Hi there!

I require assistance for questions 1.1 to 1.4 as given in the pictures. Please may all calculations AND explanations be included in the answers. For revision and understanding purposes, please avoid vague or basic answers.

In addition, the answers should be according to mark allocation and and IFRS/IAS Accounting Standards and pronciples.

If required:

Vat Rate South Africa : 15%

Company Tax Rate South Africa : 28%

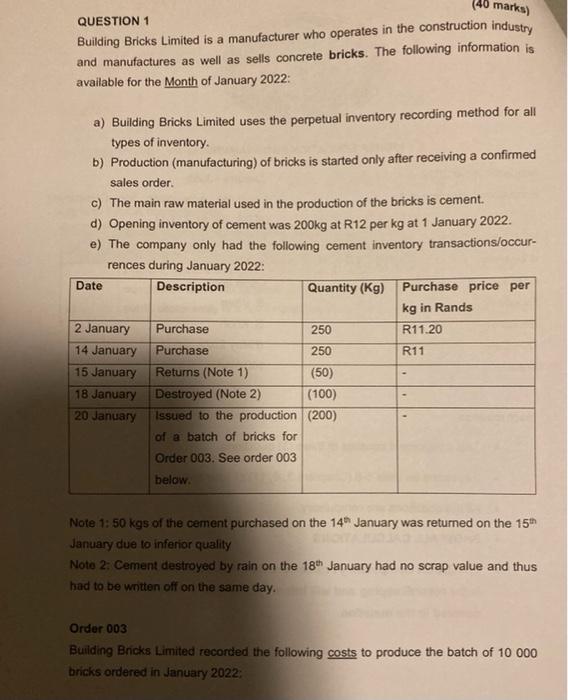

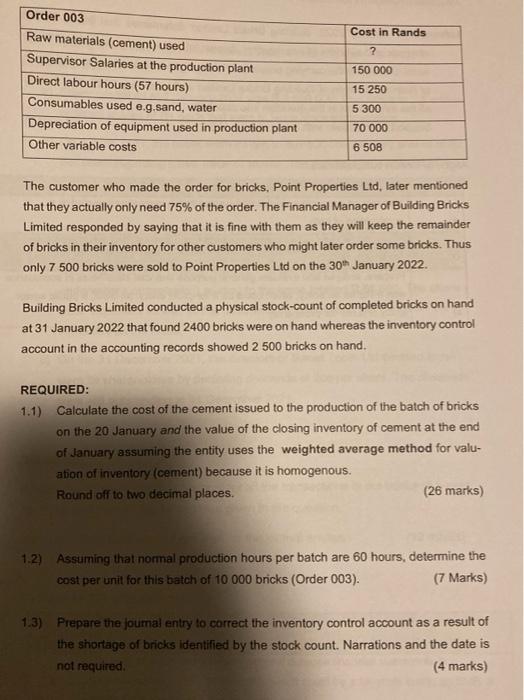

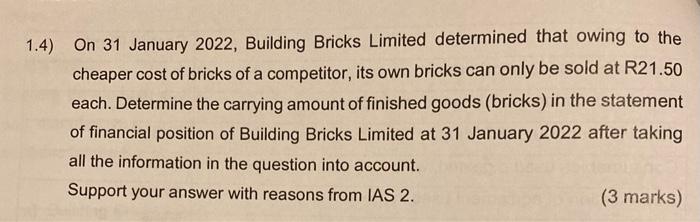

(40 marks) QUESTION 1 Building Bricks Limited is a manufacturer who operates in the construction industry and manufactures as well as sells concrete bricks. The following information is available for the Month of January 2022: a) Building Bricks Limited uses the perpetual inventory recording method for all types of inventory. b) Production (manufacturing) of bricks is started only after receiving a confirmed sales order. c) The main raw material used in the production of the bricks is cement. d) Opening inventory of cement was 200kg at R12 per kg at 1 January 2022. e) The company only had the following cement inventory transactions/occur- rences during January 2022: Date Description Quantity (Kg) Purchase price per kg in Rands 2 January Purchase 250 R11.20 14 January Purchase 250 R11 15 January Returns (Note 1) (50) 18 January Destroyed (Note 2) (100) 20 January (200) Issued to the production of a batch of bricks for Order 003. See order 003 below. Note 1: 50 kgs of the cement purchased on the 14th January was returned on the 15th January due to inferior quality Note 2: Cement destroyed by rain on the 18th January had no scrap value and thus had to be written off on the same day. Order 003 Building Bricks Limited recorded the following costs to produce the batch of 10 000 bricks ordered in January 2022: Order 003 Cost in Rands Raw materials (cement) used ? Supervisor Salaries at the production plant 150 000 Direct labour hours (57 hours) 15.250 Consumables used e.g.sand, water 5 300 Depreciation of equipment used in production plant 70 000 Other variable costs 6 508 The customer who made the order for bricks, Point Properties Ltd, later mentioned that they actually only need 75% of the order. The Financial Manager of Building Bricks Limited responded by saying that it is fine with them as they will keep the remainder of bricks in their inventory for other customers who might later order some bricks. Thus only 7 500 bricks were sold to Point Properties Ltd on the 30th January 2022. Building Bricks Limited conducted a physical stock-count of completed bricks on hand at 31 January 2022 that found 2400 bricks were on hand whereas the inventory control account in the accounting records showed 2 500 bricks on hand. REQUIRED: 1.1) Calculate the cost of the cement issued to the production of the batch of bricks on the 20 January and the value of the closing inventory of cement at the end of January assuming the entity uses the weighted average method for valu- ation of inventory (cement) because it is homogenous. Round off to two decimal places. (26 marks) 1.2) Assuming that normal production hours per batch are 60 hours, determine the cost per unit for this batch of 10 000 bricks (Order 003). (7 Marks) 1.3) Prepare the journal entry to correct the inventory control account as a result of the shortage of bricks identified by the stock count. Narrations and the date not required. (4 marks) 1.4) On 31 January 2022, Building Bricks Limited determined that owing to the cheaper cost of bricks of a competitor, its own bricks can only