Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi there, I just need the answers to C and D please. Thank you!! 10. Pension Benefits. (Obj. 2) On August 10, 2020, Don turned

Hi there, I just need the answers to C and D please. Thank you!!

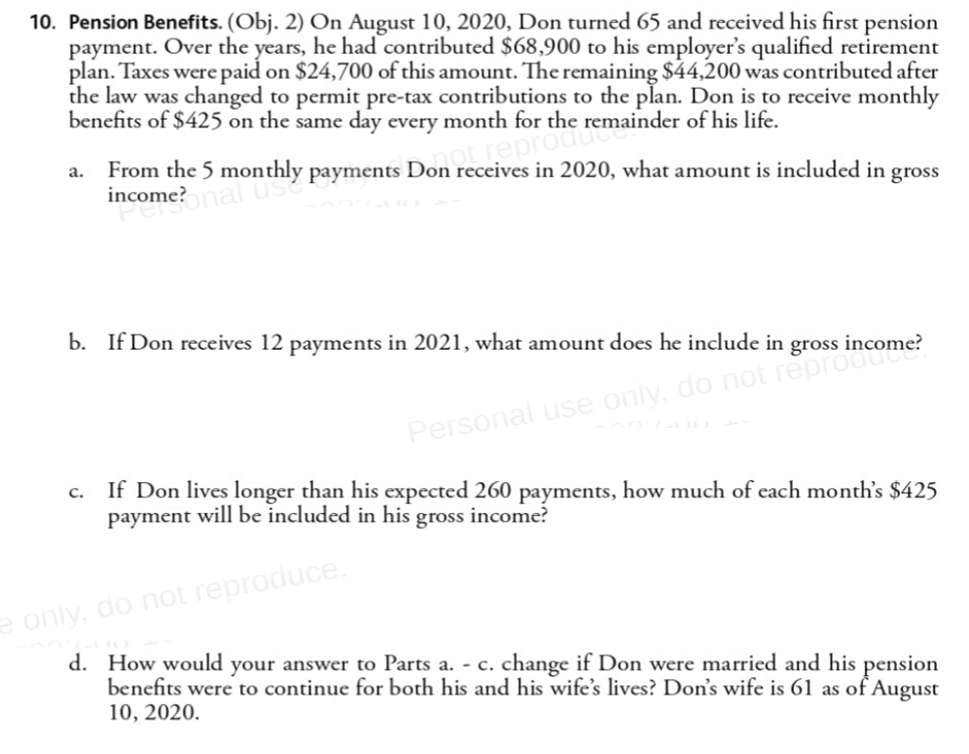

10. Pension Benefits. (Obj. 2) On August 10, 2020, Don turned 65 and received his first pension payment. Over the years, he had contributed $68,900 to his employer's qualified retirement plan. Taxes were paid on $24,700 of this amount. The remaining $44,200 was contributed after the law was changed to permit pre-tax contributions to the plan. Don is to receive monthly benefits of $425 on the same day every month for the remainder of his life. a. From the 5 monthly payments Don receives in 2020 , what amount is included in gross income? b. If Don receives 12 payments in 2021, what amount does he include in gross income? c. If Don lives longer than his expected 260 payments, how much of each month's $425 payment will be included in his gross income? d. How would your answer to Parts a. - c. change if Don were married and his pension benefits were to continue for both his and his wife's lives? Don's wife is 61 as of August 10,2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started