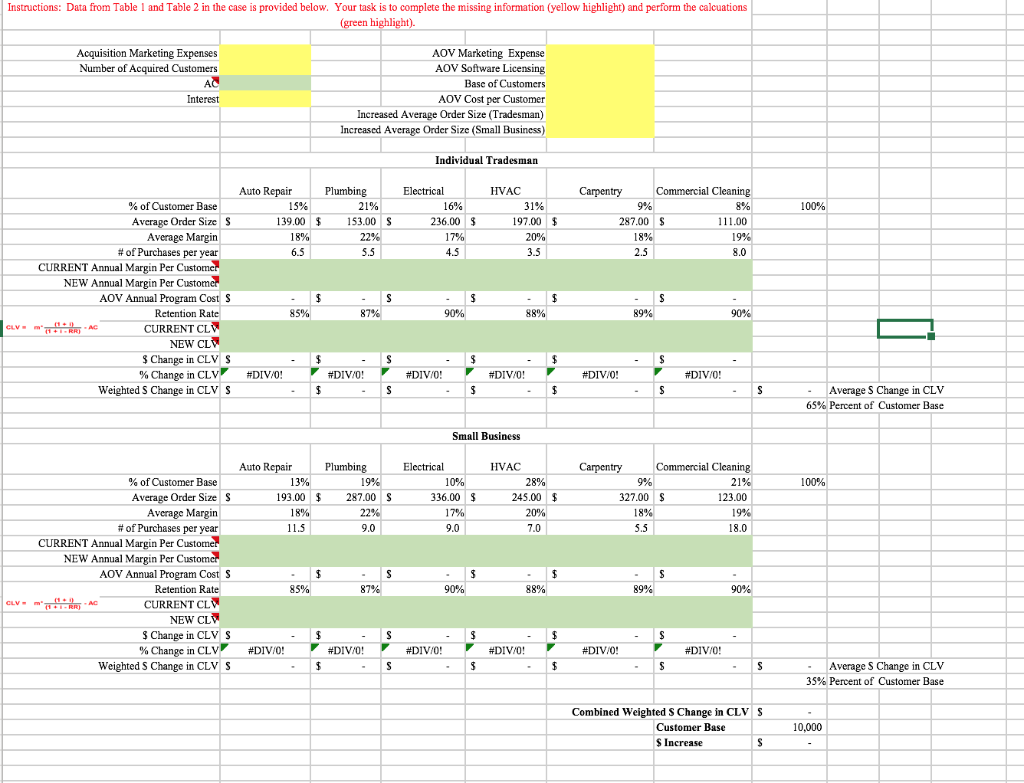

It was Tuesday morning and Sarah Bains had cleared her schedule to develop an analysis to support the incremental marketing budget she planned on asking the new CMO, Boyd Nivens, for on Friday. Sarah was the senior director of marketing for Castle Products. The company manufactured and sold maintenance supplies used in industrial applications, such as cleaners, degreasers, lubricants and drain openers through its ecommerce website. The companys products were used by customers in a range of professions including auto repair, carpentry, plumbing, electrical, and HVAC. Castle Products customers based was comprised of small businesses and independent tradesman. Small businesses represented 35% of the companys customer base.

Having been with the company for five years, she had observed that when the company acquired a new customer that customer typically remained a customer for many years. However, she also observed that most existing customers reordered the same items, rarely buying new items the company added to its product line. The companys product line included over 235 individual SKUs, across a range of categories. Almost all of the companys marketing efforts were focused on new customer acquisition.

Sarah believed, that the company needed to focus not only on acquiring new customers, but on building the average order value (AOV) of its existing base of customers. She wanted to invest in upsell marketing and software that would automate product placements using aggregated behavioral data (those that viewed this, also viewed that) and personal recommendations (you previously bought this and might like that). She estimated the incremental marketing expense to support this new AOV program would run about $30,000 per year, plus the licensing cost of the software which was $40,000 per year. With 10,000 active customers, the annual cost per customer for this AOV marketing program would be $7. Sarah questioned if she could justify the budget request, given the multi-year licensing requirement for the software.

Where to Start?

Sarah realized that to substantiate a request for incremental marketing budget to support a marketing program to upsell her existing customers, she needed to first understand the economic value that existing customers brought to the company. This required understanding three critical factors:

- The cost to acquire a customer.

- The annual profit the company generated from each customer.

- The length of time a customer does business with the company.

Customer Acquisition Costs

Castles online marketing efforts to acquire new customers consisted of banner advertising, paid per-click placement, opt-in email, affiliate partnering programs, customer referral and search engine optimization. In total, the company spent $168,000 each year in its acquisition marketing effort. These marketing efforts resulted in the company pretty consistently acquiring about 900 new customers per year.

Customer Profitability

Sarah had gathered historical sales data on the companys customers. In reviewing the data, she observed that while loyalty was similar across all types of customers (e.g., individual tradesman or small business) and trades (e.g., plumbing, electrical, auto repair, etc.), purchasing behavior differed quite significantly. To effectively measure customer economic value, Sarah felt the analysis would need to be done by customer segment.

Customer Lifetime

Castle has a good reputation in the trades for providing high quality products at very reasonable prices. The company was prompt to address customer issues, maintained a large inventory of product and provided free shipping for all orders over $100. These practices earned Castle high customer loyalty that translated into customer retention rates of 85% - 90% depending on the segment of customer.

Calculating Customer Lifetime Value

Sarah consolidated the data she had collected into a table, organizing the information by type of customer across trade groups (see Table 1: Castle Tradesman Segments & Table 2: Castle Small Business Segments). Realizing that she needed to take into account that cash flow received from customers today is more valuable than cash flow that would be received by the company in the future, she had asked Castles CFO what discount rate she should factor in her calculation. The CFO recommended that she use 10%, which was the annual interest rate that Castle could obtain through its cash investments.

Table 1: Castle Tradesman Segment

| Auto Repair | Plumbing | Electrical | HVAC | Carpentry | Commercial Cleaning | |

| % of Customer Base | 15% | 21% | 16% | 31% | 9% | 8% |

| Average Order Size | $139.00 | $153.00 | $236.00 | $197.00 | $287.00 | $111.00 |

| Average Margin | 18% | 22% | 17% | 20% | 18% | 19% |

| # of Purchases per year | 6.5 | 5.5 | 4.5 | 3.5 | 2.5 | 8.0 |

| Retention Rate | 85% | 87% | 90% | 88% | 89% | 90% |

Table 2: Castle Small Business Segments

| Auto Repair | Plumbing | Electrical | HVAC | Carpentry | Commercial Cleaning | |

| % of Customer Base | 13% | 19% | 10% | 28% | 9% | 21% |

| Average Order Size | $193.00 | $287.00 | $336.00 | $245.00 | $327.00 | $123.00 |

| Average Margin | 18% | 22% | 17% | 20% | 18% | 19% |

| # of Purchases per year | 11.5 | 9.0 | 9.0 | 7.0 | 5.5 | 18.0 |

| Retention Rate | 85% | 87% | 90% | 88% | 89% | 90% |

Justifying the Investment

While the $70,000 a year incremental budget request represented an almost 42% increase to her annual marketing budget, Sarah felt strongly that the investment would pay off. She had attended an industrial products conference earlier that year and learned from a peer that when his company implemented a similar AOV program to the one that she wanted to propose their average order size increased by 8% for their small businesses, but only 3% for individual tradesman.

With her office door closed, Sarah pulled up a spreadsheet and set out to analyze the data.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started