be sold at R21.50 each. Determine the carrying amount of finished goods (bricks) in the statement of financial position of Building Bricks Limited at 31 January 2022 after taking all the information in the question into account. Support your answer with reasons from IAS 2. (3 marks) (40 marks) QUESTION 1 Building Bricks Limited is a manufacturer who operates in the construction industry and manufactures as well as sells concrete bricks. The following information is available for the Month of January 2022: a) Building Bricks Limited uses the perpetual inventory recording method for all types of inventory. b) Production (manufacturing) of bricks is started only after receiving a confirmed sales order. c) The main raw material used in the production of the bricks is cement. d) Opening inventory of cement was 200kg at R12 per kg at 1 January 2022. e) The company only had the following cement inventory transactions/occur- rences during January 2022: Date Description Quantity (Kg) Purchase price per kg in Rands 2 January Purchase 250 R11.20 14 January Purchase 250 R11 15 January Returns (Note 1) (50) 18 January Destroyed (Note 2) (100) 20 January (200) Issued to the production of a batch of bricks for Order 003. See order 003 below. Note 1: 50 kgs of the cement purchased on the 14th January was returned on the 15th January due to inferior quality Note 2: Cement destroyed by rain on the 18th January had no scrap value and thus had to be written off on the same day. Order 003 Building Bricks Limited recorded the following costs to produce the batch of 10 000 bricks ordered in January 2022: Order 003 Cost in Rands Raw materials (cement) used ? Supervisor Salaries at the production plant 150 000 Direct labour hours (57 hours) 15.250 Consumables used e.g.sand, water 5 300 Depreciation of equipment used in production plant 70 000 Other variable costs 6 508 The customer who made the order for bricks, Point Properties Ltd, later mentioned that they actually only need 75% of the order. The Financial Manager of Building Bricks Limited responded by saying that it is fine with them as they will keep the remainder of bricks in their inventory for other customers who might later order some bricks. Thus only 7 500 bricks were sold to Point Properties Ltd on the 30th January 2022. Building Bricks Limited conducted a physical stock-count of completed bricks on hand at 31 January 2022 that found 2400 bricks were on hand whereas the inventory control account in the accounting records showed 2 500 bricks on hand. REQUIRED: 1.1) Calculate the cost of the cement issued to the production of the batch of bricks on the 20 January and the value of the closing inventory of cement at the end of January assuming the entity uses the weighted average method for valu- ation of inventory (cement) because it is homogenous. Round off to two decimal places. (26 marks) 1.2) Assuming that normal production hours per batch are 60 hours, determine the cost per unit for this batch of 10 000 bricks (Order 003). (7 Marks) 1.3) Prepare the journal entry to correct the inventory control account as a result of the shortage of bricks identified by the stock count. Narrations and the date not required. (4 marks) 1.4) On 31 January 2022, Building Bricks Limited determined that owing to the cheaper cost of bricks of a competitor, its own bricks can only be sold at R21.50 each. Determine the carrying amount of finished goods (bricks) in the statement of financial position of Building Bricks Limited at 31 January 2022 after taking all the information in the question into account. Support your answer with reasons from IAS 2